Didi Turns a Profit in More Than Half Its Cities

June 03 2016 - 2:20AM

Dow Jones News

HONG KONG—China's largest ride-hailing company, Didi Chuxing

Technology Co., is profitable in more than half of the 400 cities

in which it operates, the company's Senior Director of

International Strategy Zijian Li said Friday.

The almost four-year-old company will be profitable overall

"very soon," he said at the Converge technology conference, hosted

by The Wall Street Journal and f.ounders.

Didi gained a powerful backer in its battle against Uber

Technologies Inc. last month when Apple Inc. announced a $1 billion

investment in the Chinese startup. Didi's other investors include

Chinese internet giants Alibaba Group Holding Ltd. and Tencent

Holdings Ltd. while China's third major internet company, Baidu

Inc., backs Uber.

Mr. Li said the investment from Apple will help Didi advance its

big-data and machine-learning technology, the key focus for Didi in

the near term.

"Now we have the ability [in some cities] to precisely predict

15 minutes in advance of the supply and demand mismatch in a

certain area," he said.

Beijing-based Didi has its roots as a service to help Chinese

commuters book traditional taxis, but it has become the largest

private ride-hailing player in China after entering the sector two

years ago to compete with Uber.

Mr. Li said Didi doesn't plan to expand directly to other

countries, but its partnerships with Lyft and other overseas

ride-hailing services will help it provide convenient rides for

Chinese travelers when they go overseas. There were five million

travelers between the U.S. and China last year, and this number is

growing 15% to 20% annually, he said.

One big variable for the sector is a coming Chinese national

ride-hailing regulation expected to come out later this year. A

draft version of the rules last year would have required companies

such as Didi to seek local licenses for their drivers and take

other steps that would make them more like traditional taxi

companies. It is unclear what the rules will look like in their

final form.

Mr. Li said Didi's chief executive, Cheng Wei, has met multiple

times with senior Chinese leaders in the past few months, as the

government sees increasing value in the sharing economy.

Private ride-sharing businesses are technically still illegal in

China, as they are in a number of other countries.

China's government is getting "more and more open" to sharing

economy businesses such as Didi as the country seeks to shift its

economy toward higher-value technology sectors, he said.

Write to Eva Dou at eva.dou@wsj.com

(END) Dow Jones Newswires

June 03, 2016 02:05 ET (06:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

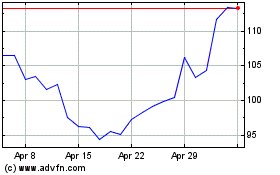

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Aug 2024 to Sep 2024

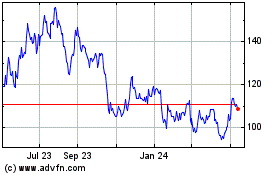

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Sep 2023 to Sep 2024