UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 15, 2015

U.S. BANCORP

(Exact name of registrant as specified in its charter)

1-6880

(Commission File Number)

|

|

|

| DELAWARE |

|

41-0255900 |

| (State or other jurisdiction |

|

(I.R.S. Employer Identification |

| of incorporation) |

|

Number) |

800 Nicollet Mall

Minneapolis, Minnesota 55402

(Address of principal executive offices and zip code)

(651) 466-3000

(Registrant’s telephone number, including area code)

(not applicable)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 Under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)) |

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On April 15, 2015, U.S. Bancorp (the “Company”) issued a press release reporting quarter ended March 31, 2015 results, and

posted on its website its 1Q15 Earnings Conference Call Presentation, which contains certain additional historical and forward-looking information relating to the Company. The press release is included as Exhibit 99.1 hereto and is incorporated

herein by reference. The information included in the press release is considered to be “filed” under the Securities Exchange Act of 1934. The 1Q15 Earnings Conference Call Presentation is included as Exhibit 99.2 hereto and is incorporated

herein by reference. The information included in the 1Q15 Earnings Conference Call Presentation is considered to be “furnished” under the Securities Exchange Act of 1934. The press release and 1Q15 Earnings Conference Call Presentation

contain forward-looking statements regarding the Company and each includes a cautionary statement identifying important factors that could cause actual results to differ materially from those anticipated.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(c) Exhibits.

| |

99.1 |

Press Release issued by U.S. Bancorp on April 15, 2015, deemed “filed” under the Securities Exchange Act of 1934. |

| |

99.2 |

1Q15 Earnings Conference Call Presentation, deemed “furnished” under the Securities Exchange Act of 1934. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| U.S. BANCORP |

|

| By /s/ Craig E. Gifford |

| Craig E. Gifford |

Executive Vice President and

Controller |

DATE: April 15, 2015

Exhibit 99.1

|

|

|

|

|

|

|

|

|

|

News Release |

|

|

|

Contacts: Dana Ripley

Media

(612) 303-3167 |

|

Sean O’ Connor

Investors/Analysts (612)

303-0778 |

|

|

U.S. BANCORP REPORTS FIRST QUARTER 2015 EARNINGS

| |

Ø |

Year-over-year increase in earnings per diluted common share of 4.1 percent |

| |

Ø |

Return on average assets of 1.44 percent and return on average common equity of 14.1 percent |

| |

Ø |

Returned 70 percent of first quarter earnings to shareholders |

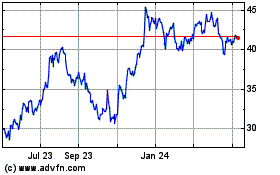

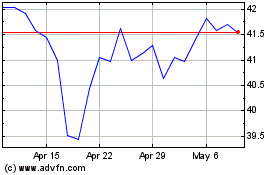

MINNEAPOLIS, April 15, 2015 — U.S. Bancorp (NYSE: USB) today reported net income of $1,431 million for the first

quarter of 2015, or $0.76 per diluted common share, compared with $1,397 million, or $0.73 per diluted common share, in the first quarter of 2014.

U.S. Bancorp Chairman, President and Chief Executive Officer Richard K. Davis said, “U.S. Bancorp, once again, delivered

industry-leading performance measures in the first quarter. We achieved net income of $1.43 billion, or $0.76 per diluted common share, return on average assets (ROA) of 1.44 percent, return on average common equity (ROE) of 14.1 percent, and an

efficiency ratio of 54.3 percent. The first quarter results reflect normal seasonal effects, such as the expected reduction of post-holiday spending. We believe the diversification of our business mix has served us well through the prolonged low

interest rate environment and slow economic recovery, and we are well positioned for stronger growth when the economy gains momentum and interest rates rise.”

Davis continued, “In the first quarter, we returned 70 percent of our earnings to shareholders through dividends and share

buybacks, demonstrating our continued commitment to value creation for our shareholders. We were also pleased to receive the Federal Reserve’s non-objection to our capital distribution plan, which will allow us to increase our annual dividend

by 4.1 percent in the second quarter. Because of our diverse business profile, wide-ranging customer base, and balanced revenue generation between margin and fee businesses, we are able to withstand challenging revenue environments. For example,

average total loans grew 5.1 percent in the first quarter compared to a year ago, fueled by the strength of our Wholesale Banking franchise. Average total commercial loans grew 15.1 percent demonstrating the versatility of our earnings platform. In

addition, average total deposits rose 8.1 percent, which emphasizes the overall strength and stability of both our Retail and Wholesale Banking franchises. As we look toward our financial performance in the quarters ahead, we will continue to stay

focused on the best revenue growth opportunities, while prudently controlling expenses.”

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

2

“One of U.S. Bancorp’s highlights from the first quarter was being

named as one of the World’s Most Ethical Companies® by the Ethisphere Institute. This designation recognizes the deep commitment our 67,000 employees have toward serving our customers,

helping them build financially secure futures, and always doing the right thing. A commitment to ethical leadership is one of the cornerstones of the U.S. Bancorp culture and core values. We are proud to be bankers and to have the privilege to be a

trusted partner for our shareholders, customers, and communities as we move toward our vision for the future.”

Highlights for the first quarter of

2015 included:

| |

Ø |

Growth in average total loans of 5.1 percent over the first quarter of 2014 |

| |

¡ |

Growth in average total loans of 0.6 percent on a linked quarter basis (0.8 percent excluding the impact of a reclassification of certain municipal loans to securities at the end of the fourth quarter 2014)

|

| |

¡ |

Growth in average total commercial loans of 15.1 percent over the first quarter of 2014 and 2.4 percent over the fourth quarter of 2014 |

| |

¡ |

Growth in average commercial and commercial real estate revolving commitments of 11.7 percent year-over-year and 1.9 percent over the prior quarter |

| |

Ø |

Strong new lending activity of $48.8 billion during the first quarter, including: |

| |

¡ |

$29.0 billion of new and renewed commercial and commercial real estate commitments |

| |

¡ |

$2.8 billion of lines related to new credit card accounts |

| |

¡ |

$17.0 billion of mortgage and other retail loan originations |

| |

Ø |

Growth in average total deposits of 8.1 percent over the first quarter of 2014 (6.4 percent excluding the Charter One franchise acquisition in late June 2014) and 1.1 percent on a linked quarter basis, the strongest

first quarter deposit growth in the past three years |

| |

¡ |

Average low cost deposits, including noninterest-bearing and total savings deposits, grew by 11.4 percent year-over-year and 1.7 percent on a linked quarter basis |

| |

Ø |

Net interest income growth over the first quarter of 2014 driven by average earning assets growth of 10.6 percent and continued strong growth in lower cost core deposit funding. Linked quarter net interest income

decreased 1.7 percent principally due to fewer days in the quarter. |

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

3

| |

Ø |

Declines in net charge-offs of 9.4 percent on a linked quarter basis and 18.2 percent on a year-over-year basis. Provision for credit losses was $15 million less than net charge-offs in the current quarter

|

| |

¡ |

Allowance for credit losses to period-end loans was 1.77 percent at March 31, 2015 |

| |

¡ |

Annualized net charge-offs to average total loans ratio decreased to 0.46 percent |

| |

Ø |

Decreases in nonperforming assets of 15.2 percent on a year-over-year basis and 6.2 percent on a linked quarter basis |

| |

Ø |

Capital generation continued to reinforce capital position and returns. Ratios at March 31, 2015, were: |

| |

¡ |

Common equity tier 1 capital to risk-weighted assets estimated for the Basel III fully implemented standardized approach of 9.2 percent and for the Basel III fully implemented advanced approaches of 11.8 percent

|

| |

¡ |

Basel III transitional standardized approach: |

| |

¡ |

Common equity tier 1 capital ratio of 9.6 percent |

| |

¡ |

Tier 1 capital ratio of 11.1 percent |

| |

¡ |

Total risk-based capital ratio of 13.3 percent |

| |

Ø |

Returned 70 percent of first quarter earnings to shareholders through dividends and the buyback of 12 million common shares |

| |

Ø |

Early compliance with fully implemented U.S. Liquidity Coverage Ratio (“LCR”) based on the Company’s interpretation of the final U.S. LCR rule |

| |

Ø |

Supplementary Leverage Ratio (“SLR”) exceeds the applicable minimum requirement |

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

4

Net income attributable to U.S. Bancorp was $1,431 million for the first

quarter of 2015, 2.4 percent higher than the $1,397 million for the first quarter of 2014, and 3.8 percent lower than the $1,488 million for the fourth quarter of 2014. Diluted earnings per common share of $0.76 in the first quarter of 2015 were

$0.03 higher than the first quarter of 2014 and $0.03 lower than the previous quarter. Return on average assets and return on average common equity were 1.44 percent and 14.1 percent, respectively, for the first quarter of 2015, compared with 1.56

percent and 14.6 percent, respectively, for the first quarter of 2014. The provision for credit losses was lower than net charge-offs by $15 million in the first quarter of 2015, $20 million lower than net charge-offs in the fourth quarter of 2014,

and $35 million lower than net charge-offs in the first quarter of 2014.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS SUMMARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 1 |

|

| ($ in millions, except per-share data) |

|

1Q

2015 |

|

|

4Q

2014 |

|

|

1Q

2014 |

|

|

Percent

Change

1Q15 vs

4Q14 |

|

|

Percent

Change

1Q15 vs

1Q14 |

|

| |

|

|

|

|

| |

|

|

|

|

|

| Net income attributable to U.S. Bancorp |

|

|

$1,431 |

|

|

|

$1,488 |

|

|

|

$1,397 |

|

|

|

(3.8 |

) |

|

|

2.4 |

|

| Diluted earnings per common share |

|

|

$.76 |

|

|

|

$.79 |

|

|

|

$.73 |

|

|

|

(3.8 |

) |

|

|

4.1 |

|

| |

|

|

|

|

|

| Return on average assets (%) |

|

|

1.44 |

|

|

|

1.50 |

|

|

|

1.56 |

|

|

|

|

|

|

|

|

|

| Return on average common equity (%) |

|

|

14.1 |

|

|

|

14.4 |

|

|

|

14.6 |

|

|

|

|

|

|

|

|

|

| Net interest margin (%) |

|

|

3.08 |

|

|

|

3.14 |

|

|

|

3.35 |

|

|

|

|

|

|

|

|

|

| Efficiency ratio (%) (a) |

|

|

54.3 |

|

|

|

54.3 |

|

|

|

52.9 |

|

|

|

|

|

|

|

|

|

| Tangible efficiency ratio (%) (a) |

|

|

53.4 |

|

|

|

53.3 |

|

|

|

51.9 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Dividends declared per common share |

|

|

$.245 |

|

|

|

$.245 |

|

|

|

$.230 |

|

|

|

— |

|

|

|

6.5 |

|

| Book value per common share (period end) |

|

|

$22.20 |

|

|

|

$21.68 |

|

|

|

$20.48 |

|

|

|

2.4 |

|

|

|

8.4 |

|

| |

|

(a) Computed as noninterest expense divided by the sum of net interest income on a taxable-equivalent basis and

noninterest income excluding net securities gains (losses), and for tangible efficiency ratio, intangible amortization. |

|

Net income attributable to U.S. Bancorp for the first quarter of 2015 was $34 million (2.4

percent) higher than the first quarter of 2014, and $57 million (3.8 percent) lower than the fourth quarter of 2014. The increase in net income year-over-year was principally due to increases in net interest income and fee-based revenue, and a

decline in the provision for credit losses, partially offset by an increase in noninterest expense. The decrease in net income on a linked quarter basis was due to lower net interest income, primarily the result of two fewer days in the quarter, and

seasonally lower fee-based revenue, partially offset by decrease in noninterest expense.

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

5

Total net revenue on a taxable-equivalent basis for the first quarter of 2015

was $4,906 million, which was $92 million (1.9 percent) higher than the first quarter of 2014, reflecting a 2.2 percent increase in noninterest income and a 1.7 percent increase in net interest income. The increase in net interest income

year-over-year was the result of an increase in average earning assets and continued growth in lower cost core deposit funding, partially offset by an approximately $50 million decrease related to the previously communicated wind down of the

short-term, small-dollar deposit advance product, Checking Account Advance (“CAA”), lower reinvestment rates on investment securities, and lower rates on new loans and a change in loan portfolio mix. Noninterest income increased

year-over-year due to higher revenue in most fee businesses and higher equity investment gains in other income. Total net revenue on a taxable-equivalent basis was $263 million (5.1 percent) lower on a linked quarter basis due to a 1.7 percent

decrease in net interest income, mainly the result of two fewer days in the quarter, and a 9.1 percent decrease in noninterest income, due to seasonally lower revenue in most fee businesses and the fourth quarter 2014 Nuveen gain.

Total noninterest expense in the first quarter of 2015 was $2,665 million, which was $121 million (4.8 percent) higher than the

first quarter of 2014 and $139 million (5.0 percent) lower than the fourth quarter of 2014. The increase in total noninterest expense year-over-year was primarily due to an increase in compensation expense, reflecting the impact of merit increases,

acquisitions, and higher staffing for risk and compliance activities and increased benefits expense due to higher pension costs, along with higher other expense primarily related to mortgage servicing-related activities. The decrease in total

noninterest expense on a linked quarter basis was due to seasonally lower costs related to investments in tax-advantaged projects and professional services, as well as lower marketing and business development and other expense due to the impact of

the fourth quarter 2014 notable items, comprised of charitable contributions and legal accruals, partially offset by higher compensation expense and benefits expense related to higher pension costs and seasonally higher payroll taxes.

The Company’s provision for credit losses for the first quarter of 2015 was $264 million, $24 million (8.3 percent) lower

than the prior quarter and $42 million (13.7 percent) lower than the first quarter of 2014. The provision for credit losses was lower than net charge-offs by $15 million in the first quarter of 2015, $20 million lower than net charge-offs in the

fourth quarter of 2014, and $35 million lower than net charge-offs in the first quarter of 2014. Net charge-offs in the first quarter of 2015 were $279 million, compared with $308 million in the fourth quarter of 2014, and $341 million in the first

quarter of 2014. Given current economic conditions, the Company expects the level of net charge-offs to increase modestly in the second quarter of 2015.

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

6

Nonperforming assets were $1,696 million at March 31, 2015, compared

with $1,808 million at December 31, 2014, and $1,999 million at March 31, 2014. The decrease in nonperforming assets compared with a year ago was driven primarily by reductions in the commercial, commercial mortgage and construction and

development portfolios, as well as improvement in credit card loans. The Company expects total nonperforming assets to remain relatively stable in the second quarter of 2015. The ratio of the allowance for credit losses to period-end loans was 1.77

percent at March 31, 2015, and at December 31, 2014, compared with 1.89 percent at March 31, 2014.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME STATEMENT HIGHLIGHTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 2 |

|

| (Taxable-equivalent basis, $ in millions, except per-share data) |

|

1Q

2015 |

|

|

4Q

2014 |

|

|

1Q

2014 |

|

|

Percent

Change

1Q15 vs

4Q14 |

|

|

Percent

Change

1Q15 vs

1Q14 |

|

| |

|

|

|

|

| |

|

|

|

|

|

| Net interest income |

|

|

$2,752 |

|

|

|

$2,799 |

|

|

|

$2,706 |

|

|

|

(1.7 |

) |

|

|

1.7 |

|

| Noninterest income |

|

|

2,154 |

|

|

|

2,370 |

|

|

|

2,108 |

|

|

|

(9.1 |

) |

|

|

2.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total net revenue |

|

|

4,906 |

|

|

|

5,169 |

|

|

|

4,814 |

|

|

|

(5.1 |

) |

|

|

1.9 |

|

| Noninterest expense |

|

|

2,665 |

|

|

|

2,804 |

|

|

|

2,544 |

|

|

|

(5.0 |

) |

|

|

4.8 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income before provision and taxes |

|

|

2,241 |

|

|

|

2,365 |

|

|

|

2,270 |

|

|

|

(5.2 |

) |

|

|

(1.3 |

) |

| Provision for credit losses |

|

|

264 |

|

|

|

288 |

|

|

|

306 |

|

|

|

(8.3 |

) |

|

|

(13.7 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income before taxes |

|

|

1,977 |

|

|

|

2,077 |

|

|

|

1,964 |

|

|

|

(4.8 |

) |

|

|

.7 |

|

| Taxable-equivalent adjustment |

|

|

54 |

|

|

|

55 |

|

|

|

56 |

|

|

|

(1.8 |

) |

|

|

(3.6 |

) |

| Applicable income taxes |

|

|

479 |

|

|

|

521 |

|

|

|

496 |

|

|

|

(8.1 |

) |

|

|

(3.4 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

1,444 |

|

|

|

1,501 |

|

|

|

1,412 |

|

|

|

(3.8 |

) |

|

|

2.3 |

|

| Net (income) loss attributable to noncontrolling interests |

|

|

(13 |

) |

|

|

(13 |

) |

|

|

(15 |

) |

|

|

— |

|

|

|

13.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to U.S. Bancorp |

|

|

$1,431 |

|

|

|

$1,488 |

|

|

|

$1,397 |

|

|

|

(3.8 |

) |

|

|

2.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income applicable to U.S. Bancorp common shareholders |

|

|

$1,365 |

|

|

|

$1,420 |

|

|

|

$1,331 |

|

|

|

(3.9 |

) |

|

|

2.6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per common share |

|

|

$.76 |

|

|

|

$.79 |

|

|

|

$.73 |

|

|

|

(3.8 |

) |

|

|

4.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Income

Net interest income on a taxable-equivalent basis in the first quarter of 2015 was $2,752 million, an increase of $46 million

(1.7 percent) over the first quarter of 2014. The increase was the result of growth in average earning assets and in lower cost core deposit funding, partially offset by lower rates on new loans and securities and the CAA product wind down. Average

earning assets were $34.6 billion (10.6 percent) higher than the first quarter of 2014, driven by increases of $18.5 billion (22.5 percent) in average investment securities and $12.1 billion (5.1 percent) in average total loans. Net interest income

decreased $47 million (1.7 percent) on a linked quarter basis, primarily the result of two fewer days in the quarter and

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

7

lower net interest margin. The net interest margin in the first quarter of 2015 was 3.08 percent, compared with 3.35 percent in the first quarter of 2014, and 3.14 percent in the fourth quarter

of 2014. The decline in the net interest margin on a year-over-year basis primarily reflected growth in the investment portfolio at lower average rates, as well as lower reinvestment rates on investment securities, lower loan fees due to the CAA

product wind down, lower rates on new loans and a change in loan portfolio mix, partially offset by lower funding costs. On a linked quarter basis, the reduction in net interest margin was principally due to growth in lower rate investment

securities and lower reinvestment rates, lower interest recoveries, lower rates on new loans and a change in loan portfolio mix, along with the impact of higher cash balances at the Federal Reserve as a result of continued deposit growth.

Average investment securities in the first quarter of 2015 were $18.5 billion (22.5 percent) higher year-over-year and $2.5

billion (2.6 percent) higher than the prior quarter. The increases were primarily due to purchases of U.S. government agency-backed securities, net of prepayments and maturities, to support liquidity coverage ratio regulatory requirements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET

INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 3 |

|

| (Taxable-equivalent basis; $ in millions) |

|

1Q

2015 |

|

|

4Q

2014 |

|

|

1Q

2014 |

|

|

Change

1Q15 vs

4Q14 |

|

|

Change

1Q15 vs

1Q14 |

|

| |

|

|

|

|

| |

|

|

|

|

|

| Components of net interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income on earning assets |

|

|

$3,116 |

|

|

|

$3,158 |

|

|

|

$3,078 |

|

|

|

$(42 |

) |

|

|

$38 |

|

| Expense on interest-bearing liabilities |

|

|

364 |

|

|

|

359 |

|

|

|

372 |

|

|

|

5 |

|

|

|

(8 |

) |

| |

|

|

|

|

| Net interest income |

|

|

$2,752 |

|

|

|

$2,799 |

|

|

|

$2,706 |

|

|

|

$(47 |

) |

|

|

$46 |

|

| |

|

|

|

|

| |

|

|

|

|

|

| Average yields and rates paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earning assets yield |

|

|

3.49% |

|

|

|

3.54% |

|

|

|

3.81% |

|

|

|

(.05)% |

|

|

|

(.32)% |

|

| Rate paid on interest-bearing liabilities |

|

|

.55 |

|

|

|

.55 |

|

|

|

.63 |

|

|

|

— |

|

|

|

(.08) |

|

| |

|

|

|

|

| Gross interest margin |

|

|

2.94% |

|

|

|

2.99% |

|

|

|

3.18% |

|

|

|

(.05)% |

|

|

|

(.24)% |

|

| |

|

|

|

|

| Net interest margin |

|

|

3.08% |

|

|

|

3.14% |

|

|

|

3.35% |

|

|

|

(.06)% |

|

|

|

(.27)% |

|

| |

|

|

|

|

| |

|

|

|

|

|

| Average balances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment securities (a) |

|

|

$100,712 |

|

|

|

$98,164 |

|

|

|

$82,216 |

|

|

|

$2,548 |

|

|

|

$18,496 |

|

| Loans |

|

|

247,950 |

|

|

|

246,421 |

|

|

|

235,859 |

|

|

|

1,529 |

|

|

|

12,091 |

|

| Earning assets |

|

|

360,841 |

|

|

|

354,961 |

|

|

|

326,226 |

|

|

|

5,880 |

|

|

|

34,615 |

|

| Interest-bearing liabilities |

|

|

267,882 |

|

|

|

259,938 |

|

|

|

238,276 |

|

|

|

7,944 |

|

|

|

29,606 |

|

| |

|

|

|

|

|

| (a) Excludes unrealized gain

(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average total loans were $12.1 billion (5.1 percent) higher in the first quarter of 2015 than

the first quarter of 2014, driven by growth in total commercial loans (15.1 percent), total commercial real estate (6.5

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

8

percent), total other retail loans (3.5 percent), and credit card (2.4 percent). These increases were partially offset by declines in covered loans (37.5 percent) and residential mortgages (0.3

percent). Average total loans, excluding covered loans, were higher by 6.7 percent year-over-year. Average total loans were $1.5 billion (0.6 percent) higher in the first quarter of 2015 than the fourth quarter of 2014, driven by growth in total

commercial real estate (4.2 percent), total commercial loans (2.4 percent), and total other retail loans (0.4 percent). These increases were partially offset by declines in covered loans (24.2 percent), residential mortgages (0.9 percent), and

credit card (0.9 percent). Average total loans, excluding covered loans, were higher by 1.3 percent on a linked quarter basis. At the end of the first quarter, approximately $3 billion of student loans were transferred from the loan portfolio to

loans held for sale.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE LOANS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 4 |

|

| ($ in millions) |

|

1Q

2015 |

|

|

4Q

2014 |

|

|

1Q

2014 |

|

|

Percent

Change

1Q15 vs

4Q14 |

|

|

Percent

Change

1Q15 vs

1Q14 |

|

| |

|

|

|

|

| |

|

|

|

|

|

| Commercial |

|

|

$76,183 |

|

|

|

$74,333 |

|

|

|

$65,645 |

|

|

|

2.5 |

|

|

|

16.1 |

|

| Lease financing |

|

|

5,325 |

|

|

|

5,292 |

|

|

|

5,189 |

|

|

|

.6 |

|

|

|

2.6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total commercial |

|

|

81,508 |

|

|

|

79,625 |

|

|

|

70,834 |

|

|

|

2.4 |

|

|

|

15.1 |

|

| |

|

|

|

|

|

| Commercial mortgages |

|

|

33,119 |

|

|

|

31,783 |

|

|

|

32,049 |

|

|

|

4.2 |

|

|

|

3.3 |

|

| Construction and development |

|

|

9,552 |

|

|

|

9,183 |

|

|

|

8,001 |

|

|

|

4.0 |

|

|

|

19.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total commercial real estate |

|

|

42,671 |

|

|

|

40,966 |

|

|

|

40,050 |

|

|

|

4.2 |

|

|

|

6.5 |

|

| |

|

|

|

|

|

| Residential mortgages |

|

|

51,426 |

|

|

|

51,872 |

|

|

|

51,584 |

|

|

|

(.9 |

) |

|

|

(.3 |

) |

| |

|

|

|

|

|

| Credit card |

|

|

17,823 |

|

|

|

17,990 |

|

|

|

17,407 |

|

|

|

(.9 |

) |

|

|

2.4 |

|

| |

|

|

|

|

|

| Retail leasing |

|

|

5,819 |

|

|

|

5,939 |

|

|

|

5,979 |

|

|

|

(2.0 |

) |

|

|

(2.7 |

) |

| Home equity and second mortgages |

|

|

15,897 |

|

|

|

15,853 |

|

|

|

15,366 |

|

|

|

.3 |

|

|

|

3.5 |

|

| Other |

|

|

27,604 |

|

|

|

27,317 |

|

|

|

26,312 |

|

|

|

1.1 |

|

|

|

4.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total other retail |

|

|

49,320 |

|

|

|

49,109 |

|

|

|

47,657 |

|

|

|

.4 |

|

|

|

3.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Total loans, excluding covered loans |

|

|

242,748 |

|

|

|

239,562 |

|

|

|

227,532 |

|

|

|

1.3 |

|

|

|

6.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Covered loans |

|

|

5,202 |

|

|

|

6,859 |

|

|

|

8,327 |

|

|

|

(24.2 |

) |

|

|

(37.5 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Total loans |

|

|

$247,950 |

|

|

|

$246,421 |

|

|

|

$235,859 |

|

|

|

.6 |

|

|

|

5.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average total deposits for the first quarter of 2015 were $21.0 billion (8.1 percent) higher

than the first quarter of 2014. Average noninterest-bearing deposits increased $3.7 billion (5.2 percent) year-over-year, mainly in Consumer and Small Business Banking, as well as Wholesale Banking and Commercial Real Estate, partially offset by

decreases in corporate trust balances. Average total savings deposits were $20.8

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

9

billion (14.5 percent) higher year-over-year, the result of growth in Consumer and Small Business Banking, including the $3.3 billion impact of the Charter One acquisition, corporate trust, and

in Wholesale Banking and Commercial Real Estate balances. Average time deposits less than $100,000 were $1.0 billion (9.0 percent) lower due to maturities, while average time deposits greater than $100,000 decreased $2.5 billion (8.0 percent),

primarily due to a decline in Wholesale Banking and Commercial Real Estate, corporate trust and Consumer and Small Business Banking balances. Time deposits greater than $100,000 are primarily managed as an alternative to other funding sources, such

as wholesale borrowing, based largely on relative pricing.

Average total deposits increased $3.0 billion (1.1 percent)

over the fourth quarter of 2014. Average noninterest-bearing deposits decreased $2.4 billion (3.2 percent) on a linked quarter basis, due to seasonally lower balances in corporate trust and Consumer and Small Business Banking, partially offset by

higher balances in Wholesale Banking and Commercial Real Estate. Average total savings deposits increased $6.5 billion (4.1 percent), reflecting increases in Consumer and Small Business Banking, Wholesale Banking and Commercial Real Estate and

institutional trust balances. Compared with the fourth quarter of 2014, average time deposits less than $100,000 decreased $356 million (3.3 percent) due to maturities. Average time deposits greater than $100,000 decreased $728 million (2.5 percent)

on a linked quarter basis, principally due to declines in Wholesale Banking and Commercial Real Estate, corporate trust and Consumer and Small Business Banking balances.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE DEPOSITS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 5 |

|

| ($ in millions) |

|

1Q

2015 |

|

|

4Q

2014 |

|

|

1Q

2014 |

|

|

Percent

Change

1Q15 vs

4Q14 |

|

|

Percent

Change

1Q15 vs

1Q14 |

|

| |

|

|

|

|

| |

|

|

|

|

|

| Noninterest-bearing deposits |

|

|

$74,511 |

|

|

|

$76,958 |

|

|

|

$70,824 |

|

|

|

(3.2 |

) |

|

|

5.2 |

|

| Interest-bearing savings deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest checking |

|

|

54,658 |

|

|

|

54,199 |

|

|

|

51,305 |

|

|

|

.8 |

|

|

|

6.5 |

|

| Money market savings |

|

|

73,889 |

|

|

|

68,914 |

|

|

|

59,244 |

|

|

|

7.2 |

|

|

|

24.7 |

|

| Savings accounts |

|

|

36,033 |

|

|

|

34,955 |

|

|

|

33,200 |

|

|

|

3.1 |

|

|

|

8.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total of savings deposits |

|

|

164,580 |

|

|

|

158,068 |

|

|

|

143,749 |

|

|

|

4.1 |

|

|

|

14.5 |

|

| Time deposits less than $100,000 |

|

|

10,410 |

|

|

|

10,766 |

|

|

|

11,443 |

|

|

|

(3.3 |

) |

|

|

(9.0 |

) |

| Time deposits greater than $100,000 |

|

|

28,959 |

|

|

|

29,687 |

|

|

|

31,463 |

|

|

|

(2.5 |

) |

|

|

(8.0 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest-bearing deposits |

|

|

203,949 |

|

|

|

198,521 |

|

|

|

186,655 |

|

|

|

2.7 |

|

|

|

9.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total deposits |

|

|

$278,460 |

|

|

|

$275,479 |

|

|

|

$257,479 |

|

|

|

1.1 |

|

|

|

8.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

10

Noninterest Income

First quarter noninterest income was $2,154 million, which was $46 million (2.2 percent) higher than the first quarter of 2014

and $216 million (9.1 percent) lower than the fourth quarter of 2014. The year-over-year increase in noninterest income was due to increases in a majority of fee revenue categories and equity investment gains in other income, partially offset by

small reductions in commercial products revenue and corporate payment products revenue. In particular, trust and investment management fees increased $18 million (5.9 percent) year-over-year, reflecting account growth and improved market conditions.

Merchant processing service fees reflected a growth rate of 0.8 percent inclusive of the impact of foreign currency rate changes. Excluding the impact of foreign currency rate changes the growth would have been approximately 5.0 percent. The

decrease in commercial products revenue of $5 million (2.4 percent) was primarily due to lower wholesale transaction activity, including standby letters of credit and syndication fees, and lower commercial leasing revenue, partially offset by

increased bond underwriting fees.

Noninterest income was $216 million (9.1 percent) lower in the first quarter of 2015

than the fourth quarter of 2014, principally due to seasonally lower fee revenue and the fourth quarter 2014 Nuveen gain. Credit and debit card revenue decreased $31 million (11.4 percent) primarily due to seasonally lower sales volumes and fewer

days. Merchant processing services was $25 million (6.5 percent) lower on a linked quarter basis due to seasonally lower product fees and fewer days. Deposit service charges decreased $19 million (10.6 percent) due to fewer days and seasonally lower

volumes. Commercial products revenue decreased $19 million (8.7 percent) primarily due to lower wholesale transaction activity, including standby letters of credit and syndication fees, partially offset by increased bond underwriting fees. Partially

offsetting these decreases was an increase in mortgage banking revenue, which increased $5 million (2.1 percent), due to higher origination and sales volume, partially offset by an unfavorable change in the valuation of mortgage servicing rights

(“MSRs”), net of hedging activities.

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 6 |

|

| ($ in millions) |

|

1Q

2015 |

|

|

4Q

2014 |

|

|

1Q

2014 |

|

|

Percent

Change

1Q15 vs

4Q14 |

|

|

Percent

Change

1Q15 vs

1Q14 |

|

| |

|

|

|

|

| |

|

|

|

|

|

| Credit and debit card revenue |

|

|

$241 |

|

|

|

$272 |

|

|

|

$239 |

|

|

|

(11.4 |

) |

|

|

.8 |

|

| Corporate payment products revenue |

|

|

170 |

|

|

|

174 |

|

|

|

173 |

|

|

|

(2.3 |

) |

|

|

(1.7 |

) |

| Merchant processing services |

|

|

359 |

|

|

|

384 |

|

|

|

356 |

|

|

|

(6.5 |

) |

|

|

.8 |

|

| ATM processing services |

|

|

78 |

|

|

|

80 |

|

|

|

78 |

|

|

|

(2.5 |

) |

|

|

— |

|

| Trust and investment management fees |

|

|

322 |

|

|

|

322 |

|

|

|

304 |

|

|

|

— |

|

|

|

5.9 |

|

| Deposit service charges |

|

|

161 |

|

|

|

180 |

|

|

|

157 |

|

|

|

(10.6 |

) |

|

|

2.5 |

|

| Treasury management fees |

|

|

137 |

|

|

|

136 |

|

|

|

133 |

|

|

|

.7 |

|

|

|

3.0 |

|

| Commercial products revenue |

|

|

200 |

|

|

|

219 |

|

|

|

205 |

|

|

|

(8.7 |

) |

|

|

(2.4 |

) |

| Mortgage banking revenue |

|

|

240 |

|

|

|

235 |

|

|

|

236 |

|

|

|

2.1 |

|

|

|

1.7 |

|

| Investment products fees |

|

|

47 |

|

|

|

49 |

|

|

|

46 |

|

|

|

(4.1 |

) |

|

|

2.2 |

|

| Securities gains (losses), net |

|

|

— |

|

|

|

1 |

|

|

|

5 |

|

|

|

nm |

|

|

|

nm |

|

| Other |

|

|

199 |

|

|

|

318 |

|

|

|

176 |

|

|

|

(37.4 |

) |

|

|

13.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Total noninterest income |

|

|

$2,154 |

|

|

|

$2,370 |

|

|

|

$2,108 |

|

|

|

(9.1 |

) |

|

|

2.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Expense

Noninterest expense in the first quarter of 2015 totaled $2,665 million, an increase of $121 million (4.8 percent) over the

first quarter of 2014, and a $139 million (5.0 percent) decrease from the fourth quarter of 2014. The increase in total noninterest expense year-over-year was primarily the result of higher compensation, employee benefits and other expenses. The

increase in compensation expense of $64 million (5.7 percent) reflected the impact of merit increases, acquisitions, and higher staffing for risk and compliance activities, and commissions related to mortgage production. The increase in employee

benefits expense of $28 million (9.7 percent) was driven by higher pension costs. The increase in other expense of $48 million (12.4 percent) was primarily due to mortgage servicing-related expenses.

Noninterest expense decreased $139 million (5.0 percent) on a linked quarter basis, primarily driven by a decrease in other

noninterest expense of $107 million (19.7 percent) due to seasonally lower costs related to investments in tax-advantaged projects and the impact of the fourth quarter 2014 legal accruals, partially offset by increased mortgage servicing-related

expenses. Marketing and business development expense decreased $59 million (45.7 percent) due to the fourth quarter 2014 charitable contributions and lower advertising costs. Professional services expense was $55 million (41.7 percent) lower due to

seasonally lower costs across a majority of the lines of business. Partially offsetting these decreases were higher employee benefits expense, which increased $72 million (29.4 percent) due to increased pension costs and

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

12

seasonally higher payroll taxes, and compensation expense, which increased $28 million (2.4 percent) reflecting the seasonal impact of stock based compensation grants and commissions related to

mortgage production.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONINTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 7 |

|

| ($ in millions) |

|

1Q

2015 |

|

|

4Q

2014 |

|

|

1Q

2014 |

|

|

Percent

Change

1Q15 vs

4Q14 |

|

|

Percent

Change

1Q15 vs

1Q14 |

|

| |

|

|

|

|

| |

|

|

|

|

|

| Compensation |

|

$ |

1,179 |

|

|

$ |

1,151 |

|

|

$ |

1,115 |

|

|

|

2.4 |

|

|

|

5.7 |

|

| Employee benefits |

|

|

317 |

|

|

|

245 |

|

|

|

289 |

|

|

|

29.4 |

|

|

|

9.7 |

|

| Net occupancy and equipment |

|

|

247 |

|

|

|

248 |

|

|

|

249 |

|

|

|

(.4 |

) |

|

|

(.8 |

) |

| Professional services |

|

|

77 |

|

|

|

132 |

|

|

|

83 |

|

|

|

(41.7 |

) |

|

|

(7.2 |

) |

| Marketing and business development |

|

|

70 |

|

|

|

129 |

|

|

|

79 |

|

|

|

(45.7 |

) |

|

|

(11.4 |

) |

| Technology and communications |

|

|

214 |

|

|

|

219 |

|

|

|

211 |

|

|

|

(2.3 |

) |

|

|

1.4 |

|

| Postage, printing and supplies |

|

|

82 |

|

|

|

86 |

|

|

|

81 |

|

|

|

(4.7 |

) |

|

|

1.2 |

|

| Other intangibles |

|

|

43 |

|

|

|

51 |

|

|

|

49 |

|

|

|

(15.7 |

) |

|

|

(12.2 |

) |

| Other |

|

|

436 |

|

|

|

543 |

|

|

|

388 |

|

|

|

(19.7 |

) |

|

|

12.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Total noninterest expense |

|

$ |

2,665 |

|

|

$ |

2,804 |

|

|

$ |

2,544 |

|

|

|

(5.0 |

) |

|

|

4.8 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for Income Taxes

The provision for income taxes for the first quarter of 2015 resulted in a tax rate on a taxable-equivalent basis of 27.0

percent (effective tax rate of 24.9 percent), compared with 28.1 percent (effective tax rate of 26.0 percent) in the first quarter of 2014, and 27.7 percent (effective tax rate of 25.8 percent) in the fourth quarter of 2014. The decrease was the

result of resolution of certain tax matters.

Credit Quality

The allowance for credit losses was $4,351 million at March 31, 2015, compared with $4,375 million at December 31,

2014, and $4,497 million at March 31, 2014. Nonperforming assets decreased on a linked quarter and year-over-year basis as economic conditions continued to slowly improve. Total net charge-offs in the first quarter of 2015 were $279 million,

compared with $308 million in the fourth quarter of 2014, and $341 million in the first quarter of 2014. The $29 million (9.4 percent) decrease in net charge-offs on a linked quarter basis was due to improvement in the commercial, commercial real

estate and other retail portfolios, while the $62 million (18.2 percent) decrease in net charge-offs on a year-over-year basis reflected improvements in residential mortgages, home equity and second mortgages, as well as in

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

13

construction and development. The Company recorded $264 million of provision for credit losses in the current quarter, which was $15 million less than net charge-offs.

The ratio of the allowance for credit losses to period-end loans was 1.77 percent at March 31, 2015, and at

December 31, 2014, compared with 1.89 percent at March 31, 2014. The ratio of the allowance for credit losses to nonperforming loans was 322 percent at March 31, 2015, compared with 298 percent at December 31, 2014, and 278

percent at March 31, 2014.

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLOWANCE FOR CREDIT LOSSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 8 |

|

|

|

|

|

| ($ in millions) |

|

1Q |

|

|

|

|

|

4Q |

|

|

|

|

|

3Q |

|

|

|

|

|

2Q |

|

|

|

|

|

1Q |

|

|

|

|

| |

|

2015 |

|

|

% (b) |

|

|

2014 |

|

|

% (b) |

|

|

2014 |

|

|

% (b) |

|

|

2014 |

|

|

% (b) |

|

|

2014 |

|

|

% (b) |

|

| |

|

|

|

|

| Balance, beginning of period |

|

|

$4,375 |

|

|

|

|

|

|

|

$4,414 |

|

|

|

|

|

|

|

$4,449 |

|

|

|

|

|

|

|

$4,497 |

|

|

|

|

|

|

|

$4,537 |

|

|

|

|

|

| Net charge-offs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial |

|

|

40 |

|

|

|

.21 |

|

|

|

48 |

|

|

|

.26 |

|

|

|

52 |

|

|

|

.29 |

|

|

|

52 |

|

|

|

.30 |

|

|

|

34 |

|

|

|

.21 |

|

| Lease financing |

|

|

3 |

|

|

|

.23 |

|

|

|

(2 |

) |

|

|

(.15 |

) |

|

|

6 |

|

|

|

.46 |

|

|

|

3 |

|

|

|

.24 |

|

|

|

2 |

|

|

|

.16 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total commercial |

|

|

43 |

|

|

|

.21 |

|

|

|

46 |

|

|

|

.23 |

|

|

|

58 |

|

|

|

.30 |

|

|

|

55 |

|

|

|

.29 |

|

|

|

36 |

|

|

|

.21 |

|

| Commercial mortgages |

|

|

(1 |

) |

|

|

(.01 |

) |

|

|

(3 |

) |

|

|

(.04 |

) |

|

|

1 |

|

|

|

.01 |

|

|

|

(6 |

) |

|

|

(.08 |

) |

|

|

(1 |

) |

|

|

(.01 |

) |

| Construction and development |

|

|

(17 |

) |

|

|

(.72 |

) |

|

|

(7 |

) |

|

|

(.30 |

) |

|

|

3 |

|

|

|

.13 |

|

|

|

2 |

|

|

|

.09 |

|

|

|

(2 |

) |

|

|

(.10 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total commercial real estate |

|

|

(18 |

) |

|

|

(.17 |

) |

|

|

(10 |

) |

|

|

(.10 |

) |

|

|

4 |

|

|

|

.04 |

|

|

|

(4 |

) |

|

|

(.04 |

) |

|

|

(3 |

) |

|

|

(.03 |

) |

| Residential mortgages |

|

|

35 |

|

|

|

.28 |

|

|

|

39 |

|

|

|

.30 |

|

|

|

42 |

|

|

|

.32 |

|

|

|

57 |

|

|

|

.44 |

|

|

|

57 |

|

|

|

.45 |

|

| Credit card |

|

|

163 |

|

|

|

3.71 |

|

|

|

160 |

|

|

|

3.53 |

|

|

|

158 |

|

|

|

3.53 |

|

|

|

170 |

|

|

|

3.92 |

|

|

|

170 |

|

|

|

3.96 |

|

| Retail leasing |

|

|

1 |

|

|

|

.07 |

|

|

|

1 |

|

|

|

.07 |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

.07 |

|

|

|

— |

|

|

|

— |

|

| Home equity and second mortgages |

|

|

14 |

|

|

|

.36 |

|

|

|

17 |

|

|

|

.43 |

|

|

|

24 |

|

|

|

.61 |

|

|

|

23 |

|

|

|

.60 |

|

|

|

31 |

|

|

|

.82 |

|

| Other |

|

|

41 |

|

|

|

.60 |

|

|

|

52 |

|

|

|

.76 |

|

|

|

49 |

|

|

|

.72 |

|

|

|

45 |

|

|

|

.68 |

|

|

|

45 |

|

|

|

.69 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other retail |

|

|

56 |

|

|

|

.46 |

|

|

|

70 |

|

|

|

.57 |

|

|

|

73 |

|

|

|

.59 |

|

|

|

69 |

|

|

|

.58 |

|

|

|

76 |

|

|

|

.65 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net charge-offs, excluding covered loans |

|

|

279 |

|

|

|

.47 |

|

|

|

305 |

|

|

|

.51 |

|

|

|

335 |

|

|

|

.56 |

|

|

|

347 |

|

|

|

.60 |

|

|

|

336 |

|

|

|

.60 |

|

| Covered loans |

|

|

— |

|

|

|

— |

|

|

|

3 |

|

|

|

.17 |

|

|

|

1 |

|

|

|

.05 |

|

|

|

2 |

|

|

|

.10 |

|

|

|

5 |

|

|

|

.24 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net charge-offs |

|

|

279 |

|

|

|

.46 |

|

|

|

308 |

|

|

|

.50 |

|

|

|

336 |

|

|

|

.55 |

|

|

|

349 |

|

|

|

.58 |

|

|

|

341 |

|

|

|

.59 |

|

| Provision for credit losses |

|

|

264 |

|

|

|

|

|

|

|

288 |

|

|

|

|

|

|

|

311 |

|

|

|

|

|

|

|

324 |

|

|

|

|

|

|

|

306 |

|

|

|

|

|

| Other changes (a) |

|

|

(9 |

) |

|

|

|

|

|

|

(19 |

) |

|

|

|

|

|

|

(10 |

) |

|

|

|

|

|

|

(23 |

) |

|

|

|

|

|

|

(5 |

) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, end of period |

|

|

$4,351 |

|

|

|

|

|

|

|

$4,375 |

|

|

|

|

|

|

|

$4,414 |

|

|

|

|

|

|

|

$4,449 |

|

|

|

|

|

|

|

$4,497 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Components |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan losses |

|

|

$4,023 |

|

|

|

|

|

|

|

$4,039 |

|

|

|

|

|

|

|

$4,065 |

|

|

|

|

|

|

|

$4,132 |

|

|

|

|

|

|

|

$4,189 |

|

|

|

|

|

| Liability for unfunded credit commitments |

|

|

328 |

|

|

|

|

|

|

|

336 |

|

|

|

|

|

|

|

349 |

|

|

|

|

|

|

|

317 |

|

|

|

|

|

|

|

308 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total allowance for credit losses |

|

|

$4,351 |

|

|

|

|

|

|

|

$4,375 |

|

|

|

|

|

|

|

$4,414 |

|

|

|

|

|

|

|

$4,449 |

|

|

|

|

|

|

|

$4,497 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross charge-offs |

|

|

$383 |

|

|

|

|

|

|

|

$415 |

|

|

|

|

|

|

|

$410 |

|

|

|

|

|

|

|

$432 |

|

|

|

|

|

|

|

$422 |

|

|

|

|

|

| Gross recoveries |

|

|

$104 |

|

|

|

|

|

|

|

$107 |

|

|

|

|

|

|

|

$74 |

|

|

|

|

|

|

|

$83 |

|

|

|

|

|

|

|

$81 |

|

|

|

|

|

| Allowance for credit losses as a percentage of Period-end loans, excluding

covered loans |

|

|

1.79 |

|

|

|

|

|

|

|

1.78 |

|

|

|

|

|

|

|

1.81 |

|

|

|

|

|

|

|

1.83 |

|

|

|

|

|

|

|

1.90 |

|

|

|

|

|

| Nonperforming loans, excluding covered loans |

|

|

321 |

|

|

|

|

|

|

|

297 |

|

|

|

|

|

|

|

291 |

|

|

|

|

|

|

|

294 |

|

|

|

|

|

|

|

293 |

|

|

|

|

|

| Nonperforming assets, excluding covered assets |

|

|

261 |

|

|

|

|

|

|

|

245 |

|

|

|

|

|

|

|

245 |

|

|

|

|

|

|

|

246 |

|

|

|

|

|

|

|

243 |

|

|

|

|

|

| Period-end loans |

|

|

1.77 |

|

|

|

|

|

|

|

1.77 |

|

|

|

|

|

|

|

1.80 |

|

|

|

|

|

|

|

1.82 |

|

|

|

|

|

|

|

1.89 |

|

|

|

|

|

| Nonperforming loans |

|

|

322 |

|

|

|

|

|

|

|

298 |

|

|

|

|

|

|

|

282 |

|

|

|

|

|

|

|

279 |

|

|

|

|

|

|

|

278 |

|

|

|

|

|

| Nonperforming assets |

|

|

257 |

|

|

|

|

|

|

|

242 |

|

|

|

|

|

|

|

230 |

|

|

|

|

|

|

|

229 |

|

|

|

|

|

|

|

225 |

|

|

|

|

|

| |

| (a) Includes net changes in credit losses

to be reimbursed by the FDIC and reductions in the allowance for covered loans where the reversal of a previously recorded allowance was offset by an associated decrease in the indemnification asset, and the impact of any loan sales. |

|

|

(b) Annualized and calculated on average loan balances

|

|

(MORE)

U.S. Bancorp Reports First Quarter 2015 Results

April 15, 2015

Page

15

Nonperforming assets at March 31, 2015, totaled $1,696 million, compared

with $1,808 million at December 31, 2014, and $1,999 million at March 31, 2014. The ratio of nonperforming assets to loans and other real estate was 0.69 percent at March 31, 2015, compared with 0.73 percent at December 31, 2014,

and 0.84 percent at March 31, 2014. Total commercial nonperforming loans were $25 million (22.3 percent) lower on a linked quarter basis and $101 million (53.7 percent) lower year-over-year. Total commercial real estate nonperforming loans