TIDMPMG

RNS Number : 7567S

Parkmead Group (The) PLC

25 November 2011

25 November 2011

The Parkmead Group plc

("Parkmead", "the Company" or "the Group")

Preliminary Results for the year ended 30 June 2011

The Parkmead Group plc, a new independent oil and gas company,

is pleased to report its preliminary results for the year ended 30

June 2011.

HIGHLIGHTS

-- Proven oil and gas team recruited to deliver the Group's growth plans

-- Acquisition of a strategic stake in the Platypus gas field

and Possum gas prospect offering near term drilling and significant

upside potential

-- Joint venture created with DEO Petroleum plc, providing a

strong and focused alliance for growth in the UK Central North

Sea

-- Revenue increased 58% to GBP3.75 million (2010: GBP2.36 million)

-- Total Assets rose to GBP12.33 million at 30 June 2011 (GBP11.34 million at 30 June 2010)

-- Cash balances of GBP1.3 million as at 30 June 2011

-- The Group is now fully funded following the provision of a

shareholder loan for GBP8 million

Parkmead's Executive Chairman, Tom Cross commented:

"The last year has been a period of strategic transformation for

the Group. I am delighted to have become Parkmead's Executive

Chairman and relish the opportunity to drive the business forward

into an exciting new chapter of its development. 2011 has been a

successful year and I believe we are now well positioned with the

essential skills and resources to build a significant new

independent oil and gas company.

I am pleased to report on Parkmead's improved operating

capability for the year to 30 June 2011. The Group's Turnover and

Gross Profit both increased substantially and Net Assets have also

increased.

We remain focused on the pursuit of value-adding acquisitions,

at both asset and corporate levels, in line with the Group's

strategy. The Board is pleased to be able to report that our first

asset transaction in our core target market was completed earlier

this month. In addition, the Group is now fully funded for its

forward programme of drilling activities and is well positioned to

capitalise on further strategic opportunities."

For enquiries please contact:

The Parkmead Group plc 01224 622200

Tom Cross, Executive Chairman tom.cross@parkmeadgroup.com

Donald MacKay, Chief Financial Officer Donald.mackay@parkmeadgroup.com

Kathryn Ramsay, Investor Relations kathryn.ramsay@parkmeadgroup.com

Charles Stanley Securities 020 7149 6000

Nominated Adviser & Broker

Marc Milmo / Carl Holmes

College Hill 020 7457 2020

Nick Elwes

Chairman's Statement

As Parkmead embarks upon this important new phase I am pleased

to share with you the Group's ambitious strategy for growth, our

progress to date and our financial performance for the year to 30

June 2011. The Group's Turnover and Gross Profit both increased

substantially, Net Assets have also increased and the Group remains

well funded.

Vision and Strategy

The Parkmead Board is working to build a significant new

independent oil and gas company, on an accelerated basis, using a

proven business model. The Group will draw on the experience of its

core oil and gas team, which has a strong technical and commercial

background, to exploit exploration and production

opportunities.

The Group will focus on both asset and corporate level

transactions as it looks to add exploration and production assets

to its portfolio. Parkmead's team has been tasked with identifying

and completing transactions in the Group's currently preferred

geographies of Europe and Africa.

The Parkmead team will utilise its detailed technical knowledge

of certain proven and frontier areas to identify and acquire assets

and participate in licensing rounds. In addition, it will seek to

use its existing government and industry relationships to access

ground floor acreage positions. A disciplined deal culture exists

within the oil and gas team. This will ensure that the assets in

which the Group invests will be in line with the Parkmead strategy

and will serve towards maximising shareholder value. The core team

has an excellent track record for commercial innovation and

successful acquisitions.

During November 2011, the Group completed its first acquisition

in the UK North Sea in line with its philosophy of acquiring known

properties, in this case the Platypus gas field and Possum gas

prospect. The Parkmead technical and commercial experts have a long

history and detailed knowledge of these assets making these an

ideal first acquisition for the Group.

Parkmead will look to form joint-ventures with companies where

the Group can achieve aligned strategies in a particular asset or

area of operation. These partnerships will focus on the key

strengths of each company. During 2011, Parkmead formed a strategic

alliance with DEO Petroleum plc covering specific areas in the

Central North Sea. Parkmead and DEO will combine exploration and

development skills to target acquisition opportunities and jointly

participate in the UKCS 27th Licensing Round.

Results

The Group's revenue has increased significantly in 2011 to

GBP3.7 million (2010: GBP2.4 million). The increase in turnover was

driven by revenue generated from Aupec, highlighting Aupec's

strength in its core fields of valuation, benchmarking and energy

sector economics. Revenues generated to 30 June 2011 represent the

Group's first full year of trading following the acquisition of

Aupec by Parkmead in November 2009. Following the investment in a

substantial new exploration and production team to deliver

Parkmead's growth plans, the Group's operating loss for the year

was GBP3.6 million (2010: GBP1.5 million). A profit from the

realisation of available-for-sale financial assets of GBP0.11

million resulted from the sale of shares in Prevx Group Limited.

The loss after tax was GBP3.6 million (2010: GBP1.5 million).

A profit of GBP1.73 million from discontinued operations was

recognised from the value of the deferred consideration due, which

was paid in full during the year, from the sale of Quayside

Corporate Services Limited in 2007.

Total comprehensive income for the year was GBP35k (2010:

GBP113k).

The Group's total assets increased to GBP12.3 million (2010:

GBP11.3 million), including increased available-for-sale financial

assets of GBP7.1 million (2010:GBP5.4 million) and increased cash

and cash equivalents of GBP1.3 million (2010: GBP0.3 million). The

total current liabilities decreased to GBP1.1 million (2010: GBP2.8

million) mainly due to decreased payables of GBP0.8 million (2010:

GBP2.7 million).

The Group's net asset value increased to GBP9.0 million (2010:

GBP8.5 million). Some 5,965,925 new ordinary shares were issued on

the exercise of options, bringing the Group's total ordinary shares

in issue to 609,601,823 (2010: 603,635,898).

As at 30 June 2011 Parkmead remained debt free.

The Board is focused on building a portfolio of high potential

oil and gas interests and therefore is not recommending the payment

of a dividend in 2011 (2010: nil).

Investments

The Group's principal investment is in Faroe Petroleum plc

("Faroe") (LSE AIM: FPM.L.). As at 30 June 2011 the value of this

investment had increased by some 37% to GBP7.05 million (30 June

2010: GBP5.15 million).

Faroe's share price rose from 118p to 160p over the 12 months to

30 June 2011, following a successful year for the company. Faroe

enjoyed significant exploration success with the Maria oil

discovery in the Norwegian Sea, which it subsequently traded with

Petoro AS for a number of oil and gas producing assets in Norway.

Further production was added to the company through the acquisition

of an 18.0% interest in the Blane oil field from ENI UK Limited and

ENI ULX Limited.

Faroe completed a placing of 37,718,024 new ordinary shares at a

placing price of 165 pence per ordinary share in November 2010. The

placing raised GBP62.2 million of new funding. Parkmead holds

4,377,039 ordinary shares in Faroe representing 2.1% of the issued

share capital of Faroe. We remain of the view that Faroe has

significant medium and long-term upside. The investment is held as

available-for-sale and the increase in its value has been reflected

in equity.

During the year, the Group disposed of its holding in Prevx

Group Limited, a private technology company. A profit of GBP0.11

million was realised from the sale of this asset.

Outlook

The Directors of Parkmead are confident that attractive

opportunities exist in our key target areas and, with the

appointment of our proven oil and gas team, the Group now has the

technical and commercial capabilities to exploit these

opportunities in order to maximise shareholder value. In addition,

the Board is pleased to report that Parkmead's first asset deal in

the UK North Sea was completed earlier this month. Coinciding with

this acquisition, Parkmead secured a flexible shareholder loan of

GBP8 million ensuring the Group is now fully funded for its forward

programme of drilling activities and well positioned to capitalise

on further strategic opportunities.

Parkmead's wholly-owned subsidiary, Aupec, continues to perform

well and the Directors believe that the Group will benefit from the

experience, technical capabilities and relationships that have been

built up over more than 25 years of success within Aupec.

The last 12 months has been a period of significant development

within Parkmead and the Board remains focused on the pursuit of

value-adding acquisitions, at both asset and corporate levels, in

line with the Group's strategy. We will continue to update

shareholders as we make further progress.

Tom Cross

Executive Chairman

24 November 2011

Group income statement

For the year ended 30 June 2011

Note 2011 2010

GBP GBP

Continuing operations

Revenue 3,745,565 2,364,151

Cost of sales (2,016,418) (1,549,671)

-------------------------------------------- ----- ------------ ------------

Gross profit 1,729,147 814,480

Other operating income 7,951 -

Administrative expenses (5,310,345) (2,274,291)

-------------------------------------------- ----- ------------ ------------

Operating loss (3,573,247) (1,459,811)

Finance income 12,417 531,403

Finance costs (797) (6,739)

Profit on sale of available-for-sale

financial assets 112,388 74,396

Amounts written off available-for-sale

financial assets and loans - (539,995)

Other losses on financial assets

at fair value through profit or loss (927) (8,033)

-------------------------------------------- ----- ------------ ------------

Loss before taxation (3,450,166) (1,408,779)

Taxation (139,470) (85,773)

-------------------------------------------- ----- ------------ ------------

Loss for the year from operations (3,589,636) (1,494,552)

--------------------------------------------------- ------------ ------------

Discontinued operations

Gain/(loss) for the year from discontinued

operations 1,732,247 (108,825)

-------------------------------------------- ----- ------------ ------------

Loss for the year attributable to the equity

holders of the Parent (1,857,389) (1,603,377)

--------------------------------------------------- ------------ ------------

Loss per share (pence)

Continuing operations

Basic and diluted 2 (0.59) (0.29)

Continuing and discontinued operations

Basic and diluted 2 (0.31) (0.31)

Group and company statement of comprehensive income

For the year ended 30 June 2011

Group Company

2011 2010 2011 2010

GBP GBP GBP GBP

Loss for the year (1,857,389) (1,603,377) (1,434,087) (2,057,345)

Other comprehensive

income

Available-for-sale financial

assets

Fair value gain on available-for-sale

financial assets 1,892,634 1,716,492 1,892,634 1,716,492

--------------------------------------- ------------ ------------ ------------ ------------

1,892,634 1,716,492 1,892,634 1,716,492

Income tax relating

to components of other

comprehensive income

--------------------------------------- ------------ ------------ ------------ ------------

Other comprehensive

income for the year,

net of tax 1,892,634 1,716,492 1,892,634 1,716,492

--------------------------------------- ------------ ------------ ------------ ------------

Total comprehensive

income for the year

attributable to the

equity holders of the

Parent 35,245 113,115 458,547 (340,853)

--------------------------------------- ------------ ------------ ------------ ------------

Group and company statement of financial position

As at 30 June 2011

Group Company

2011 2010 2011 2010

GBP GBP GBP GBP

Non-current assets

Property, plant and equipment 128,557 60,778 77,295 16,072

Goodwill 2,173,532 2,173,532 - -

Other intangible assets 43,657 99,106 - -

Investment in subsidiary

and joint ventures - - 3,902,817 3,883,353

Available-for-sale financial

assets 7,064,017 5,384,124 7,064,017 5,384,124

Trade and other receivables - 33,320 - 94,715

Deferred tax assets - 101,574 - -

------------------------------- ------------- ------------ ------------- -------------

Total non-current assets 9,409,763 7,852,434 11,044,129 9,378,264

------------------------------- ------------- ------------ ------------- -------------

Current assets

Trade and other receivables 1,650,105 3,199,194 197,334 206,834

Other financial assets - 878 - 878

Cash and cash equivalents 1,274,198 291,869 749,539 6,661

------------------------------- ------------- ------------ ------------- -------------

Total current assets 2,924,303 3,491,941 946,873 214,373

------------------------------- ------------- ------------ ------------- -------------

Total assets 12,334,066 11,344,375 11,991,002 9,592,637

------------------------------- ------------- ------------ ------------- -------------

Current liabilities

Current portion of capital

lease obligations - (1,043) - (1,043)

Trade and other payables (761,570) (2,737,838) (383,768) (1,445,640)

Current tax liabilities - (66,097) - -

Provisions (338,089) (1,959) (324,063) (1,959)

------------------------------- ------------- ------------ ------------- -------------

Total current liabilities (1,099,659) (2,806,937) (707,831) (1,448,642)

------------------------------- ------------- ------------ ------------- -------------

Non-current liabilities

Other liabilities (2,219,226) - (2,219,226) -

Deferred tax liabilities (7,924) (26,829) - -

------------------------------- ------------- ------------ ------------- -------------

Total non-current liabilities (2,227,150) (26,829) (2,219,226) -

------------------------------- ------------- ------------ ------------- -------------

Total liabilities (3,326,809) (2,833,766) (2,927,057) (1,448,642)

------------------------------- ------------- ------------ ------------- -------------

Net assets 9,007,257 8,510,609 9,063,945 8,143,995

------------------------------- ------------- ------------ ------------- -------------

Equity attributable to

equity holders

Called up share capital 18,658,349 18,652,383 18,658,349 18,652,383

Share premium 2,907,986 2,647,059 2,907,986 2,647,059

Merger reserve - (952,109) - 1,454,546

Employee benefit trust

reserve (1,128,008) (1,128,008) (1,128,008) (1,128,008)

Foreign exchange reserve - 7,377 - 7,377

Revaluation reserve 264,680 (1,182,639) 264,680 (1,182,639)

Retained deficit (11,695,750) (9,533,454) (11,639,062) (12,306,723)

------------------------------- ------------- ------------ ------------- -------------

Total Equity 9,007,257 8,510,609 9,063,945 8,143,995

------------------------------- ------------- ------------ ------------- -------------

Group statement of changes in equity

For the year ended 30 June 2011

Share Share Merger Employee Foreign Revaluation Retained Total

capital premium reserve Benefit exchange reserve earnings

Trust reserve

reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 July 2009 18,417,089 - (952,109) (1,128,008) 157,382 (2,892,904) (8,008,195) 5,593,255

Loss for the

year - - - - - - (1,603,377) (1,603,377)

Fair value gain

on

available-for-sale

financial assets - - - - 6,227 1,710,265 - 1,716,492

-------------------- ----------- ---------- ---------- ------------ ---------- ------------ ------------- ------------

Total comprehensive

income for the

year - - - - 6,227 1,710,265 (1,603,377) 113,115

Foreign exchange

loss on

available-for-sale

financial asset

recognised in

profit or loss

on derecognition - - - - (156,232) - - (156,232)

Issue of new

ordinary shares 235,294 2,647,059 - - - - - 2,882,353

Share-based

payments - - - - - - 78,118 78,118

-------------------- ----------- ---------- ---------- ------------ ---------- ------------ ------------- ------------

At 30 June 2010 18,652,383 2,647,059 (952,109) (1,128,008) 7,377 (1,182,639) (9,533,454) 8,510,609

-------------------- ----------- ---------- ---------- ------------ ---------- ------------ ------------- ------------

Loss for the

year - - - - - - (1,857,389) (1,857,389)

Fair value gain

on

available-for-sale

financial assets - - - - - 1,892,634 - 1,892,634

-------------------- ----------- ---------- ---------- ------------ ---------- ------------ ------------- ------------

Total comprehensive

income for the

year - - - - - 1,892,634 (1,857,389) 35,245

Transfer of

reserves

on impaired

available-for-sale

financial assets - - - - (7,377) (445,315) 453,127 435

Transfer of

reserves

on discontinued

activities - - 952,109 - - - (952,109) -

Issue of new

ordinary shares 5,966 260,927 - - - - - 266,893

Share-based

payments - - - - - - 194,075 194,075

-------------------- ----------- ---------- ---------- ------------ ---------- ------------ ------------- ------------

At 30 June 2011 18,658,349 2,907,986 - (1,128,008) - 264,680 (11,695,750) 9,007,257

-------------------- ----------- ---------- ---------- ------------ ---------- ------------ ------------- ------------

Company Statement of changes in equity

For the year ended 30 June 2011

Share Share Merger Employee Foreign Revaluation Retained Total

capital premium reserve Benefit exchange reserve earnings

Trust reserve

reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 July 2009 18,417,089 - 1,454,546 (1,128,008) 157,382 (2,892,904) (10,327,496) 5,680,609

Loss for the

year - - - - - - (2,057,345) (2,057,345)

Fair value

gain on

available-for-sale

financial assets - - - - 6,227 1,710,265 - 1,716,492

-------------------- ----------- ---------- ------------ ------------ ---------- ------------ ------------- ------------

Total comprehensive

income for

the year - - - - 6,227 1,710,265 (2,057,345) (340,853)

Foreign exchange

loss on

available-for-sale

financial asset

recognised

in profit or

loss on

derecognition - - - - (156,232) - - (156,232)

Issue of new

ordinary shares 235,294 2,647,059 - - - - - 2,882,353

Share-based

payments - - - - - - 78,118 78,118

-------------------- ----------- ---------- ------------ ------------ ---------- ------------ ------------- ------------

At 30 June

2010 18,652,383 2,647,059 1,454,546 (1,128,008) 7,377 (1,182,639) (12,306,723) 8,143,995

Loss for the

year - - - - - - (1,434,087) (1,434,087)

Fair value

gain on

available-for-sale

financial assets - - - - - 1,892,634 - 1,892,634

-------------------- ----------- ---------- ------------ ------------ ---------- ------------ ------------- ------------

Total comprehensive

income for

the year - - - - - 1,892,634 (1,434,087) 458,547

Transfer of

reserves on

impaired

available-for-sale

financial assets - - - - (7,377) (445,315) 453,127 435

Transfer of

reserves on

discontinued

activities - - (1,454,546) - - - 1,454,546 -

Issue of new

ordinary shares 5,966 260,927 - - - - - 266,893

Share-based

payments - - - - - - 194,075 194,075

-------------------- ----------- ---------- ------------ ------------ ---------- ------------ ------------- ------------

At 30 June

2011 18,658,349 2,907,986 - (1,128,008) - 264,680 (11,639,062) 9,063,945

-------------------- ----------- ---------- ------------ ------------ ---------- ------------ ------------- ------------

Group and company statement of cashflows

For the year ended 30 June 2011

Group Company

2011 2010 2011 2010

Note GBP GBP GBP GBP

Cashflows from operating

activities

Continuing activities 3 (1,091,202) (2,613,588) (2,718,159) (462,728)

Taxation paid (121,560) (124,288) - -

-------------------------------- ----- ------------ ------------ -------------- ------------

Net cash (used in) operating

activities (1,212,762) (2,737,876) (2,718,159) (462,728)

-------------------------------- ----- ------------ ------------ -------------- ------------

Cash flow from investing

activities

Interest received 3,442 14,075 3,292 13,575

Proceeds from sale of

subsidiary 1,969,449 - 1,969,449 -

Proceeds from sale of

investments 94,968 439,083 94,968 439,083

Acquisition of subsidiary

net of cash acquired - 1,558,808 - (1,000,000)

Dividend received from

subsidiary - - 1,206,311 -

Acquisition of investments - (1,458,315) - (1,458,315)

Acquisition of intangible

assets (34,223) (7,834) - -

Acquisition of property,

plant and equipment (108,909) (20,264) (84,164) (4,240)

Proceeds from sale of

property, plant and equipment 5,331 - 5,331 -

-------------------------------- ----- ------------ ------------ -------------- ------------

Net cash generated by/(used

in) investing activities 1,930,038 525,553 3,195,187 (2,009,897)

-------------------------------- ----- ------------ ------------ -------------- ------------

Cash flow from financing

activities

Issue of ordinary shares 266,893 - 266,893 -

Interest paid (797) (179) - -

Finance lease principal

payments (1,043) (12,521) (1,043) (12,521)

-------------------------------- ----- ------------ ------------ -------------- ------------

Net cash generated by/(used

in) financing activities 265,053 (12,700) 265,850 (12,521)

-------------------------------- ----- ------------ ------------ -------------- ------------

Net increase/(decrease)

in cash and cash equivalents 982,329 (2,225,023) 742,878 (2,485,146)

-------------------------------- ----- ------------ ------------ -------------- ------------

Cash and cash equivalents

at beginning of year 291,869 2,516,892 6,661 2,491,807

------------------------------------- ------------ ------------ -------------- ------------

Cash and cash equivalents

at end of year 1,274,198 291,869 749,539 6,661

-------------------------------------- ------------ ------------ -------------- ------------

Notes to the financial information for the year ended 30 June

2011

1. Basis of preparation of the financial statements

The financial information set out in this announcement does not

comprise the Group and Company's statutory accounts for the years

ended 30 June 2011 or 30 June 2010.

The financial information has been extracted from the audited

statutory accounts for the years ended 30 June 2011 and 30 June

2010. The auditors reported on those accounts; their reports were

unqualified and did not contain a statement under either Section

498 (2) or Section 498 (3) of the Companies Act 2006 and did not

include references to any matters to which the auditor drew

attention by way of emphasis.

The statutory accounts for the year ended 30 June 2010 have been

delivered to the Registrar of Companies. The statutory accounts for

the year ended 30 June 2011 will be delivered to the Registrar of

Companies following the Company's Annual General Meeting.

The accounting policies are consistent with those applied in the

preparation of the interim results for the period ended 31 December

2010 and the statutory accounts for the year ended 30 June 2010,

which have been prepared in accordance with International Financial

Reporting Standards ("IFRS").

2. Loss per share

Loss per share attributable to equity holders of the Company

arise from continuing and discontinued operations as follows:

2011 2010

Loss per 0.01p ordinary share from

continuing operations (pence)

Basic and diluted (0.59p) (0.29p)

Profit/(loss) per 0.01p ordinary

share from discontinued operations

(pence)

Basic 0.28p (0.02p)

Diluted 0.26p (0.02p)

------------------------------------- -------- --------

Loss per 0.01p ordinary share from

total operations (pence)

Basic and diluted (0.31p) (0.31p)

------------------------------------- -------- --------

The calculations were based on the following information:

2011 2010

GBP GBP

(Loss)/profit attributable to ordinary

shareholders

Continuing operations (3,589,636) (1,494,552)

Discontinued operations 1,732,247 (108,825)

---------------------------------------- ------------ ------------

Total (1,857,389) (1,603,377)

---------------------------------------- ------------ ------------

Weighted average number of shares

in issue

Basic weighted average number of

shares 605,525,848 522,411,079

---------------------------------------- ------------ ------------

Dilutive potential ordinary shares

Share options 55,939,513 -

---------------------------------------- ------------ ------------

Loss per share is calculated by dividing the loss for the year

by the weighted average number of ordinary shares outstanding

during the year. Potential ordinary shares are anti-dilutive and

are therefore excluded from the weighted average number of ordinary

shares for the purposes of continuing and total operations diluted

earnings per share.

Diluted loss per share

Loss per share requires presentation of diluted loss per share

when a company could be called upon to issue shares that would

decrease net profit or increase net loss per share. For a loss

making company with outstanding share options, net loss per share

would only be decreased by the exercise of share options.

3. Notes to the statement of cashflows

Reconciliation of operating loss to net cash flow from

continuing operations

Group Company

2011 2010 2011 2010

GBP GBP GBP GBP

Operating loss (3,573,247) (1,459,811) (4,496,395) (1,950,034)

Depreciation 37,119 162,081 18,930 151,767

Amortisation 89,672 124,075 - -

Impairment of loans/investments 96,467 - 96,467 -

Foreign exchange on receivables 435 - 435 -

Gain on disposal of fixed assets (1,318) 3,251 (1,318) 3,251

Provision for share based payments 2,144,186 78,118 2,123,722 78,118

(Increase)/decrease in receivables 1,508,140 (3,116,336) 9,652 583,739

Increase/(decrease) in payables (1,728,786) 1,596,694 (791,756) 672,091

Increase/(decrease) in other provisions 336,130 (1,660) 322,104 (1,660)

------------------------------------------ ------------ ------------ ------------ ------------

Net cash flow from operations (1,091,202) (2,613,588) (2,718,159) (462,728)

------------------------------------------ ------------ ------------ ------------ ------------

4. Approval of this preliminary announcement

The preliminary report, including the financial information

contained therein, is the responsibility of, and has been approved

by, the Directors. The Directors are responsible for preparing the

report in accordance with the AIM rules issued by the London Stock

Exchange.

This announcement was approved by the Board of Directors on 24

November 2011.

5. Posting of annual report and accounts

Copies of the Annual Report and Accounts will be posted to

shareholders shortly. The Annual Report and Accounts will be made

available to download, along with a copy of this announcement, on

the investor relations section of the Company's website

www.parkmeadgroup.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FEEFWLFFSEIF

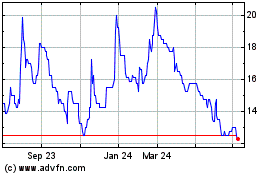

Parkmead (LSE:PMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

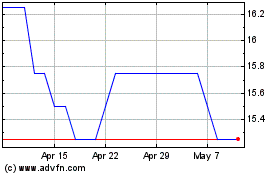

Parkmead (LSE:PMG)

Historical Stock Chart

From Apr 2023 to Apr 2024