In the Interim Report for the six months ended 31 October 2014,

the Group announced its intention to discontinue its Management

services business. The Group initiated an orderly wind-down of the

Management services business during the financial year which was

completed by the end of the financial year apart from some residual

payables and receivables, nearly all of which have been settled

since the year-end. The Group also disposed of Geomerics Limited

(Note 8) in the prior year and the subsequent residual transactions

from this have been treated as a discontinued operation. In

accordance with IFRS 5 Non-current assets held for sale and

discontinued operations these businesses have been classified as

discontinued operations and the prior periods have been restated to

show these discontinued operations separately from continuing

operations. A summary of the results is set out below:

Results of discontinued operations

2015 2014

GBP'000 GBP'000

Revenue 586 801

Operating costs (639) (1,273)

Share based payments - (1)

Change in fair value 35 1,334

Finance income - 99

----------- -----------

Profit/(loss) for the year (18) 960

=========== ===========

The Consolidated Statement of Cash Flows shows the net cash used

in the operating and investing activities of the discontinued

operations. The impact of the discontinued operations on the

Statement of Financial Position is minimal.

6 Earnings/(loss) per share

The basic and diluted earnings/(loss) per share is calculated on

the loss for the year from continuing and discontinued operations

of GBP3.9 million (2014: GBP1.2 million).

In accordance with IAS 33 Earnings per share 1) the "basic"

weighted average number of ordinary shares calculation excludes

shares held by the Employee Share Ownership Trust (ESOT) as these

are treated as treasury shares and 2) the "diluted" weighted

average number of ordinary shares calculation excludes potentially

dilutive ordinary shares from instruments that could be converted.

Share options are potentially dilutive where the exercise price is

less than the average market price during the period. Due to the

losses in 2015 and 2014, share options are non-dilutive for those

years and therefore the diluted loss per share is equal to the

basic loss per share.

The basic and diluted earnings/(loss) per share are based on a

weighted average of 47,625,033 ordinary 10p shares (2014:

45,129,800).

7 Intangible assets

Intellectual Computer Goodwill Product Total

property software development

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost or deemed cost

At 1 May 2013 524 12 98 973 1,607

Additions 30 1 - 217 248

Reclassification 62 - - (62) -

Disposals (400) (2) (98) - (500)

Exchange movements (10) - - (83) (93)

At 30 April

2014 206 11 - 1,045 1,262

Additions 66 1 - 37 104

Exchange movements 14 - - 109 123

At 30 April

2015 286 12 - 1,191 1,489

============= ========= ========= ============ ========

Amortisation and impairment

At 1 May 2013 400 10 98 19 527

Charge for

the year - 1 - 98 99

Disposals (400) (2) (98) - (500)

Exchange movements - - - (6) (6)

At 30 April

2014 - 9 - 111 120

Charge for

the year - 1 - 109 110

Impairment 94 - - - 94

Exchange movements - - - 16 16

At 30 April

2015 94 10 - 236 340

============= ========= ========= ============ ========

Net book value

At 30 April

2015 192 2 - 955 1,149

============= ========= ========= ============ ========

At 30 April

2014 206 2 - 934 1,142

============= ========= ========= ============ ========

The carrying value of intangible assets is reviewed for

impairment annually or whenever events or changes in circumstances

indicate that the carrying value may not be recoverable. The

recoverable amount is assessed on the basis of "value in use". The

key assumptions to assess value in use are the estimated useful

economic life, future revenues, cash flows and the discount rate to

determine the net present value of these cash flows. Where value in

use exceeds the carrying value then no impairment is made. Where

value in use is less than the carrying value then an impairment

charge is made.

Amortisation and impairment charges are charged to operating

costs in the Consolidated Statement of Comprehensive Income.

"Product development" relates to internally generated assets

that were capitalised in accordance with IAS 38 Intangible Assets.

Capitalised product development costs are directly attributable

costs comprising cost of materials, specialist contractor costs,

labour and overheads. Product development costs are amortised over

their estimated useful lives commencing when the related new

product is in commercial production. Development costs not meeting

the IAS 38 criteria for capitalisation continue to be expensed

through the Statement of Comprehensive Income as incurred.

8 Trade and other receivables

2015 2014

GBP'000 GBP'000

Current assets:

Trade receivables 4 126

Other receivables - investments 636 -

Other receivables 124 55

Prepayments and accrued income 244 147

----------- -----------

1,008 328

=========== ===========

"Other receivables - investments" relates to the Group's

investment in Geomerics (computer games middleware and computer

graphics) which was sold in December 2013. There is a retention

payment of GBP0.7 million due to be received in December 2015 which

has been designated at fair value (discounted for the time value of

money). As the retention payment is due within 12 months this has

been reclassified from "Non-current assets - Other receivables" to

"Current assets - Trade and other receivables".

9 Share capital

The Company has one class of ordinary shares which carry no

right to fixed income and at 30 April 2015 had 58,974,338 ordinary

shares of 10p each allotted, called up and fully paid (2014:

45,243,059).

The Company issued 13,481,279 new ordinary shares with a nominal

value of GBP0.10 at an issue price of GBP0.65 per share in a

placing, subscription and offer of shares, realising proceeds of

GBP8.2 million, net of costs. Shares were admitted to trading on

AIM as to 11,173,587 in February 2015 for the placing and

subscription and 2,307,692 in March 2015 for the offer.

The Company issued 250,000 new ordinary shares with a nominal

value of GBP0.10 at an exercise price of GBP0.2575 per share as a

result of the exercise of share options by employees. Shares were

admitted to trading on AIM as to 166,667 in March 2015 and 83,333

in April 2015.

10 Shareholder communications

Copies of this announcement are posted on the Company's website

www.ANGLEplc.com.

The Annual General Meeting of the Company will be held at 2:00pm

on Wednesday 30 September 2015 at the Surrey Technology Centre, 40

Occam Road, the Surrey Research Park, Guildford, GU2 7YG. Notice of

the meeting will be enclosed with the audited Statutory Financial

Statements.

The audited Statutory Financial Statements for the year ended 30

April 2015 are expected to be distributed to shareholders by 5

September 2015 and will subsequently be available on the Company's

website or from the registered office, 3 Frederick Sanger Road,

Surrey Research Park, Guildford, GU2 7YD.

This preliminary announcement was approved by the Board on 22

July 2015.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PKBDDBBKBKOB

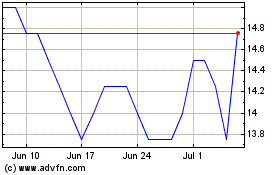

Angle (LSE:AGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

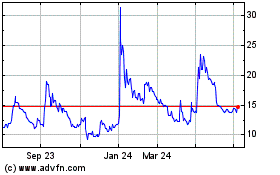

Angle (LSE:AGL)

Historical Stock Chart

From Apr 2023 to Apr 2024