Dollar Strengthens Against Most Majors

May 21 2012 - 8:52AM

RTTF2

The US dollar advanced against most of its major rivals in early

New York deals Monday on increasing safe-haven bets as weekend

summit of the G8 leading industrialized nations failed to announce

necessary steps to lift the encircling gloom over Greece's debt

woes.

Over the weekend, leaders of the G8 nations that they support

Greece remaining in the Eurozone, while welcoming the ongoing

discussion in Europe on how to generate growth alongside a firm

commitment on fiscal consolidation.

Eurozone leaders are yet to reach consensus on how to solve the

Greece crisis. The country will go to polls on June 17 as no party

gained majority and negotiations to form a coalition government

failed.

Amid fears of a possible Greece exit, another struggling nation

Spain reportedly said that its banks do not need European funding.

Last week, Moody's downgraded 16 Spanish banks, citing rising loan

defaults and restricted funding access.

Spain revised its budget deficit for 2011 to 8.9 percent of

gross domestic product from 8.5 percent, as individual regions

raised their estimates.

The dollar touched the day's peak against the pound, hitting as

high as 1.5783 before holding steady around 8:30 am ET. If the

dollar extends gains, it may re-visit last week's fresh 2-month

high of 1.5735.

House prices in the U.K. remained unchanged in May as the

expiration of stamp duty exemption for first time home buyers and

the eurozone crisis damped demand, a survey by Rightmove

revealed.

Separately, a survey by Markit Economics showed that household

finances in the U.K. deteriorated at the fastest pace in four

months in May.

The US dollar reversed its early Asian session losses against

the currencies of Europe and Switzerland in subsequent trading

hours.

The greenback is presently quoted at 0.9428 against the Swiss

franc and 1.2743 against the euro, up from Asian session's 6-day

lows of 0.9377 and 1.2814, respectively.

Near-term resistance levels for the US currency are seen at

0.9450 against the Swiss franc and 1.2715 against the euro.

Switzerland's consumer confidence improved further between

January and April, a survey by the State Secretariat for Economic

Affairs (SECO) showed today.

The consumer confidence index rose to -8 in January-April from

-19 in three months to January. The latest result was better than

economists' expectations for an improvement to -15.

Eurozone construction output rebounded sharply in March, the

latest figures from Eurostat revealed today. Construction output

jumped 12.4 percent month-on-month in March, recovering from a 10.4

percent slump in February and 0.5 percent fall in January.

Year-on-year, construction output decreased 3.8 percent.

Building construction fell 3.4 percent and civil engineering

decreased 4.9 percent.

The dollar that rose as high as 79.48 against the yen in early

deals Monday consolidated around the 79.25/30 area in New York

morning.

Japan's leading index improved in March, but at a slower than

initially estimated pace, final data published by the Cabinet

Office revealed today.

The leading index rose to 96.4 in March from 96.1 in February.

The reading for March was revised down from 96.6. The index signals

the direction of the economy in the months ahead.

Meanwhile, the coincident index, that measures the current

economic activity, climbed to 96.7, up from last month's 95.2 and

the initial estimate of 96.5.

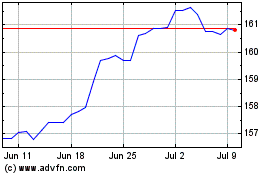

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024