Australian Dollar Weakens Against Majors

May 02 2012 - 10:50PM

RTTF2

During early Asian deals on Thursday, the Australian dollar

weakened against other major currencies as a report from the

Australian Industry Group showed that the country's performance of

service index plunged in April.

The headline figure came in with a score of 39.6, falling

sharply from the March reading of 47.0.

Adding to aussie's slide, a survey by the China Federation of

Logistics and Purchasing (CFLP) and the National Bureau of

Statistics showed that China's non-manufacturing sector growth

slowed in April, with the index declining to 56.1 in April from 58

in March.

The Australian dollar slipped to as low as 1.0288 against the US

dollar and 82.48 against the Japanese yen, compared to Wednesday's

close of 1.0335 and 82.84, respectively. The next downside target

level for the aussie is seen at 1.026 against the greenback and

82.2 against the yen.

The Australian dollar that ended yesterday's trading at 1.0198

against the Canadian dollar fell to more than a 5-month low of

1.0150. If the aussie-loonie pair weakens further, it may likely

target the 1.010 level.

Against the euro, the Australian dollar dropped to 1.2780,

compared to 1.2738 hit late New York Wednesday. On the downside,

1.280 is seen as the next target level for the Australian

currency.

Looking ahead, U.K. service PMI for April and the Eurozone PPI

for March are slated for release in the European session.

At 7:45 am ET, European Central Bank is due to announce its

interest rate decision. Analysts expect the central bank to retain

its rate at 1 percent.

From the U.S., weekly jobless claims report for the week ended

April 28, preliminary report on fourth quarter non-farm

productivity and unit labor costs and the Institute for Supply

Management's non-manufacturing survey for April are expected in the

New York morning session.

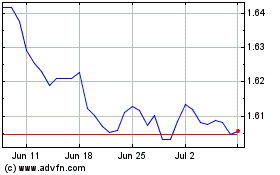

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

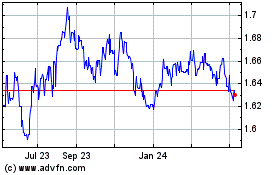

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024