Allied Energy, Inc. Announces Operations

Updates

BOWLING GREEN,

KY--(Marketwire – January 28, 2013) - Allied Energy, Inc.

(“Company”)(OTCMarkets:

AGGI) today announced updates relating to its

operations.

Drilling Update:

Yakesh 2-H Prospect: During

December 2012, Allied Operating Texas, LLC, (“AOT”) a wholly-owned

subsidiary

of Allied Energy, Inc., executed a drilling contract with

Independent Drilling,

LLC, Kilgore, TX and commenced spudding of the Yakesh 2-H

horizontal well,

located in Milam County, TX.

As

of

January 16, 2013, total vertical depth had been reached at 6,300

feet, and

after consultation and review of drilling logs, a decision was made

to drill

the lateral (horizontal) section through the upper Buda

formation. It is anticipated that the drilling

phase of the lateral section will be completed by early February

2013.

The costs of developing the Yakesh 2-H prospect are funded by

two

general partnerships sponsored by the Company. The

partnerships hold a majority working interest in the

Yakesh 2-H prospect. The Company

holds a 0.1% working interest (0.075% net revenue interest),

inclusive of its

interests in the general partnerships.

Non-Commercial Well Update:

B. Bryant #1 Prospect:

In early December 2012, the B.

Bryant #1 well, located in Wood County, TX, was drilled to the

Rodessa and

Pettit formations at a total depth of approximately 10,100

feet.

After

reaching total depth, the well was logged and Company engineers met

with log

analysts from Schlumberger to review the open-hole

logs and make recommendations for the completion of the

well.

After

extensive evaluation by Schlumberger Open Hole Logging experts,

Company

geologists, and Allied Energy Inc.’s VP of Operations, the

operational decision

was made to Plug and Abandon (P&A) the well. It was

determined that while the well was capable of

producing on a very limited basis, it was not capable of producing

in

quantities necessary to cover the costs of completing the

well.

The

drilling of the B. Bryant #1 well was funded by two general

partnerships

sponsored by the Company. The

partnerships hold a majority working interest in the B. Bryant

#1

prospect. The Company holds a

0.05037% working interest (0.03777% net revenue interest),

inclusive of its

interests in the general partnerships.

Completion Update:

Ragsdale #2 Well:

In November 2012, the Ragsdale #2 well, located in

Cherokee County, TX, was drilled to the Pettit formation at a total

depth of

approximately 10,500’.

Based

on

well logs run by Schlumberger, the Company believes that there are

hydrocarbons

present and approximately 70’ of pay.

A decision was made to complete the well, the operations of which

are

currently ongoing.

The

drilling and completion of the Ragsdale #2 well was funded by two

general

partnerships sponsored by the Company.

The partnerships hold a majority working interest in the Ragsdale

#2

prospect. The Company holds a

0.25% working interest (0.1875% net revenue interest), inclusive of

its

interests in the general partnerships.

Production Update:

E. Cantrell #1: During

August 2012, the E. Cantrell #1 well, located in Wood County, TX,

was drilled

to the Travis Peak formation at a total depth of approximately

10,709 ft.

After

reaching total depth, the well was logged and Company engineers met

with log

analysts from Schlumberger and consulting geologists to review the

open-hole

logs and make recommendations for the completion of the

well.

After

evaluation by Schlumberger and Company personnel, the operational

decision was

made to complete the well in the Rodessa formation.

The

well

is presently in initial stages of production testing.

The

drilling and completion of the E. Cantrell #1 well was funded by

two general

partnerships sponsored by the Company.

The partnerships hold a majority working interest in the E.

Cantrell #1

prospect. The Company holds a

0.05037% working interest (0.03777% net revenue interest),

inclusive of its

interests in the general partnerships.

Acquisition Update:

Yakesch Unit: In

August

2012, the Company acquired a 100% working interest (78-80% net

revenue

interest) in the 130.49-acre Yakesch Unit in Milam County,

TX. The lease includes one vertical well,

which is in the process of being re-completed and is not producing

hydrocarbons. The lease is being further developed

with the drilling of the Yakesh 2-H horizontal well primarily by

two

partnerships sponsored by the Company.

Operations management believes that there is the potential for

the

drilling of one additional vertical well on the Unit.

WT Pearson Lease:

In October 2012, the Company acquired the WT

Pearson Lease in Milam County, TX.

The lease is comprised of approximately 200 net acres, and includes

36

existing wellbores that were drilled to the Navarro sands. A

few of these wells are producing very

small amounts of oil. The Company

is in the process of checking each of these wellbores to attempt to

determine

their capabilities, if any.

The

wells

had combined total production for the fourth quarter of 2012 of

approximately

160 barrels of oil. To date, work

performed on the lease by the Company has been limited to deferred

maintenance

and basic remedial operations.

The

Company owns an 87.5% working interest (65.625% net revenue

interest) in the

lease. The development plan for

the lease includes the strategic deepening of certain of the wells

along with

the initiation of a “pressure maintenance” program. It is

estimated that there may be up to 12 additional

prospective well locations on the lease.

Clark Lease, Milam County, TX: In

October 2012, the Company acquired a 45% working interest, (33.75%

net revenue

interest) in the Clark Lease, and, in order to test the Pecan Gap

formation,

participated with an industry partner in the drilling of the Clark

#1 well to a

depth of 2,000’. The well is

currently being tested for completion.

The lease is comprised of approximately 198 net acres, and is

contiguous

with the Company’s 200-acre WT Pearson lease. It is estimated

that up to 20 additional drilling locations

may be available on the lease.

Pearson River Bottom Ranch Lease – Milam

County, TX:

In October 2012, the Company acquired a 45% working

interest, (33.75% net revenue interest), in the Pearson River

Bottom Ranch

Lease, which consists of approximately 5 net acres. In order

to test the Pecan Gap formation, the Company has

participated with an industry partner in the drilling of the

Pearson C1 well to

a depth of 1,800’. The well is

currently being tested for completion.

The lease is contiguous with the Company’s 200-acre WT Pearson

lease.

High Island Block 19S Prospect: In

October 2012, the Company entered into an agreement to participate

with

industry partners in the re-entry and reclamation of an orphan well

in

Jefferson County, TX. Allied's

share of the first well is a 3.0% working interest (2.25% net

revenue

interest). The work on the first

well is planned for the first quarter of 2013. The Company's

participation also includes the first right to

participate in any future wells on the entire 320-acre lease at up

to a 10%

working interest (7.5% net revenue interest).

North Constitution “Hooks” Prospect: In

October 2012, the Company entered into an agreement to participate

with

industry partners in the drilling of a 14,500’ well in Jefferson

County,

TX. The Company is participating

with a 3.25% working interest, (2.4375% net revenue

interest). Plans are to spud the well during the

first quarter of 2013.

J.T. Fields-Berry Lease: In

November 2012, the Company acquired an 87.5% working interest

(65.625% net

revenue interest) in the J.T. Fields-Berry Lease in Caldwell

County, TX. The lease is comprised of approximately

36 net acres and includes 5 existing wellbores that were drilled,

(during the

1980’s), to a depth of approximately 2,100’, to the Austin

Chalk/Buda

formations. One of the wellbores

was completed and is currently a marginal oil producer at less than

½ BOD. The remaining four wellbores were cased

by the previous operator, but have never been completed for

production.

The

plan

for the development of the lease is to drill a new well, obtain

fresh logs to

determine the precise depth of any oil bearing formation(s), and

then to treat

and complete the new well plus the four existing (drilled but not

completed)

wells. In addition to the existing

wells, there is an active saltwater disposal well located on the

lease. It is calculated that there could be up

to 7 additional prospective well locations on the

lease.

Opal Gas Unit: In

December 2012, the Company acquired a 100% working interest

(74%-80% net revenue

interest) in the Opal Gas Unit.

The leases that comprise the Unit have one vertical well that

produced 1

barrel of oil and 1703 MCF of natural gas in December 2012.

The Unit is comprised of approximately

703.6 net acres, and is contiguous to the Company’s 186-acre

“Ragsdale”

lease. It is estimated that the

lease could accommodate up to 6 additional vertical wells, or 2

horizontal

wells.

Rogers County, Oklahoma:

The Company continues to evaluate all

of the interests of the general partnerships for which the Company

acts as

managing general partner in Rogers County, OK. The Company is

conducting a review of production and expense

records to determine the financial condition of the partnerships

and the status

of each of the partnerships’ wells, (a large majority of which may

be

non-commercial). Based upon the

findings of the review, we expect to make specific recommendations

either to 1)

“shut-in” wells that might benefit by a future rebound in the

market prices of

gas, 2) plug and abandon wells deemed to be non-commercial, or 3)

continue to

operate wells that are profitable or may be candidates for

enhancement

procedures or re-engineering to improve production.

About Allied Energy:

Allied

Energy, Inc. is engaged in the oil and gas exploration and

development

business, with operations located primarily in Texas, Oklahoma and

Ohio. The Company sponsors oil & gas

partnerships through which it raises funds for the drilling and

development of

oil & gas wells. The Company

serves as managing general partner of the partnerships and often

owns differing

partnership interests in the partnerships and/or differing direct

interests in

the properties in which the partnerships

participate.

The Company’s

subsidiaries include Allied Operating, LLC and Allied Operating,

Texas, LLC,

two operating companies that are used to manage the drilling,

development and

operations of the oil & gas drilling partnerships sponsored by

the Company,

as well as for other non-affiliated oil and gas companies that are

joint

interest owners in drilling activities owned primarily by

partnerships

sponsored by the Company. The

Company is also majority owner of Allied Gas Transmission, Inc.,

which owns the

pipeline system used to transmit production from gas wells located

in Rogers

County, Oklahoma to gas purchasers.

The

Company’s ultimate strategic focus is on the development of oil and

natural gas

production and reserves. The

Company believes that its oil and natural gas development strategy

will provide

growth to the Company in the future.

For more information:

www.alliedenergy.com

Forward-Looking and Continuing

Statements:

Certain

statements in this release and the attached corporate profile that

are not

historical facts are "forward-looking statements" within the

meaning

of the Private Securities Litigation Reform Act of 1995. Such

statements may be identified by

the use of words such as "anticipate," "believe,"

"expect," "future," "may," "will,"

"would," "should," "plan," "projected,"

"intend," and similar expressions. Such forward-looking

statements involve known and unknown

risks including but not limited to geological and geophysical risks

inherent to

the oil and gas industry, uncertainties and other factors that may

cause the

actual results, price of oil and natural gas, state of the economy,

industry

regulation, reliance upon expert recommendations and opinions,

performance or

achievements of the Company to be materially different from those

expressed or

implied by such forward-looking statements. The Company's

future operating results are dependent upon

many factors, including but not limited to: (I) the Company’s

ability to obtain

sufficient capital or strategic business arrangements to fund its

drilling

plans; (ii) the Company’s ability to build the management and human

resources

and infrastructure necessary to support the growth of its business;

(iii)

competitive factors and developments beyond the Company's control,

including

but not limited to the strength of the overall economy; and (iv)

other risk

factors inherent to the oil and gas industry.

Contact:

Heather Age

Allied Energy, Inc.

2427 Russellville Road

Bowling Green, KY 42101

Phone: 866-256-5836

Fax:

800-251-9322

Website:

http://www.alliedenergy.com

Email:

info@alliedenergy.com

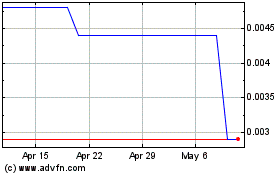

Allied Energy (PK) (USOTC:AGGI)

Historical Stock Chart

From Apr 2024 to May 2024

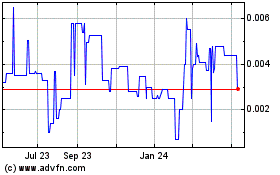

Allied Energy (PK) (USOTC:AGGI)

Historical Stock Chart

From May 2023 to May 2024