Brazil Wants BTC: 7,400 Bitcoin Futures Contracts Created On First Day Of Trading

April 22 2024 - 8:30AM

NEWSBTC

After announcing in March its plans to include Bitcoin futures in

its offerings, B3, a Brazilian stock exchange, has officially

opened up trades, achieving a significant milestone on its very

first day of trading Bitcoin futures. B3 Bitcoin Futures Sees

Surge In Demand Following its launch of Bitcoin futures on April

17, B3 experienced a massive wave of demand and interest from

cryptocurrency enthusiasts eager to trade the newly listed Bitcoin

futures. The stock exchange reported that on the debut trading day,

more than 7,400 Bitcoin futures contracts were actively

traded. Related Reading: Shiba Inu Burn Rate Sees 81% Daily

Increase, But Why Is Participation Low? This unprecedented trading

volume underscores investors’ strong interest in cryptocurrency

derivatives as well as the increasing demand for BTC exposure among

Brazilian cryptocurrency traders and enthusiasts. Notably, B3

disclosed that the demand for Bitcoin futures on its exchange was

so profound that it had hit 111,000 buy or sell orders on the

trading screen. The market had displayed intense participation in

the newly launched contracts, with the Director of Listed Products

at B3, Marcos Skistymas, affirming that the heightened demand

resulted from B3’s introduction of its first-ever derivative linked

to a cryptocurrency. The introduction of Bitcoin futures

marks a significant step forward for the stock exchange, aligning

with its vision to expand its offerings to cater to users’ needs.

Skistymas has also indicated that the market’s response to the

recently listed Bitcoin futures was overwhelmingly positive,

reflecting a significant potential for these contracts within the

Brazilian market. BTC Futures To Act As A Hedge Against

Market Volatility According to Skistymas, Bitcoin futures were a

“suitable instrument” that could become a hedge against Bitcoin,

potentially providing Brazilian investors a means to manage the

flurry of risks associated with Bitcoin’s price fluctuations. For

more clarity, a Bitcoin future is a contract between investors who

wager on the future price of the pioneer cryptocurrency, providing

exposure to Bitcoin without the need to purchase it. Given btc’s

high volatility and price fluctuations during certain market

conditions, accurately predicting the price of the cryptocurrency

can be challenging. Additionally, only a handful of crypto analysts

and investors have managed to forecast Bitcoin’s price actions with

precision. Related Reading: Ripple CEO Walks Back $5 Trillion

Crypto Marker Prediction, Unveils New Target At the beginning of

the year, the price of BTC surged from below $50,000 to an all-time

high of more than $75,000 in March 2024. As of writing, the

cryptocurrency is trading at $66,129 after witnessing a major price

correction and plummeting by 0.09% over the past month, according

to CoinMarketCap. Irrespective of BTC’s unpredictability and

price variations, the launch of Bitcoin futures on B3 has the

potential to bring in a new era of adoption among Brazilian

investors, providing them with fresh opportunities to diversify

their portfolios with these regulated financial instruments. BTC

price falls below $66,000 | Source: BTCUSD on Tradingview.com

Featured image from Business Post Nigeria, chart from

Tradingview.com

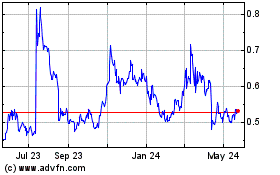

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Apr 2024 to May 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From May 2023 to May 2024