Delta's Unit Revenue Falls 7% in July

August 02 2016 - 12:30PM

Dow Jones News

Delta Air Lines Inc. said its unit revenue fell 7% in July,

furthering the trend of declines at the airline and across the

industry.

Shares of Delta fell 6.2% to $37.05 in morning trading in New

York.

The company blamed the decline in unit revenue—the amount it

takes in per seat flown a mile—on continued domestic yield

weakness, ongoing supply-demand imbalance in the trans-Atlantic and

headwinds from the company's yen hedge positions. Last month, Delta

said passenger unit revenue dropped 4.9% in the June quarter; the

airline had anticipated a 2.5%-to-4.5% decline. The metric, a

closely watched sign of demand and how well an airline is

generating sales, has been declining across the industry because of

relatively rapid expansions.

For Delta's current quarter, which ends in September, the

company expects passenger unit revenue to fall 4% to 6%.

The No. 2 air carrier by traffic said its overall traffic rose

1.2% in July. Capacity increased 2.1%, while load factor, or the

percentage or seats filled, declined to 87.1% from 87.9% a year

earlier.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

August 02, 2016 12:15 ET (16:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

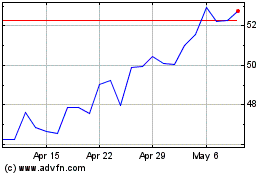

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

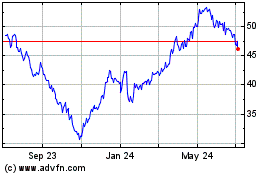

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024