Organic rental income growth of

+4.6%

2024 objectives confirmed

Regulatory News:

Vincent Ravat, Mercialys’ (Paris:MERY) Chief Executive Officer:

“Mercialys continued building on its very robust business trends

during the first quarter of 2024, with organic growth of +4.6%. The

economic environment is stabilizing, with inflation easing and

household consumption picking up strength. Alongside this, the

Casino group’s divestment of the business operations of

hypermarkets owned by Mercialys is expected to further strengthen

the appeal of the Company’s sites, while improving its rental risk

profile. Mercialys is therefore able to confirm its objectives for

2024, with net recurrent earnings per share growth of at least +2%

and a dividend payout ratio to range from 75% to 95% of 2024 net

recurrent earnings”.

I. Very robust organic growth in invoiced

rents of +4.6%

During the first quarter of 2024, Mercialys recorded +4.6%

organic growth. Invoiced rents came to Euro 45.5

million, up +4.5% from the first quarter of 2023, reflecting a

virtually neutral scope effect for the quarter.

(In thousands of euros)

At March 31, 2023

At March 31, 2024

Change

Current basis (%)

Change

Like-for-like basis

(%)

Invoiced rents

43,501

45,463

+4.5%

+4.6%

Lease rights

132

82

-37.9%

Rental revenues

43,633

45,545

+4.4%

The change in invoiced rents reflects the following factors:

At March 31, 2023

At March 31, 2024

Indexation

+3.6 pp

+€1.5m

+4.6 pp

+€2.0m

Contribution by Casual Leasing

-1.1 pp

-€0.5m

+0.3 pp

+€0.1m

Contribution by variable rents

+0.8 pp

+€0.3m

+0.7 pp

+€0.3m

Actions carried out on the portfolio

-1.2 pp

-€0.5m

-0.7 pp

-€0.3m

Accounting impact of “Covid-19 rent

relief”

granted to retailers

+0.9 pp

+€0.4m

-0.3 pp

-€0.1m

Growth (like-for-like)

+3.0 pp

+€1.3m

+4.6 pp

+€2.0m

Asset acquisition and sales

-2.7 pp

-€1.2m

0.0 pp

€0.0m

Other effects

-0.2 pp

-€0.1m

0.0 pp

€0.0m

Growth (current basis)

+0.2 pp

+€0.1m

+4.5 pp

+€2.0m

Invoiced rents benefited from positive indexation of

+4.6% for the first quarter of 2024, factoring in the French

commercial rent index (ILC) figures published in 2023 and

specifically those for the second and third quarters (+6.60% and

+5.97% respectively), which represent nearly 70% of the indexation

for 2024.

The contributions from Casual Leasing and variable

rents are up +0.3% and +0.7% respectively for the quarter,

reflecting a positive underlying trend for the various sites and

the good level of activity for retailers.

The actions carried out on the portfolio are down

-0.7%. The Company’s commitment to ensuring the continued

sustainability of rents for its retailers, at a time when

indexation remains high, while price effects seem to be stabilizing

in terms of retailers’ activity, is reflected in a moderation of

reversion levels. Mercialys is limiting the volatility of the

vacancy rate and ensuring the sustainability of tenants within a

partnership-based approach.

During the first quarter, Mercialys maintained a positive trend

for renewals and relettings, illustrated in particular by the deals

signed with Sephora in Nîmes, Intersport in Marseille and Besançon,

as well as the homeware retailer Kraft in Quimper.

After factoring in the deferrals applicable under IFRS, lease

rights and despecialization indemnities received over the period

came to less than Euro 0.1 million for the first quarter of

2024.

In view of these elements, rental revenues totaled Euro 45.5

million in the first quarter, up by nearly Euro +2 million (+4.4%)

compared with the corresponding quarter in 2023.

II. Retailer sales growth of +3.3%

Footfall in Mercialys’ shopping centers is up +2.9% at end-March

2024, compared with +2.1% for the Quantaflow national index,

outperforming the national benchmark index by +80bp, which reflects

the attractive positioning of the Company’s centers.

The takeover of the business operations of a large part of the

hypermarkets, as presented below, is expected to drive an upturn in

footfall at these stores, helping improve the perception of the

shopping centers among visitors and retailers. These expectations

are illustrated by the change in footfall at the Besançon

hypermarket, whose operations were taken over by Intermarché in

October 2023, where the strong increase in footfall following the

banner transfer (+24.9% in November and +37.5% in December 2023)

continued during the first quarter of 2024, with +37.1% growth.

This positive trend for the sites is also reflected in the sales

recorded by tenant retailers, up +3.3% at end-March 2024. This

sales growth came to +2.3% at end-February 2024, while the national

panel (FACT) recorded +1.6% growth over the same period,

representing +70bp outperformance for the Company’s sites.

The monthly sales figures reported by Mercialys’ retailers for

March show very robust growth of +6,1%, perfectly aligned with the

information published by Procos on April 8. The latter shows a

+6.1% increase in activity levels for retailers in March, following

-1.5% in January and +0.8% in February. This upturn needs to be

confirmed, but several indicators are moving in the right

direction, such as the slowdown in inflation and the increase in

purchasing power, which are expected to positively impact household

consumption over the coming months.

Moreover, following the agreements signed by the Casino group

with Intermarché, Auchan Retail and Carrefour, the retailers in the

hypermarkets owned by Mercialys will change based on the following

schedule:

- Annemasse, Clermont-Ferrand, Fréjus,

Gassin, Istres, Lanester, Marseille, Narbonne and Quimper : April

30, 2024; - Aix, Angers, and Nîmes: May 31, 2024; - Le Puy: date

not yet confirmed.

The Besançon hypermarket already switched to the Intermarché

banner in October 2023.

Mercialys’ economic rental exposure to food retail, on a pro

forma basis at December 31, 2023, would be as follows:

- Auchan: 4.1% - Intermarché: 5.2% -

Carrefour: 2.0% - Monoprix: 1.5% - Aldi: 0.2% - Lidl: 0.1% -

Casino: 4.7%

The residual exposure to Casino (Géant banner) corresponds to

the five hypermarkets or supermarkets located in Corsica (3.6% of

rental exposure) and the hypermarkets in Brest (0.6%) and Niort

(0.5%). These sites were not included in the overall transactions

and will be subject to individual discussions with food operators.

The Casino group has not indicated any plans to close stores to

date.

Note that pending the potential divestment of business

operations at these stores, Casino will continue to hold the

leases. The leases for the portfolio in Corsica have an end date of

June 2030, with a 3-year break option in June 2027, which would

transfer the business operations to the landlord if it was

exercised. The leases for the Brest and Niort hypermarkets have an

end date of June 2027, with the 3-year option from June 2024 not

exercised.

To date, the Casino group is paying its rents in accordance with

its contractual commitments.

III. Proposed dividend of Euro 0.99 per

share

As announced on February 14 with the 2023 full-year earnings

release, Mercialys’ Board of Directors will submit a proposal at

the General Meeting on April 25, 2024 for a dividend of Euro 0.99

per share for 2023, up +3.1% compared with the dividend for

2022.

The proposed dividend corresponds to 85% of 2023 recurrent

earnings and offers a particularly attractive yield of 5.8% on the

NDV of Euro 17.1 per share at end-2023 and 9.9% on the year’s

closing share price.

This proposed dividend is based primarily on the distribution

requirement with the SIIC tax status concerning exempt profits

from:

- property rental or sub-letting operations (including dividends

paid by the subsidiaries subject to the SIIC system), i.e. Euro

0.86 per share;

- the distribution of exempt income recorded on the Company’s

balance sheet for Euro 0.13 per share.

The ex-dividend date would be April 29, 2024, with the dividend

to be paid on May 2, 2024.

MERCIALYS RENTAL

REVENUES

2023

Mar 31, 2023

Jun 30, 2023

Sep 30, 2023

Dec 31, 2023

Q1

Q2

Q3

Q4

Invoiced rents

43,501

87,910

132,183

177,495

43,501

44,408

44,272

45,312

Lease rights

132

254

395

515

132

122

141

119

Rental revenues

43,633

88,164

132,578

178,010

43,633

44,531

44,413

45,431

Change in invoiced rents

+0.2%

+2.1%

+2.4%

+2.8%

+0.2%

+4.1%

+3.1%

+4.0%

Change in rental revenues

+0.1%

+2.0%

+2.3%

+2.7%

+0.1%

+3.9%

+3.0%

+3.9%

2024

Mar 31, 2024

Jun 30, 2024

Sep 30, 2024

Dec 31, 2024

Q1

Q2

Q3

Q4

Invoiced rents

45,463

45,463

Lease rights

82

82

Rental revenues

45,545

45,545

Change in invoiced rents

+4.5%

+4.5%

Change in rental revenues

+4.4%

+4.4%

Appendix 1 - List of hypermarkets owned by

Mercialys

SITES

Current food operator

Future food

Scheduled transfer

date

operator

ANNEMASE

Casino Hyperfrais

Intermarché

Apr 30, 2024

AIX-EN-PROVENCE

Casino Hyperfrais

Auchan

May 31, 2024

AJACCIO

Géant Casino

Géant Casino

Not yet sold

ANGERS

Casino Hyperfrais

Auchan

May 31, 2024

BESANCON

Intermarché

Intermarché

Oct 15, 2023

BREST

Casino Hyperfrais

Casino Hyperfrais

Not yet sold

CHAVILLE

Monoprix

Monoprix

Not concerned

CLERMONT FERRAND

Casino Hyperfrais

Intermarché

Apr 30, 2024

CORTE

Casino Supermarché

Casino Supermarché

Not yet sold

FREJUS

Casino Hyperfrais

Auchan

Apr 30, 2024

FURIANI

Géant Casino

Géant Casino

Not yet sold

GASSIN

Casino Hyperfrais

Auchan

Apr 30, 2024

GRENOBLE

Monoprix

Monoprix

Not concerned

ISTRES

Casino Hyperfrais

Auchan

Apr 30, 2024

LANESTER

Casino Hyperfrais

Carrefour

Apr 30, 2024

LE PUY

Intermarché

Carrefour

Date not confirmed

MARCQ-EN-BAROEUL

Monoprix

Monoprix

Not concerned

MARSEILLE-PDC

Casino Hyperfrais

Intermarché

Apr 30, 2024

NARBONNE

Casino Supermarché

Auchan

Apr 30, 2024

NIMES CAP COSTIERES

Casino Hyperfrais

Auchan

May 31, 2024

NIORT

Casino Hyperfrais

Casino Hyperfrais

Not yet sold

PORTO-VECCHIO

Géant Casino

Géant Casino

Not yet sold

PUTEAUX

Monoprix

Monoprix

Not concerned

QUIMPER

Casino Hyperfrais

Intermarché

Apr 30, 2024

TOGA

Géant Casino

Géant Casino

Not yet sold

Source: transfer notification letter received

Appendix 2 - List of hypermarkets not owned

that anchor Mercialys shopping centers

SITES

Current food operator

Future food

Scheduled transfer

date

operator

AGEN

Casino Hyperfrais

Intermarché

Apr 30, 2024

ALBERTVILLE

Intermarché

Intermarché

Oct 15, 2023

ANGOULEME

Casino Hyperfrais

Auchan

Apr 30, 2024

ANNECY

Casino Hyperfrais

Auchan

Apr 30, 2024

ARLES

Casino Hyperfrais

Auchan

Apr 30, 2024

AURILLAC

Casino Hyperfrais

Casino Hyperfrais

Not yet sold

BRIVE

Casino Hyperfrais

Casino Hyperfrais

Not yet sold

CARCASSONNE

Casino Hyperfrais

Auchan

May 31, 2024

CHARTRES

Casino Hyperfrais

Intermarché

Apr 30, 2024

DIJON

Casino Hyperfrais

Casino Hyperfrais

Not yet sold

LE PORT

Carrefour

Carrefour

Not concerned

MANDELIEU

Casino Hyperfrais

Auchan

Apr 30, 2024

MARSEILLE-LA VALENTINE

Casino Hyperfrais

Auchan

Apr 30, 2024

MILLAU

Intermarché

Intermarché

Oct 15, 2023

MONTARGIS

Casino Hyperfrais

Carrefour

Date not confirmed

MONTAUBAN

Super U

Super U

Not concerned

MONTPELLIER

Casino Hyperfrais

Intermarché

Date not confirmed

MORLAIX

Casino Hyperfrais

Carrefour

Apr 30, 2024

PARIS MASSENA

Casino Supermarché

Intermarché

Apr 30, 2024

PARIS ST DIDIER

Casino Supermarché

Auchan

Jul 1, 2024

RENNES

Super U

Super U

Not concerned

RODEZ

Super U

Super U

Not concerned

SAINT BENOIT

Carrefour

Carrefour

Not concerned

SAINT PIERRE

Carrefour

Carrefour

Not concerned

SAINTE MARIE

Intermarché

Intermarché

Not concerned

SAINT-ETIENNE

Casino Hyperfrais

Auchan

Apr 30, 2024

TOULOUSE

Casino Hyperfrais

Auchan

Apr 30, 2024

TOURS

Intermarché

Intermarché

Oct 15, 2023

VALENCE

Casino Supermarché

Intermarché

Date not confirmed

Source: newspaper articles

* * *

This press release is available on

www.mercialys.com.

About Mercialys Mercialys is one of France’s leading real

estate companies. It is specialized in the holding, management and

transformation of retail spaces, anticipating consumer trends, on

its own behalf and for third parties. At December 31, 2023,

Mercialys had a real estate portfolio valued at Euro 2.9 billion

(including transfer taxes). Its portfolio of 2,038 leases

represents an annualized rental base of Euro 175.5 million.

Mercialys has been listed on the stock market since October 12,

2005 (ticker: MERY) and has “SIIC” real estate investment trust

(REIT) tax status. Part of the SBF 120 and Euronext Paris

Compartment B, it had 93,886,501 shares outstanding at December 31,

2023.

IMPORTANT INFORMATION This press release contains certain

forward-looking statements regarding future events, trends,

projects or targets. These forward-looking statements are subject

to identified and unidentified risks and uncertainties that could

cause actual results to differ materially from the results

anticipated in the forward-looking statements. Please refer to

Mercialys’ Universal Registration Document available at

www.mercialys.com for the year ended December 31, 2023 for more

details regarding certain factors, risks and uncertainties that

could affect Mercialys’ business. Mercialys makes no undertaking in

any form to publish updates or adjustments to these forward-looking

statements, nor to report new information, new future events or any

other circumstances that might cause these statements to be

revised.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240418681552/en/

Analyst and investor Olivier Pouteau Tel: +33 (0)6 30 13

27 31 Email: opouteau@mercialys.com

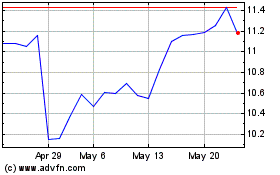

Mercialys (EU:MERY)

Historical Stock Chart

From Apr 2024 to May 2024

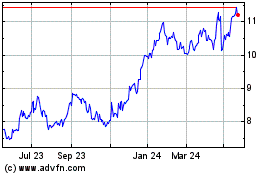

Mercialys (EU:MERY)

Historical Stock Chart

From May 2023 to May 2024