SunCar Technology Group Inc. (“SunCar” or the “Company”) (Nasdaq:

SDA), a leading provider of digitalized enterprise automotive

after-sales services and online auto insurance intermediation

service in China, today announced its unaudited financial results

for the six months ended June 30, 2023.

Six months ended June 30, 2023 Financial

Highlights

- Total

revenues increased by 28% to $159.4 million from $124.7

million for the same period ended June 30, 2022.

-

Operating profit decreased by 81% to $1.1 million

from $6.0 million for the same period ended June 30, 2022.

- Net

profit was $1.1 million, compared to net profit of $5.7

million for the same period ended June 30, 2022.

- Net cash

used in operating activities was $20.5 million, compared

to net cash used in operating activities of $20.5 million for the

same period ended June 30, 2022.

Management Commentary

Mr. Ye Zaichang, Chairman & CEO of SunCar,

commented, “We are pleased to report our financial results for the

first half of the year 2023. Our revenue increased by 28% to $159.4

million for the first half of fiscal year 2023 as compared to the

same period of last year. In the first half of 2023, we

successfully executed our sustainable growth strategy and

strengthened our leadership in automotive after-sales services and

the online insurance market for NEV. We attributed our solid

results to increased institutional partner base, expanded network

and new service initiatives. In the meanwhile, we made efforts to

improve operational efficiency and maintain a healthy balance

sheet. Looking into the future, we plan to continuously develop

strategic cooperation with leading NEV companies, expand supplier

network, and invest in technology.”

Six months ended June 30, 2023 Financial

Results

Total revenues in the six

months ended June 30, 2023 were $159.4 million, representing an

increase of 28% from $124.7 million in the same period ended June

30, 2022.

Revenue from automotive after-sales service in

the six months ended June 2023 increased by 10% to $98.8 million

from $89.9 million in the same period ended June 30, 2022.

Revenue from insurance intermediation service in

the six months ended June 2023 increased by 63% to $47.7 million

from $29.3 million in the same period ended June 30, 2022.

Revenue from technology service in the six

months ended June 2023 increased by 132% to $12.9 million from $5.5

million in the same period ended June 30, 2022.

Operating costs and expenses in

the six months ended June 2023 increased by 33% to $158.3 million

from $118.7 million in the same period ended June 30, 2022.

Integrated service cost in the

six months ended June 2023 increased by 15% to $87.9 million from

$76.7 million in the same period ended June 30, 2022.

Promotional service expenses in

the six months ended June 30, 2023 increased by 75% to $49.6

million from $28.4 million in the same period ended June 30,

2022.

Selling expenses in the six

months ended June 30, 2023 increased by 88% to $12.8 million from

$6.8 million in the same period ended June 30, 2022

General and administrative

expenses in the six months ended June 30, 2023 decreased

by 19% to $4.0 million from $4.9 million in the same period ended

June 30, 2022.

Research and development

expenses in the six months ended June 30, 2023 increased

by 108% to $4.0 million from $1.9 million in the same period ended

June 30, 2022.

Operating profit in the six

months ended June 30, 2023 decreased by 81% to $1.1 million from

$6.0 million in the same period ended June 30, 2022.

Net profit in the six months

ended June 30, 2023 was $1.1 million, compared to net profit of

$5.7 million in the same period ended June 30, 2022.

Net loss attributable

to ordinary shareholders in the six months ended June 30,

2023 was $3.4 million, compared to net income attributable to

ordinary shareholders of $2.1 million in the same period ended June

30, 2022.

Basic and diluted net loss per

share is $0.04 in the six months ended June 30, 2023,

compared with basic and diluted net income per share of $0.04 in

the same period ended June 30, 2022.

As of June 30, 2023, the aggregate amount

of the Company's cash and cash equivalents was $38.1

million.

Net cash used in operating

activities in the six months ended June 30, 2023 was $20.5

million, compared to net cash used in operating activities of $20.5

million in the same period ended June 30, 2022.

About SunCar Technology Group

Inc.

Originally founded in 2007, SunCar is

transforming the customer journey for car insurance and aftermarket

services in China, the largest passenger vehicle market in the

world. SunCar develops and operates online platforms that

seamlessly connect drivers with a wide range of automotive services

and insurance coverage options from a nationwide network of

provider partners. As a result, SunCar has established itself as

the leader in China in the B2B automotive after-sales services

market and the online insurance market for electric vehicles. The

company’s multi-tenant, cloud-based platform empowers its

enterprise clients to optimally access and manage their customer

database and offerings, and drivers gain access to hundreds of

services from tens of thousands of independent providers in a

single application.

Forward-Looking Statements

This press release contains information about

the Company's view of its future expectations, plans and prospects

that constitute forward-looking statements. Actual results may

differ materially from historical results or those indicated by

these forward-looking statements as a result of a variety of

factors including, but not limited to, risks and uncertainties

associated with its ability to raise additional funding, its

ability to maintain and grow its business, variability of operating

results, its ability to maintain and enhance its brand, its

development and introduction of new products and services, the

successful integration of acquired companies, technologies and

assets into its portfolio of products and services, marketing and

other business development initiatives, competition in the

industry, general government regulation, economic conditions,

dependence on key personnel, the ability to attract, hire and

retain personnel who possess the technical skills and experience

necessary to meet the requirements of its clients, and its ability

to protect its intellectual property. The Company's encourages you

to review other factors that may affect its future results in the

Company's annual reports and in its other filings with the

Securities and Exchange Commission.

Contact

SunCar:

Mr. Stanley YangEmail: yang.ts@car1768.comMs.

Hui JiangEmail: jianghui@4008801768.com

|

|

|

|

SUNCAR TECHNOLOGY GROUP INC |

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

(In U.S. Dollar thousands, except for share and per share

data, or otherwise noted) |

|

| |

|

| |

|

December 31, |

|

|

June 30, |

|

|

| |

|

2022 |

|

|

2023 |

|

|

| |

|

|

|

|

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

| Cash |

|

$ |

21,200 |

|

|

$ |

35,460 |

|

|

| Restricted cash |

|

|

2,717 |

|

|

|

2,653 |

|

|

| Short-term investments |

|

|

26,544 |

|

|

|

20,985 |

|

|

| Accounts receivable, net |

|

|

85,619 |

|

|

|

74,593 |

|

|

| Prepaid expenses and other

current asset |

|

|

9,270 |

|

|

|

43,601 |

|

|

| Total current

assets |

|

|

145,350 |

|

|

|

177,292 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

|

|

|

| Long-term investment |

|

|

290 |

|

|

|

276 |

|

|

| Software and equipment,

net |

|

|

18,491 |

|

|

|

15,040 |

|

|

| Deferred tax assets, net |

|

|

13,070 |

|

|

|

12,630 |

|

|

| Other non-current assets |

|

|

14,423 |

|

|

|

17,267 |

|

|

| Right-of-use assets |

|

|

344 |

|

|

|

1,514 |

|

|

| Total non-current

assets |

|

|

46,618 |

|

|

|

46,727 |

|

|

| |

|

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

$ |

191,968 |

|

|

$ |

224,019 |

|

|

| |

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

| Short-term loans |

|

$ |

74,653 |

|

|

$ |

85,199 |

|

|

| Accounts payable |

|

|

24,200 |

|

|

|

30,326 |

|

|

| Contract liabilities |

|

|

3,569 |

|

|

|

3,870 |

|

|

| Tax Payable |

|

|

2,042 |

|

|

|

1,749 |

|

|

| Accrued expenses and other

current liabilities |

|

|

4,849 |

|

|

|

4,037 |

|

|

| Amount due to related

parties |

|

|

45,564 |

|

|

|

168 |

|

|

| Lease liabilities |

|

|

315 |

|

|

|

624 |

|

|

| Total current

liabilities |

|

|

155,192 |

|

|

|

125,973 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

|

|

|

| Lease liabilities |

|

|

- |

|

|

|

796 |

|

|

| Amount due to a related

party |

|

|

- |

|

|

|

43,330 |

|

|

| Warrant liabilities |

|

|

- |

|

|

|

32 |

|

|

| Total non-current

liabilities |

|

|

- |

|

|

|

44,158 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Total

liabilities |

|

$ |

155,192 |

|

|

$ |

170,131 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Commitments and

contingencies (Note 17) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Shareholders’

equity |

|

|

|

|

|

|

|

|

|

| Class A ordinary

shares* (par value of US$0.0001 per share; 400,000,000 Class A

Ordinary Shares authorized as of December 31, 2022 and June 30,

2023, respectively; 30,371,435 and 36,058,102 Class A Ordinary

Shares issued and outstanding as of December 31, 2022 and June 30,

2023, respectively) |

|

$ |

3 |

|

|

$ |

4 |

|

|

| Class B Ordinary

Shares* (par value of US$0.0001 per share; 100,000,000 Class B

Ordinary Shares authorized as of December 31, 2022 and June 30,

2023, respectively; 49,628,565 and 49,628,565 Class B Ordinary

Shares issued and outstanding as of December 31, 2022 and June 30,

2023, respectively) |

|

|

5 |

|

|

|

5 |

|

|

| Additional paid in

capital |

|

|

95,764 |

|

|

|

114,084 |

|

|

| Accumulated

deficit |

|

|

(99,580 |

) |

|

|

(103,200 |

) |

|

| Accumulated other

comprehensive loss |

|

|

(1,476 |

) |

|

|

(1,643 |

) |

|

| Total

SUNCAR TECHNOLOGY GROUP INC’s shareholders’ (deficit)

equity |

|

|

(5,284 |

) |

|

|

9,250 |

|

|

| Non-controlling

interests |

|

|

42,060 |

|

|

|

44,638 |

|

|

| Total

equity |

|

|

36,776 |

|

|

|

53,888 |

|

|

| |

|

|

|

|

|

|

|

|

| TOTAL

LIABILITIES AND EQUITY |

|

$ |

191,968 |

|

|

$ |

224,019 |

|

|

| |

|

|

|

|

|

|

|

|

|

* Shares are related to the reverse recapitalization on May 17,

2023 for the business combination and presented on a retroactive

basis to reflect the reverse recapitalization.

|

|

|

SUNCAR TECHNOLOGY GROUP INC |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME (LOSS) |

|

(In U.S. Dollar thousands, except for share and per share

data, or otherwise noted) |

| |

| |

|

For the Six Months Ended June 30, |

|

| |

|

2022 |

|

|

2023 |

|

|

| |

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

Automotive after-sales service |

|

$ |

89,851 |

|

|

|

98,813 |

|

|

| Insurance intermediation

service |

|

|

29,346 |

|

|

|

47,710 |

|

|

| Technology service |

|

|

5,531 |

|

|

|

12,855 |

|

|

| Total

revenues |

|

|

124,728 |

|

|

|

159,378 |

|

|

| |

|

|

|

|

|

|

|

|

| Operating costs and

expenses |

|

|

|

|

|

|

|

|

| Integrated service cost |

|

|

(76,717 |

) |

|

|

(87,854 |

) |

|

| Promotional service cost |

|

|

(28,363 |

) |

|

|

(49,563 |

) |

|

| Selling expenses |

|

|

(6,802 |

) |

|

|

(12,793 |

) |

|

| General and administrative

expenses |

|

|

(4,935 |

) |

|

|

(4,020 |

) |

|

| Research and development

expenses |

|

|

(1,930 |

) |

|

|

(4,020 |

) |

|

| Total operating costs

and expenses |

|

|

(118,747 |

) |

|

|

(158,250 |

) |

|

| |

|

|

|

|

|

|

|

|

| Operating

profit |

|

|

5,981 |

|

|

|

1,128 |

|

|

| |

|

|

|

|

|

|

|

|

| Other expenses |

|

|

|

|

|

|

|

|

| Financial expenses, net |

|

|

(1,756 |

) |

|

|

(1,915 |

) |

|

| Investment income |

|

|

249 |

|

|

|

323 |

|

|

| Other income, net |

|

|

3,139 |

|

|

|

2,450 |

|

|

| Total other income,

net |

|

|

1,632 |

|

|

|

858 |

|

|

| |

|

|

|

|

|

|

|

|

| Profit before income tax |

|

|

7,613 |

|

|

|

1,986 |

|

|

| Income tax expense |

|

|

(890 |

) |

|

|

(850 |

) |

|

| Income from continuing

operations, net of tax |

|

|

6,723 |

|

|

|

1,136 |

|

|

| |

|

|

|

|

|

|

|

|

| Discontinued operations: |

|

|

|

|

|

|

|

|

| Net loss from the operations

of the discontinued operations, net of tax |

|

|

(1,031 |

) |

|

|

- |

|

|

| |

|

|

|

|

|

|

|

|

| Net

profit |

|

|

5,692 |

|

|

|

1,136 |

|

|

| |

|

|

|

|

|

|

|

|

| Net income from continuing

operations |

|

|

6,723 |

|

|

|

1,136 |

|

|

| Less: Net income attributable

to non-controlling interests of continuing operations |

|

|

3,568 |

|

|

|

4,515 |

|

|

| Net income (loss) from

continuing operations attributable to SunCar Technology Group Inc’s

ordinary shareholders |

|

|

3,155 |

|

|

|

(3,379 |

) |

|

| |

|

|

|

|

|

|

|

|

| Loss from discontinued

operations, net of tax |

|

|

(1,031 |

) |

|

|

- |

|

|

| Less: Net loss attributable to

non-controlling interests of discontinue operations |

|

|

(1 |

) |

|

|

- |

|

|

| Net loss from discontinued

operations attributable to SunCar Technology Group Inc’s ordinary

shareholders |

|

|

(1,030 |

) |

|

|

- |

|

|

| |

|

|

|

|

|

|

|

|

| Net income (loss)

attributable to SunCar Technology Group Inc’s ordinary

shareholders |

|

|

2,125 |

|

|

|

(3,379 |

) |

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) per ordinary

share from continuing operations: |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

0.04 |

|

|

$ |

(0.04 |

) |

|

| |

|

|

|

|

|

|

|

|

| Net loss per ordinary share

from discontinued operations: |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

(0.01 |

) |

|

$ |

- |

|

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) attributable

to SunCar Technology Group Inc’s ordinary shareholders per ordinary

share |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

0.03 |

|

|

$ |

(0.04 |

) |

|

| |

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding used in calculating basic and diluted income (loss) per

share |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

80,000,000 |

|

|

|

81,374,609 |

|

|

| |

|

|

|

|

|

|

|

|

| Income from continuing

operations before non-controlling interests |

|

$ |

6,723 |

|

|

$ |

1,136 |

|

|

| Loss from discontinued

operation, net of tax |

|

|

(1,031 |

) |

|

|

- |

|

|

| Net

income |

|

|

5,692 |

|

|

|

1,136 |

|

|

| Other comprehensive loss |

|

|

|

|

|

|

|

|

| Foreign currency translation

difference |

|

|

(2,412 |

) |

|

|

(2,614 |

) |

|

| Total other

comprehensive loss |

|

|

(2,412 |

) |

|

|

(2,614 |

) |

|

| |

|

|

|

|

|

|

|

|

| Total comprehensive

income (loss) |

|

|

3,280 |

|

|

|

(1,478 |

) |

|

| Less: total comprehensive

income attributable to non-controlling interest |

|

|

800 |

|

|

|

2,068 |

|

|

| Total comprehensive

(loss) income attributable to SUNCAR TECHNOLOGY GROUP INC’s

shareholders |

|

$ |

2,480 |

|

|

$ |

(3,546 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Shares are related to the reverse

recapitalization on May 17, 2023 for the business combination and

presented on a retroactive basis to reflect the reverse

recapitalization.

|

|

|

SUNCAR TECHNOLOGY GROUP INC |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(In U.S. Dollar thousands, except for share and per share

data, or otherwise noted) |

| |

| |

|

For the Six Months EndedJune

30, |

|

| |

|

2022 |

|

|

2023 |

|

|

| |

|

|

|

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net profit from continuing operations |

|

$ |

6,723 |

|

|

$ |

1,136 |

|

|

| Net loss from discontinued

operations |

|

|

(1,031 |

) |

|

|

- |

|

|

| |

|

|

|

|

|

|

|

|

| Adjustments to reconcile net

income (loss) to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Provision for doubtful

accounts |

|

|

245 |

|

|

|

(3,694 |

) |

|

| Depreciation and

amortization |

|

|

2,077 |

|

|

|

2,840 |

|

|

| Amortization of right-of-use

assets |

|

|

- |

|

|

|

350 |

|

|

| Share-based compensation of

subsidiary |

|

|

830 |

|

|

|

776 |

|

|

| Loss on disposal of software

and equipment |

|

|

2 |

|

|

|

- |

|

|

| Change in deferred taxes |

|

|

(249 |

) |

|

|

(207 |

) |

|

| Fair value income from

short-term investments |

|

|

- |

|

|

|

(323 |

) |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable, net |

|

|

(13,894 |

) |

|

|

10,353 |

|

|

| Prepaid expenses and other

current asset, net |

|

|

(1,084 |

) |

|

|

(38,757 |

) |

|

| Accounts payable |

|

|

(17,696 |

) |

|

|

7,647 |

|

|

| Contract liabilities |

|

|

548 |

|

|

|

497 |

|

|

| Accrued expenses and other

current liabilities |

|

|

916 |

|

|

|

(787 |

) |

|

| Tax payable |

|

|

(86 |

) |

|

|

(202 |

) |

|

| Operating lease

liabilities |

|

|

- |

|

|

|

(321 |

) |

|

| Amount due to related

parties |

|

|

1,185 |

|

|

|

167 |

|

|

| Net cash used in

operating activities of continuing operations |

|

|

(20,483 |

) |

|

|

(20,525 |

) |

|

| Net cash used in

operating activities of discontinued operations |

|

|

(54 |

) |

|

|

- |

|

|

| Total net cash used in

operating activities |

|

|

(20,537 |

) |

|

|

(20,525 |

) |

|

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

| Purchase of software and

equipment |

|

|

(1,082 |

) |

|

|

(577 |

) |

|

| Purchase short-term

investment |

|

|

(105 |

) |

|

|

- |

|

|

| Proceeds from sale of

short-term investment |

|

|

- |

|

|

|

4,784 |

|

|

| Purchase of other non-current

assets |

|

|

- |

|

|

|

(3,310 |

) |

|

| Net cash (used in)

provided by investing activities of continuing

operations |

|

|

(1,187 |

) |

|

|

897 |

|

|

| Net cash used in

investing activities of discontinued operations |

|

|

(537 |

) |

|

|

- |

|

|

| Total net cash (used

in) provided by investing activities |

|

|

(1,724 |

) |

|

|

897 |

|

|

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FORM

FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

| Proceeds from short-term bank

loans |

|

|

70,564 |

|

|

|

68,271 |

|

|

| Repayments of short-term bank

loans |

|

|

(43,942 |

) |

|

|

(53,418 |

) |

|

| Repurchase of non-controlling

interests |

|

|

(496 |

) |

|

|

- |

|

|

| Proceeds from Private

Placement |

|

|

- |

|

|

|

21,737 |

|

|

| Net cash paid on reverse

recapitalization |

|

|

- |

|

|

|

(482 |

) |

|

| Payment for the offering

cost |

|

|

- |

|

|

|

(623 |

) |

|

| Net cash provided by

financing activities of continuing operations |

|

|

26,126 |

|

|

|

35,485 |

|

|

| Net cash provided by

financing activities of discontinued operations |

|

|

- |

|

|

|

|

|

| Total net cash

provided by financing activities |

|

|

26,126 |

|

|

|

35,485 |

|

|

| |

|

|

|

|

|

|

|

|

| Effect of exchange rate

changes |

|

|

(1,463 |

) |

|

|

(1,661 |

) |

|

| |

|

|

|

|

|

|

|

|

| Net change in cash and

restricted cash |

|

|

2,402 |

|

|

|

14,196 |

|

|

| |

|

|

|

|

|

|

|

|

| Cash and restricted

cash, beginning of the period |

|

$ |

37,347 |

|

|

$ |

23,917 |

|

|

| Cash and restricted

cash, end of the period |

|

$ |

39,749 |

|

|

$ |

38,113 |

|

|

| |

|

|

|

|

|

|

|

|

| Less: cash of discontinued

operations at end of the period |

|

|

- |

|

|

|

- |

|

|

| Cash and restricted

cash at end of the period for continuing operations |

|

$ |

39,749 |

|

|

$ |

38,113 |

|

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of cash

and restricted cash to the consolidated balance

sheets: |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

36,958 |

|

|

$ |

35,460 |

|

|

| Restricted cash |

|

$ |

2,791 |

|

|

$ |

2,653 |

|

|

| Total cash and restricted

cash |

|

$ |

39,749 |

|

|

$ |

38,113 |

|

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

|

|

| Income tax paid |

|

$ |

1,108 |

|

|

$ |

1,128 |

|

|

| Interest expense paid |

|

$ |

2,271 |

|

|

$ |

1,704 |

|

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of non-cash activities: |

|

|

|

|

|

|

|

|

| Disposal of Shengda Group |

|

|

24,042 |

|

|

|

- |

|

|

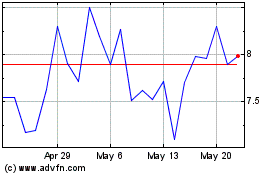

SunCar Technology (NASDAQ:SDA)

Historical Stock Chart

From Apr 2024 to May 2024

SunCar Technology (NASDAQ:SDA)

Historical Stock Chart

From May 2023 to May 2024