iShares(R) Canada Announces Launch of Two New ETFS

June 24 2009 - 9:18AM

Marketwired

Barclays Global Investors Canada Limited (iShares) (TSX: XBB)(TSX:

XCB)(TSX: XCG)(TSX: XCV)(TSX: XDV)(TSX: XEG)(TSX: XFN)(TSX:

XGB)(TSX: XGD)(TSX: XIC)(TSX: XIN)(TSX: XIT)(TSX: XIU)(TSX:

XLB)(TSX: XMA)(TSX: XMD)(TSX: XRB)(TSX: XRE)(TSX: XSB)(TSX:

XSP)(TSX: XTR)(TSX: XSU)(TSX: XEN)(TSX: XCS)(TSX: XCR)(TSX:

XGR)(TSX: XGC)(TSX: XAL) -

The iShares Exchange Traded Funds (ETFs) business, a division of

Barclays Global Investors Canada Limited (BGI Canada), today

announced the launch of two new funds, the iShares CDN MSCI World

Index Fund (XWD) and the iShares CDN MSCI Emerging Markets Index

Fund (XEM). Both new funds offer investors desired exposure to

international stocks and emerging markets respectively. They will

begin trading on the Toronto Stock Exchange today.

"Investors are looking for better ways to gain exposure to

international opportunities," said Heather Pelant, Head of iShares,

BGI Canada. "These funds stand above and apart from others because

they enable investors to access foreign markets while avoiding the

currency and estate tax considerations usually associated with

U.S.-listed ETFs. At the same time, investors can be assured they

will enjoy the same traditional advantages they've come to expect

from iShares ETFs: transparency, tax and cost efficiency, immediate

access, liquidity and easy diversification."

The new iShares ETFs include:

- The iShares CDN MSCI World Index Fund (XWD), with a management

expense ratio of 0.45%, is the first ETF of its kind in North

America. The fund provides long-term capital growth by replicating,

as closely as possible, the performance of the MSCI World Index,

net of expenses. The MSCI World Index provides worldwide exposure

to more than 1,500 stocks from 23 developed markets around the

globe.

- The iShares CDN MSCI Emerging Markets Index Fund (XEM), with a

management expense ratio of 0.82%, provides long-term capital

growth by replicating, as closely as possible, the performance of

the MSCI Emerging Markets index, net of expenses.

For more information about the new iShares funds, please visit

www.iShares.ca.

About BGI Canada

BGI Canada is an indirect subsidiary of Barclays PLC and part of

Barclays Global Investors (BGI), a division of Barclays PLC. BGI is

one of the world's largest asset managers and a leading global

provider of investment management products and services with more

than 3,000 institutional clients and US$1.5 trillion of assets

under management as of December 31, 2008. BGI is the global product

leader in exchange traded funds (iShares) with over 360 funds

globally across equities, fixed income and commodities which trade

on 18 exchanges worldwide. iShares' customer base consists of the

institutional segment of pension plans and fund managers, as well

as the retail segment of financial advisors and high net worth

individuals. As at March 31, 2009, BGI Canada managed over $64

billion in Canadian assets and in other assets for Canadian

clients, including $17 billion in the TSX-listed iShares Funds. BGI

Canada has offices in Toronto and Montreal.

Contacts: More information, or to schedule an interview: Contact

for Media: Veritas Communications Lisa An 416-955-4587 or Cell:

647-292-2478 an@veritascanada.com All other inquiries:

1-866-iShares (1-866-474-2731) iSharesCanada@barclaysglobal.com

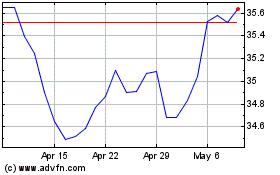

S&P TSX Capped Composite... (TSX:XIC)

Historical Stock Chart

From May 2024 to Jun 2024

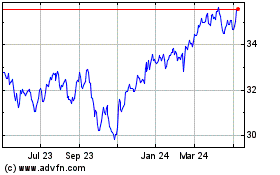

S&P TSX Capped Composite... (TSX:XIC)

Historical Stock Chart

From Jun 2023 to Jun 2024