Unum Group (UNM) reported first-quarter

operating income of 73 cents per share, missing the Zacks Consensus

Estimate by 3 cents. Results compare favorably with 70 cents earned

in the prior-year period. Operating income was $213.2 million in

the quarter, down 2.7% from $219.1 million in first-quarter

2011.

The company experienced soft results at Unum UK and the Closed

Block. However, solid performances at Unum US and Colonial Life

compensated for the weak performances and led to the year-over-year

improvement. Share repurchases also aided the bottom line.

The quarter had net realized investment gain of $8.3 million,

offset by non-operating retirement-related loss of $7.6 million,

thereby having no material impact on the bottom line.

Total revenue in the quarter was $2.61 billion, up 1.9% year

over year. The top line surpassed the Zacks Consensus Estimate of

$2.59 billion.

Segment Update

Unum US Segment: Segment premium in

the quarter was $1.112 billion, up 4% year over year.

Operating income increased 5.8% year over year to $205.9 million

in the quarter.

Unum UK Segment: Premium increased

2.2% year over year to $170.7 million in the fourth quarter of

2011. In local currency, premium increased 4.2% year over year to

£108.6 million.

Segment operating income was $38.8 million in the quarter, down

20.7% year over year.

The benefit ratio was 72.4% in first-quarter 2012, up from 69.3%

in the prior-year quarter. The higher benefit ratio resulted from

unfavorable risk experience in the group life line of business.

Colonial Life Segment: Premium in the

quarter increased 5.7% year over year to $296.3 million.

Operating income increased 4% year over year to $69.7 million in

the reported quarter.

The benefit ratio was 52.1% compared with 51.4% in the year-ago

period. The increase was a result of higher risk experience in the

accident, sickness and disability line.

Closed Block Segment: The segment now

includes the results of the closed blocks of individual disability,

long-term care and other closed blocks, previously reported in the

Corporate and Other segment.

Premium income for the individual disability – closed block line

of business decreased 7.5% year over year while premium income for

the long-term care line of business increased 3.1% year over

year.

The segment reported an operating income of $15.4 million, down

51.7% year over year. The decline was attributable to lower income

from the long-term care line of business, partially offset by

higher income from the individual disability – closed block line of

business.

Corporate and Other Segment: Operating

loss of $20.6 million in the reported quarter was narrower than the

loss of $21.8 million incurred a year ago.

Financial Update

Unum Group ended the quarter with a debt of $1.94 billion, flat

with the end level of 2011.

The debt-to-capital ratio was 23.4%, up 100 basis points from

22.4% as of December 31, 2011.

Book value as of December 31, 2011, was $28.62 per share, up

3.8% from $27.58 as of December 31, 2010.

Dividends

The Board of Directors approved a 23.8% hike in the quarterly

dividend. The increased dividend of 13 cents will be paid in the

third quarter of 2012.

Share Repurchase

Unum Group spent $175.2 million to buy back 7.5 million shares

in the quarter. As of March 31, 2012, the company is left with

$349.7 million remaining under its $1.0 billion share repurchase

authorization.

Business Restructuring

Following the strategic review of the long-term care business,

Unum Group discontinued new sales of group long-term care contracts

during the first quarter of 2012 and reclassified the long-term

care line of business to the Closed Block segment from the Unum US

unit.

Looking at 2012

Unum Group expects operating income per share to grow in the

lower range of 6% to 12%.

Peer Comparison

AFLAC Inc's (AFL), which competes with Unum,

reported first-quarter 2012 operating earnings per share of $1.74

outpacing both the Zacks Consensus Estimate of $1.65 and the

year-ago quarter’s earnings of $1.62.

A stronger yen/dollar exchange rate and higher investment income

related to portfolio de-risking boosted the operating earnings per

share by 4 cents and 5 cents, respectively.

Total revenue for the reported quarter spiked up 21.9% year over

year to $6.24 billion, slivering past the Zacks Consensus Estimate

of $6.2 billion. Despite the ongoing derisking activities, total

revenue benefited from the strengthening of yen against the dollar

along with consistent improvement in the U.S. and

better-than-expected performance in Japan.

Lincoln National Corp. (LNC), competing with

Unum, is scheduled to release its first quarter results today after

the bell while yet another peer Cigna Corp. (CI)

is scheduled to release its first quarter results on May 3 before

the bell.

Zacks Rank

We maintain our long-term Neutral recommendation on Unum Group.

The quantitative Zacks #4 Rank (short-term Sell rating) for the

company indicates slight downward pressure on the shares over the

near term.

AFLAC INC (AFL): Free Stock Analysis Report

CIGNA CORP (CI): Free Stock Analysis Report

LINCOLN NATL-IN (LNC): Free Stock Analysis Report

UNUM GROUP (UNM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

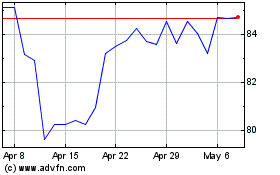

AFLAC (NYSE:AFL)

Historical Stock Chart

From Aug 2024 to Sep 2024

AFLAC (NYSE:AFL)

Historical Stock Chart

From Sep 2023 to Sep 2024