UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO/A

Tender Offer Statement Under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 3)

COPART, INC.

(Name of Subject Company (Issuer) and Name of Filing Person (Offeror))

Common Stock, Par Value $0.0001 Per Share

(Title of Class of Securities)

217204106

(CUSIP Number

of Class of Securities)

A. Jayson Adair

Chief

Executive Officer

Copart, Inc.

14185 Dallas Parkway, Suite 300

Dallas, TX 75254

(972)

391-5000

(Name, address and telephone number of person authorized to receive notices and communication on behalf of Filing Persons)

Copy to:

Paul A.

Styer

Senior Vice President, General Counsel and Secretary

Copart, Inc.

14185

Dallas Parkway, Suite 300

Dallas, TX 75254

(972) 391-5000

Copy to:

Robert F. Kornegay

Michael Occhiolini

Wilson Sonsini Goodrich & Rosati

Professional Corporation

12235 El Camino Real, Suite 200

San Diego, California 92130-3002

Tel: (858) 350-2300

CALCULATION OF

REGISTRATION FEE

|

|

|

| Transaction Valuation* |

|

Amount of Filing Fee** |

| $324,999,987.00 |

|

$32,727.50 |

| |

| * |

Estimated for purposes of calculating the amount of the filing fee only, this amount is based on the assumed purchase of 8,333,333 shares of common stock at the tender offer price of $39.00 per share.

|

| ** |

The Amount of Filing Fee calculated in accordance with Rule 0-11(b) of the Securities Exchange Act of 1934, as amended, equals $100.70 for each $1,000,000 of the value of the

transaction. |

| x |

Check the box if any part of the filing fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

| Amount Previously Paid: $30,210.00 |

|

Filing Party: Copart, Inc. |

| Form or Registration No.: Schedule TO-I |

|

Date Filed: November 24, 2015 |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transaction to which the statement relates:

| |

¨ |

third party tender offer subject to Rule 14d-1. |

| |

x |

issuer tender offer subject to Rule 13e-4. |

| |

¨ |

going private transaction subject to Rule 13e-3. |

| |

¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below to designate the appropriate rule

provision(s) relied upon:

| |

¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

AMENDMENT NO. 3 TO SCHEDULE TO-I

This Amendment No. 3 (this “Amendment No. 3”) amends and supplements the Tender Offer Statement on Schedule TO

originally filed on November 24, 2015 by Copart, Inc., a Delaware corporation, as amended on November 25, 2015 and December 4, 2015 (the “Schedule TO”). The Schedule TO, as amended by this Amendment No. 3,

relates to the offer by Copart, Inc. to purchase up to 7,317,073 shares of its common stock, par value $0.0001 per share, at a price not greater than $41.00 nor less than $38.00 per share, upon the terms and subject to the conditions set forth in

the Offer to Purchase, dated November 24, 2015 (the “Offer to Purchase”), previously filed as Exhibit (a)(1)(A) to the Schedule TO, and in the related Letter of Transmittal (the “Letter of Transmittal”), previously

filed as Exhibit (a)(1)(B) to the Schedule TO (which, as amended or supplemented from time to time, together constitute the “Offer”). The Offer expired at 5:00 p.m., New York City time, on Wednesday, December 23, 2015. This Amendment

No. 3, as it amends and supplements the Schedule TO, is intended to satisfy the reporting requirements of Rule 13e-4(c)(3) of the Securities Exchange Act of 1934, as amended.

This Amendment No. 3 is filed to include the information set forth below and only those items amended are reported in this Amendment

No. 3. Except as specifically provided herein, the information contained in the Schedule TO remains unchanged and this Amendment No. 3 does not modify any of the information previously reported on Schedule TO.

| Item 4. |

Terms of the Transaction. |

Item 4 of the Schedule TO is hereby amended and

supplemented by inserting at the end thereof the following:

“The tender offer expired at 5:00 p.m., New York City time, on Wednesday,

December 23, 2015. Based on a preliminary count, we have been advised by the depositary that 11,845,788 shares of our common stock (including 3,810,996 shares of common stock delivered pursuant to guaranteed deliveries), were validly

tendered and not withdrawn in the tender offer at or below a price of $39.00. We expect to acquire approximately 8,333,333 shares of our common stock at a purchase price of $39.00 per share for a total cost of approximately $325.0 million,

excluding fees and expenses related to the tender offer. The 8,333,333 shares represent approximately 6.9% of the shares issued and outstanding. The shares expected to be purchased include the 7,317,073 shares we initially offered to purchase

and approximately 1,016,260 additional shares of our outstanding common stock that we have elected to purchase pursuant to our right to purchase up to an additional 2% of our outstanding shares.

| Item 11. |

Additional Information. |

Item 11 of the Schedule TO is hereby amended and

supplemented by adding the following paragraph at the end thereof:

“On December 24, 2015, Copart issued a press release

announcing the preliminary results of the tender offer, which expired at 5:00 p.m., New York City time, on Wednesday, December 23, 2015. A copy of the press release is filed as Exhibit (a)(1)(H) to this Schedule TO and is incorporated herein by

reference.”

|

|

|

| (a)(1)(A) ** |

|

Offer to Purchase dated November 24, 2015. |

|

|

| (a)(1)(B) ** |

|

Letter of Transmittal. |

|

|

| (a)(1)(C) ** |

|

Notice of Guaranteed Delivery. |

|

|

| (a)(1)(D) ** |

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees dated November 24, 2015. |

|

|

| (a)(1)(E) ** |

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees dated November 24, 2015. |

|

|

| (a)(1)(F) ** |

|

Press Release, dated November 24, 2015. |

-1-

|

|

|

|

|

| (a)(1)(G) ** |

|

Summary Advertisement, dated November 24, 2015. |

|

|

| (a)(1)(H) * |

|

Press Release, dated December 24, 2015. |

|

|

| (a)(5)(A) ** |

|

Pre-commencement press release issued by the Company on November 23, 2015. |

|

|

| (d)(1) |

|

Copart Inc. 2001 Stock Option Plan (incorporated by reference from Exhibit 4.1 to the Company’s Registration Statement on Form S-8 filed on June 17, 2002). |

|

|

| (d)(2) |

|

Form of Indemnification Agreement signed by executive officers and directors (incorporated by reference from Exhibit 10.17 to the Company’s Annual Report on Form 10-K filed on October 1, 2012). |

|

|

| (d)(3) |

|

Copart Inc. 2007 Equity Incentive Plan, as amended and restated, (“2007 EIP”) (incorporated by reference from Exhibit 4.1 to the Company’s Registration Statement on Form S-8 filed on January 9,

2014). |

|

|

| (d)(4) |

|

Form of Performance Share Award Agreement for use with 2007 EIP (incorporated by reference from Exhibit 10.2 to the Company’s Current Report on Form 8-K filed on December 12, 2007). |

|

|

| (d)(5) |

|

Form of Restricted Stock Unit Award Agreement for use with 2007 EIP (incorporated by reference from Exhibit 10.3 to the Company’s Current Report on Form 8-K filed on December 12, 2007). |

|

|

| (d)(6) |

|

Form of Stock Option Award Agreement for use with 2007 EIP (incorporated by reference from Exhibit 10.5 to the Company’s Current Report on Form 8-K filed on December 12, 2007). |

|

|

| (d)(7) |

|

Form of Restricted Stock Award Agreement for use with 2007 EIP (incorporated by reference from Exhibit 10.4 to the Company’s Current Report on Form 8-K filed on December 12, 2007). |

|

|

| (d)(8) |

|

Copart, Inc. Executive Bonus Plan (incorporated by reference from Exhibit 10.13 to the Company’s Current Report on Form 8-K filed on August 3, 2006). |

|

|

| (d)(9) |

|

Form of Copart, Inc. Stand-Alone Stock Option Award Agreement for grant of options to purchase 2,000,000 shares of the Company’s common stock to each of Willis J. Johnson and A. Jayson Adair (incorporated by

reference from Exhibit 4.1 to the Company’s Registration Statement on Form S-8 filed on June 12, 2009). |

|

|

| (d)(10) |

|

Amended and Restated Stand-Alone Stock Option Award Agreement dated June 2, 2015, between the Company and A. Jayson Adair (incorporated by reference from Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on June 4,

2015). |

|

|

| (d)(11) |

|

Amended and Restated Stand-Alone Stock Option Award Agreement dated June 2, 2015, between the Company and Vincent W. Mitz (incorporated by reference from Exhibit 10.2 to the Company’s Current Report on Form 8-K filed on June 4,

2015). |

|

|

| (d)(12) |

|

Amendment dated June 9, 2010 to Option Agreements dated June 6, 2001, October 21, 2002 and August 19, 2003 between the Company and Willis J. Johnson (incorporated by reference from Exhibit 10.17 to the

Company’s Quarterly Report on Form 10-K filed on September 23, 2010). |

|

|

| (d)(13) |

|

Amended and Restated Executive Officer Employment Agreement between the Company and William E. Franklin, dated September 25, 2008 (incorporated by reference from Exhibit No. 10.1 to the Quarterly Report on Form 10-Q filed on

December 10, 2008). |

|

|

| (d)(14) |

|

2014 Employee Stock Purchase Plan (incorporated by reference from Exhibit 10.1 of the Company’s Current Report on Form 8-K filed with the SEC on December 5, 2014). |

|

|

| (d)(15) |

|

Executive Officer Employment Agreement, effective January 4, 2016, between the Registrant and Jeffrey Liaw (incorporated by reference from Exhibit 10.26 of the Company’s Current Report on Form 8-K filed with the SEC on November

23, 2015). |

|

|

| (d)(16) ** |

|

Executive Officer Employment Agreement, effective August 1, 2014, between the Company and Rama Prasad. |

-2-

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

| Date: December 24, 2015 |

|

COPART, INC. |

|

|

|

|

|

By: |

|

/s/ Paul A. Styer |

|

|

|

|

Name: Paul A. Styer |

|

|

|

|

Title: Senior Vice President, General Counsel,

and Secretary |

-3-

Exhibit Index

|

|

|

| Exhibit No. |

|

Description |

|

|

| (a)(1)(A) ** |

|

Offer to Purchase dated November 24, 2015. |

|

|

| (a)(1)(B) ** |

|

Letter of Transmittal. |

|

|

| (a)(1)(C) ** |

|

Notice of Guaranteed Delivery. |

|

|

| (a)(1)(D) ** |

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees dated November 24, 2015. |

|

|

| (a)(1)(E) ** |

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees dated November 24, 2015. |

|

|

| (a)(1)(F) ** |

|

Press Release, dated November 24, 2015. |

|

|

| (a)(1)(G) ** |

|

Summary Advertisement, dated November 24, 2015. |

|

|

| (a)(1)(H) * |

|

Press Release, dated December 24, 2015. |

|

|

| (a)(5)(A) ** |

|

Pre-commencement press release issued by the Company on November 23, 2015. |

|

|

| (d)(1) |

|

Copart Inc. 2001 Stock Option Plan (incorporated by reference from Exhibit 4.1 to the Company’s Registration Statement on Form S-8 filed on June 17, 2002). |

|

|

| (d)(2) |

|

Form of Indemnification Agreement signed by executive officers and directors (incorporated by reference from Exhibit 10.17 to the Company’s Annual Report on Form 10-K filed on October 1, 2012). |

|

|

| (d)(3) |

|

Copart Inc. 2007 Equity Incentive Plan, as amended and restated, (“2007 EIP”) (incorporated by reference from Exhibit 4.1 to the Company’s Registration Statement on Form S-8 filed on January 9,

2014). |

|

|

| (d)(4) |

|

Form of Performance Share Award Agreement for use with 2007 EIP (incorporated by reference from Exhibit 10.2 to the Company’s Current Report on Form 8-K filed on December 12, 2007). |

|

|

| (d)(5) |

|

Form of Restricted Stock Unit Award Agreement for use with 2007 EIP (incorporated by reference from Exhibit 10.3 to the Company’s Current Report on Form 8-K filed on December 12, 2007). |

|

|

| (d)(6) |

|

Form of Stock Option Award Agreement for use with 2007 EIP (incorporated by reference from Exhibit 10.5 to the Company’s Current Report on Form 8-K filed on December 12, 2007). |

|

|

| (d)(7) |

|

Form of Restricted Stock Award Agreement for use with 2007 EIP (incorporated by reference from Exhibit 10.4 to the Company’s Current Report on Form 8-K filed on December 12, 2007). |

|

|

| (d)(8) |

|

Copart, Inc. Executive Bonus Plan (incorporated by reference from Exhibit 10.13 to the Company’s Current Report on Form 8-K filed on August 3, 2006). |

|

|

| (d)(9) |

|

Form of Copart, Inc. Stand-Alone Stock Option Award Agreement for grant of options to purchase 2,000,000 shares of the Company’s common stock to each of Willis J. Johnson and A. Jayson Adair (incorporated by

reference from Exhibit 4.1 to the Company’s Registration Statement on Form S-8 filed on June 12, 2009). |

|

|

| (d)(10) |

|

Amended and Restated Stand-Alone Stock Option Award Agreement dated June 2, 2015, between the Company and A. Jayson Adair (incorporated by reference from Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on June 4,

2015). |

|

|

| (d)(11) |

|

Amended and Restated Stand-Alone Stock Option Award Agreement dated June 2, 2015, between the Company and Vincent W. Mitz (incorporated by reference from Exhibit 10.2 to the Company’s Current Report on Form 8-K filed on June 4,

2015). |

-4-

|

|

|

| Exhibit No. |

|

Description |

|

|

| (d)(12) |

|

Amendment dated June 9, 2010 to Option Agreements dated June 6, 2001, October 21, 2002 and August 19, 2003 between the Company and Willis J. Johnson (incorporated by reference from Exhibit 10.17 to the

Company’s Quarterly Report on Form 10-K filed on September 23, 2010). |

|

|

| (d)(13) |

|

Amended and Restated Executive Officer Employment Agreement between the Company and William E. Franklin, dated September 25, 2008 (incorporated by reference from Exhibit No. 10.1 to the Quarterly Report on Form 10-Q filed on

December 10, 2008). |

|

|

| (d)(14) |

|

2014 Employee Stock Purchase Plan (incorporated by reference from Exhibit 10.1 of the Company’s Current Report on Form 8-K filed with the SEC on December 5, 2014). |

|

|

| (d)(15) |

|

Executive Officer Employment Agreement, effective January 4, 2016, between the Registrant and Jeffrey Liaw (incorporated by reference from Exhibit 10.26 of the Company’s Current Report on Form 8-K filed with the SEC on November

23, 2015). |

|

|

| (d)(16) ** |

|

Executive Officer Employment Agreement, effective August 1, 2014, between the Company and Rama Prasad. |

-5-

Exhibit (a)(1)(H)

For Immediate Release

Copart Announces Preliminary Results of Its Tender Offer

Copart expects to acquire approximately 8,333,333 shares at $39.00 per share

Dallas, TX (December 24, 2015) – Copart, Inc. (NASDAQ: CPRT) today announced the preliminary results of its modified “Dutch Auction” tender

offer, which expired at 5:00 p.m., New York City time, on Wednesday, December 23, 2015.

Based on the preliminary count by the depositary for

the tender offer, an aggregate of 11,845,788 shares were properly tendered and not withdrawn at or below a price of $39.00, including 3,810,996 shares that were tendered through notice of guaranteed delivery. Copart expects to acquire

approximately 8,333,333 shares of its common stock at a purchase price of $39.00 per share for a total cost of approximately $325.0 million, excluding fees and expenses related to the tender offer. The 8,333,333 shares represent

approximately 6.9% of the shares issued and outstanding. The shares expected to be purchased include the 7,317,073 shares Copart initially offered to purchase and approximately 1,016,260 additional shares of Copart’s outstanding common

stock that Copart has elected to purchase pursuant its right to purchase up to an additional 2% of its outstanding shares.

Because more than

7,317,073 shares of common stock have been validly tendered and not validly withdrawn, the offer is oversubscribed, and Copart expects to only accept for purchase, on a pro rata basis, approximately 70.1% of the shares validly tendered at or

below $39.00 (assuming all shares tendered through guaranteed delivery procedures are delivered under the terms of the offer), based on the total number of shares reported to be tendered at or below $39.00 and not withdrawn prior to the expiration

of the offer and accounting for “odd lot” priority and the conditional tender provisions of the offer. This preliminary proration factor is subject to change based on, among other things, the number of tendered shares which satisfy the

guaranteed delivery procedures.

The number of shares to be purchased, the proration factor, and the price per share are preliminary. The determination of

the final number of shares to be purchased, the final proration factor, and the final price per share is subject to confirmation by the depositary of the proper delivery of the shares validly tendered and not withdrawn. The actual number of shares

validly tendered and not withdrawn, the final proration factor, and the final price per share will be announced following the completion of the confirmation process. Payment for the shares accepted for purchase will occur promptly thereafter.

Payment for shares will be made in cash, without interest.

The self-tender offer was made pursuant to an Offer to Purchase and Letter of Transmittal,

each filed with the Securities and Exchange Commission on November 24, 2015, as amended on November 25, 2015 and December 4, 2015. The information agent is Georgeson Inc. and the depositary is Computershare Trust Company, N.A. For

questions and information regarding the tender offer, please call the information agent at 1-800-932-9864.

THIS PRESS RELEASE IS FOR INFORMATIONAL

PURPOSES ONLY AND DOES NOT CONSTITUTE AN OFFER TO PURCHASE OR THE SOLICITATION OF AN OFFER TO SELL SHARES OF COPART COMMON STOCK. THE TENDER OFFER WAS MADE ONLY PURSUANT TO THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND RELATED MATERIALS THAT

COPART

-1-

DISTRIBUTED TO ITS STOCKHOLDERS AND FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. STOCKHOLDERS AND INVESTORS SHOULD READ CAREFULLY THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND RELATED

MATERIALS BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING THE VARIOUS TERMS OF, AND CONDITIONS TO, THE TENDER OFFER.

About Copart

Copart, founded in 1982, provides vehicle sellers with a full range of remarketing services to process and sell salvage and clean title vehicles to dealers,

dismantlers, rebuilders, exporters and, in some locations, to end users. Copart remarkets the vehicles through Internet sales utilizing its VB3 technology. Copart sells vehicles on behalf of insurance companies, banks, finance companies, fleet

operators, dealers, car dealerships and others as well as cars sourced from the general public. The company currently operates in the United States and Canada, the United Kingdom, Brazil, Germany, the United Arab Emirates, Oman and Bahrain, India,

and Spain.

Forward-Looking Statements

This press

release contains forward-looking statements, as defined under the federal securities laws. These forward-looking statements include statements regarding Copart’s expectation regarding the number of shares to be purchased, the price at which

such shares will be purchased, the proration factor, and the payment for shares related thereto. These forward-looking statements are not guarantees and are subject to risks, uncertainties and assumptions that could cause the actual number of shares

to be purchased, the price at which shares are ultimately purchased, or the final proration factor to differ materially and adversely from the number and amount expressed in the forward-looking statements in this press release. Results may differ

due to various factors, such as the possibility that stockholders may not tender their shares in the tender offer, or if other conditions to completion of the tender offer are not satisfied. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as to Copart’s expectations as of the date hereof. Copart undertakes no obligation to update these forward-looking statements as a result of events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events.

| Contact: |

Christopher M. Smith, Senior Analyst, Office of the Chief Financial Officer |

| |

972-391-5021 or christopher.smith3@copart.com |

-2-

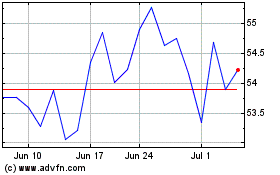

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Aug 2024 to Sep 2024

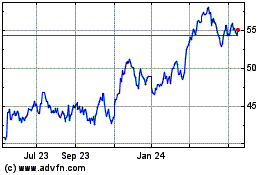

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Sep 2023 to Sep 2024