London Stock Exchange Group PLC Trading Statement (3371J)

December 17 2015 - 2:00AM

UK Regulatory

TIDMLSE

RNS Number : 3371J

London Stock Exchange Group PLC

17 December 2015

17 December 2015

LONDON STOCK EXCHANGE GROUP plc

PRE-CLOSE TRADING UPDATE

Unless otherwise stated, the following commentary refers to

non-financial KPIs for the eleven months ended 30 November 2015

and, where appropriate, to the corresponding period last year.

-- Good performance across each of the Group businesses

-- In Information Services:

- Continued momentum in the integration of FTSE Russell and delivery of synergies

- ETF assets benchmarked to FTSE Russell up 4%

- demand for other information products, including UnaVista and SEDOL, remained strong

- trend in professional users of real time market data broadly unchanged

-- In Post Trade Services, LCH.Clearnet has delivered a good performance in all OTC areas:

- increased use of compression services through LCH.Clearnet,

with $304 trillion compressed in total in the period, helping

reduce IRS notional outstanding to $263 trillion, down 27%

- global client swap clearing up 67% - with 612,000 trades cleared

- CDSClear notional cleared up 165% - to EUR155 billion

- ForexClear notional cleared up 19% - to $974 billion

- fixed income clearing broadly unchanged - at EUR67 trillion

- cash equities and listed derivatives clearing up 22% and down

19% respectively, reflecting a continued decline in derivative

trading levels in customer venues

-- In Post Trade Italy, clearing volumes increased 11%; initial

margin held increased 24%, averaging EUR12.3 billion

-- In Capital Markets:

- Primary markets were robust with GBP40 billion equity capital

raised on the Group's markets for the period - down just 2% on last

year in more challenging market conditions - with 161 new issues

(2014: 193)

- Secondary markets saw average daily UK equity value traded up

9%; Italian average daily volumes up 7%; derivatives contracts

traded on IDEM in Italy rose 14%; MTS money markets (repo) value

traded increased 21% and fixed income cash markets value traded

declined 4%

- announcement of CurveGlobal, a new interest rate derivatives

venture with a number of major dealer banks and CBOE, in line with

our open access and partnership approach. Products to be traded on

London Stock Exchange Derivatives market and cleared through

LCH.Clearnet

Commenting on performance for the period, Xavier Rolet, Group

Chief Executive, said:

"The Group has once again delivered a good performance across

our business areas, particularly at LCH.Clearnet and FTSE Russell.

The Capital Markets business delivered a robust performance and the

new issue pipeline remains encouraging.

"We continue to invest in a wide range of attractive organic

growth opportunities, focusing in particular on our Post Trade and

Information Services businesses. The Group continues to innovate

and partner with customers as we deliver on our strategy to be a

leading global, open access market infrastructure business."

The Group expects to announce its Preliminary results for the

period ending 31 December 2015 on 4 March 2016.

Further information is available from:

Gavin Sullivan - +44 (0) 20 7797

Media 1222

London Stock Exchange Paul Froud - Investor +44 (0) 20 7797

Group plc Relations 3322

Guy Lamming / Michael +44 (0) 20 7251

Finsbury Turner 3801

Additional information on London Stock Exchange Group plc can be

found at www.lseg.com

Key Performance Indicators

Capital Markets - Primary

Markets

Eleven months

ended

30 November Variance

----------------

2015 2014 %

New Issues

UK Main Market,

PSM & SFM 82 68 21%

UK AIM 54 101 (47%)

Borsa Italiana 25 24 4%

Total 161 193 (17%)

---------------------- ------- ------- ---------

Money Raised (GBPbn)

UK New 9.5 14.8 (36%)

UK Further 23.5 15.9 48%

Borsa Italiana new

and further 7.0 10.3 (32%)

Total (GBPbn) 40.0 41.0 (2%)

---------------------- ------- ------- ---------

Capital Markets - Secondary

Markets

Eleven months

ended

30 November Variance

----------------

Equity 2015 2014 %

Totals for period

UK value traded

(GBPbn) 1,152 1,069 8%

Borsa Italiana (no

of trades m) 66.3 61.7 7%

Turquoise value

traded (EURbn) 997 864 15%

SETS Yield (basis

points) 0.62 0.63 (2%)

Average daily

UK value traded

(GBPbn) 5.0 4.6 9%

Borsa Italiana (no

of trades '000) 283 265 7%

Turquoise value

traded (EURbn) 4.2 3.67 16%

Derivatives (contracts

m)

LSE Derivatives 4.3 10.8 (60%)

IDEM 40.8 35.8 14%

Total 45.1 46.6 (3%)

------------------------- ------- ------- ---------

Fixed Income

MTS cash and BondVision

(EURbn) 3,792 3,933 (4%)

MTS money markets

(EURbn term adjusted) 82,663 68,066 21%

Post Trade Services - CC&G and

Monte Titoli

Eleven months

ended

30 November Variance

----------------

2015 2014 %

CC&G Clearing

Contracts (m) 111.3 100.3 11%

Initial margin

held (average EURbn) 12.3 9.9 24%

Monte Titoli

Settlement instructions

(trades m) 56.5 60.1 (6%)

Custody assets

under management

(average EURtrn) 3.31 3.30 0%

Post Trade Services -

LCH.Clearnet

Eleven months

ended

30 November Variance

----------------

2015 2014 %

OTC derivatives

SwapClear

IRS notional cleared

($trn) 486 606 (20%)

SwapClear members 115 113 2%

Client trades ('000) 612 367 67%

CDSClear

Notional cleared

(EURbn) 154.9 58.4 165%

CDSClear members 11 10 10%

ForexClear

Notional value

cleared ($bn) 974 817 19%

ForexClear members 23 21 10%

------------------------- ------- ------- ---------

Non-OTC

Fixed income -

Nominal value (EURtrn) 66.9 67.7 (1%)

Listed derivatives

(contracts m) 132.6 163.0 (19%)

Cash equities trades

(m) 504.3 414.1 22%

------------------------- ------- ------- ---------

Average cash collateral

(EURbn) 56.7 47.1 20%

Information Services

As at

30 November Variance

------------------

2015 2014 %

ETFs assets under

management benchmarked

($bn)

FTSE 216 222 (3%)

Russell Indexes 165 146 13%

----------------------------- -------- -------- ---------

Total 381 368 4%

----------------------------- -------- -------- ---------

Terminals

UK 75,000 76,000 (1%)

Borsa Italiana Professional

Terminals 131,000 130,000 1%

Russell Investment

Management AuM ($bn)(1) 247 276 (11%)

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTVQLFFELFLFBE

(END) Dow Jones Newswires

December 17, 2015 02:00 ET (07:00 GMT)

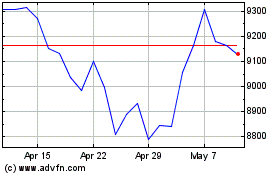

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

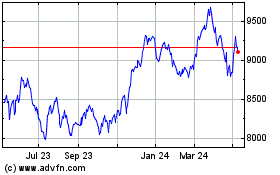

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024