TIDMAOF

RNS Number : 9108L

Africa Opportunity Fund Limited

30 April 2015

30 April 2015

Africa Opportunity Fund Limited (AOF.L and AOFC.L)

Announcement of Annual Results for the Year ended 31 December

2014

The Board of Africa Opportunity Fund Limited ("AOF", the

"Company" or the "Fund") is pleased to announce its audited results

for the year ended 31 December 2014.

Highlights

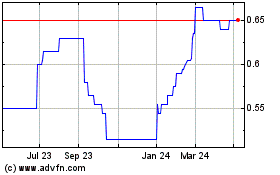

-- AOF's ordinary share net asset value per share of US$1.011 as

at 31 December 2014 decreased by 17% from the 31 December 2013 net

asset value per share of US$1.221.

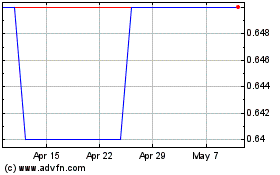

-- AOF's C share net asset value per share of US$0.912 as at 31

December 2014 decreased by 9% from the 17 April 2014 placing price

of US$1.000.

-- AOF closed a share placing which raised US$29.2 million through the issue of C shares.

-- AOF's Ordinary shares and the C shares were admitted to

trading on the London Stock Exchange's Specialist Fund Market

("SFM") effective 17 April 2014. Concurrent with the listing on the

SFM, the Ordinary shares were cancelled from admission to trading

on AIM.

-- As at 31 December 2014, AOF's investment allocation for its

Ordinary shares was 76% equities, 20% debt and 4% cash and for its

C shares was 40% equities, 14% debt and 46% cash.

The Company

Africa Opportunity Fund Limited ("AOF" or the "Company") is a

Cayman Islands incorporated closed-end investment company traded on

the SFM market of the London Stock Exchange ("LSE"). Effective 17

April 2014 AOF was cancelled from trading on AIM and admitted to

the Specialist Fund Market of the LSE. Additionally, on 17 April

2014 AOF raised US$29.2 million in the form of a "C" share

offering. AOF's net asset value on 31 December 2014 was US$69.7

million and its market capitalisation was US$64.9 million.

Chairperson's Statement

2014 Review

2014 was an eventful year for the Africa Opportunity Fund (the

"Fund" or "AOF"). Shareholders voted to extend AOF's life until

2019 and, at the same time, AOF also raised new capital in the form

of a $29.2 million "C" share offering and moved its shares from AIM

to the Specialist Fund Market of the London Stock Exchange. Those

corporate decisions of our shareholders endorsed AOF's status and

record as a rare Africa-focused, dividend paying, closed-end

investment company - and therefore one that positions our investors

as patient acquirers of excellent companies on the African

continent at reasonable to cheap prices.

2014 was a buoyant year for world markets and a difficult year

for the Fund. To provide some basis for comparison, South Africa

rose 1%, Nigeria fell 24%, Kenya rose 17%, and Egypt rose 20%. In

non-African emerging markets, China rose 54%, Brazil fell 13%,

Russia fell 42%, and India rose 35%. In developed markets, Japan

fell 4%, the US rose 14%, and the UK fell 5%.[1]

AOF's 2014 results incorporated the effects of tougher financial

conditions in some of AOF's investment countries such as Ghana,

Nigeria, Zambia, and Zimbabwe. In certain instances such as in

Ghana, those conditions included declining currencies and, with

nearly 30% of AOF's portfolio invested in Ghana at the beginning of

the year, AOF suffered its share of Ghana's tribulations. Ghana's

nominal gross domestic product declined 17% from $42.5 billion in

2013 to $35.2 billion in 2014(2) while its currency the Cedi

declined 26%. Declines in nominal GDP in the 15%-20% range in a 12

month period hinted at a contraction in economic activity more

reminiscent of the Great Depression than even the Great Recession

of 2008 and 2009. Although quietly and reluctantly, Ghanaian

households have had to accept their straitened circumstances,

deferring for many dreams of a middle class life, yet, quietly and

persistently, policyholders of Enterprise Life Assurance Company, a

subsidiary of Ghana's Enterprise Group in which the Fund is

invested, maintained the premium payments for their policies to

protect their families and to save for their futures; while modern

shopping malls and office towers continued to open in the midst of

Ghana's woes. Both these trends pointed to the steady African

demand for the amenities of an orderly urban existence, suggesting

that Africa should prove no different from other continents like

Asia and South America where investing in companies providing

services to satisfy that demand has been a reliable path to

long-term profits.

Although AOF's audited net asset value for its ordinary shares

(or "A shares") declined by 17%, including dividends, while the A

share price fell by 25.5% and the net asset value of the "C" shares

declined by 9% and its share price fell by 4.9%, the 2014 results

must be taken in the context of AOF's long-term orientation. In

that context AOF's thesis and strategy of seeking to purchase the

strong growth prospects of various African industries without

paying too much for them at the time of investment means the Fund

remains an excellent investment vehicle for the long term

investor.

A long term investor pays much less for the income stream of a

profitable African company than he would on almost any other

continent.(3) This thesis is supported by the experience of another

of AOF's investee companies. Sonatel, a company working in the

telecommunications sector - a sector that continues to grow

profitably in Africa - was able to more than double its net profits

in Guinea to $71 million. Guinea is one of the centers of the Ebola

virus epidemic in West Africa. Guinea has lost, tragically, 2365

people to the virus.(4) Despite that epidemic, Sonatel increased

its investment in Guinea by 54% and its Guinean subscribers by 39%

from 3.2 million subscribers to 4.5 million subscribers at the end

of 2014 thereby illustrating the resilience of those industries

focused on sating Africa's thirst for modern amenities.

AOF's strategy in 2014 focused on searching for inexpensive

entry points into industries with strong growth prospects in Africa

- a strategy that drove its regional exposures. One region of

Africa which had a strong 2014 was East Africa. AOF's investments

in Tanzania and Uganda -Tanzania Breweries, enjoying a total return

of 96% in 2014, and Stanbic Uganda - benefited from the benign

macro-economic settings of those two countries. This at a time when

inflation in Tanzania in 2014 was 4.75%(5) and the Tanzanian

shilling depreciated 8% against the US Dollar. Uganda's 2014

inflation was 4.3% while its currency depreciated 9% against the US

Dollar.(6) The Fund expanded its North African exposure through

purchases of investment-grade debt issued by Moroccan phosphate

fertilizer producer and the equity of a Moroccan telecommunications

company. Its Southern African additions were in Zimbabwean real

estate, consumer finance, and electric utilities.

Outlook

2015 promises to be a challenging year for African investors.

The gross export proceeds of Africa, as a primary

commodity-exporting continent, are set to decline sharply in tandem

with its deteriorating terms of trade. The oil price and iron-ore

price collapses of 2014, continuing in 2015, are emblematic of the

loss of export earnings. Even if Nigeria's loss as an oil exporter

is Botswana's gain, the tightening financial conditions in the

United States of America will be felt on African shores. Gradually,

but inexorably, many African central banks will raise interest

rates, dampening the performance of their capital markets. Three

notable exceptions should be the central banks in francophone

Sub-Saharan Africa which follow the monetary policy of the European

Union, North African countries like Morocco which strive to keep

their currencies competitive with the Euro, and net oil importing

countries like Egypt and Kenya that are also not major commodity

exporters to China. AOF's investment approach in this environment

will be to focus even more on identifying goods and services for

which African consumers are willing to spend scarce US Dollars or

their local currency equivalent, regardless of domestic political

or economic conditions. Sectors which have been dominated by the

state, but are opening up to private sector participants are of

especial interest. Many of those sectors were viewed as "natural

monopolies" that have evolved into havens of inefficiency,

subsidies, and losses. Pent-up and unsatisfied demand of African

companies and consumers has been the inevitable outcome in those

havens. Thus, infrastructure and suppliers of services to Africa's

infrastructure industries, for example, will be a growing theme in

AOF's 2015 investing activities. In the arena of commodities, there

are a few commodities which remain in short supply even today in a

weak global economy. AOF will seek to gain exposure to those

commodities.

In continuance of its strategy, AOF will pay particular

attention to situations in which it is able to buy natural

resources at steep discounts to their implied net present value

based on spot prices.

AOF's C shares are to be converted into ordinary shares of AOF

when a minimum of 85% of the C share capital has been invested and

a satisfactory outcome has been achieved in the Shoprite matter.

The Board has determined that AOF should await developments in the

Shoprite case before proceeding with this conversion. It is hoped

that this conversion will be consummated in 2015.

Concluding Thoughts

The peaceful and successful conclusion of Nigeria's presidential

elections of March 28, 2015 is a cause for great celebration. As

the largest economy in Africa, with the biggest population and

faced with delivering meaningful economic growth to its ethnically

and religiously diverse population, it serves as a light-house

illuminating Africa's political trajectory. The peaceful transfer

of power from President Jonathan to President-elect Buhari is

positive for Nigeria because it affirms the supremacy of the

Nigerian electorate, the Rule of Law, and Nigeria's constitution.

In memorable contrast to former Ivorian president, Laurent Gbagbo,

President Jonathan's congratulatory call to President-elect Buhari

was a statesmanlike gesture that augurs well for Nigeria's future.

Yet, the rejection of incumbency by Nigerian voters continues a

trend that is becoming more common in Africa. Ghana has changed its

parliamentary majority twice in 2000 and 2008. Senegal denied

former President Abdoulaye Wade a third term in 2012, replacing him

with current President Macky Sall. Most recently in December of

2014 Mauritian voters threw out their former Prime Minister - Navin

Ramgoolam - in a landslide to express their displeasure at

constitutional proposals to increase the powers of the Mauritius

presidency in preparation for his occupying that office. Over the

years, the Fund has evinced a strong preference for investments in

African countries which are becoming stronger democracies. AOF's

view is that the institutional and legal setting in which

investment decisions are made becomes more durable and predictable

with repeated experiences of peaceful transfers of power in

experienced democracies, leading to a wider range of potential

investments for AOF. Today, the dominant powers in each Sub-Saharan

Africa region are all tested democracies, entrenching relatively

predictable and peaceful environments for the conduct of commerce

and investments. Therefore, as always, we remain optimistic about

AOF's prospects.

In closing, we extend our thanks to our shareholders for their

support and partnership and look forward to continuing to work with

you in the years to come.

Dr. Myma Belo-Osagie

Chairperson

April 2015

[1] Reference indices are calculated in US Dollars using:

Nigeria NSE Allshare Index, South Africa FTSE/JSE Africa Allshare

Index, Nairobi NSE Allshare Index, Egypt Hermes Index, Russia MICEX

Index, Brazil IBOV Index, the Shanghai composite index, the India

SENSEX Index, the S&P 500, the FTSE 100, and the Nikkei

225.

2 Ghana's 2014 Bond Prospectus, p. 16. The Budget Statement and

Economic Policy of the Government of Ghana for the 2015 financial

year, delivered November 19, 2014, Appendix 1C, Nominal GDP for the

Medium Term. Ghana's 2014 nominal GDP of 113.4 billion Cedis

converted into US Dollars at the end of year rate of 3.22

Cedis/$.

3 MSCI Africa Index, ex South Africa had a P/E ratio of 12 and a

dividend yield of 3.35%; MSCI Africa Index had a P/E ratio of 16.66

and a dividend yield of 2.75%. MSCI Asia, ex Japan had a P/E ratio

of 13.42 and a dividend yield of 2.4%. Comparable P/E ratios and

dividend yields for MSCI Latam (14.66 and 2.76%), MSCI North

America (18.84 and 1.98%), MSCI Emerging Europe and Middle East

Index (8.2 and 3.9%), MSCI Emerging Asia (13.9 and 2.18%). Data as

of April 20, 2015.

4http://www.cdc.gov/vhf/ebola/outbreaks/2014-west-africa/case-counts.html.

5 Tanzania National Bureau of Statistics, Press Release of

January 8, 2015: National Consumer Price Index for December

2014.

6 Uganda's 2014 Composite Consumer Price Index, Uganda Bureau of

Statistics.

Manager's Report

2014 marked the seventh full year of operation of Africa

Opportunity Fund ("the Fund" or "AOF"). During the year the Fund

issued shares, which trade currently as "C shares" until they are

merged with the original issue of the Fund's shares (hereinafter

referred to as "A shares"). The A shares had a return of -17.7%,

including dividends, while the C shares had a return of -9.0%. At

year-end, AOF held $51.7 million in equity securities, $12.1

million in debt securities, $16.8 million in cash; and derivative

and short sale liabilities equal to $11.5 million. In class terms,

the A shares held $40.6 million in equity securities; $6.7 million

in debt securities; $5.7 million in cash; and derivative and short

sale liabilities equal to $10.5 million. The C shares held $11

million in equity securities; $5.4 million in debt securities;

$11.1 million in cash; and derivative and short sale liabilities

equal to $1.0 million. The Fund's underlying end-of-year holdings

were in Botswana, Cote d'Ivoire, the Republic of Congo, Egypt,

Ghana, Morocco, Nigeria, Senegal, South Africa, Tanzania, Uganda,

Zambia, and Zimbabwe. Our lodestar for measuring the Fund's

portfolio is our estimate of its appraisal value per share. That

somewhat subjective estimate measures the Manager's view of the

long-term attractiveness of the portfolio. It was $1.22 per share

at the end of 2014 for the A Shares, in comparison to a closing

price of $0.86 and a 2013 appraisal value per share of $1.32; and

$1.04 per share for the C Shares.

2014 was a difficult year for the Fund. Not only did the Fund's

two classes suffer large losses, but the Fund's performance lagged

several Africa indices. This unsatisfying performance has continued

in 2015. An amalgam of mark-to-market losses that are the likely

concomitants of rising real interest rates in mismanaged economies,

losses in our portfolio of commodity producers, errors, and slow

progress on the Shoprite front were the ingredients for our humble

pie. AOF's 2014 performance notwithstanding, we remain optimistic

because the underlying free cash flow in the Fund's major holdings

continues to grow at a decent pace in US Dollars. Many of AOF's

companies are continental leaders in their industries, whether

measured by profitability or balance sheet quality or market

position. Sooner or later, AOF will enjoy the market's

acknowledgement of those underlying financial data.

We are steadfast in believing that Africa's own secular

prospects remain undimmed, positive, and powerful.

The 2014 performances of different African capital markets were

molded by the worsening terms of trade of most African exporters

caused by a decelerating Chinese economy, the end of the US Fed's

QE program, and displays of fiscal profligacy by some African

governments. This triple cocktail of macro causes undermined the

living standards of African consumers, reduced the profitability of

the African corporate sector, and lowered the external value of

most African currencies. It was brutal. In order of depreciation

against the US Dollar: the Ghanaian Cedi fell by 26%; the Zambian

Kwacha by 14%; the Naira by 13%; the CFA Franc by 11%; the Moroccan

Dirham by 10%; the Rand by 9%; the Ugandan shilling by 9%; the

Tanzanian shilling by 8%; the Botswana Pula by 8%; the Kenyan

shilling by 5%; the Egyptian Pound by 3%; and the Guinean Franc by

1%(7) . The depth of the respective drops in the external value of

those African currencies depended on a few variables: the sobriety

of a government's budget; whether a country was an oil, precious

metals, or base metals exporter; whether a country was a net

importer of oil; whether a country exported other goods or services

enjoying rising prices; whether bilateral or multilateral donor

inflows to a country were rising or falling; and the degree to

which a country's currency was pegged to the Euro. Ghana had the

complete set of poisonous variables: huge budget deficits; net

exports of both oil and gold; and declining donor inflows. Botswana

was the opposite: sober government finances; a net oil importer;

and an exporter of diamonds, a commodity which bucked the general

pattern of declining commodity prices. Interest rates and inflation

tend to rise in the typical African open economy experiencing a

fall in the external value of its currency, leading to a tightening

of its domestic monetary conditions. Tightening monetary

conditions, in turn, repress the valuations of listed securities

while easing monetary conditions lead to buoyant markets. Thus, the

stock markets of net oil importers like Egypt and Kenya, swaddled

in loose monetary conditions, soared in 2014 while oil and metals

exporters like Ghana, deficient in fiscal discipline, suffered

steep falls.

We owe AOF's shareholders an explanation for AOF being

underweight in soaring markets and overweight in sinking markets.

We hunt for the best African opportunity in a specific industry. An

ideal industry has a product or service in short supply. If the

best opportunities are in one region of Africa, so be it, in our

view. Having found an investment prospect, we study the

macro-economic and macro-political patterns in its country (or

countries) of operation to estimate an appropriate cost of capital,

or discount rate, for the selected prospect. The enterprise value

of that investment prospect may be less than the intrinsic value of

that prospect, applying the selected discount rate, in which case

we acquire securities of that prospect. Alternatively, that

intrinsic value of that prospect may be less than its enterprise

value, forcing us to ignore that prospect. One of the more

subjective aspects in assessing a country's patterns is

understanding how its electoral cycles shape the quality of its

political and economic governance. We tend to overestimate the

dangers in a country recovering from political calamities, such as

Cote d' Ivoire, Egypt, or Kenya, thus imposing an unduly high cost

of capital screen for potential investments. Furthermore, in some

cases, strong companies in soaring markets were less attractive

than competitors in other markets. For example, AM Best, the

leading credit rating agency for the American insurance industry,

preferred the catastrophe assessment system of Continental

Reinsurance listed in Nigeria over that of Kenya Re listed in

Kenya. We paid a performance price for owning Continental

Reinsurance instead of Kenya Re since Kenya Re's total return in

US

Dollars was positive in 2014 while Continental Reinsurance

posted a negative total return.

One of the intermittent conundrums we face as long-term African

investors is whether to invest in, or divest from, a profitable

company blessed with strong prospects and an attractive valuation

because it operates in a country suffering severe macro-economic or

political difficulties. The sheer ubiquity of African economies

reliant on one or two primary commodities such as cotton or copper

for export earnings exposes investors to the dangers of gyrating

interest rate cycles or steep decelerations in economic activity in

any one of those economies. "Severe" refers to national problems

like Mali plunging into civil war in 2012 or Zimbabwe devoting more

than 70% of its current government budget to wages for its civil

servants or the Arab Spring or Nigeria losing half its export

proceeds in a year from the plunge in oil prices. One solution to

those conundrums is to avoid all companies located in severely

troubled countries. In other words, "better safe than sorry". We

prefer to focus on whether an industry in a country has a capacity

to maintain or grow its profits in US Dollars over a 3 to 5 year

period. Enterprise Group in Ghana presented that dilemma to AOF in

2014, as we suffered a total return of -23% in US Dollars. So did

Copperbelt Energy in Zambia, Continental Reinsurance in Nigeria,

and Sonatel in Mali and Guinea to name a few other AOF investments.

Ghana's sovereign debt was downgraded in March six rungs below

investment grade to B3, with a negative outlook, by Moody's. The

Ghana government was running budget deficits of "Greek" proportions

even before the collapse of the oil price in the second half of

2014. As a percentage of Ghana's gross domestic product, its budget

deficit was 4.0, in 2011, 11.5 in 2012, 10.1 in 2013, 9.5 in 2014,

and is forecast to be 7.5(8) in 2015. Current account deficits, as

a percentage of gross domestic product over the same period, were

9.0, 12.3, 13.4, and 9.9 (for 2014)(9) . Those percentages can be

explained partially by the 28% decline in the gold price since the

beginning of 2013, the 50% decline in the oil price since June

2014, power outages, and the steady reduction in donor funding over

the last few years. Thus, heading into 2014, it was predictable

that the Cedi would suffer a crisis of confidence manifest in its

losing value against the US Dollar. We were taken aback, though, by

the 25% depreciation of the Cedi against the Dollar. Unfortunately,

2015 and 2016 suggest that the Cedi will continue its depreciating

fall. Why should AOF's shareholders own the securities of a

Ghanaian company? Two reasons. The first reason is that, since the

trauma of Ghana's economic difficulties is not spread evenly among

the industries and companies in Ghana, some industries and

companies will emerge stronger from those difficulties. Private

power generation is one such industry. Property and casualty

insurance constitutes a second example as the rising replacement

value of existing assets raises the cost of self-insurance and

under-insurance. The second reason is that a few Ghanaian companies

continue to report some of the strongest returns within their

respective African industries, in the midst of Ghana's woes and

despite their own subdued results. For example, Standard Chartered

Bank Ghana's return on equity declined to 41% in nominal terms (and

25% in real terms) and its return on assets was 6.4%. It should

struggle to maintain those return ratios in 2015 as non-performing

loans climb in a tough Ghanaian operating environment. Still, it

should remain one of the most profitable banks on the African

continent. Investing over the long haul in the best African

companies should be rewarding, in US Dollar terms, despite storms

of national difficulties that have to be navigated

periodically.

Enterprise's 2014 revenue was 203.9 million Cedis ($66.5

million) versus 157.8 million Cedis ($76.3 million) in 2013.

Reported cash flow from operations plummeted from $20.1 million in

2013 to $5 million in 2014. However, after adding back investments

made by Enterprise in those periods and recognizing the profits

belonging to Enterprise shareholders disclosed in its embedded

value statement, but yet to be recognized in its financial

statements, Enterprise's gross operating cash flow before

investments attributable to shareholders declined 8% from $18.3

million in 2013 to our estimate of $16.8 million in 2014.

Furthermore, it is deepening its US Dollar earning capacity by

entering the commercial office real estate market. It also remains

the largest private insurance group in a country with an insurance

penetration rate slightly above 1% of its gross domestic product,

much less than Kenya's approximate 3% of GDP. As per capita income

rises, the consumption of savings and insurance products in a

country rises more rapidly until a country's insurance penetration

rate reaches global norms. Ghana is far from global norms,

therefore investing in Enterprise should prove to be an investment

in a company facing vistas of rapid and profitable growth in real

terms for several years. Should AOF divest from Enterprise because

of the lowly credit rating of its sovereign? Our answer is to take

advantage of Ghana's abysmal sovereign credit status to add to our

Enterprise holdings so long as we believe that Enterprise is both

materially undervalued and will be able to increase its profits in

US Dollars at a decent clip in the next 3 to 5 year. Through its

partnership with Santam - South Africa's largest property and

casualty insurance company - in property and casualty insurance,

Sanlam - South Africa's second largest life assurance company -,

its focus on introducing new insurance products, and its top

position in Ghana's new private pension administration industry, it

should be able to meet our expectations. Collateral confirmation of

the potential of Ghana's insurance industry comes from the entry of

all the top South African insurance groups into Ghana, as well as

the arrival of Allianz from Germany, Prudential from the United

Kingdom, and the recent announcement of Axa of France about its

intent to enter Ghana. It must be admitted, though, that we are

assuming that a peaceful democratic Ghana will accept the sober

fiscal straitjacket of the International Monetary Fund to

strengthen its capacity to raise rapidly its per capita income and

economy in the future.

Another sector guaranteed to enjoy years of rapid profitable

growth in Africa is the electric utility industry. Almost every

African country today is busy fashioning its own lexicon to

describe the unpredictable interruptions in the supply of

electricity from its national electricity grid. The sound of diesel

generators can be heard in all regions of sub-Saharan Africa. Yet,

all of Africa consumes less electricity than Spain. For years, the

sale of electricity at tariffs which were too low to support

continuous reinvestment to keep up with African population and

industrial growth has been the continental norm. That norm is under

assault because of the constraints on economic activity and social

well-being imposed by the insufficient electricity generation,

transmission, and distribution facilities. The days of state-owned

electricity monopolies are ending. Therein lies a type of

investment opportunity which appeals to AOF: regulatory regimes in

transition clouding over several years the eventual emergence of a

profitable private industry. Copperbelt Energy PLC in Zambia

presented AOF with the same dilemma as Enterprise. Our Copperbelt

investment experienced an 18% decline in value in 2014. Zambia's

economy has been under stress, as its principal

export-copper-suffers from the declining appetite of China for

infrastructure and real estate investment. Copper prices dropped

17% in 2014. Yet, Copperbelt Energy is a conduit not only into

electricity transmission to Zambian and Congolese copper mines, but

also an electricity distribution company for Nigeria's capital city

- Abuja - and an investor in Nigeria's newest hydroelectric dam -

the Shiroro Dam. Its product-a kilowatt/hour of electricity-is

denominated in US Dollars or the local currency equivalent of US

Dollars. Copperbelt invested $200 million in Nigeria. What is

intriguing is that, as a consequence of the large amount of debt

assumed by Copperbelt to make its Nigerian investments and its $198

million loss incurred in 2014 in Nigeria, the Zambian markets

accords a negative value to its Nigerian portfolio. The market is

willing to pay for only its profitable Zambian operations, despite

its Nigerian operations generating $4 million of cash flow from

operations.

We elected to increase AOF's holding in Copperbelt Energy,

despite Zambia's macro-economic difficulties.

It is time to make some observations about AOF's portfolio of

commodity producers. 2013's steep decline in the gold price was

exceeded in 2014 by an even steeper collapse of the oil price in

2014. Crude oil declined 50% in 6 months. In US Dollar terms,

platinum fell 12%; copper fell 17%, manganese fell 14%; rubber fell

41%; and palm oil fell 18%. The underlying reason? Somnolent global

growth, in spite of an awakening US economy, encountered surging

supplies stimulated by several years of high commodity prices. It

is painful irony to recite commodity price declines since AOF's

chairman expressed misgivings about the dangers faced by African

commodity producers from a weakening China as far back as 2010 and

we expressed some anxiety in last year's report. It has taken

longer than we expected for the harsh price implications of those

misgivings to mature into low export earnings for African companies

and countries. The A Shares had a 28% allocation to the commodity

sector at the beginning of 2014, primarily in bonds. We elected to

keep our equity holdings of low cost producers like Zimplats and

Societe de Caoutchoucs de Grand-Bereby ("SOGB") because of their

record of generating profits even in a low price environment. They

have not disappointed us in that regard. But, their

valuations have been crushed. SOGB was acquired in 2010 and 2011

at an average share price of 30,717 CFA Francs or $67. It is a

rubber and palm oil plantation subsidiary in the Bollore Group. A

few years ago, we owned also shares of its Nigerian affiliate -

Okomu Oil Palm Company PLC , and Societe Africaine de Plantations

d'Heveas. SOGB was the lowest cost plantation operator in our

plantation portfolio. Like many other companies listed on the

Bourse Regionale de Valeurs Mobiliers in Abidjan, average daily

trading volume is miniscule. Accumulating shares of African

companies with average daily trading volumes under $10,000 is

difficult and of unpredictable duration. Selling those shares, with

the expectation of reacquiring disposed shares at reasonable

prices, is fraught with as much peril because shares may not be

waiting to be summoned on to the market at reasonable prices when

one wants to own those shares. Thus, our approach is to ask whether

we are willing to be long-term owners of those companies. If we are

so willing, then we try to take advantage of mark-to-market losses

to add to our holdings over time instead of selling our holdings in

times of low prices. SOGB is one of the most productive of the

African rubber or palm oil plantations. Its palm oil yields per

hectare are higher than West African yields and approximate to

Malaysian and Indonesian yields because its palm oil trees grow in

water-logged troughs. Palm oil plantation productivity is higher in

South East Asia than in West Africa whereas rubber plantation

productivity is higher in West Africa than in South East Asia.

SOGB's rubber output began to rise in 2013 as rubber trees

replanted in 2005 and 2006 delivered their first wet cups of latex.

SOGB has also been encouraging small scale farmers living around

its plantation to expand their rubber tree holdings. Several years

of generally rising output lie ahead for SOGB, but probably

insufficient to compensate for the continuing drop in rubber

prices. An additional negative fact is that the Ivorian government

has increased the tax burden on plantations. What did we miss in

the global rubber industry? We failed to link the controversial

Thai payment schemes under which Thai small scale farmers sold

their agricultural produce above world prices to the Thai

government with a probable dumping of those stocks on to the world

market when the Thai government ran out of

money. Those schemes were harbingers of declining prices.

The 2014 journey of our senior secured Tizir bonds showed how we

reacted to the deteriorating revenues of a mining investment. Tizir

is a joint venture of Eramet of France and Mineral Deposits of

Australia. The joint venture was established by Eramet contributing

100% of its ilmenite processing plant in Tyssedal, Norway (one of 5

such smelters in the world and the only one in Europe), $95 million

in cash, and a commitment to provide a subordinated $45 million

loan to Tizir. Mineral Deposits contributed its 90% interest in the

Grande Cote mineral sands dredging project in Senegal, (the

Senegalese government holding the remaining 10%). Tizir had spent

$783 million on building the Grande Cote mine by the end of 2014.

The strategic basis for the joint venture is that the Senegalese

mine will supply the feedstock of the Tyssedal smelter. Tyssedal

currently smelts ilmenite to produce 200,000 tonnes of high TiO

sulphate titanium slag sold to pigment producers and 100,000 tonnes

of high purity pig iron sold to ductile iron foundries. Grande

Cote's nameplate capacity contemplates annual production of 85,000

tonnes of zircon and 575,000 tonnes of ilmenite, plus minuscule

quantities of rutile and leucoxene for a minimum period of 25

years. In fact, the current mineral resource statement of Grande

Cote discloses 21.7 million tonnes of heavy mineral sands

sufficient to support a 40 year life of mine. The Tyssedal smelter

is to be closed for 3 months in Q4 2015 for the relining of its

electric furnace, a 15% expansion of its smelting capacity, and

upgrading to allow Grande Cote's ilmenite to be smelted into

chloride titanium slag. Then, Tyssedal will be able to oscillate

between supplying sulphate titanium slag and chloride titanium slag

in response to market conditions. At Grande Cote's nameplate

capacity, Tizir will account for 7% of both global zircon and

titanium feedstock supply. Commissioning of the Grande Cote mine

commenced in Q2 of 2014. Despite delays caused by problems with

impellors and mining seals, the first shipment of ilmenite from

Senegal to Norway occurred in October and Grande Cote achieved 51%

of its nameplate capacity in Q4 2014, moving Tizir closer to its

goal of becoming a vertically integrated operation. That strategic

progress occurred amidst weakening zircon and ilmenite prices which

slashed Tizir's cash flows, forced it to increase its debt levels,

impaired the economic value of its mineral rights, and diminished

its asset and interest coverage ratios. Notwithstanding Tizir's

operational progress, it lost $156 million in 2014 and wrote down

to zero the entire $108.4 million value accorded to its mineral

rights in 2013. Tizir's 2014 book value was $502 million.

Anemic residential construction activity in China and Europe

have cast a pall over the mineral sands industry. The A shares had

8.8% of their December 2013 net asset value invested in Tizir bonds

priced at 104. That pricing dropped to 81 by December 2014. A 22%

drop in price for a bond is material bad news because it is the

equivalent of losing a few years' worth of interest. We sold half

of the A shares' Tizir bonds in August and September 2014 above

100. By the end of the year the bonds declined to 75% of par,

delivering significant mark-market losses. Including mark-to-market

losses and interest income, the A shares had lost 8.25% on their

Tizir bond holdings and constituted 4.3% of the net asset value of

the A shares. Two errors are obvious in retrospect. The first one

is that our valuation of the creditworthiness of Tizir's bonds

accorded excessive weight to the successful end of the Grande Cote

mine construction and insufficient weight to the downward glide of

mineral sands prices. The second one was investing more than 5% of

AOF's capital in one high yield debt issue around par. Profit is

capped in bonds priced at par and downside can be substantial. We

reduced our holdings as it become evident that Tizir's cash flows

were weakening. Nevertheless, we remain optimistic about the

soundness of the Tizir bonds.

One of AOF's rewarding commodity investments in 2014 was its

holdings in Pallinghurst Resources ("Pallinghurst"). Pallinghurst

is a specialist natural resources investment company which has

invested in new long life and low cost mines in emeralds and

rubies, manganese, and platinum. Pallinghurst owns indirectly 48%

of Gemfields. Gemfields extracts one quarter of the world's

emeralds from the Kagem mine in Zambia and mines Mozambican rubies.

It owns also 100% of Faberge, a small but iconic name in the luxury

jewelry segment. Pallinghurst entered the colored gemstones

industry because of a belief that the demand for colored gemstones

outstripped supply. Supply is constrained by a lack of uniformity

in the classification of rough gemstones that inhibits sales.

Gemfields introduced a proprietary grading system akin to that of

De Beers in the diamonds industry, coupled with auctions of its

graded rough gemstones. Its grading innovations have led to

gradually rising volumes and prices of rough gemstones sold at its

auctions. Faberge, by contrast, continues to bleed losses. Overall,

Gemfields has served as a profitable catalyst of a growing colored

gemstones industry. Pallinghurst's manganese and platinum mines are

shallow operations in South Africa. Pallinghurst's platinum mine in

South Africa incurred a loss for the 9 month period ended September

30, 2014 of $21 million. Its new manganese mine - Tshipi Borwa in

the northern Cape - doubled its annual mine production to 2.4

million tonnes in 2014 to become the 5th largest manganese mine in

the world. We chose to become shareholders of Pallinghurst from

March 2012 because it traded at a substantial discount to the value

of underlying mines and development projects, allowing AOF to get

exposure to new low cost and large mining assets at steep discounts

to the enterprise values of those assets. That discount gave AOF a

margin of safety. Subsequently, the underlying manganese and

platinum operations have moved from development into production,

reducing the risk-profile of Pallinghurst and leading to a rise in

its market capitalization.

One way of satisfying our orientation to seek absolute positive

returns for AOF, regardless of market conditions, is to invest in

mispriced securities. Early in 2014, the Fund bought shares of

Naspers, the South African print, pay-tv, and internet company, and

sold short its proportionate interest in Tencent, the spectacularly

successful Chinese mobile internet company. The pay-tv Africa

business of Naspers is a de facto monopoly and a generous source of

cash flow. Our goal was to accentuate the Fund's exposure to

Naspers' cash-generating Africa operations at a time when the

market accorded them a negative valuation. The Africa operations of

Naspers was overshadowed by the tilt of Naspers towards loss-making

e-commerce and the Internet. The Fund's gross long and short

positions in this paired trade constituted 14.6% of its end-of-year

net asset value. By the end of the year, this paired trade had

earned a gross return on capital of 10.6% and a 21x return on its

modest quantum of equity. It began to dawn on the markets that the

non-Tencent and Mail.Ru Internet investments of Naspers had a

private market value materially higher than what the stock markets

had been willing to recognize. The stock markets went from

temperamental pessimism to tepid optimism about the Internet

investments of Naspers and AOF obtained decent returns. It was the

initial mispricing of this paired trade which enabled the Fund to

prosper as a shareholder of Naspers.

Our review of 2014 would be incomplete without an update about

the Shoprite litigation. AOF sued Shoprite in the Western Cape High

Court of South Africa for its failure to pay dividends due to AOF

since August 2011. It sued in its capacity as a beneficial owner of

the Shoprite shares because Standard Chartered Bank, custodian of

those shares, refused to sue Shoprite in its capacity as the

registered owners of those Shoprite shares. Unsurprisingly,

Shoprite has challenged AOF's standing as beneficial owner, to

institute legal proceedings against it, acknowledging the right of

Standard Chartered, but not AOF. It will be a matter of first

impression under South Africa's new Companies Act whether

beneficial owners have a standing to enforce shareholder rights.

Shoprite requested that both parties submit their dispute to

arbitration in South Africa. We have in principle agreed to that

request because arbitration is more flexible and time efficient so

that it is highly likely that the arbitration will be concluded in

2015. Furthermore, in arbitration, the parties would usually agree

on a senior legal practitioner, with expert commercial background

in the subject matter, to sit as the arbitrator versus a court

process where parties do not have any control over which judges

should preside over their dispute. Meanwhile, the background of

judges on the bench is diverse and many of them do not have an

expert commercial background. Shoprite has civil and criminal

actions pending against its former transfer agent, Lewis Nathan

Associates, in another court in Zambia. The Lusaka High Court

decided that it was best for all the actions to be heard by the

same court to avoid possible conflicting judgments on the Shoprite

claims. Shoprite has joined the Fund's custodian and other

defendants to its other legal suits in Zambia. Shoprite has

conceded in its pleadings in our South Africa lawsuit, as well as

in its new statement of claims in the Zambian litigation, that

title to Shoprite shares acquired through stockbrokers other than

Stockbrokers Zambia was legally acquired. The effect of Shoprite's

concession is that AOF's title to 240,402 shares out of AOF's

679,145 Shoprite shares are no longer subject to challenge and

dispute. Shoprite is however insisting in its pleadings that it is

entitled to withhold unilaterally the payment of dividends in

respect of all of AOF's shares until the dispute in respect of

title has been settled. According to Shoprite, 438,743 of AOF's

shares, representing 10% of the year-end net asset value of the A

shares, were acquired in allegedly unauthorized trades in Shoprite

shares. To recap, we bought shares on the Lusaka Stock Exchange via

open market purchases only to learn later that some of the shares

sold were allegedly treasury shares of Shoprite and allegedly sold

in breach of Shoprite's mandate to its transfer agent. As a result,

Shoprite argues that valid title did not transfer to the Fund. Our

view remains unchanged. We are confident that AOF's action against

Shoprite will have a favorable outcome and title to all of the

Fund's shares will be confirmed.

The remainder of this report comprises commentary on two of the

Fund's largest investments and a restatement of the Manager's

investment philosophy.

Sonatel. This Senegalese integrated telephone operator listed on

the Bourse Regionale de Valeurs Mobiliers is the largest investment

of the A Shares. Sonatel has operations in Senegal, Mali, Guinea,

and Guinea-Bissau. It has 100% of Senegal's fixed line market and

58 of Senegal's mobile telephony market (a gain of 1 percent in

market share from last year), 54% of Mali's mobile telephony market

(a decline of 10% in market share from last year), 51% of Guinea's

mobile telephony market (an increase of3 percent), and 48% of the

mobile telephony market in Guinea-Bissau (a 2 % increase). Sonatel

continues to hold the number 1 position in all its markets, except

for Guinea-Bissau where it is the second out of three operators.

Its subscribers grew by 18% in 2014 to 26.3 million. At 27% for the

2014 financial year, Sonatel's net margin remains among the highest

in Africa. Sonatel's average revenue per user ("arpu"), a monthly

revenue statistic, declined by 5% to $5.20 from $5.50. Its

operating cash flow per subscriber declined modestly from $39 to

$38. Free cash flow per subscriber, after capital expenditure,

declined to $22. Data accounts for only 5% of Sonatel's revenues;

therefore, the pattern of rising arpu associated with telephone

operators with large consumers of data services through

smartphones, is yet to appear in Sonatel. Nevertheless, it is

encouraging that Sonatel has begun to test 4G services in Senegal.

Measures of Sonatel's profitability and financial sobriety continue

to be exemplary: a debt to equity ratio of 0.5%, a debt to total

assets ratio of 0.3%; and a return on average equity of 33%.

Indeed, as of March 31, 2015, with an enterprise value around $4.6

billion and a market capitalization of $4.8 billion, Sonatel had a

valuation, with a PE ratio of 14.5X and an enterprise value per

subscriber of $210, which acknowledged its superb financial

characteristics.

Stanbic Uganda. This is the largest bank in Uganda and a

subsidiary of Standard Bank of South Africa. It is the second

largest investment of the C Shares. Uganda is an inland oil

importing country which has discovered a couple of billion barrels

of crude oil. It is expected to become an oil exporter within the

next 5 years. Today, it benefits handsomely from the collapse in

crude oil prices. Years ago, Stanbic Uganda was owned by the

Ugandan government. Consequently, it has an extensive national

branch network which is useful in the retail banking sphere.

Control by Standard Bank of South Africa, as well as its own strong

balance sheet, qualify it as one of the best corporate banking

operations in Uganda. Inflation in Uganda is 1.5%, although it is

expected to rise to about 5% in the next 12 months. Based on its H1

2014 results, Stanbic Uganda's return on average equity is 33% and

its return on average assets is 4%. Stanbic's cost-to-income ratio

is on the high side at 52%, but it has a wide net interest spread

of 10%. Uganda's currency depreciated by 20% in 2011, when

inflation rose to 27%. Stanbic's impairment charges rose, in

response to the 2011 macro-economic stresses, and only started to

decline in 2014. Unsurprisingly, Stanbic's loans to customers rose

by 16% in H1 2014 versus H1 2013, as impairment charges diminished

in size. Equity capital, as a percentage of total assets, stood at

12.5% on June 30, 2014 while its loans to deposits ratio was 80%.

Stanbic's valuation is reasonable. Its market capitalization of

$574 million places it on a Price/Book ratio of 3.5x and a

Price/Earnings ratio of 12.4x. An investment in Stanbic Uganda

gives AOF diversified exposure to a current African oil importer

before its transformation into an oil exporter. There are two

principal drawbacks to an investment denominated in Ugandan

shillings. The first one is that the Ugandan shilling is

depreciating quite rapidly. It has depreciated by 9% against the US

Dollar since the beginning of this year. The second is that

Uganda's exports have been harmed by the civil war in southern

Sudan because that country imports many of its goods from Uganda.

Nevertheless, it seems axiomatic that Stanbic Uganda will be one of

the major banking beneficiaries of Uganda's strong economic

growth.

We end with a statement of our investing philosophy. The key

elements of the investment strategy for the Fund are:

Material discounts to intrinsic value: The Fund invests

primarily where and when an investment can be made at a material

discount to the Manager's estimate intrinsic value.

Company preference: The Fund prefers companies which demonstrate

both high real returns on assets and an earnings yield higher than

the yield to maturity of local currency denominated government

debt.

Industry focus rather than country focus: The Fund seeks to

invest in industries it finds attractive with little regard to

national borders.

National resource discounts: The Fund seeks natural resource

companies whose market valuations reflect a discount to the spot

and future world market prices for those natural resources.

"Turnaround" countries: The African continent is home to a large

number of reforming or "turnaround" countries. "Turnaround"

countries combine secular political reform with the opening of

industries to private sector participation.

Balkanized investment landscape: The Fund seeks to invest in

companies with low valuations in relation to peers across the

continent and uses an arbitrage approach to provide attractive

investment returns.

Point of entry: The Fund seeks the most favorable risk adjusted

point of entry into a capital structure, whether through financing

a new company or acquiring the debt or listed equity of an

established company.

Africa offers several attractive investment opportunities,

albeit planted in a briar of deepening doubts emanating from a

slowing China and a tightening US Fed. China's slowdown will reduce

the terms of trade of many an African exporter to China while

rising US interest rates will dissolve the enthusiasm with which

many institutional investors accepted low yields on African

sovereign bonds. Still, the Fund's own portfolio of undervalued

companies exemplifies Africa's appeal. As of the end of March 2015,

AOF's combined top 10 holdings juxtaposed high operational returns

with reasonable valuation ratios, signifying strong earning power.

Those holdings had a weighted average dividend yield of 3.8%, a P/E

ratio of 16X, a return on assets of 6.6%, and a return on equity of

13.4%. We remain interested in industries which have products in

short supply in Africa that rely more on domestic African demand

than global growth. We are hunting in those terrains for compelling

equity investments. We are unhappy about the losses inflicted on

our shareholders in 2014, but shall continue to build a portfolio

that delivers both capital growth and

income to the shareholders of the Fund.

Francis Daniels

Africa Opportunity Partners

March 30, 2015

7 Bloomberg

8 Ghana Minister of Finance Statement to Parliament on the

Implications of the Fall in Crude Oil Prices on the 2015 Budget on

March 12, 2015.

9 September 2014 Bond Prospectus for the Republic of Ghana

8.125% Bond

Responsibility Statements

The Board of Directors confirm that, to the best of their

knowledge:

a. The financial statements, prepared in accordance with

International Financial Reporting Standards, give a true and fair

view of the assets, liabilities, financial position and profit or

loss of the Company.

b. The Interim Investment Manager Report, and Condensed Notes to

the Financial Statements include: i. a fair review of the

information required by DTR 4.2.7R (indication of important events

that have occurred during the first six months and their impact on

the financial statements, and a description of principal risks and

uncertainties for the remaining six months of the year); and

ii. a fair review of the information required by DTR 4.2.8R

(confirmation that no related party transactions have taken place

in the first four months of the year that have materially affected

the financial position or performance of the Company during that

period).

Per Order of the Board

30 April 2015

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2014

Notes 2014 2013

--------------- -------------

USD USD

Income

Interest revenue 1,047,599 936,925

Dividend revenue 2,388,453 1,520,373

Net gains on financial assets and liabilities

at fair value through profit or loss 2 (c) - 13,330,102

Other income 333,657 180,000

Net foreign exchange gain 1,059,102 40,928

--------------- -------------

4,828,811 16,008,328

--------------- -------------

Expenses

Net gains on financial assets and liabilities

at fair value through profit or loss 2 (c) 12,092,559 -

Placing agent fee 8 937,987 -

Performance fee 5 - 2,361,064

Management fee 5 1,196,481 933,052

Brokerage fees and commissions 681,880 570,495

Net foreign exchange loss - -

Custodian, secretarial and administration

fees 343,193 286,545

Dividend expense on securities sold not

yet purchased 178,917 70,710

Marketing fees 25,137 -

Other operating expenses 8 452,009 73,660

Directors' fees 144,422 80,000

Audit fees 40,265 32,840

16,092,850 4,408,366

--------------- -------------

Profit before tax (11,264,039) 11,599,962

Less withholding tax (238,339) (154,652)

Decrease in net assets attributable to

shareholders from operations/ Total Comprehensive

Income for the year (11,502,378) 11,445,310

=============== =============

Attributable to:

Shareholders/Equity holders of the parent (11,436,911) 11,333,272

Non-controlling interest (65,467) 112,038

-----------

(11,502,378) 11,445,310

============= ===========

Basic and diluted earnings per share attributable

to the equity holders of the Company during

the year 2013 - 0.266

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2014

Notes 2014 2013

----------- -------------

USD USD

ASSETS

Cash and cash equivalents 16,848,480 3,413,104

Trade and other receivables 1,036,802 1,114,001

Financial assets at fair value through

profit or loss 2(a) 63,822,689 55,473,931

----------- -------------

Total assets 81,707,971 60,001,036

----------- =============

EQUITY AND LIABILITIES

LIABILITIES

Trade and other payables 131,467 2,497,233

Dividend payable - 85,291

Financial liabilities at fair value

through profit or loss 2(b) 11,501,094 4,963,864

----------- -------------

Total Liabilities 11,632,561 7,546,388

----------- -------------

TOTAL LIABILITIES (excluding net assets

attributable to shareholders) 70,075,410 -

=========== ===========

EQUITY

Ordinary share capital 3 - 426,303

Ordinary share premium - 37,921,452

Retained earnings - 13,701,196

----------- -------------

.

Equity attributable to equity holders

of parent - 52,048,951

Non-controlling interest 340,230 405,697

----------- -------------

Total equity 340,230 52,454,648

----------- -------------

Net assets attributable to shareholders 3 69,735,180 -

Total equity attributable to equity

holders of parent and total net assets

attributable to shareholders 70,075,410 -

=========== =============

Net assets attributable to:

- Ordinary shares 3 43,099,112 -

- Class C shares 3 26,636,068 -

-----------

Net assets attributable to shareholders 69,735,180 -

Net assets value per share:

- Ordinary shares 3 1.011 1.221

- Class C shares 3 0.912 -

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2014

ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT

Share Share Retained Non-controlling Total

capital Premium earnings Total interest equity

-------- ----------- ----------- ----------- ---------------- -----------

Notes USD USD USD USD USD USD

At 1 January 2013 426,303 38,262,525 2,367,924 41,056,752 293,659 41,350,411

Profit for the year - - 11,333,272 11,333,272 112,038 11,445,310

Dividend 7 - (341,073) - (341,073) - (341,073)

At 31 December 2013 426,303 37,921,452 13,701,196 52,048,951 405,697 52,454,648

Profit for the

period - - 282,153 282,153 1,711 283,864

Dividend 7 - (76,859) - (76,859) - (76,859)

At 17 April 2014 426,303 37,844,593 13,983,349 52,254,245 407,408 52,661,653

Transfer to consolidated

statement

of changes in net assets

(note 10) (426,303) (37,844,593) (13,983,349) (52,254,245) - (52,254,245)

Loss for the period - - - - (67,178) (67,178)

At 31 December 2014 - - - - 340,230 340,230

=========== ============= ============= ============ ======== ===========

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

FOR THE YEAR ENDED 31 DECEMBER 2014

Ordinary Class C Net assets

Number of Share shares attributable

units to shareholders

----------------- ------------------ ------------ -----------------

USD USD USD USD

At 17 April 2014 -

transfer from equity

(refer to note 10) 42,630,327 52,254,245 - 52,254,245

CAPITAL TRANSACTIONS:

Issue of C shares 29,200,000 29,200,000 29,200,000

OPERATIONS:

Decrease in net assets

attributable to shareholders

from operations for

the period - (9,155,133) (2,563,932) (11,719,065)

At 31 December 2014 71,830,327 43,099,112 26,636,068 69,735,180

================= ================== ============ =================

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2014

Notes 2014 2013

--------------- ---------------

USD USD

Operating activities

Decrease in net assets attributable

to shareholders from operations/ Total

Comprehensive Income for the year (11,502,378) 11,445,310

Adjustment for non-cash items:

Unrealised loss/(gain) on financial

assets at fair value through profit

or loss 2(a) 10,339,284 (9,760,083)

Realised loss/(gain) on sale of financial

assets at fair value through profit

or loss 2(a) 2,132,906 (1,364,934)

Unrealised loss/(gain) on financial

liabilities held for trading 2(b) 135,784 (1,757,400)

Realised gain on financial liabilities

held for trading 2(b) (515,415) (447,685)

Effect of exchange rate on cash and

cash equivalents (1,059,102) (40,928)

--------------- ---------------

Cash (used in)/ generated from operating

activities (468,921) (1,925,720)

--------------- ---------------

Net changes in operating assets and

liabilities

Purchase of financial assets at fair

value through profit or loss (32,760,408) (25,490,028)

Proceeds on disposal of financial

assets at fair value through profit

or loss 11,939,459 23,300,414

Proceeds on derecognition of financial

liabilities held for trading 6,916,861 4,927,383

Purchase of financial liabilities

held for trading - (2,304,319)

Increase in trade and other receivables 77,198 (513,843)

Increase in trade and other payables (2,365,766) 2,111,323

--------------- ---------------

Net cash (used)/generated from operating

activities (16,192,656) 2,030,930

--------------- ---------------

Financing activities

Proceeds from issue of redeemable 29,200,000 -

shares

Dividend paid (162,149) (366,621)

--------------- ---------------

Net cash flow generated/(used in)

financing activities 29,037,851 (366,621)

--------------- ---------------

Net increase/(decrease) in cash and

cash equivalents 12,376,274 (261,411)

Effect of exchange rate on cash and

cash equivalents 1,059,102 40,928

Cash and cash equivalents at the start

of the year 3,413,104 3,633,587

Cash and cash equivalents at the end

of the year 16,848,480 3,413,104

1. GENERAL INFORMATION

Africa Opportunity Fund Limited (the "Company") was launched

with an Alternative Market Listing "AIM" in July 2007 and moved to

the Specialist Funds Market "SFM" on 17 April 2014.

Africa Opportunity Fund Limited is a closed-ended fund

incorporated with limited liability and registered in Cayman

Islands under the Companies Law on 21 June 2007, with registered

number MC-188243.

The Company aims to achieve capital growth and income through

investment in value, arbitrage, and special situations investments

in the continent of Africa. The Company may therefore invest in

securities issued by companies domiciled outside Africa which

conduct significant business activities within Africa. The Company

has the ability to invest in a wide range of asset classes

including real estate interests, equity, quasi-equity or debt

instruments and debt issued by African sovereign states and

government entities.

The Company's investment activities are managed by Africa

Opportunity Partners Limited, a limited liability company

incorporated in the Cayman Islands and acting as the investment

manager pursuant to an Amended and Restated Investment Management

Agreement dated 12 February 2014.

To ensure that investments to be made by the Company and the

returns generated on the realisation of investments are both

effected in the most tax efficient manner, the Company has

established Africa Opportunity Fund L.P. as an exempted limited

partnership in the Cayman Islands. All investments made by the

Company are made through the limited partnership. The limited

partners of the limited partnership are the Company and AOF CarryCo

Limited. The general partner of the limited partnership is Africa

Opportunity Fund (GP) Limited.

The consolidated financial statements for the Company for the

year ended 31 December 2014 were authorised for issue in accordance

with a resolution of the Board of Directors on 30 April 2015.

Presentation currency

The consolidated financial statements are presented in United

States dollars ("USD").

2. FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE THROUGH PROFIT OR LOSS

2(a) Financial assets at fair value through profit or loss

2014 2013

------------- -------------

USD USD

Designated at fair value through profit

or loss:

At 1 January 55,473,931 42,159,300

Additions 32,760,408 25,490,028

Disposals (14,072,366) (21,935,480)

Net (losses)/ gains on financial assets

at fair value through profit or loss (10,339,284) 9,760,083

------------- -------------

At 31 December (at fair value) 63,822,689 55,473,931

Analysed as follows:

* Listed equity securities 50,685,167 43,574,212

* Listed debt securities 11,887,510 10,949,719

1,000,012

* Unlisted equity securities -

* Unlisted debt securities 250,000 950,000

----------- -----------

63,822,689 55,473,931

Net changes on fair value of financial assets at fair value

through profit or loss

2014 2013

------------- -----------

USD USD

Realised (2,132,906) 1,364,934

Unrealised (10,339,284) 9,760,083

-------------

Total (losses)/ gains (12,472,190) 11,125,017

2(b) Financial liabilities at fair value through profit or loss

2014 2013

----------- ------------

USD USD

Written call options - 141,400

Written put options 132,883 428,072

Listed equity securities sold short 11,368,211 4,394,392

----------- ------------

Financial liabilities at fair value through

profit or loss 11,501,094 4,963,864

2014 2013

----------- ----------

USD USD

Net changes on fair value of financial liabilities

at fair value through profit or loss

Realised 515,415 447,685

Unrealised (135,784) 1,757,400

----------

Total gains 379,631 2,205,085

2(c) Net gains/ (losses) on financial assets and liabilities at

fair value through profit or loss

2014 2013

--------------- ------------

USD USD

Net (losses)/gains on fair value of financial

assets at fair value through profit or loss (12,472,190) 11,125,017

Net gains on fair value of financial liabilities

at fair value through profit or loss 379,631 2,205,085

Net gains (12,092,559) 13,330,102

2(d) Fair value hierarchy

The Group uses the following hierarchy for determining and

disclosing the fair value of the financial instruments by valuation

technique:

Level 1: quoted (unadjusted) market prices in active markets for

identical assets and liabilities.

Level 2: Valuation techniques for which the lowest level input

that is significant to the fair value measurement is directly or

indirectly observable.

Level 3: Valuation techniques for which the lowest level input

that is significant to the fair value measurement is

unobservable.

Recurring fair value measurement of assets and liabilities -

2014

31 December

2014 Level 1 Level 2 Level 3

------------ ---------- ---------- ----------

USD USD USD USD

Financial assets at fair value through profit or loss:

Equities 51,685,179 43,999,833 7,685,346 -

Debt securities 12,137,510 - 12,137,510 -

------------ ------------ ----------- ----

63,822,689 43,999,833 19,822,856 -

============ ============ =========== ====

Financial liabilities

at fair value through

profit or loss 11,501,094 11,368,211 132,883 -

============ ============ =========== ====

Recurring fair value measurement of assets and liabilities -

2013

31 December

2013 Level 1 Level 2 Level 3

------------ ---------- ---------- ----------

USD USD USD USD

Financial assets at fair value through profit or loss:

Equities 43,574,212 35,858,047 7,716,165 -

Debt securities 11,899,719 - 10,949,719 950,000

----------- ------------ ----------- --------

55,473,931 35,858,047 18,665,884 950,000

=========== ============ =========== ========

Financial liabilities

at fair value through

profit or loss 4,963,864 4,394,392 569,472 -

=========== ============ =========== ========

3(a) ORDINARY SHARE CAPITAL

2014 2014 2013 2013

-------------- ----------- -------------- -----------

Number USD Number USD

Authorised share capital

Ordinary shares with

a par value of USD

0.01 1,000,000,000 10,000,000 1,000,000,000 10,000,000

============== ===========

Share capital

At 1 January 42,630,327 426,303 42,630,327 426,303

Reclassification (42,630,327) (426,303) - -

-------------- ----------- -------------- -----------

At 31 December - - 42,630,327 426,303

The directors have the general authority to repurchase the

ordinary shares in issue subject to the Company having funds

lawfully available for the purpose. However, if the market price of

the ordinary shares falls below the Net Asset Value, the directors

will consult with the Investment Manager as to whether it is

appropriate to instigate a repurchase of the ordinary shares.

3(b) NET ASSETS ATTRIBUTABLE TO SHAREHOLDERS

Ordinary Class C

Shares Shares Total

----------- ------------ --------------

USD USD USD

Reclassification from equity

at 17 April 2014 52,254,245 - 52,254,245

Changes during the year:

Issue of shares - 29,200,000 29,200,000

Redemption of shares - - -

Loss for the period (9,155,133) (2,563,932) (11,719,065)

At 31 December 2014 43,099,112 26,636,068 69,735,180

============ ============ =============

Net assets value per share in

2014 1.011 0.912

------------ ------------

Net assets value per share in 1.221 -

2013

------

C shares

AOF closed a Placing of 29.2 million C shares of US$0.10 each at

a placing price of US$1.00 per C share, raising a total of $29.2

million before the expenses of the Issue. The placing was closed on

11 April 2014 with the shares commencing trading on 17 April

2014.

AOF's Ordinary Shares and the C Shares from the April placing

were admitted to trading on the LSE's Specialist Fund Market

("SFM") effective 17 April 2014. Simultaneous with the listing on

the SFM, the Ordinary shares were cancelled from admission to

trading on the AIM.

C Shares are a transient class of shares: the assets

representing the net proceeds of any issue of C Shares will be

maintained, managed and accounted for as a separate pool of capital

of the Company until those C Shares convert into Ordinary Shares

(which will occur once 85 per cent. of all of the assets

representing the Net Placing Proceeds have been invested in

accordance with the Company's existing investment policy (or, if

earlier, six months after the date of issue of the C Shares)).

Under the Articles the Directors have discretion to make such

adjustments to the timing of Conversion as they consider reasonable

having regard to the interests of all Shareholders. In this regard,

although Conversion was anticipated to occur no later than six

months after Admission, the Directors considered it is in the best

interests of all Shareholders (being at that time Ordinary

Shareholders and C Shareholders) to extend the Conversion Date

beyond the six month period as the Shoprite case was still

unresolved as at year end. On such conversion, each holder of C

Shares will receive such number of Ordinary Shares as equals the

number of C Shares held by them multiplied by the Net Asset Value

per C Share and divided by the Net Asset Value per Ordinary Share

(subject to a discount of 5 per cent.), in each case as at a date

shortly prior to Conversion. As at 31 December 2014, the dispute

with Shoprite is still unresolved and the Conversion has not yet

been made.

The Net Placing Proceeds is the aggregate value of the C Shares

issued under the Placing at the Placing Price less the applicable

fees and expenses of the Placing.

The Company does not have a fixed life but, as stated in the

Company's admission document published in 2007, the Directors

consider it desirable that Shareholders should have the opportunity

to review the future of the Company at appropriate intervals.

Accordingly, Shareholders passed an ordinary resolution at an

extraordinary general meeting of the Company on 28 February 2014

that the Company continues in existence.

In 2019, the Directors will convene another general meeting

where an ordinary resolution will be proposed that the Company will

continue in existence. If the resolution is not passed, the

Directors will be required to formulate proposals to be put to

Shareholders to reorganise, reconstruct or wind up the Company. If

the resolution is passed, the Company will continue its operations

and a similar resolution will be put to Shareholders every five

years thereafter.

At the same time as the continuation vote in 2019, the Company

will provide Shareholders with, without first requiring a

Shareholder vote to implement this policy, an opportunity to

realise all or part of their shareholding in the Company for a net

realised pro rata share of the Company's investment portfolio.

The directors have the discretion to defer the conversion

indefinitely. Hence, there could be two classes of shares (the

Ordinary and the C Class shares) that could be realised in a forced

liquidation by the shareholders, and then the requirements of IAS

32.16C and 16D would need to be applied to both classes. Due to the

fact that there are two separate pools of assets and liabilities

attributable to the C Class and Ordinary shareholders respectively,

the requirements of IAS 32.16C(a) would not be met. Therefore both

the classes have been classified as financialliabilities as from

April 17, 2014 upon issuance of a Class C shares.

The equity attributable to ordinary shareholders (classified as

equity) amounting to USD 52,254,245 have been reclassified to "net

assets attributable to shareholders" as from 17 April 2014

(reclassified now as "financial liabilities" under IAS 32) upon

issue of C shares where two separate pools are now being managed

(note 6).

3(c) FAIR VALUE OF NET ASSETS ATTRIBUTABLE TO SHAREHOLDERS

Recurring fair value measurement of financial liabilities

The below table shows the fair value hierarchy of the Net assets

attributable to shareholders. This has been presented for 2014 only

as the shares were classified as equity instruments and not

financial liabilities in 2013.

Level 1 Level 2 Level 3

USD USD USD

Ordinary shares - 43,099,112 -

C Class shares - 26,636,068 -

At 31 December 2014 - 69,735,180 -

=================== ===============

The Ordinary and C Class shares are quoted on the SFM of the

LSE. The shares are traded on the exchange at the quoted price as

determined by the participants on the LSE. In a liquidation

scenario or if investors elect to initiate their opportunity to

realise all or part of the shareholding at the time of the

continuation vote in 2019, the proceeds to the shareholders would

be determined by the net realisation of the net asset value.

Therefore, the Directors have concluded that the most

appropriate estimate of fair value of both classes of shares is

their net asset value per share, without adjustment, at the

reporting date. This price is calculated by taking the net assets

attributable to shareholders and dividing by the number of shares

in issue.

4. EARNING PER SHARE

In the prior year, the ordinary shares were classified as equity

and as such the earnings per share have been disclosed on the face

of the consolidated statement of comprehensive income for 2013 as

required by IAS 33.

Following the classification of the ordinary and C shares as

financial liabilities during the current year, the disclosure of

the earning per share on the face of the consolidated statement of

comprehensive is not required in terms of IAS 33 as the instruments

are no longer classified as equity. However, the Company has

voluntarily disclosed the earnings per share as per below.

Earnings per share is the prior year was calculated by dividing

the profit attributable to equity holders of the Company by the

weighted average number of ordinary shares in issue during the year