Additional Proxy Soliciting Materials (definitive) (defa14a)

April 18 2016 - 12:59PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant

þ

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

|

|

|

|

¨

Preliminary Proxy Statement

|

|

¨

Confidential, for Use of the Commission Only

|

|

¨

Definitive Proxy Statement

|

|

(as permitted by Rule 14a-6(e)(2))

|

|

þ

Definitive Additional Materials

|

|

|

|

¨

Soliciting Material Pursuant to §240.14a-12

|

|

|

eBay Inc.

(Name of Registrant as Specified

In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

|

|

|

þ

|

|

No fee required.

|

|

|

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

On April 18, 2016, eBay Inc. will provide the following information to certain of its investors.

Additional 2016 Proxy Materials April 2016

$3.6B GMV1 $0.7B Rev 162M Global Active

Buyers $78B GMV1 59% International GMV1 … >190 Markets Served 43% of GMB2 Closed on Mobile $7.2B Rev $0.7B Rev 1 Gross merchandise volume 2 Gross merchandise bought Note: GMV & Revenue represent Full Year 2015 results; Active Buyers, %

International GMV and % GMB Closed on Mobile as of Q4 2015 Our Platforms

Best Choice Most Relevance 2016 Focus

Strong, Stable & Secure Commerce Platform Engaging Product & Brand Experiences Vibrant Marketplace Powerful Selling Platform Brand Positioning Mobile Our Strategic Priorities

Separation created sharper strategic focus

and better positioned each business to capitalize on growth opportunities as independent companies to succeed in the increasingly competitive landscape Sept. 2014 Announcement eBay Inc. announces plan to spin-off PayPal (acquired in 2002) Separation

process led by CEO John Donahoe and CFO Bob Swan with extensive independent director oversight and involvement Sept. 2014 to July 2015 Leadership Transition New leadership team for independent eBay announced, all NEOs new to roles eBay Inc. names

new Board of Directors for the two companies July 2015 Spin-Off Completed eBay and PayPal split into two independent publicly traded companies Devin Wenig assumes CEO role, John Donahoe retires Thomas Tierney appointed non-executive board Chairman

eBay / PayPal Spin-off: Successful Business and Leadership Transformation Today Two leading independent technology franchises eBay: $8.6BN1 in revenues, $29BN2 market cap, ~11,600 employees PayPal: $9.2BN1 in revenues, $47BN2 market cap, ~16,800

employees Combined returns for shareholders3 24.0% since announcement 14.1% since separation 1 FY 2015 Financial Releases 2 As of 4/15/2016 3 Capital IQ as of 4/15/2016

Compensation Program Aligned with Business

Goals and Culture 1. Align compensation with our business objectives, performance and stockholder feedback 2. Motivate named executive officers (“NEOs”) to enhance long-term stockholder value 3. Position us competitively among the

companies against which we recruit and compete for talent 4. Enable us to attract, retain, and reward NEOs and other key employees who contribute to our long-term success Pay practices align with and support… Emphasize pay-for-performance

alignment Majority of total compensation is performance-based Multiple performance measures, caps on incentive payments, and overlapping two-year performance periods for PBRSU awards Meaningful stock ownership requirements for executive officers

Maintain a clawback policy Retain an independent compensation consultant Prohibit hedging and pledging by executive officers and directors Limited perquisites to executive officers …the goals of our executive pay program 2016 Compensation

Changes Further Drive Alignment CEO Compensation is Heavily Performance- and Equity-Based Prior (2015) Today (2016) Performance-based restricted stock 50% of NEO long-term incentives 60% of NEO long-term incentives Use of options Minor component of

NEO compensation Options eliminated Peer group Based on combined business and scale of pre-spin eBay Modified to reflect business and scale of post-spin eBay Note: 2015 reported compensation breakdown for Mr. Wenig as disclosed in 2016 proxy

statement 2015 CEO compensation 67% performance-based and composed of 75% equity Our compensation program is heavily performance- and equity-based and aligns management with stockholders

Compensation Philosophy and Program Aligned

with Business Goals, Culture and Stockholder Interests Our Compensation Committee and Board have carefully used equity as a valuable tool to: Help attract and retain our employees Closely align award recipients’ interests with our stockholders

Motivate them to increase stockholder value by contributing to the long-term growth and success of our Company Equity compensation is critical to future execution of eBay’s financial, strategic and other priorities as it is: An integral

component of compensation in the technology industry for wide cross-sections of the employee population Essential in attracting top talent in a dynamic marketplace with an active and mobile talent pool Critical in retaining employees who provide the

greatest value creation and prospects for long-term success

Board Has Demonstrated Responsible

Management of Equity Awards and Share Usage Dilution and Burn-Rate are In-Line with Peers, but eBay Uses Equity to Drive Incentives for the Broad Employee Base, Not Just Executives2 Dilution (Full) 3-Year Avg. Adj. Burn Rate Grants to CEO (2015)

Grants to NEOs (2015) eBay 17.8% 4.2% 1.1% 3.1% Peers 16.7% 4.7% 14.0% 26.7% Broad-based: Our equity plans are used to drive incentives across our employee population; we make equity grants to ~60% of our employees as part of our LTI compensation

structure, with grants to our CEO and NEOs representing a lower percentage of total grants than peers1 Dilution management: We actively manage dilution by conducting regular stock repurchases to programmatically offset the impact of dilution from

our equity compensation programs; we repurchased $1.15BN shares in 2H15 1 4-digit GICS (Software & Services) peers 2 From the 2016 ISS research report. Figures shown for eBay and peers computed based on ISS methodology, and shown here to provide

comparison between eBay and peers. eBay computes dilution (see next slide) and burn rate (see Proxy page 29) in a different manner Our Compensation Committee and Board are committed to disciplined utilization of equity awards and share usage under

the broad-based equity plans incentivizing employees throughout all levels of the Company

Plan Summary and Key Features Increasing

the number of shares available for future issuance under the 2008 Plan by an additional 50,000,000 shares This share request is to fund our equity compensation programs for an additional two years Include a limit on the annual value of awards

granted to non-employee directors; and a requirement that stockholder approval must be obtained in order to change this limit Modifying the minimum vesting provision under the 2008 Plan, such that the number of shares subject to full value awards

that vest earlier than one year after the date of grant will not exceed 5% of the aggregate number of shares available under the 2008 Plan Extending the term of the 2008 Plan to the tenth anniversary of stockholder approval of the amendment and

restatement of the 2008 Plan Stockholders are being asked to approve an amendment to our 2008 Equity Incentive Award Plan with the purpose of: Effect of 2016 Option Elimination on Dilution Plan Shares Dilution (Basic) Dilution (Full) 2016 request

assuming maximum dilution 89,493,467 7.8% 6.4% 2016 request assuming all Full Value awards 50,000,000 4.4% 3.9% Total Dilution (Full Value Shares Granted Going Forward + Granted Unexercised/Unvested shares) 156,808,340 13.7% 12.1% Oversight by 100%

Independent Compensation Committee Limitation on Reuse of Shares No Repricing or Granting of Discounted Stock Options or SARs No “Evergreen” Provision Clawback Deductibility of Awards Limitation on Awards to Any One Individual Plan

features designed to serve stockholders’ interests and facilitate effective corporate governance Elimination of stock options in 2016 decreases dilution rate The Equity Plan is a critical component of our broad-based compensation program and

is structured to drive stockholder returns and minimize dilution – the Board recommends that stockholders vote FOR proposal #3

Recent Investor Questions on our Equity

Plan Does the Plan allow for discretion to accelerate vesting? The Plan does provide for discretion of the independent Compensation Committee to accelerate vesting This is intended to provide flexibility where the exercise of discretion is

determined to be in the best interest of stockholders to motivate and retain key talent in the event of extraordinary future situations In the past five years, the Committee has exercised discretion for limited acceleration for three terminating

executives, plus the acceleration of equity for the departing five leaders following their departure from eBay at the time of the Spin-off of PayPal (as disclosed). Does the Plan allow for the granting of stock options? The Plan does provide for the

granting of stock options, to preserve future flexibility However, as of 2016, we have made the determination to cease granting stock options What is the impact of the fungible share reserve on the Plan? The fungible share reserve within the Plan is

associated with stock options, which have been eliminated in our current compensation program The fungible share reserve within the Plan counts awards against the available plan reserve based on ratios tied to the expected value of the award, with

full value awards counting as one share for each share subject to the award, and options and stock appreciation rights counting as 0.5587 shares. Based on the elimination of stock options as part of our regular course program, we expect that the

maximum number of shares to be granted will be equal to the number of shares we have requested

Strong, Independent Board and Commitment

to Corporate Governance Best Practices Strong Board independence (9 of 11 director nominees are independent) P Annually elected board P Majority vote standard for uncontested director elections P Separate Chair and CEO roles P Simple

majority vote standard for bylaw/charter amendments and transactions P Independent Chair with robust responsibilities P Clawback policy P Stock ownership requirements for our executive officers and directors P Stockholder right to

call a special meeting P Stockholder proxy access (adopted March 2016) P Strong stockholder engagement practices P Anti-hedging and anti-pledging policies P 4 independent directors added to the Board in 2015 9 of 11 director nominees

are independent

We remain committed to our ongoing

efforts to promote gender diversity in the workplace – the proposal would not meaningfully enhance our existing commitment to an inclusive culture or workplace diversity eBay complies with the EEOC reporting requirements and in 2016 began an

additional detailed review of gender pay equity We are committed to addressing any gender pay equity issue, if one exists (“If we determine we have an issue, we will fix it.” Devin Wenig, eBay President & CEO, April 8, 2016) However,

the Board believes that eBay should retain the flexibility to identify and address any issue in a manner and on a time frame that is best for our stockholders and employees Ongoing gender equality initiatives Stockholder Proposal on Gender Pay

Equity: Diversity Remains a Long-Standing Focus of eBay In 2010, eBay launched its Women’s Initiative Network (WIN) to attract and engage women to build lasting, successful careers at eBay Through WIN, we have more than doubled women in

leadership roles and increased the share of leadership positions held by women Pioneer Partner of the Anita Borg Institute and Diamond Sponsor of the 2016 Grace Hopper Conference Leverage research insights from the Clayman Institute for Gender

Research at Stanford University, as well as from leading academics Beginning in 2014, we publish our global gender diversity and U.S. ethnic diversity workforce data annually Women represent 43% of our global workforce and 29% of global leaders

Females comprise >30% of our President and CEO’s direct reports and our board includes two women, Bonnie Hammer and Kathleen Mitic eBay is committed to gender diversity – it is premature to support the stockholder proposal at this

time eBay has a long-standing commitment to diversity and is in the process of evaluating gender pay equity – the Board recommends that stockholders vote AGAINST proposal #5

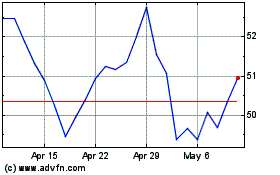

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

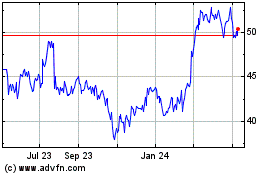

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024