Can one really trade consistently enough to make a living from the markets?

The statistics say that more than 85% of retail traders lose money in this business.

This is true of any of the markets. Whether it’s equities, commodities, forex, futures…the statistics say that most traders lose. That said, even if there are some traders making a living solely from trading the Forex markets, it can be done.

How many times have you found yourself in a trade that appears to be a profitable win, only to have the price turn on you for no reason? The thrill of taking a profit, quickly becomes an overwhelming feeling of defeat.

You may tend to think that the market Gods are against you. That they know exactly when you will enter the trade, just so they can take it away from you and laugh.

Let’s face it, the market is always right.

It’s the trader who isn’t fully prepared and simply moving down the wrong path.

So are there any particular methods or techniques, that traders use to ensure success in the markets? – Not Really.

With 20 years of trading experience along with coaching hundreds of traders. I have been able to come to one conclusion.

The ultimate cause of failure is not taking into account some crucial factors, which I call the 3 M’s.

I define the 3M’s as:

- Money: Money Management

- Mind: Discipline & Patience.

- Method: Trading strategies based on either technical analysis or fundamental analysis.

Further, if we were to distribute the 3M’s on a scale of 10:

- Money – would make up 5 parts.

- Mind – would make up 3 parts.

- Method – make up 2 parts.

Over the years these 3 M’s have been the difference between confidently taking profits from the market or just gambling away my capital.

Looking back at these 3M,s, you may be asking yourself, “Why such a low emphasis on method?” when most of the information available says otherwise?

Most books and courses focus on technical indicators, chart patterns etc…

Rarely will you come across a book or course which tells you to concentrate on money and mind.

While all of the resources and ‘so called’ education courses are focused on techniques rather than a comprehensive strategy, it’s no surprise that so many traders struggle with taking profits and end up losing.

I find the techniques can bring traders short term wins, which unfortunately lead to a false sense of security.

If you are looking to leverage trading as a viable source of income, adopting a trading plan with the 3 M’s is crucial to your success.

What we are going to do, is to look at these 3 crucial M’s in a little more detail.

Let’s start with Money

Money management is the most crucial aspect of trading, which ironically is ignored by most traders. A trader can have access to the best trading system, but if the money management policies are not correct, there is little chance of growing the account.

On the other hand, applying the correct principles of money management drastically increases the probability of success.

Practical Money Management Tips

Expect losing trades.

When we take a trade, it is only natural that we tend to focus on potential profits rather than dwell on possible losses.

We are usually so convinced that the trade will be profitable, that we tend to ignore the losses that would occur should the trade go wrong.

But losses in trading are inevitable, and one must accept this fact. In fact, a successful trader is one who manages and controls these losses.

Placing stops

Trading without stops is akin to walking a tightrope without a safety net.

One must have stop loss orders in place since this is the only way to control the losses.

While this can be a ‘double edged sword’ as a trader may get stopped out of a trade for no reason, it is still the best ‘safety net’.

Stop loss levels

The most important rule is that the stop loss levels should never be mere “dollar value” stops, but technically correct stops.

Which simply means that one cannot decide on the stop level based on his/her personal risk level. A trader cannot say that “I am going to risk only $50.00 for the trade”.

The market does not care about your comfort levels; it respects the technical levels.

Hence a stop must be at a technical level, regardless of how far it is away from the entry.

If one does not follow this simple rule, the “comfortable” dollar values stop would probably get stopped out more often, which defeats the very purpose of placing a stop.

Trading is a Business of Probabilities

You can be in control of your trading process only until the moment of the entry. Once you are filled in the trade, the market will dictate where the price will go.

You cannot control this, just like you cannot control the amount of profit (or loss) that will result.

But what you can control is minimizing your losses and protecting your gains through a well-defined money management strategy.

Drawdowns

The first priority of a trader is to conserve the capital.

The trader’s capital is his bloodline. Without it, one cannot trade, so preserving it becomes a matter of utmost importance.

Without implementation of proper loss control techniques, a sudden large drawdown can shrink an account to such an extent, that the possibility of attaining profitability becomes remote.

A single loss is not only a loss of capital; it also puts a trader two steps behind in the quest to profitability.

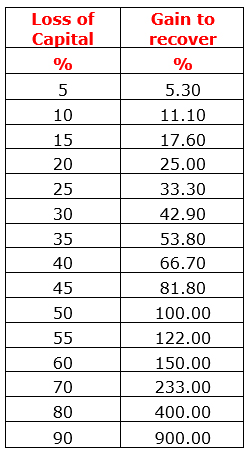

This is because the percent gain needed to recover from a loss increases geometrically with every loss.

This table illustrates the concept, and ultimately the importance of controlling the loss of capital.

A trader must have a money management policy, which is nothing but a set of techniques that helps the trader minimize the risk of loss, while still enabling him to participate in major price gains.

It is probably the most critical aspect of trading and the most overlooked.

A sound Money management policy becomes an absolute must in trading, especially while trading instruments that offer high leverage.

As the popular saying goes “take care of your losses, and the profits will come by itself.”

Mind

I would define the “Mind” factor simply as Discipline & Patience.

- Patience to wait for the market to give you the trade setup (as per your trade Plan)

- Discipline to follow the rules of your Trade Plan, once you get the trade opportunity.

While this sounds simple enough, it is not easy to implement & traders usually struggle with this aspect.

I would like to give an example here of a trader I know, who is successful simply because of the ‘Mind’ factor.

This gentleman trades the forex market & has a full-time job, thus restricting the time he can spend on trading. He trades on the daily charts by looking for one particular trade setup, so he needs to look at the charts once a day…maybe twice.

He gets into apr. 2-3 trades a month & has his share of losing trades. But the magnitudes of the trades are large & each successful trade achieves a large Risk-to-Reward ratio, thus conforming to the principles of ‘Money Management.’

There are times, he says, when we see’s a particular currency making huge moves & the temptation of getting into that trade is strong.

But he has a simple 2 question check – does this fit into my trading plan & will it offer the correct Risk-to-Reward ratio?

If not, he will simply ignore that setup.

Now that takes discipline, plus waiting for just 1-2 trades a month, takes patience.

Ask yourself, would you be able to do that?

Method

The “Method” part is actually the least important part of the trading process.

While this does not diminish the importance of technical analysis, it is imperative to implement the “Money” & “Mind” into the trading techniques.

It’s only natural that most technical traders would start the trading process by looking at the charts first, which unfortunately leads to ignoring the other crucial factors.

Traders always look for different techniques & will use all types of tools – like different indicators, Fibonacci ratios, algorithms etc…..concentrating on getting the perfect ‘Trading System’.

In this entire process, the ‘Money’ & ‘Mind’ factors are given a low priority or ignored altogether, which is one of the main reasons leading to a trader’s failure.

Hence its crucial to formulate a Trade Plan, which includes the ‘Money’ &’Mind’ into the traders ‘Method’.

Let me end with some practical tips:

You must treat trading as a business. This is not an “overnight get rich” scheme, but a lifetime skill that has to be developed.

And like every business, trading requires hard work, dedication & planning.

Sunil Mangwani is the founder of www.fibforex123.com & has been trading & coaching traders since 20 years, based on his proprietary & patented trading techniques based on Fibonacci’s & the 3M’s.

Hot Features

Hot Features