After reporting a record rise in subscriptions as a result of the Covid-19 pandemic, Netflix has seen its latest $1bn (£810m, €930m) bond offering significantly oversubscribed by investors.

One of the best performing stocks of the past decade, Netflix has grown from a DVD delivery service to a multi-billion dollar streaming and production behemoth. With hundreds of millions of people forced to stay at home by government-imposed lockdowns, the company has continued its impressive growth in this new decade.

Demand from bond investors was so great, with orders at around ten times the offering size according to Bloomberg, that Netflix reportedly managed to reduce the yields on both portions from levels previously discussed.

At a 3.625 per cent yield, Netflix sold its $500m of dollar-denominated bonds around the lowest level ever seen in the American high-yield bond market and more around the prices usually offered on investment grade bonds. Its 470m eurobond offering was sold at 3 per cent.

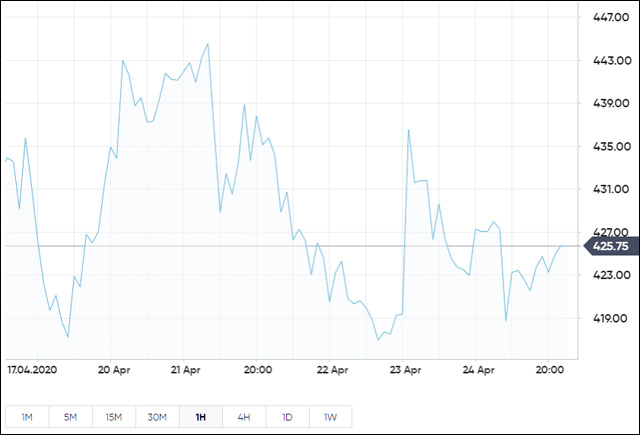

While the wider market has been plunged into a recession which many anticipate will surpass the 2008/9 Global Financial Crisis, Netflix’s share price has gained nearly 32 per cent on the year-to-date.

In the three months to 31 March the company added a record 15.8 million subscribers and posted its first quarter of positive free cash flow in six years as a result of its larger audience.

Doubts remain as to whether the company will be able to sustain this positive cash flow beyond the pandemic. While Netflix’s original content such as Tiger King have proved wildly popular in the midst of the novel coronavirus outbreak, such projects, particularly dramas, require significant levels of investment.

Consequently Netflix is a heavily indebted company. Even before its latest bond offering its total debt stood at a record $16.265bn, this figure has now risen to $17bn.

Hot Features

Hot Features