First Solar: Expects Feed-In-Tariff Soon For 2GW China Plant

November 17 2009 - 4:15AM

Dow Jones News

Electricity from First Solar Inc.'s (FSLR) planned 2-gigawatt

solar power plant in China's Inner Mongolia will likely be priced

via a feed-in tariff structure which hopefully will be set by the

end of 2009, a senior official with the U.S. company said

Tuesday.

"The Chinese government is considering a feed-in tariff

structure. We are certainly expecting that the feed-in-tariff will

be enacted and are hoping it will be so before the end of this

year," First Solar president Bruce Sohn told a media briefing.

He said the tariff level was "critical to the success of this

project."

"Feed-in tariffs establish transparency and clarity for the

pricing of energy for a long period of time."

China for now sets solar tariffs on a case-by-case basis, and in

most cases project developers can only get clarity over tariffs

well after construction has started, increasing investment

risk.

The Beijing government has said it is studying a fixed feed-in

tariff system, but details haven't been made public yet.

One of the largest solar photovoltaic projects to date, the

First Solar project will be built in stages, beginning with 30

megawatts in phase one, construction of which will start in

2010.

The capacities of phases two, three and four are to be 100MW,

870MW and 1,000MW respectively. The second and third stages are due

for completion by 2014, and the fourth is due to be ready by

2019.

The First Solar project is one of a number of China-U.S. joint

ventures in the solar sector announced recently.

On Oct. 26, Duke Energy (DUK) said it had signed an agreement

with Chinese energy company and solar panel maker ENN Group to

develop, own and operate solar-power projects in the U.S.

Sohn said the cost of the First Solar project, to be built in

Ordos City beginning in June, hasn't been finalized, but will be

"somewhat lower" than the $4 billion to $5 billion that a similar

project would cost if built in the U.S.

In August, China set the feed-in tariff for its first commercial

solar utility project at CNY1.09 per kilowatt hour, and this may

set a benchmark for future projects.

As the Chinese government's policy on solar power develops,

demand for solar modules should grow, Sohn said.

"First Solar views China as potentially a very large and

significant market," Sohn said. "We do anticipate that the market

will continue to grow."

"The movement toward more assertive goals, the movement toward

introducing a feed-in tariff in the near future...should create a

sustainable and vibrant solar industry," he said.

Beijing has a target of 300 MW of annual solar power generation

capacity by 2010 and as much as 20 gigawatts by 2020, but as of

end-2008 capacity was under 100MW.

In July, China gave its fledgling solar power industry a boost

by announcing construction subsidies for on-grid solar power

plants.

On Monday, the Ministry of Finance said China will spend over

CNY20 billion to subsidize 642 MW of pilot solar utility projects

in the next two-three years.

Sohn also said the Tempe, Ariz., company may consider setting up

manufacturing facilities in China.

"China is a very viable location," he said. "As we see the

market develop and mature here, this seems like a very appropriate

place to manufacture."

First Solar sources materials for portions of its supply chain

outside China, he said.

Sohn was in Beijing to sign an agreement firming up details of

the project, which was announced in September.

-By Patricia Jiayi Ho, Dow Jones Newswires; (8610) 6588 5848;

patricia.ho@dowjones.com

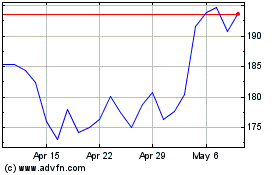

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

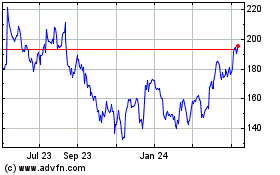

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Apr 2023 to Apr 2024