California Business Bank Announces Sixth Consecutive Quarterly Profits

July 17 2008 - 9:00AM

Business Wire

California Business Bank (OTCBB:CABB) announced financial results

today for the second quarter ended, June 30, 2008. For the second

quarter of 2008, the after tax profit was $30,708, or 1.6 cents per

share, compared with net profit of $197,000, or 10.7 cents per

share for the same quarter last year. The 2008 year to date pre-tax

profits was $164,632 and the after tax profits totaled $98,633, or

5.25 cents per share compared to $243,000, or 13.1 cents per share

for same period last year. Highlights for the second quarter ended

June 30, 2008 include: Total Assets increased by 26% or $27.7

million to $133.8 million compared to $106.1 at June 30, 2007;

Loans outstanding increased $22.7 million to $92.1 million, or a

32.6% increase from $69.4 million at June 30, 2007; Deposits grew

by 17.2% to $103.9 million from $88.7 million at June 30, 2007; The

allowance for loan losses to total loan was 1.23%, compared with

1.26% at June 30, 2007; Return on average assets was 0.10%,

compared to 0.80% for the second quarter of 2007. Return on average

equity was 0.68%, compared to 4.66% for the second quarter of 2007.

The Bank continued to be categorized as �well-capitalized� under

the regulatory guidelines, with Tier 1 leverage capital ratio of

13.99%, Tier 1 risk-based capital ratio of 18.85%, and Total

risk-based capital ratio of 20.09%. Mr. Wood, President and Chief

Executive Officer, stated: �The financial system is facing a

multitude of challenges resulting from the various stresses within

the economy. More notably the conspicuous intensification of both

oil and food prices, along with the complexities in the residential

housing and new construction markets, have created anxiety and

negatively impacted the banking industry. Further fueling the

bonfire are the continuous pessimistic media reports regarding the

health of financial institutions at a greater frequency than the

weather. We have noted some strains within our very limited

construction portfolio and our evaluation has denoted minimal

exposure to the bank from the orderly resolution of these loans.

Our stock price has been trading between $10.95 and $8.50 per share

in small quantities and at June 30, 2008, the stock was trading

around $10.40 per share. The bank continues to expand our

non-interest bearing deposits and commercial loan relationships

within our target markets. We expect to have our Inland Empire

branch opened mid-third quarter and have anchored it with very

seasoned commercial bankers. Their focus will be on our core

business lines. Finally, we are looking at market opportunities for

future expansion by acquiring additional branches, and/or human

resources to achieve our strategic priorities. California Business

Bank offers a wide range of financial services to individuals,

small and medium size businesses in Los Angeles, and the

surrounding communities in Southern California. Our commitment is

to deliver the highest quality financial services and products to

our customers. Forward-Looking Statements Certain matters discussed

in this press release constitute forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, and are subject to the safe harbors created by the act. These

forward-looking statements refer to the Company�s current

expectations regarding future operating results, and growth in

loans, deposits, and assets. These forward-looking statements are

subject to certain risks and uncertainties that could cause the

actual results, performance, or achievements to differ materially

from those expressed, suggested, or implied by the forward-looking

statements. These risks and uncertainties include, but are not

limited to (1) the impact of changes in interest rates, a decline

in economic conditions, and increased competition by financial

service providers on the Company�s results of operation; (2) the

Company�s ability to continue its internal growth rate; (3) the

Company�s ability to build net interest spread; (4) the quality of

the Company�s earning assets; and (5) governmental regulations.

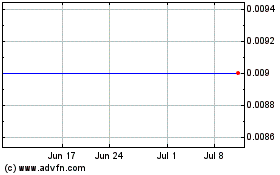

California Business Bank (CE) (USOTC:CABB)

Historical Stock Chart

From Apr 2024 to May 2024

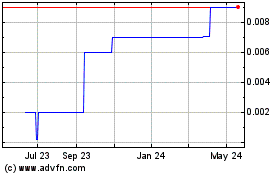

California Business Bank (CE) (USOTC:CABB)

Historical Stock Chart

From May 2023 to May 2024