TIDMJMAT

RNS Number : 6638E

Johnson Matthey PLC

20 July 2016

Q1 Trading Update

20(th) July 2016

Unless otherwise stated, figures and commentary quoted in this

statement are based on the quarter ended 30(th) June 2016 and

compare this quarter to Q1 2015/16 at actual rates

Q1 Highlights

-- Solid start to the year, group sales for continuing

businesses(1) up 6% (up 2% at constant rates(2) )

-- Strong sales growth in Emission Control Technologies and further progress in New Businesses

-- Overall demand stable in quarter for Process Technologies,

Precious Metal Products and Fine Chemicals(1)

-- Underlying(3) profit before tax on a continuing basis(1)

broadly in line with last year at constant rates(2)

-- Full year outlook at constant rates remains in line with our previous expectations

Q1 Q1 Q1 on Q1 % change

2016/17 2015/16 continuing businesses(1)

GBP million GBP actual actual constant

million rates(2)

Sales excluding precious

metals (sales)

Emission Control

Technologies 521 478 +9 +9 +5

Process Technologies 134 130 +3 +3 -1

Precious Metal Products 91 85 +6 +6 +1

Fine Chemicals 59 78 -25 - -5

New Businesses 43 38 +14 +14 +11

Eliminations (26) (12)

------------ ---------

Group sales 822 797 +3 +6 +2

Overview of Trading

Group sales for the continuing businesses increased by 6% to

GBP822 million (up 2% at constant rates), supported by continued

good demand in Emission Control Technologies and an increasing

contribution from New Businesses. Sales in both Process

Technologies and Precious Metal Products were stable although

markets in both divisions remained challenging. Demand in Fine

Chemicals' continuing businesses(1) was steady.

Underlying(3) profit before tax for the quarter was supported by

actions taken to reduce costs in the last financial year. Our

outlook for the full year at constant rates is unchanged. If

current exchange rates prevail for the remainder of 2016/17, the

group's reported results will further benefit from a positive

translational impact.

Emission Control Technologies (ECT)

ECT continued to perform well, with sales up 9% to GBP521

million (5% ahead at constant rates).

Sales in our light duty vehicle catalyst business were up 14% to

GBP331 million (12% ahead at constant rates), continuing to outpace

global car production which grew by 2%. The business saw growth

across all regions with particularly strong growth in Europe,

helped in part by robust car production growth in the region's key

markets.

Our heavy duty catalyst business' sales were up 1% to GBP190

million (down 5% at constant rates). As expected, the slowdown in

demand for Class 8 trucks in North America held back growth in our

sales. Production of Class 8 trucks has continued to weaken during

our first quarter although we still expect production levels to

stabilise later in the year. Our sales in Europe were strong,

helped by the good growth in Western European truck production.

Underlying operating profit in ECT was broadly in line with the

same period last year.

Process Technologies

Sales in Process Technologies grew by 3% to GBP134 million (down

1% at constant rates) with sales growth in Chemicals offsetting

reduced demand in our Oil and Gas businesses.

Our Chemicals businesses' sales increased in the quarter with

good demand for speciality products for petrochemical applications

offsetting ongoing weakness in licensing activity. No new licences

were signed in the period and we expect low levels of licensing

activity to continue over the year.

Sales in our Oil and Gas businesses were lower partly as a

result of reduced demand in our Gas Processing business after a

strong 2015/16. Tough market conditions due to the low oil price

continued to adversely impact demand in Diagnostic Services from

customers in upstream oil and gas markets. On the other hand,

demand for hydrogen catalysts was strong in the quarter.

Underlying operating profit for the division improved

substantially as a result of the actions taken in the second half

of 2015/16 to reduce costs, but market conditions remain

challenging.

Precious Metal Products

Precious Metal Products' sales increased by 6% to GBP91 million

(up 1% at constant rates).

In Services, Precious Metals Management's sales increased as the

business benefited from the volatility in platinum group metal

(pgm) prices during the period. Intake volumes in our Pgm Refining

and Recycling business were stable, albeit at relatively low

levels. Sales in our Manufacturing businesses were slightly down as

a weaker first quarter for Noble Metals was partly offset by good

demand across all regions in Advanced Glass Technologies.

The division's underlying operating profit was down, principally

due to lower average pgm prices (platinum averaged $1,010/oz, down

11% on the same period last year, and palladium average $573/oz,

down 25%).

Fine Chemicals

As expected, sales in Fine Chemicals' continuing businesses(1)

were flat at GBP59 million (5% down at constant rates). Our Active

Pharmaceutical Ingredient (API) Manufacturing business' sales were

slightly down due to timing of orders. Catalysis and Chiral

Technologies had a good start to the year with strong demand for

homogeneous catalysts.

Underlying operating profit for the division was lower, partly

due to the absence of income from Research Chemicals which was sold

on 30(th) September 2015.

New Businesses

New Businesses continued to make further progress with sales

increasing 14% to GBP43 million (11% ahead at constant rates), with

good demand for battery materials and an early contribution from

the recent Water Technologies acquisitions made in April and

May.

The operating loss for the division continued to be in line with

our expectations for the full year.

Outlook

In line with our preliminary results announcement on 2(nd) June

2016, we continue to expect the group's performance in 2016/17 to

be ahead of 2015/16, albeit weighted towards the second half.

The underlying performance of the group for 2016/17 at constant

rates remains in line with our previous expectations. However, the

full year positive translational impact from exchange rates at

2(nd) June 2016 of approximately GBP15 million has increased

substantially recently. If exchange rates remain at current levels

for the remainder of 2016/17, the positive translational impact to

full year underlying operating profit would increase by around a

further GBP25 million to a total of approximately GBP40

million.

It is too early to predict the exact consequences of the UK's

vote to leave the EU. However, the board currently believes that

this will not have a long term material impact on Johnson Matthey

and we continue to focus on executing our strategy for the group.

We will continue to grow the business by investing in R&D, our

manufacturing facilities and our employees, whilst improving our

health and safety performance and delivering the very best products

and service for our customers.

Notes:

Call for Analysts and Investors

Robert MacLeod, Chief Executive, will host a conference call at

8.00 am today, Wednesday 20(th) July 2016, to discuss this trading

update. The dial-in number for UK callers is 0203 139 4830; for

overseas callers please see

http://events.arkadin.com/ev/docs/NE_FEL_Events_International_Access_List.pdf.

The passcode is 89159815#. Please dial in approximately 15 minutes

prior to the start of the conference call to allow time for

registration.

Enquiries:

Director, IR and Corporate 020 7269

Sally Jones Communications 8407

020 7269

Simon McGough Head of Investor Relations 8235

020 7353

David Allchurch Tulchan Communications 4200

www.matthey.com

(1) 2015/16 adjusted to exclude contribution of the Research

Chemicals business.

(2) at constant rates (if Q1 2015/16 results are converted at

average exchange rates for Q1 2016/17).

(3) before amortisation of acquired intangibles, major

impairment and restructuring charges, profit or loss on disposal of

businesses.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTBRGDRLUBBGLC

(END) Dow Jones Newswires

July 20, 2016 02:00 ET (06:00 GMT)

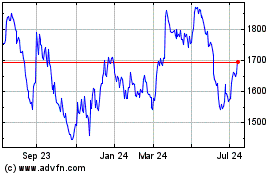

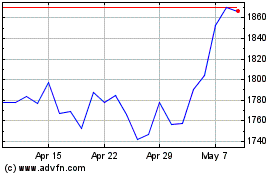

Johnson Matthey (LSE:JMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson Matthey (LSE:JMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024