For investors looking for current income, the Federal Reserve’s

policies have not been a huge help. The central bank’s endless

parade of QE has kept bond rates depressed while a similar

situation could soon impact mortgages and REIT-focused investments

now that the bank has taken a closer look at MBS purchases.

This trend has undoubtedly pushed investors back into equities,

helping to boost stock prices pretty much across the board. While

this has been a decent strategy so far, some cracks are beginning

to appear in a global recovery, suggesting that we could be in for

a rough patch to close out the year.

After all, Europe is at or already in a recession while many

emerging markets, including China, are in the process of slowing

down. The U.S. isn’t that much better, but the domestic market is

arguably the best of the worst in this environment meaning that a

tilt towards American stocks could be the way to go in this climate

(also read Buy American with these Three Commodity ETFs).

However, a purely large cap focus doesn’t seem like that great

of a strategy as most large and mega cap securities do a

significant amount of business outside of the U.S., implying that

exposure to large caps isn’t likely to be too focused on American

economic health. In fact, some estimates peg the amount of S&P

500 revenues that come from international sources at around 50%, so

to say that these large caps are zeroed in on the American market

seems a little out of date to say the least.

That is why, in our opinion, true domestic exposure can best be

achieved via small cap securities. These pint sized stocks aren’t

big enough to be international behemoths, so they are pretty much

entirely focused on the U.S. for their revenues, potentially making

them great choices in a global slowdown.

Yet, while many small cap securities can be quite volatile,

those that pay out hefty yields on a regular basis tend to be

safer. Plus, their outsized yields can certainly help during this

low rate environment, suggesting that they could be great picks for

those looking for current income as well (see Three Overlooked High

Yield ETFs).

With this backdrop, we have highlighted below three small cap

ETFs that have impressive yields. Any of the following three could

be interesting choices for investors searching for yield, but with

a more domestic focus during this shaky time for the global

economy:

PowerShares S&P Small Cap Utilities ETF

(PSCU)

For a sector approach to the small cap problem, investors can

always look to the high dividend payers in the utility industry.

This segment which is often known for its high yields in the large

cap space, can also offer up high payouts in the small cap market

by following the S&P Small cap 600 Capped Utilities &

Telecom Services Index.

This benchmark results in a fund that has just 22 holdings in

total, although assets are relatively well spread out with no one

security accounting for more than 10% of assets. From a sector

look, telecoms account for under 20%-- with utilities making up the

rest—while over 90% of the fund is categorized as value stocks (see

the Comprehensive Guide to Utility ETF Investing).

Currently, the fund is a low cost choice in the space, charging

investors just 29 basis points a year in fees, although bid ask

spreads look to be rather wide. Still, the product is a high payer,

giving investors a 3.0% yield in 30 Day SEC terms.

WisdomTree Trust Small Cap Dividend ETF

(DES)

For a true dividend focus in the small cap market, it is hard to

go wrong with WisdomTree’s DES. The product tracks the WisdomTree

SmallCap Dividend Index which consists of the bottom 25% of the

market capitalization of the WisdomTree Dividend Index, after the

300 largest firms have been removed.

Once this is done, the component stocks are weighted by the

amount of cash dividends that each component is expected to pay in

the next year. With this focus, the fund holds over 600 components,

putting an extremely heavy weight on financials as these account

for over half of the portfolio.

Still, the top holding only accounts for 2.1% of assets,

suggesting a very well spread out product from an individual

security perspective. It should also be noted that the fund is a

relatively liquid product as well as one that has a low cost,

coming in at just 38 basis points a year (read Small Cap Value ETF

Investing 101).

Furthermore, the fund has an impressive yield of over 4% in 30

Day SEC terms, so investors will have to weigh this solid payout

against the heavy financial concentration if they are considering

an ETF in the small cap market that has a dividend focus.

Wilshire Micro-Cap ETF (WMCR)

For a look at the smallest of the small, investors could

consider the Wilshire Micro-Cap ETF (WMCR). This product tracks the

Wilshire Micro Cap Index which consists of nearly 1,500 firms that

are also in the bottom half of market capitalization in the broad

Wilshire 5000 index.

Of this benchmark, the fund holds roughly 870 securities and

does a great job of spreading out assets, as no one firm accounts

for more than 0.5% of the fund. However, the product is somewhat

concentrated from a sector perspective, as financials (29.3%),

health care (18.9%), and technology (16.2%) combine to make up a

pretty sizable chunk of assets (also read For Japan ETFs, Think

Small Caps).

Still, the product charges a decent 0.50% per year in fees,

although volume is quite low suggesting wide bid ask spreads.

However, the annual yield is rather robust, currently coming in at

3.4%, implying that it could be a yield destination for some

investors in the micro cap market.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

WISDMTR-SC DIV (DES): ETF Research Reports

PWRSH-SP SC UTL (PSCU): ETF Research Reports

WILSHR-MICRO-CP (WMCR): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

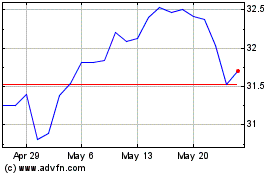

WisdomTree US SmallCap D... (AMEX:DES)

Historical Stock Chart

From Apr 2024 to May 2024

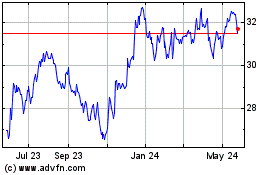

WisdomTree US SmallCap D... (AMEX:DES)

Historical Stock Chart

From May 2023 to May 2024