UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 23, 2016

Carriage Services, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 1-11961 | | 76-0423828 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

3040 Post Oak Boulevard, Suite 300

Houston, Texas 77056

(Address, including zip code, of principal executive offices)

Registrant's telephone number, including area code:

(713) 332-8400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 7.01 REGULATION FD

On February 25, 2016, the Company issued a press release announcing that its Board of Directors has approved a share repurchase program, the details of which are set forth in Item 8.01 below. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information presented herein under Item 7.01 and set forth in the attached Exhibit 99.1 is deemed to be “furnished” solely pursuant to Item 7.01 of this Current Report on Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information or the exhibit be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

ITEM 8.01 OTHER EVENTS

On February 23, 2016, the Board of Directors approved a share repurchase program authorizing the Company to purchase up to an aggregate of $25 million of the Company’s common stock. The share repurchase program is in accordance with Rule 10b-18 of the Exchange Act. Subject to applicable rules and regulations, the shares may be purchased from time to time in the open market or in privately negotiated transactions. Such purchases will be at times and in amounts as the Company deems appropriate, based on factors such as market conditions, legal requirements and other business considerations.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits. The following are furnished as part of this current report on Form 8-K:

|

| | |

Exhibit No. | | Description of Exhibit |

| |

99.1 | | Press Release dated February 25, 2016, announcing the approval of a share repurchase program. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Carriage Services, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| CARRIAGE SERVICES, INC. |

| | | |

Dated: February 25, 2016 | By: | | /s/ Melvin C. Payne |

| | | Melvin C. Payne |

| | | Chairman of the Board and Chief Executive Officer |

| | | (Principal Executive Officer) |

INDEX TO EXHIBITS

|

| | |

Exhibit No. | | Description of Exhibit |

| |

99.1 | | Press Release dated February 25, 2016, announcing the approval of a share repurchase program. |

Carriage Services' Board Of Directors Approves Share Repurchase Plan

HOUSTON, Feb. 25, 2016 /PRNewswire/ -- Carriage Services, Inc. (NYSE: CSV) announced today that its Board of Directors has approved the repurchase of up to an aggregate of $25 million of its common stock. The share repurchases may be made from time to time through open market transactions or privately negotiated transactions and are subject to market conditions, as well as corporate, regulatory, and other considerations. The company intends to make all repurchases in compliance with applicable regulatory guidelines and to administer the plan in accordance with applicable laws, including Rule 10b-18 of the Securities Exchange Act of 1934, as amended.

Commenting on the announcement, Melvin C. Payne, Chief Executive Officer, stated "I am pleased to announce that our Board has approved a $25 million common share repurchase program, effective immediately. The Board's action demonstrates our continuing confidence in the Company's vision, strategy, growth opportunities and financial strength, but most of all our confidence in the Being The Best quality of the leaders and employees in our businesses and support teams. We believe that the purchase of our shares during the recent market volatility at prices that do not reflect the growing cash earning power and intrinsic value of our company is a wise allocation of the Company's capital and enhances long term value for all remaining shareholders. Carriage continues to get better as an operating and consolidation platform that has also become a superior value creation investment platform. As I discussed in our recent annual press release, our goal for Capital Allocation is to invest our recurring Adjusted Free Cash Flow among various options to create maximum 'per share' value over the long term.

"During May and September 2015, our Board of Directors approved the repurchase of up to an aggregate of $45 million of the Company's common stock. The repurchases through year end 2015 totaled 1.9 million shares at an aggregate cost of $45 million and average cost per share of $23.34, which represented about 10.4% of our previous shares outstanding. On a pro forma basis to December 31, 2015, our Free Cash Flow per share with the lower share count would have been $2.63 for 2015, offering current shareholders a Free Cash Flow Equity Yield of 12.8%.

"We will repurchase shares under our $25 million approved plan from time to time as long as we can buy our shares at prices under what we consider 'fair value.' We will continue to prioritize the allocation of our internally generated capital on acquiring the best remaining independent funeral and cemetery businesses in the country and on internal growth projects that generate rates of return well in excess of our cost of capital.

"Our company goal remains the creation of long term value for our shareholders and improvement of our credit profile over time consistent with our high and sustainable performance through 4E Leadership execution of our three models since beginning the Carriage Good To Great Journey in 2012," concluded Mr. Payne.

Certain statements made herein or elsewhere by, or on behalf of, the Company that are not historical facts are intended to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on assumptions that the Company believes are reasonable; however, many important factors, as discussed under "Forward-Looking Statements and Cautionary Statements" in the Company's Annual Report and Form 10-K for the year ended December 31, 2015, could cause the Company's results in the future to differ materially from the forward-looking statements made herein and in any other documents or oral presentations made by, or on behalf of, the Company. The Company assumes no obligation to update or publicly release any revisions to forward-looking statements made herein or any other forward-looking statements made by, or on behalf of, the Company. A copy of the Company's Form 10-K, and other Carriage Services information and news releases, are available at http://www.carriageservices.com.

Carriage Services is a leading provider of deathcare services and merchandise in the United States. Carriage operates 167 funeral homes in 27 states and 32 cemeteries in 11 states.

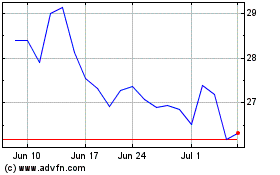

Carriage Services (NYSE:CSV)

Historical Stock Chart

From Mar 2024 to Apr 2024

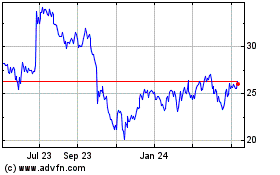

Carriage Services (NYSE:CSV)

Historical Stock Chart

From Apr 2023 to Apr 2024