GBPJPY Price Analysis – August 5

The GBPJPY regains traction upward despite being taken aback by a withdrawal near the level of 139.00 and rapidly retreated in the early North American session around 45 pips. The GBP buyers have largely shaken off fears about the second wave of coronavirus infections and anxiety of a no-deal Brexit.

Key Levels

Resistance Levels: 144.95, 141.24, 139.74

Support Levels: 136.62, 131.75, 129.29

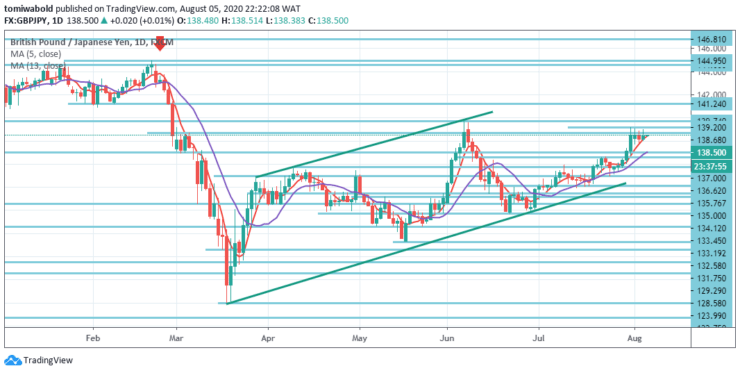

GBPJPY Long term Trend: Ranging

GBPJPY Long term Trend: Ranging

Given the factors impacting it, the GBPJPY cross failed to make it through the 139.00 level, requiring investors sufficient vigilance to soften their bullish bias. That makes it safe to wait for some follow-through intensity beyond last Friday’s peak, around the 139.20 level, to validate any bullish bias in the medium to long term.

The GBPJPY cross may then target to break monthly swing high resistance near the region of 139.74 in June and intensify the traction towards the main psychological mark of 140.00. Resolute breach of 147.95 level, nevertheless, may affect the possibility of bullish long-term reversal. Validation of the emphasis would then be shifted to the resistance level 156.59.

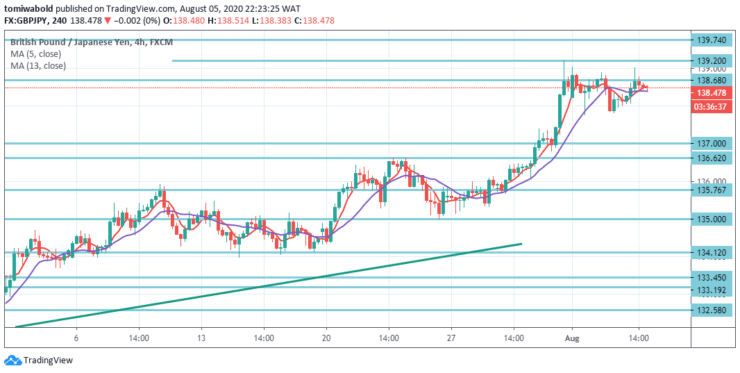

GBPJPY Short term Trend: Bullish

GBPJPY Short term Trend: Bullish

At this level, the intraday bias in GBPJPY stays neutral. Yet more increase is in view as long as the support level switched to 136.62 resistance level persists. On the upside, a solid breach of 139.74 levels may restore the entire increase from 123.99 to 135.76 levels from 129.29 at 141.24 levels.

Additionally, to extend the consolidation trend from 139.74 level, a breach of 136.62 levels may turn intraday bias back to the downside. Nonetheless, if the price continues to exit with a bullish continuation trend beyond the level of 138.68 then continuation to the horizontal support at the level of 139.20 is probable.

Source: https://learn2.trade

Hot Features

Hot Features