As filed with the Securities and Exchange Commission on December 1, 2014

Registration No. 333-194519

SECURITIES AND EXCHANGE COMMISSION

POST-EFFECTIVE AMENDMENT NO. 1 TO

FORM F-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

ELBIT IMAGING LTD.

(Exact name of Registrant as specified in its charter and translation of Registrant’s name into English)

|

Israel

|

6512

|

N/A

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial Classification

Code Number)

|

(I.R.S. Employer

Identification No.)

|

5 Kinneret Street

Bnei Brak 51261, Israel

+972-3-608-6000

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

(Name, address, including zip code, and telephone number, including area code of agent for service)

with copies to:

|

Richard H. Gilden, Esq.

Kramer Levin Naftalis & Frankel LLP

1177 Avenue of the Americas

New York, New York 10036

Telephone: 212-715-9486

Facsimile: 212-715-8085

|

Adam M. Klein, Adv.

Goldfarb Seligman & Co.

98 Yigal Alon Street

Tel-Aviv 6789141, Israel

Telephone: +972-3-608-9839

Facsimile: +972-3-608-9855

|

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

This Post-Effective Amendment No. 1 to Form F-1 Registration Statement is being filed in order to update the amounts of shares being offered as a result of a 1-for-20 reverse share split effected by the Registrant on August 21, 2014, as well as corresponding adjustments to share and share price information herein. This Post-Effective Amendment No. 1 to Form F-1 Registration Statement also incorporates by reference certain reports on Form 6-K recently filed by the Registrant. No additional securities are being registered under this Post-Effective Amendment No. 1. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

SUBJECT TO COMPLETION, DATED DECEMBER 1, 2014

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

ELBIT IMAGING LTD.

10,198,638 Ordinary Shares

The selling shareholders identified in this prospectus may offer from time to time up to 10,198,638 of our ordinary shares.

This prospectus describes the general manner in which the shares may be offered and sold by the selling shareholders. If necessary, the specific manner in which the shares may be offered and sold will be described in a supplement to this prospectus.

We will not receive any proceeds from the sale of the shares by the selling shareholders.

Our ordinary shares are traded on the NASDAQ Global Select Market, or NASDAQ, under the symbol "EMITF" and on the Tel-Aviv Stock Exchange, or TASE, under the symbol "EMIT." The closing price of our ordinary shares on NASDAQ on November 28, 2014, was $2.00 per share and the closing price of our ordinary shares on the TASE on November 30, 2014, was NIS 7.6 per share (equal to $1.95 based on the exchange rate between the NIS and the dollar, as quoted by the Bank of Israel on November 28, 2014).

In this prospectus, all references to "Elbit," the “Company,” “our,” “we” or “us,” are to Elbit Imaging Ltd. and its consolidated subsidiaries.

All references to “$” or "U.S. dollar," are to United States dollars and all references to "NIS" are to new Israeli shekel.

Investing in our securities involves risks. See "Risk Factors" beginning on page 2 of this prospectus.

Neither the Securities and Exchange Commission, the Israel Securities Authority, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense under the laws of the United States and the laws of the State of Israel.

The date of this prospectus is [ ], 2014.

You should rely only on the information contained in this prospectus and the documents incorporated by reference in this prospectus or to which we have referred you. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus or any document incorporated by reference is accurate as of any date other than the date on the front cover of this prospectus. Neither the delivery of this prospectus nor any distribution of securities pursuant to this prospectus shall, under any circumstances, create any implication that there has been no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

TABLE OF CONTENTS

|

|

1

|

|

|

2

|

|

|

3

|

|

|

3

|

|

|

4

|

|

|

5

|

|

|

5

|

|

|

5

|

|

|

6

|

|

|

7

|

|

|

8

|

|

|

9

|

|

|

9

|

|

|

10

|

|

|

10

|

|

|

11

|

|

|

11

|

FORWARD LOOKING STATEMENTS

WE MAKE STATEMENTS IN THIS PROSPECTUS THAT ARE CONSIDERED "FORWARD-LOOKING STATEMENTS," WITHIN THE MEANING OF SECTION 27A OF THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES ACT, AND SECTION 21E OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, OR THE EXCHANGE ACT. WE MAY FROM TIME TO TIME MAKE FORWARD-LOOKING STATEMENTS IN OUR REPORTS TO THE SECURITIES AND EXCHANGE COMMISSION, OR SEC, ON FORM 20-F AND FORM 6-K, IN OFFERING CIRCULARS AND PROSPECTUSES, IN PRESS RELEASES AND OTHER WRITTEN MATERIALS, AND IN STATEMENTS MADE BY OUR OFFICERS, DIRECTORS OR EMPLOYEES TO ANALYSTS, INSTITUTIONAL INVESTORS, REPRESENTATIVES OF THE MEDIA AND OTHERS. FORWARD-LOOKING STATEMENTS INCLUDE STATEMENTS REGARDING THE INTENT, BELIEF OR CURRENT EXPECTATIONS OF ELBIT AND ITS MANAGEMENT ABOUT ELBIT’S BUSINESS, FINANCIAL CONDITION, RESULTS OF OPERATIONS, RELATIONSHIPS WITH EMPLOYEES, BUSINESS PARTNERS AND OTHER THIRD PARTIES, THE CONDITION OF ITS PROPERTIES, LOCAL AND GLOBAL MARKET TERMS AND TRENDS, AND THE LIKE. WORDS SUCH AS “BELIEVE,” “EXPECT,” “INTEND,” “ESTIMATE” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS BUT ARE NOT THE EXCLUSIVE MEANS OF IDENTIFYING SUCH STATEMENTS. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE PROJECTED, EXPRESSED OR IMPLIED IN THE FORWARD-LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS INCLUDING, WITHOUT LIMITATION, THE FACTORS SET FORTH BELOW UNDER THE CAPTION "RISK FACTORS," OUR ANNUAL REPORTS ON FORM 20-F, OUR REPORTS ON FORM 6-K AND OTHER REPORTS FILED WITH OR FURNISHED TO THE SEC. ANY FORWARD-LOOKING STATEMENTS CONTAINED IN THIS PROSPECTUS SPEAK ONLY AS OF THE DATE HEREOF, AND WE CAUTION EXISTING AND PROSPECTIVE INVESTORS NOT TO PLACE UNDUE RELIANCE ON SUCH STATEMENTS. SUCH FORWARD-LOOKING STATEMENTS DO NOT PURPORT TO BE PREDICTIONS OF FUTURE EVENTS OR CIRCUMSTANCES, AND THEREFORE, THERE CAN BE NO ASSURANCE THAT ANY FORWARD-LOOKING STATEMENT CONTAINED HEREIN WILL PROVE TO BE ACCURATE. WE UNDERTAKE NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENTS.

Our business is subject to uncertainties and risks. Before you invest in our securities, you should carefully consider the risk factors described in our periodic reports filed with the SEC, including those specified in the section captioned “Risk Factors” in Item 3.D. of our Annual Report on Form 20-F for the year ended December 31, 2013, filed with the SEC on April 30, 2014, which is incorporated by reference in this prospectus, together with the other information contained in this prospectus. Our business, financial condition, liquidity, results of operations or market or trading price of our securities could be materially adversely affected by any of these risks. In addition, please read “Forward Looking Statements” in this prospectus, where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this prospectus. Please note that additional risks not presently known to us or that we currently deem immaterial may also impair our business and operations.

RECENT EVENTS

Reverse Share Split

On August 21, 2014, we effected a 1-for-20 reverse split of our ordinary shares, no par value. As a result of this reverse share split, our authorized share capital was decreased from 700,000,000 ordinary shares, no par value, to 35,000,000 ordinary shares, no par value, and our outstanding shares and options to purchase shares were adjusted accordingly. Following the reverse share split, we had 27,572,429 ordinary shares outstanding as of November 27, 2014.

Debt Restructuring

For information regarding our court-approved plan of arrangement under Section 350 of the Israeli Companies Law, 5759-1999, providing for the restructuring of our unsecured financial debt, which was consummated on February 20, 2014, or the “Debt Restructuring”, please see "Item 4.A History and Development of the Company – Recent Events" of our annual report on Form 20-F for the year ended December 31, 2013, as well as our current report on Form 6-K dated July 23, 2014 which are incorporated herein by reference.

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth our capitalization as of September 30, 2014.

The information in this table should be read in conjunction with and is qualified by reference to the consolidated financial statements and notes thereto and other financial information incorporated by reference into this prospectus.

| |

|

As of September 30, 2014 (unaudited)

|

|

| |

|

(NIS in thousands)

|

|

|

(US$ in thousands)

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

SECURED

|

|

|

|

|

|

|

|

Short-term credits

|

|

|

737,871 |

|

|

|

199,695 |

|

| |

|

|

737,871 |

|

|

|

199,695 |

|

|

UNSECURED

|

|

|

|

|

|

|

|

|

|

Short-term credits

|

|

|

847,849 |

|

|

|

229,458 |

|

|

Suppliers and service providers

|

|

|

44,618 |

|

|

|

12,075 |

|

|

Payables and other credit balances

|

|

|

156,873 |

|

|

|

42,456 |

|

| |

|

|

1,049,340 |

|

|

|

283,989 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL CURRENT LIABILITIES

|

|

|

1,787,211 |

|

|

|

483,684 |

|

| |

|

|

|

|

|

|

|

|

|

LONG TERM LIABILITIES

|

|

|

|

|

|

|

|

|

|

SECURED

|

|

|

1,109,231 |

|

|

|

300,198 |

|

|

UNSECURED

|

|

|

183,011 |

|

|

|

49,529 |

|

|

TOTAL LONG TERM LIABILITIES

|

|

|

1,292,242 |

|

|

|

349,727 |

|

| |

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Attributable to equity holders of the Company

|

|

|

409,862 |

|

|

|

110,923 |

|

|

Minority Interest

|

|

|

451,573 |

|

|

|

122,212 |

|

| |

|

|

861,435 |

|

|

|

233,135 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL CAPITALIZATION

|

|

|

3,940,888 |

|

|

|

1,066,546 |

|

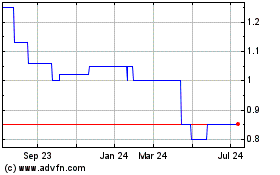

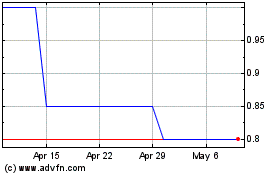

PRICE RANGE OF ORDINARY SHARES

Our ordinary shares are listed on the NASDAQ Global Select Market under the symbol “EMITF” and on the TASE under the symbol "EMIT." All prices herein have been adjusted to give retroactive effect to the 1-for-20 reverse share split effected on August 21, 2014.

Information regarding the price history of the stock listed

The annual high and low sale prices for our ordinary shares for the five most recent full financial years are:

| |

|

NASDAQ

|

|

|

TASE

|

|

|

Year Ended December 31,

|

|

High ($)

|

|

|

Low ($)

|

|

|

High ($)

|

|

|

Low ($)

|

|

|

2013

|

|

|

70 |

|

|

|

13.8 |

|

|

|

68.2 |

|

|

|

14.6 |

|

|

2012

|

|

|

66.4 |

|

|

|

36 |

|

|

|

64.6 |

|

|

|

34.8 |

|

|

2011

|

|

|

279.4 |

|

|

|

39.6 |

|

|

|

254.8 |

|

|

|

38.6 |

|

|

2010

|

|

|

495.2 |

|

|

|

241 |

|

|

|

501.6 |

|

|

|

247.4 |

|

|

2009

|

|

|

561.8 |

|

|

|

186 |

|

|

|

575 |

|

|

|

200.6 |

|

The quarterly high and low sale prices for our ordinary shares for the two most recent full financial years and any subsequent period are:

| |

|

NASDAQ

|

|

|

TASE

|

|

|

Financial Quarter

|

|

High ($)

|

|

|

Low ($)

|

|

|

High ($)

|

|

|

Low ($)

|

|

|

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4 (until November 30, 2014)

|

|

|

3.1 |

|

|

|

1.7 |

|

|

|

2.9 |

|

|

|

1.9 |

|

|

Q3

|

|

|

4.5 |

|

|

|

2.9 |

|

|

|

4.1 |

|

|

|

2.8 |

|

|

Q2

|

|

|

92 |

|

|

|

3.2 |

|

|

|

4.6 |

|

|

|

3.2 |

|

|

Q1

|

|

|

26.4 |

|

|

|

3.2 |

|

|

|

26.4 |

|

|

|

3.4 |

|

|

2013

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1

|

|

|

70 |

|

|

|

28.6 |

|

|

|

68.2 |

|

|

|

30.6 |

|

|

Q2

|

|

|

48.4 |

|

|

|

40.2 |

|

|

|

48 |

|

|

|

40.2 |

|

|

Q3

|

|

|

42.4 |

|

|

|

20.4 |

|

|

|

40.8 |

|

|

|

20.4 |

|

|

Q4

|

|

|

25.6 |

|

|

|

13.8 |

|

|

|

24.4 |

|

|

|

14.6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1

|

|

|

66.4 |

|

|

|

45 |

|

|

|

64.6 |

|

|

|

48.6 |

|

|

Q2

|

|

|

63.8 |

|

|

|

42.4 |

|

|

|

62.8 |

|

|

|

41.6 |

|

|

Q3

|

|

|

57.8 |

|

|

|

40.8 |

|

|

|

58 |

|

|

|

40.4 |

|

|

Q4

|

|

|

51 |

|

|

|

36 |

|

|

|

51.8 |

|

|

|

34.8 |

|

The monthly high and low sale prices for our ordinary shares during the past six months were:

| |

|

NASDAQ

|

|

|

TASE

|

|

|

Month

|

|

High ($)

|

|

|

Low ($)

|

|

|

High ($)

|

|

|

Low ($)

|

|

|

November 2014

|

|

|

2.6 |

|

|

|

1.7 |

|

|

|

2.5 |

|

|

|

1.9 |

|

|

October 2014

|

|

|

3.1 |

|

|

|

2.5 |

|

|

|

2.9 |

|

|

|

2.5 |

|

|

September 2014

|

|

|

4 |

|

|

|

2.9 |

|

|

|

3.9 |

|

|

|

2.8 |

|

|

August 2014

|

|

|

4.1 |

|

|

|

3.3 |

|

|

|

4 |

|

|

|

3.7 |

|

|

July 2014

|

|

|

4.5 |

|

|

|

3.5 |

|

|

|

4.1 |

|

|

|

3.47 |

|

|

June 2014

|

|

|

4 |

|

|

|

3.2 |

|

|

|

3.8 |

|

|

|

3.2 |

|

|

May 2014

|

|

|

4.4 |

|

|

|

3.4 |

|

|

|

4 |

|

|

|

3.4 |

|

We will not receive any of the proceeds from the sale of the ordinary shares being offered for sale by the selling shareholders. We will incur all costs associated with the preparation and filing of the registration statement of which this prospectus is a part. Brokerage fees, commissions and similar expenses, if any, attributable to the sale of shares offered hereby will be borne by the applicable selling shareholders.

DESCRIPTION OF ORDINARY SHARES

The following summary is not complete. You should refer to the applicable provisions of our Memorandum of Association and our Articles of Association, incorporated by reference to the registration statement in which this prospectus is included.

Following the 1-for-20 reverse split effected on August 21, 2014, our registered share capital consists of a single class of 35,000,000 ordinary shares, no par value. As of November 27, 2014, we had outstanding 27,572,429 ordinary shares and options to purchase an aggregate of 55,674 ordinary shares at a weighted average exercise price of approximately NIS 220.0 per share, with the latest expiration date of these options being December 31, 2015 (of which, options to purchase 56,272 of our ordinary shares were exercisable as of October 31, 2014).

From January 1, 2011 through October 31, 2014, we issued 16,976 ordinary shares upon the exercise of options.

For a more complete description of our ordinary shares, please see "Item 10.B Additional Information – Memorandum and Articles of Association" of our annual report on Form 20-F for the year ended December 31, 2013, which is incorporated herein by reference, as well as the description of the reverse share split under "Recent Events" above.

TAXATION

For discussion of certain income tax considerations with respect to our ordinary shares, including distributions with respect to our ordinary shares, the sale or disposition of our ordinary shares, applicable Israeli taxes, U.S. federal, state and local taxes, the tax consequences to U.S. holders if we are a passive foreign investment company, and certain information reporting and backup withholding requirements, please see our annual report on Form 20-F for the year ended December 31, 2013, which is incorporated herein by reference.

WE ENCOURAGE EACH INVESTOR TO CONSULT WITH HIS OR HER OWN TAX ADVISOR AS TO THE PARTICULAR TAX CONSEQUENCES TO SUCH INVESTOR OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF OUR ORDINARY SHARES, INCLUDING THE EFFECTS OF APPLICABLE ISRAELI, U.S. FEDERAL, STATE, AND LOCAL TAXES.

We had 27,572,429 ordinary shares outstanding as of November 11, 2014. The voting rights of all shareholders are the same. The following table sets forth certain information as of November 9, 2014, unless stated otherwise, concerning (i) persons or entities who, to our knowledge, beneficially own more than 5% of our outstanding ordinary shares and (ii) the number of our ordinary shares beneficially owned by all of our directors and officers as a group:

|

Name and Address

|

|

Number of Shares Beneficially Owned

|

|

|

Approximate Percentage of Shares

|

|

|

York Global Finance Offshore BDH (Luxembourg) S.arl (1)

|

|

|

5,447,850

|

|

|

|

19.7 |

% |

|

Davidson Kempner Capital Management LP and/or certain funds and/or accounts managed by it or its affiliates (2)

|

|

|

3,943,586

|

|

|

|

14.3 |

% |

|

All officers and directors as a group

|

|

|

5,942

|

(3) |

|

|

0.02 |

% |

_________________

|

(1)

|

Based on information received from the shareholders on November 11, 2014. York Capital Management Global Advisors, LLC ("YGA") is a SEC registered investment adviser. YGA controls York Global Finance Manager, LLC, which is the manager of York Global Finance Offshore BDH, LLC, which is the 100% shareholder of York Global Finance Offshore BDH (Luxembourg) S.à.r.l (“BDH”), which, in turn, holds our ordinary shares. Accordingly YGA is deemed to have beneficial ownership over the ordinary shares directly owned by BDH. James G. Dinan is the chairman and one of two senior managers of YGA. Daniel A. Schwartz is also a senior manager of YGA.

|

|

(2)

|

Based on information received from the shareholders on November 9, 2014. This group consists of M.H. Davidson & Co., Davidson Kempner Partners, Davidson Kempner Institutional Partners, L.P., Davidson Kempner International Ltd., Davidson Kempner Distressed Opportunities Fund LP and Davidson Kempner Distressed Opportunities International Ltd. Voting and dispositive authority over the ordinary shares is held by Davidson Kempner Capital Management LP, and Messrs. Thomas L. Kempner, Jr., Anthony A. Yoseloff, Conor Bastable and Avram Z. Friedman are responsible for the voting and investment decisions relating to such ordinary shares.

|

|

(3)

|

Includes options to purchase ordinary shares that were vested on October 31, 2014 or that were scheduled to vest within the following 60 days. Excludes the ordinary shares held by the entities owned by Mr. Mordechay Zisser referenced below.

|

York Capital Management Global Advisers LLC and Davidson Kempner Capital Management LLC, together with their respective affiliates, were significant note holders of ours and became significant shareholders as a result of the Debt Restructuring.

Prior to the consummation of the Debt Restructuring on February 20, 2014, Mr. Mordechay Zisser, through companies under his control, beneficially owned 12,545,527 ordinary shares, which then constituted approximately 50% of our outstanding ordinary shares. Immediately following the closing of the Debt Restructuring, these shares constituted approximately 2.26% of our outstanding shares. The companies that hold such shares are currently under receivership as a result of having defaulted on secured loans owing to Bank Hapoalim.

The selling shareholders acquired the securities being registered for resale pursuant to this prospectus in connection with the Debt Restructuring, as discussed above under "Debt Restructuring".

The following table sets forth, for each selling shareholder, the name, the number of ordinary shares owned as of November 11, 2014, the maximum number of ordinary shares that may be offered pursuant to this prospectus, the number of ordinary shares that would be owned after the sale of the maximum number of ordinary shares.

Other than the relationships described herein, to our knowledge, none of the selling shareholders are employees or suppliers of ours or our affiliates. Within the past three years, other than the relationships described herein, none of the selling shareholders has held a position as an officer or director of ours, nor has any selling shareholder had any material relationship of any kind with us or any of our affiliates, except that: (i) certain selling shareholders acquired ordinary shares upon the conversion of their Old Notes in the Debt Restructuring, as described above under "Debt Restructuring"; (ii) Bank Hapoalim was issued ordinary shares in connection with the refinancing of its loan agreement with us, as described above under "Debt Restructuring"; (iii) an affiliate of York Global Finance Offshore BDH (Luxembourg) S.à.r.l (“BDH”) is a significant bondholder in Plaza Centers N.V., of which we own approximately 62.5% of its share capital ("PC"); (iv) an affiliate of Davidson Kempner Capital Management LP (“DK”) holds approximately 5.5% of the outstanding shares of PC; (v) further to our Reports on Form 6-K filed on June 23, 2014, July 21, 2014 and October 14, 2014, which are incorporated herein by reference, subject to the application of the exemption detailed in the aforementioned Form 6-K and other conditions precedent, we undertook to exercise (or procure that other persons will exercise) all of our rights in the proposed EUR 20 million rights offering of shares of PC and to procure subscriptions for the unexercised portion of the rights offering (the “Undertaking”). In relation to the above, we entered into a back-stop agreement with an affiliate of DK pursuant to which such affiliate purchased under the rights offering EUR 10 million of shares of PC, subject to similar conditions precedent (the “Back-Stop Agreement”); and (vi) as described in our Reports on Form 6-K filed on June 30, 2014, September 8, 2014 and September 14, 2014 which are incorporated herein by reference, on June 29, 2014, York Global Finance II S.à r.l., a company owned by York Capital Management Global Advisers LLC and affiliated with BDH (the “Investor”), entered into a share purchase agreement (the “Investment Agreement”) with InSightec Ltd. (in which our public subsidiary Elbit Medical Technologies Ltd. (“Elbit Medical”) held prior to the consummation of the Investment Agreement approximately 48.2% (42.3% on a fully diluted basis) of the issued and outstanding share capital (“InSightec”)), pursuant to which the Investor and certain other subsequent investors invested an aggregate amount of $50 million in InSightec, reflecting a pre money valuation of InSightec of $ 200 million (on a fully diluted, as-converted basis), subject to certain adjustments as specified in the Investment Agreement. Following the aforementioned investment Elbit Medical holds approximately 37.6% (33.3% on a fully diluted basis) of the issued and outstanding share capital of InSightec. In addition, Elbit Medical will have the right to invest up to an additional US$3.5 million in InSightec within the period ending January 31, 2015. Other shareholders of InSightec had the right to invest up to an additional US$9 million in InSightec until the period ending November 30, 2014. To the extent such right is not exercised in part or in full, the Investor and the other subsequent investors will have the right to take up any shortfall. We are not aware whether such right to invest further in InSightec was exercised by the other shareholders of InSightec or by the Investor and the subsequent investors.

All information with respect to share ownership has been furnished by the selling shareholders, unless otherwise noted. The shares being offered are being registered to permit public secondary trading of such shares and each selling shareholder may offer all or part of the shares it owns for resale from time to time pursuant to this prospectus. In addition, other than the relationships described herein, none of the selling shareholders has any family relationships with our officers, directors or controlling shareholders.

Based on information we have received from the selling shareholders, none of the selling shareholders is a broker-dealer or an affiliate of a broker-dealer, except that Bank Hapoalim B.M. is the ultimate parent of Hapoalim Securities USA Inc., a broker-dealer. Bank Hapoalim received the shares in the ordinary course of its banking business. Bank Hapoalim has informed us that at the time of its acquisition of the shares, Bank Hapoalim did not have any agreements or understandings, directly or indirectly, with any person to distribute the shares. As a result, the Company believes that Bank Hapoalim is not an underwriter of the shares.

The term “selling shareholders” also includes any transferees, pledgees, donees, or other successors in interest to the selling shareholders named in the table below.

|

Name of Selling Stockholder

|

|

Shares

Ownedas of November 9, 2014

|

|

|

Percentage of Outstanding Shares Prior to the Offering

|

|

|

Maximum Number of

Shares that may be

Offered

|

|

|

Number of Shares

Owned Immediately After Sale of Maximum

Number of

Shares in the Offering

|

|

| |

|

|

|

|

|

|

|

|

|

|

# of Shares

|

|

|

% of Class

|

|

|

York Global Finance Offshore BDH (Luxembourg) S.arl

|

|

|

5,447,850 |

(1) |

|

|

19.7 |

% |

|

|

5,447,850 |

|

|

|

0 |

|

|

|

0 |

|

|

M.H. Davidson & Co.

|

|

|

73,492 |

(2) |

|

|

0.3 |

% |

|

|

73,492 |

|

|

|

0 |

|

|

|

0 |

|

|

Davidson Kempner Partners

|

|

|

258,634 |

(2) |

|

|

0.9 |

% |

|

|

258,634 |

|

|

|

0 |

|

|

|

0 |

|

|

Davidson Kempner Institutional Partners, L.P.

|

|

|

599,178 |

(2) |

|

|

2.2 |

% |

|

|

599,178 |

|

|

|

0 |

|

|

|

0 |

|

|

Davidson Kempner International Ltd.

|

|

|

591,601 |

(2) |

|

|

2.1 |

% |

|

|

591,601 |

|

|

|

0 |

|

|

|

0 |

|

|

Davidson Kempner Distressed Opportunities Fund LP

|

|

|

944,298 |

(2) |

|

|

3.4 |

% |

|

|

944,298 |

|

|

|

0 |

|

|

|

0 |

|

|

Davidson Kempner Distressed Opportunities International Ltd.

|

|

|

1,476,383 |

(2) |

|

|

5.4 |

% |

|

|

1,476,383 |

|

|

|

0 |

|

|

|

0 |

|

|

Bank Hapoalim B.M.

|

|

|

807,202 |

(3) |

|

|

2.9 |

% |

|

|

807,202 |

|

|

|

0 |

|

|

|

0 |

|

(1) York Capital Management Global Advisors, LLC ("YGA") is a SEC registered investment adviser. YGA controls York Global Finance Manager, LLC, which is the manager of York Global Finance Offshore BDH, LLC, which is the 100% shareholder of BDH, which, in turn, holds our ordinary shares. Accordingly, YGA is deemed to have beneficial ownership over the ordinary shares directly owned by BDH. James G. Dinan is the chairman and one of two senior managers of YGA. Daniel A. Schwartz is also a senior manager of YGA.

(2) Voting and dispositive authority over the ordinary shares is held by Davidson Kempner Capital Management LP, and Messrs. Thomas L. Kempner, Jr., Anthony A. Yoseloff, Conor Bastable and Avram Z. Friedman through DKCM, are responsible for the voting and investment decisions relating to such ordinary shares.

(3) The Head of Bank Hapoalim’s Financial Markets Division, Dan Koller, may be deemed to possess voting and investment power over the shares held by Bank Hapoalim. Mr. Koller disclaims beneficial ownership of these shares.

We may notify the selling shareholders to suspend the sales of the securities offered by this prospectus upon the occurrence of any event that makes any statement in this prospectus or the related registration statement untrue in any material respect or that requires the changing of statements in these documents in order to make statements in those documents not misleading.

Information concerning the selling shareholders may change from time to time and any changed information will be set forth in post-effective amendments or prospectus supplements if and when necessary.

The selling shareholders, and their pledgees, donees, transferees or other successors in interest, may from time to time offer and sell, separately or together, some or all of the ordinary shares covered by this prospectus. Registration of the ordinary shares covered by this prospectus does not mean, however, that those ordinary shares necessarily will be offered or sold.

The ordinary shares covered by this prospectus may be sold from time to time, at market prices prevailing at the time of sale, at prices related to market prices, at a fixed price or prices subject to change or at negotiated prices, by a variety of methods including the following:

|

|

·

|

in the over-the-counter market;

|

|

|

·

|

in privately negotiated transactions;

|

|

|

·

|

through broker-dealers, who may act as agents or principals;

|

|

|

·

|

through one or more underwriters on a firm commitment or best-efforts basis;

|

|

|

·

|

in a block trade in which a broker-dealer will attempt to sell a block of ordinary shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

directly to one or more purchasers;

|

|

|

·

|

in any combination of the above.

|

In effecting sales, brokers or dealers engaged by the selling shareholders may arrange for other brokers or dealers to participate. Broker-dealer transactions may include:

|

|

·

|

purchases of the ordinary shares by a broker-dealer as principal and resales of the ordinary shares by the broker-dealer for its account pursuant to this prospectus;

|

|

|

·

|

ordinary brokerage transactions; or

|

|

|

·

|

transactions in which the broker-dealer solicits purchasers on a best efforts basis.

|

To our knowledge, the selling shareholders have not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of the ordinary shares covered by this prospectus. At any time a particular offer of the ordinary shares covered by this prospectus is made, a revised prospectus or prospectus supplement, if required, will be distributed which will set forth the aggregate amount of ordinary shares covered by this prospectus being offered and the terms of the offering, including the name or names of any underwriters, dealers, brokers or agents. In addition, to the extent required, any discounts, commissions, concessions and other items constituting underwriters’ or agents’ compensation, as well as any discounts, commissions or concessions allowed or reallowed or paid to dealers, will be set forth in such revised prospectus supplement. Any such required prospectus supplement, and, if necessary, a post-effective amendment to the registration statement of which this prospectus is a part, will be filed with the SEC to reflect the disclosure of additional information with respect to the distribution of the ordinary shares covered by this prospectus.

The annual financial statements incorporated in this prospectus by reference to our report on Form 6-K filed with the SEC on March 31, 2014 have been audited by Brightman Almagor Zohar & Co., a member of Deloitte Touche Tohmatsu, an independent registered public accounting firm. Such financial statements are incorporated by reference in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

LEGAL MATTERS

The validity of the securities offered hereby under Israeli law has been passed upon for us by and other legal matters under Israeli law relating to any offering will be passed upon for us by Goldfarb Seligman & Co., Tel-Aviv, Israel.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement that we filed with the SEC. The registration statement, including the attached exhibits, contains additional relevant information about us. The rules and regulations of the SEC allow us to omit some of the information included in the registration statement from this prospectus.

Our ordinary shares are listed on the NASDAQ Global Select Market, and we are subject to the reporting requirements of the Exchange Act that are applicable to a foreign private issuer. In accordance with the Exchange Act, we file with the SEC reports, including annual reports on Form 20-F. In addition, we furnish interim financial information on Form 6-K on a quarterly basis. We also furnish to the SEC under cover of Form 6-K certain other material information. You may inspect without charge and copy at prescribed rates such material at the public reference facilities maintained by the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may also obtain copies of such material from the SEC at prescribed rates by writing to the Public Reference Section of the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. The SEC maintains an Internet site at http://www.sec.gov that contains reports and other material that are filed through the SEC’s Electronic Data Gathering, Analysis and Retrieval ("EDGAR") system.

Further information about our company is available on our website at www.elbitimaging.com. The information available on our website is not a part of this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We are allowed to incorporate by reference the information we file with the SEC, which means that we can disclose important information to you by referring to those documents. The information incorporated by reference is considered to be part of this prospectus. The documents we incorporate by reference are:

| |

(1)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on March 31, 2014 (audited financial statements as of and for the fiscal year ended December 31, 2013).

|

| |

(2)

|

Our annual report on Form 20-F for the year ended December 31, 2013, filed with the Securities and Exchange Commission on April 30, 2014.

|

| |

(3)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on May 30, 2014 (unaudited financial statements as of and for the three months ended March 31, 2014).

|

| |

(4)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on June 23, 2014 (agreements relating to rights offering of Plaza Centers).

|

| |

(5)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on June 29, 2014 (investment in Insightec Ltd.).

|

| |

(6)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on July 21, 2014 (effectiveness of PC’s Debt Arrangement).

|

| |

(7)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on July 23, 2014 (Bank Leumi Settlement).

|

| |

(8)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on August 29, 2014 (unaudited financial statements as of and for the six months ended June 30, 2014).

|

| |

(9)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on September 2, 2014 (Gamida Cell Investment).

|

| |

(10)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on September 8, 2014 (Amendment of Insightec investment).

|

| |

(11)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on September 15, 2014 (Exercise of rights in Insightec investment).

|

| |

(12)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on October 14, 2014 (pricing change in rights offering of Plaza Centers).

|

| |

(13)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on October 27, 2014 (sale of Mango operation).

|

| |

(14)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on November 25, 2014 (unaudited financial statements as of and for the nine months ended September 30, 2014).

|

| |

(15)

|

Our current report on Form 6-K filed with the Securities and Exchange Commission on November 28, 2014 (opening of PC’s rights offering).

|

As you read the above documents, you may find inconsistencies in information from one document to another. If you find inconsistencies between the documents and this prospectus, you should rely on the statements made in the most recent document. All information appearing in this prospectus is qualified in its entirety by the information and financial statements, including the notes thereto, contained in the documents incorporated by reference herein.

You may obtain a copy of any or all of these filings at no cost, by writing or telephoning us at the following address:

Elbit Imaging Ltd.

5 Kinneret Street

Bnei Brak 51261, Israel

Tel: +972-3-608-6000

Fax: +972-3-608-6050

You should rely only on the information contained or incorporated by reference in this prospectus or a prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and any arranger or agent is not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, or such earlier date, that is indicated in this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

ENFORCEMENT OF CIVIL LIABILITIES

We are incorporated under the laws of the State of Israel. Substantially all of our executive officers and directors and our Israeli auditors are nonresidents of the United States, and a substantial portion of our assets and the assets of these persons are located outside the United States. Therefore, it may be difficult to enforce a judgment obtained in the United States against us or any such persons.

Additionally, there is doubt as to the enforceability of civil liabilities under the Securities Act and the Exchange Act in original actions instituted in Israel. In addition, even if an Israeli court agrees to hear a claim, it may determine that Israeli law and not U.S. law is applicable to the claim. There is little binding case law in Israel addressing these matters. If U.S. law is found to be applicable, the content of applicable U.S. law must be proved as a fact, which can be a time-consuming and costly process. Certain matters of procedure will also be governed by Israeli law. Subject to specified time limitations and legal procedures, under the rules of private international law currently prevailing in Israel, Israeli courts may enforce a U.S. judgment in a civil matter, including a judgment based upon the civil liability provisions of the U.S. securities laws, as well as a monetary or compensatory judgment in a non-civil matter, provided that the following key conditions are met:

|

|

·

|

subject to limited exceptions, the judgment is final and non-appealable and enforceable in the state in which it was given;

|

|

|

·

|

adequate service of process has been effected and the defendant has had a reasonable opportunity to be heard;

|

|

|

·

|

the judgment and its enforcement are not contrary to the law, public policy, security or sovereignty of the State of Israel;

|

|

|

·

|

the judgment was rendered by a court of competent jurisdiction, in compliance with due process and the rules of private international law prevailing in Israel;

|

|

|

·

|

the judgment was not obtained by fraudulent means and does not conflict with any other valid judgment in the same matter between the same parties;

|

|

|

·

|

no action between the same parties in the same matter is pending in any Israeli court at the time the lawsuit is instituted in a U.S. court; and

|

|

|

·

|

the laws of the state in which the judgment was rendered provide for the enforcement of judgments of Israeli courts.

|

The following is a statement of expenses in connection with the distribution of the securities registered. All amounts shown are estimates.

|

SEC registration fee

|

|

$ |

5,017 |

|

|

Legal fees and expenses

|

|

$ |

50,000 |

|

|

Accounting fees and expenses

|

|

$ |

30,000 |

|

|

Miscellaneous

|

|

$ |

1,983 |

|

|

Total

|

|

$ |

87,000 |

|

ELBIT IMAGING LTD.

10,198,638 Ordinary Shares

__________________

PROSPECTUS

__________________

PART II.

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 6. Indemnification of Directors and Officers

Insurance, Indemnification and Exemption

General. Our Amended and Restated Articles of Association set forth the following provisions regarding the grant of insurance coverage, indemnification and an exemption from liability to any of our directors or officers, all subject to the provisions of applicable law. In accordance with such provisions and pursuant to the requisite corporate approvals, we have obtained liability insurance covering our directors and officers, have granted indemnification undertakings to our directors and officers and have agreed to exempt our officers (other than our Executive Chairman) from liability for breach of the duty of care. Our subsidiary Plaza Centers N.V. has also granted indemnification undertakings to its directors and officers.

Insurance. We are entitled to insure the liability of any director or officer to the fullest extent permitted by law. Without derogating from the aforesaid, we may enter into a contract to insure the liability of a director or officer for an obligation imposed on him in consequence of an act done in his capacity as such, in any of the following cases:

|

|

·

|

a breach of the duty of care toward us or a third party;

|

|

|

·

|

a breach of the duty of loyalty toward us, provided that the director or officer acted in good faith and had reasonable basis to believe that the act would not harm us;

|

|

|

·

|

a monetary obligation imposed on him in favor of a third party;

|

|

|

·

|

reasonable litigation expenses, including attorney fees, incurred by the director or officer as a result of an administrative enforcement proceeding instituted against him;

|

|

|

·

|

a payment imposed on the director or officer in favor of an injured party as set forth in Section 52(54)(a)(1)(a) of the Israeli Securities Law, 5728-1968, as amended, or the Securities Law; or

|

|

|

·

|

Any other matter in respect of which it is permitted or will be permitted under applicable law to insure the liability of our directors or officers.

|

Indemnification

We are entitled to indemnify a director or officer to the fullest extent permitted by law, either retroactively or pursuant to an undertaking given in advance. Without derogating from the aforesaid, we may indemnify our directors or officers for liability or expense imposed on him in consequence of an action taken by him in his capacity as such, as follows:

|

|

·

|

a financial liability incurred or imposed on him in favor of another person in accordance with a judgment, including a judgment given in a settlement or an award of an arbitrator that is approved by a court, provided that any undertaking in advance to indemnify is limited to events that, in the opinion of the board of directors, are foreseeable in light of our actual activity at the time of granting the undertaking and limited to a sum or criteria determined by the board of directors to be reasonable under the circumstances;

|

|

|

·

|

reasonable litigation expenses, including legal fees, incurred in connection with an investigation or proceeding conducted against him by an authority authorized to conduct such an investigation or proceeding, and which concluded without an indictment against him and without a financial sanction in lieu of a criminal proceeding (except for an offense that does not require proof of criminal intent), or in connection with a financial sanction;

|

|

|

·

|

reasonable litigation expenses, including legal fees, incurred by the director or officer or which he was ordered to pay by a court, within the framework of proceedings filed against him by or on behalf of us, or by a third party, or in a criminal proceeding in which he was acquitted, or in a criminal proceeding in which he was convicted of an offense which does not require a criminal intent;

|

|

|

·

|

reasonable litigation expenses, including attorney fees, incurred by the director or officer as a result of an administrative enforcement proceeding instituted against him; or

|

|

|

·

|

a payment imposed on the director or officer in favor of an injured party as set forth in Section 52(54)(a)(1)(a) of the Securities Law.

|

The aggregate indemnification amount payable by us pursuant to indemnification undertakings may not exceed the lower of (i) 25% of our shareholders’ equity as of the date of actual payment by us of the indemnification amount (as set forth in our most recent consolidated financial statements prior to such payment) and (ii) $40 million, in excess of any amounts paid (if paid) by insurance companies pursuant to insurance policies maintained by us, with respect to matters covered by such indemnification.

Exemption. We are entitled to exempt a director or officer in advance from any or all of his liability for damage in consequence of a breach of the duty of care toward us to the fullest extent permitted by law.

Limitations. The Companies Law provides that a company may not provide its directors or officers with insurance or indemnification or exempt its directors or officers from liability with respect to the following:

|

|

·

|

A breach of the duty of loyalty toward the company, unless, with respect to insurance coverage or indemnification, the director or officer acted in good faith and had a reasonable basis to believe that the act would not harm us;

|

|

|

·

|

an intentional or reckless breach of the duty of care;

|

|

|

·

|

an act done with the intention of illegally deriving a personal profit; or

|

|

|

·

|

a fine imposed on the director or officer.

|

Item 7. Recent Sales of Unregistered Securities

The issuance of notes and ordinary shares to the holders of Old Notes in the Debt Restructuring qualified for exemption under Section 3(a)(9) of the Securities Act since the notes and ordinary shares were issued in exchange for other securities of ours with our existing security holders and no commission or remuneration was paid or given directly or indirectly for soliciting such exchange. As to Bank Leumi, we believe that the issuance of notes and ordinary shares to Bank Leumi qualified as offshore transactions exempt from registration under Regulation S of the Securities Act. For more information about these issuances, see above under "Debt Restructuring".

On September 22, 2011, in connection with a loan agreement, we issued Eastgate Property LLC ("Eastgate") a warrant, as amended on April 5, 2012, to purchase up to 3.3% of our fully diluted share capital (subject to certain exceptions) at the time of exercise of such warrant, for no consideration. On February 20, 2014, immediately following the consummation of the Debt Restructuring, Eastgate exercised the warrant for 1,924,215 ordinary shares, at which time the warrant terminated. The issuance of the warrant was registered pursuant to Registration Statement No. 333-172122, and the shares were issued upon exercise pursuant an exemption from registration under Section 3(a)(9) of the Securities Act.

Over the past three years, we issued options to purchase 18,975 ordinary shares under the 2006 Plan, with a weighted average exercise price of NIS 10.25. All of these options are currently outstanding and none of these options have been exercised for shares of our ordinary shares.

We did not employ an underwriter in connection with the issuance of the securities described above.

Item 8. Exhibits and Financial Statements Schedules

See Exhibit Index on page II-6 of this registration statement.

Item 9. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and a(l)(iii) do not apply if the registration statement is on Form S-3 or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) To file a post-effective amendment to the registration statement to include any financial statements required by Item 8.A of Form 20-F at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of the Act need not be furnished, provided, that the registrant includes in the prospectus, by means of a post-effective amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information in the prospectus is at least as current as the date of those financial statements. Notwithstanding the foregoing, with respect to registration statements on Form F-3, a post-effective amendment need not be filed to include financial statements and information required by Section 10(a)(3) of the Act or Rule 3-19 of Regulation S-X if such financial statements and information are contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Form F-3.

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

(b)

|

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

|

(d) The undersigned Registrant hereby undertakes that:

(1) For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this Registration Statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act of 1933 shall be deemed to be part of this Registration Statement as of the time it was declared effective.

(2) For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form F-1 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Bnei Brak, Israel, on December 1, 2014.

|

ELBIT IMAGING LTD.

|

|

| |

|

|

By: /s/ Doron Moshe

Name: Doron Moshe

Title: Chief Financial Officer

|

By: *

Name: Ron Hadassi

Title: Executive Chairman of the Board of Directors

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

Title

|

Date

|

| |

|

|

|

*

|

Chairman of the Board and Acting CEO

(Principal Executive Officer)

|

|

|

/s/ Doron Moshe

|

Chief Financial Officer

(Principal Financial

and Accounting Officer)

|

|

|

*

|

Director

|

|

|

*

Zvi Tropp

|

External Director

|

|

|

*

Eliezer Avraham Brender

|

Director

|

|

|

*

Shlomi Kelsi

|

Director

|

|

|

*

Elina Frenkel Ronen

|

External Director

|

|

|

*

Yoav Kfir

|

Director

|

|

|

*

Boaz Lifschitz

|

Director

|

|

|

*

Nadav Livni

|

Director

|

|

Authorized Representative in the United States:

|

Puglisi & Associates

By: *_______________

Name: Donald J. Puglisi

Title: Managing Director

|

|

|

*

|

By: /s/ Doron Moshe

|

|

|

|

| |

Doron Moshe

|

|

|

|

| |

Attorney-in-fact

|

|

|

|

Exhibit Index

The following is a list of exhibits filed as part of this registration statement.

|

Exhibit

No.

|

Description

|

|

3.1

|

Amended and Restated Memorandum of Association (previously filed).

|

|

3.2

|

Amended and Restated Articles of Association (previously filed).

|

|

4.1

|

Form of ordinary share certificate (previously filed).

|

|

5.1

|

Opinion of Goldfarb Seligman & Co.

|

|

10.3

|

English translation of Agreement for the Provision of Consultancy Services for the Development of Real Estate Projects dated May 31, 2006, between Elbit Imaging Ltd. and Control Centers Ltd. (incorporated by reference to Exhibit 4.13 of our Annual Report on Form 20-F filed on July 2, 2007).

|

|

10.5

|

English translation of Employees, Directors and Offices Incentive Plan of 2006, as amended (incorporated by reference to Exhibit 4.6 of our Annual Report on Form 20-F filed on June 26, 2009).

|

|

10.6

|

Framework Agreement dated April 22, 2010, among EPN GP, LLC, Macquarie DDR Management Limited, Macquarie DDR Management LLC, Developers Diversified Realty Corporation, DDR MDT Holdings II Trust, DDR Macquarie Fund LLC, DDR MDT PS LLC, DDR MDT MV LLC, Macquarie DDR U.S. Trust Inc., Macquarie DDR U.S. Trust II Inc., Macquarie MDT Holdings Trust, Macquarie MDT Holdings Inc., Belike Nominees Pty Limited and Macquarie Group Services Australia Pty Limited (incorporated by reference to Exhibit 4.6 of our Annual Report on Form 20-F filed on May 10, 2010).

|

|

10.7

|

English translation of Management Services Agreement dated May 31, 2006, between Elbit Imaging Ltd. and Europe-Israel (M.M.S.) Ltd. (incorporated by reference to Exhibit 4.7 of our Report on Form 6-K filed on June 16, 2010).

|

|

10.8

|

Share Purchase Agreement dated December 29, 2010, among B.E.A. Hotels N.V., PPHE Hotel Group Limited and Park Plaza Hotels Europe Holdings B.V. (incorporated by reference to Exhibit 4.8 of our Annual Report on Form 20-F filed on June 6, 2011).

|

|

10.9

|

Agreement of Purchase and Sale, dated as of January 10, 2012, among certain sellers and BRE DDR RETAIL HOLDINGS LLC (incorporated by reference to Exhibit 4.10 of our Annual Report on Form 20-F filed on April 25, 2012).

|

|

10.10

|

First Amendment to Agreement of Purchase and Sale, dated as of January 24, 2012, among certain sellers and BRE DDR RETAIL HOLDINGS LLC (incorporated by reference to Exhibit 4.11 of our Annual Report on Form 20-F filed on April 25, 2012).

|

|

10.11

|

Share Purchase Agreement, dated as of March 30, 2012, by and among B.E.A. Hotels N.V., PPHE Netherland N.V. and PPHE Hotel Group Limited (incorporated by reference to Exhibit 4.12 of our Annual Report on Form 20-F filed on April 25, 2013).

|

|

21.1

|

List of subsidiaries (incorporated by reference to Exhibit 8.1 of our Annual Report on Form 20-F filed on May 14, 2013).

|

|

23.1

|

Consent of Brightman Almagor Zohar & Co.

|

|

23.2

|

Consent of Goldfarb Seligman & Co. (included in Exhibit 5.1)

|

|

23.3

|

Consent of Colliers International.

|

|

23.4

|

Consent of Cushman & Wakefield.

|

|

23.5

|

Consent of Financial Immunities Ltd.

|

|

23.6

|

Consent of Financial Immunities Ltd.

|

|

23.7

|

Consent of Financial Immunities Dealing Room Ltd.

|

|

23.8

|

Consent of Financial Immunities Dealing Room Ltd.

|

|

23.9

|

Consent of Financial Immunities Dealing Room Ltd.

|

|

23.10

|

Consent of Giza Zinger Even.

|

|

23.11

|

Consent of Cushman & Wakefield.

|

|

23.12

|

Consent of Jones Lang LaSalle Kft.

|

|

23.13

|

Consent of Giza Zinger Even.

|

|

23.14

|

Consent of Giza Zinger Even.

|

|

23.15

|

Consent of Giza Zinger Even.

|

|

23.16

|

Consent of Giza Zinger Even.

|

|

23.17

|

Consent of Giza Zinger Even.

|

|

23.18

|

Consent of De-Kalo Ben-Yehuda.

|

|

23.19

|

Consent of Financial Immunities Dealing Room Ltd.

|

|

23.20

|

Table of advisors relied upon in the consolidated financial statements for the years ended December 31, 2011, 2012 and 2013.

|

II - 8

Exhibit 5.1

Goldfarb Seligman & Co.

Electra Tower

98 Yigal Alon Street

Tel Aviv 6789141, Israel

December 1, 2014

Elbit Imaging Ltd.

5 Kinneret Street

Bnei Brak 51261

Israel

Ladies and Gentlemen,

We refer to the amended Registration Statement on Form F-1/A (the “Registration Statement”) to be filed on or about the date hereof with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Act”), on behalf of Elbit Imaging Ltd. (the “Company”), relating to the resale, from time to time, of 10,198,638 of the Company’s Ordinary Shares, no par value (the “Shares”).

We are members of the Israel Bar and we express no opinion as to any matter relating to the laws of any jurisdiction other than the laws of Israel.

In connection with this opinion, we have examined such corporate records, other documents and such questions of Israeli law as we have considered necessary or appropriate for the purposes of this opinion. In such examination, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to original documents of all copies submitted to us, the authenticity of the originals of such copies and, as to matters of fact, the accuracy of all statements and representations made by officers of the Company.

Based on the foregoing and subject to the qualifications stated herein, we advise you, that in our opinion, the Shares are duly authorized, validly issued, fully paid and non-assessable.

This opinion is rendered as of the date hereof, and we undertake no obligation to advise you of any changes in applicable law or any other matters that may come to our attention after the date hereof that may affect this opinion.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. This consent is not to be construed as an admission that we are a person whose consent is required to be filed with the Registration Statement under the provisions of the Act.

| |

Sincerely,

/s/ Goldfarb Seligman & Co.

|

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form F-1/A and on Registration Statements No. 333-117509, No. 333-130852, No. 333-136684 and No. 333-152820 on Form S-8 filed by Elbit Imaging Ltd. of our report dated March 31, 2014 relating to the consolidated financial statements of Elbit Imaging Ltd. as of December 31, 2013, which report expresses an unqualified opinion and includes explanatory paragraphs relating to: (i) a substantial doubt about a consolidated subsidiary ability to continue as a going concern; (ii) claims that have been filed against Group companies for some of which petitions have been applied to certify as class actions suits, and one of which was certified as a class action; (iii) a change of an accounting method for jointly controlled entities from the proportionate consolidated method to the equity method in the years ended December 31, 2013 and 2012 due to the adoption of IFRS 11 Joint Arrangements as of January 1, 2013.

/s/Brightman Almagor Zohar & Co.

Brightman Almagor Zohar & Co.

Certified Public Accountants

A member firm of Deloitte Touche Tohmatsu

Tel-Aviv, Israel

November 27, 2014

Exhibit 23.3

CONSENT

We hereby consent to the reference to our valuation of the Radisson Blu Hotel and Centre Ville Apart Hotel in Bucharest, Romania, as of December 31, 2013, 2012 and 2011, appearing in the Current Report on Form 6-K of Elbit Imaging Ltd. as filed with the Securities and Exchange Commission on March 31, 2014 and to the incorporation by reference of such Current Report in this Registration Statement on Form F-1/A filed by Elbit Imaging Ltd.

This consent is not to be construed as an admission that we are an expert or that we are a person whose consent is required to be filed under the provisions of the Securities Act of 1933, as amended.

/s/ Colliers International

Irina Baetulu

Financial Manager

Colliers International

Bucharest, Romania

November 27, 2014

Exhibit 23.4

CONSENT