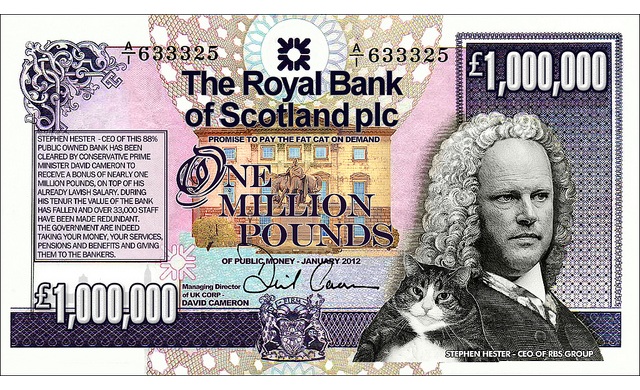

Royal Bank of Scotland Group (LSE:RBS) Chief Executive Officer Stephen Hester will no longer receive his £970,000 worth of RBS shares bonus.

The decision came after the Labour Party leader Ed Miliband declared they will rouse the House of Commons to a vote over the controversial remuneration package.

The news first broke out on Thursday, 25 January, when RBS said CEO Hester is to receive the said amount in recognition of his efforts that created “substantial progress in making RBS safer, rebuilding performance in many businesses and improving customer service and support”.

Since then, reactions surged revolving around decency in the face of economic setbacks, calling the move as “offensive” and “disgusting”.

RBS is 83% owned by the Government, following a bailout in 2008, although being run by an independent board of directors as a public company.

UK Financial Investments Limited, the company that was set up to manage the UK Government’s investment in RBS and other British banks initially referred to the bonus as a reflection of Mr. Hester’s contribution in “rebuilding RBS in 2011”.

But Chris Leslie, of the Labour Party said the move is “desperately out of touch with millions of people who are struggling to make ends meet.”

The Right Thing

Following this pronouncement, MP Miliband referred to Mr. Hester’s decision as “the right thing” to do. Prior to this, RBS Chairman Sir Philip Hampton decided not to take his own share of bonus said to amount to about £1.4 million worth of shares, saying it wasn’t something that he did not negotiate on the table upon his appointment.

It is a “sensible and welcome” decision, according to Chancellor George Osborne.

Systemic

But MP Miliband suggests RBS is just the first of many.

“But I don’t think this can be just a one-off episode, because if we don’t deal with this systematically, if we don’t deal with the issue of bankers’ bonuses in a proper way, this kind of thing is just going to re-occur.”

Miliband called for a “real change” in the boardroom and from the government.

Business Secretary Vince Cable referred it as “a welcome announcement” and a “positive step towards curbing the bonus culture”.

He added that RBS should focus on what the bank should be doing – lending to good British companies.

Shares of RBS are down 4.7% to 26.49 pence, as of 2 PM GMT.

Company Spotlight

Royal Bank of Scotland Group is a banking and insurance holding company based in Edinburgh Scotland, operating a variety of brands in the business banking, private banking, insurance, and corporate finance industries in North America, Europe, and Asia.

It is listed in both the London Stock Exchange and the New York Stock Exchange under the symbol RBS.

References

↑ RBS boss Stephen Hester rejects £1m bonus

↑ RBS boss Stephen Hester waives bonus: reaction

↑ RBS chief Stephen Hester to get £963,000 bonus

↑ RBS chief Stephen Hester to get £963,000 bonus

↑ UK Financial Investnments Limited Market Investments

↑ Cameron refuses to ‘micromanage’ huge bonuses to other RBS bosses

↑ Stephen Hester bonus: ‘real change and new rules needed at Britain’s banks’

Hot Features

Hot Features