Monte dei Paschi to Reopen Debt-to-Equity Swap Offer

December 11 2016 - 8:20PM

Dow Jones News

ROME—Troubled lender Banca Monte dei Paschi di Siena SpA said

late Sunday it will reopen a debt-to-equity swap offer, as part of

a last resort attempt to complete a €5 billion recapitalization to

stay afloat and avoid being bailed out by the Italian

government.

The bank is racing against time to complete its capital raise by

the end of the year, after the European Central Bank, which

supervises large eurozone lenders, rejected MPS' request for more

time to complete its plan.

The ECB had granted MPS until the end of the year to raise the

additional capital it needs as part of a major overhaul at the

bank, which includes the sale of €28 billion worth of bad

loans.

The bank had already offered its bondholders to swap €4.3

billion worth of subordinated, or riskier bonds, into shares.

However, the bank raked in only €1 billion in fresh capital from

the previous conversion offer.

Now it said it would open it again, after receiving regulatory

authorizations, targeting investors "who had shown interest," it

said in a statement.

MPS plans have been complicated by a government crisis—and the

uncertainty it unleashed—prompted by the Italian's rejection of

constitutional reforms in a referendum a week ago.

On Sunday, Italy's President Sergio Mattarella asked departing

Foreign Affairs Minister Paolo Gentiloni to form a new government

in a bid to quickly end a political crisis triggered by a 'no vote'

in last week's constitutional referendum.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

December 11, 2016 20:05 ET (01:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

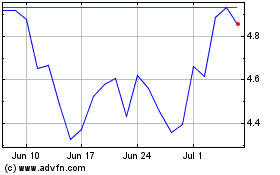

Banca Monte Dei Paschi D... (BIT:BMPS)

Historical Stock Chart

From May 2024 to Jun 2024

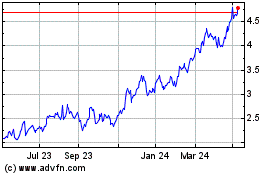

Banca Monte Dei Paschi D... (BIT:BMPS)

Historical Stock Chart

From Jun 2023 to Jun 2024