TIDMAV.

RNS Number : 6684L

Aviva PLC

11 May 2010

News release

11 May 2010

Aviva plc Interim Management Statement

3 months to 31 March 2010

+----------------------------------------------------------------------+--+

| AVIVA DELIVERS SECOND CONSECUTIVE QUARTER OF GROWTH |

+-------------------------------------------------------------------------+

| · Second consecutive quarter of growth: long-term savings sales | |

| up 16% to GBP10 billion (4Q09: GBP8.8 billion) | |

| · Long term savings sales in Europe and UK up 16%, | |

| representing 85% of group sales | |

| · Group margin in line with full year 2009 | |

| · IGD solvency surplus remains strong at GBP4.4 billion after | |

| deducting final dividend (FY: GBP4.5 billion) | |

| · UK pension scheme: long term funding plan and 2010 | |

| contributions of GBP365 million agreed; proposed closure of scheme | |

| already announced | |

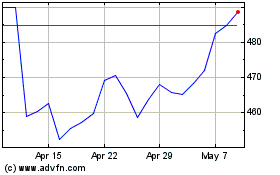

| · MCEV net asset value per share of 505 pence, up 7% (FY09: 471 | |

| pence) | |

+----------------------------------------------------------------------+--+

Andrew Moss, Aviva's group chief executive, commented:

"This is an encouraging start to the year. Europe and the UK are the primary

engines for Aviva's growth today, accounting for 85% of our long-term savings

sales in the first quarter. Sales have recovered and we've seen strong

performances across our portfolio of life, general insurance and asset

management businesses, compared to the previous quarter. Our capital position

remains strong and this second quarter of growth bodes well for the rest of the

year, even though there is still a degree of economic uncertainty in a number of

markets.

"I'm pleased that we have agreed a long-term funding plan for our main UK

pension scheme in this quarter, which we expect will eliminate the deficit over

time. When combined with our proposal to close the scheme to future accruals,

this should provide a welcome degree of certainty on funding for all our

stakeholders."

Key financial highlights

+--------------------------------------+----------+------------+---------+----------+----------+----------+

| | Quarter | Quarter | | Sterling | Sterling | Local |

| | 1 | 4 | Quarter | % | % | currency |

| | 2010 | 2009 | 1 | change | change | % change |

| | GBPm | GBPm | 2009 | on Q4 | on Q1 | on Q1 |

| | | | GBPm | 2009 | 2009 | 2009 |

+--------------------------------------+----------+------------+---------+----------+----------+----------+

| Total life and pensions sales | 9,131 | 7,943 | 9,569 | 15% | (5)% | (2)% |

| (PVNBP)1 | | | | | | |

+--------------------------------------+----------+------------+---------+----------+----------+----------+

| Total investment sales2 | 1,043 | 830 | 744 | 26% | 40% | 34% |

+--------------------------------------+----------+------------+---------+----------+----------+----------+

| Total long-term savings | 10,174 | 8,773 | 10,313 | 16% | (1)% | - |

+--------------------------------------+----------+------------+---------+----------+----------+----------+

| General insurance and health net | 2,465 | 2,126 | 2,467 | 16% | -% | (1)% |

| written premiums | | | | | | |

+--------------------------------------+----------+------------+---------+----------+----------+----------+

| World-wide total sales | 12,639 | 10,899 | 12,780 | 16% | (1)% | (1)% |

+--------------------------------------+----------+------------+---------+----------+----------+----------+

| | | | | | | |

+--------------------------------------+----------+------------+---------+----------+----------+----------+

| | 31 | 31December | | Sterling | | |

| | March | 2009 | | change | | |

| | 2010 | | | | | |

+--------------------------------------+----------+------------+---------+----------+----------+----------+

| MCEV net asset value per share | 505p | 471p | | 7% | | |

+--------------------------------------+----------+------------+---------+----------+----------+----------+

| IFRS net asset value per share | 395p | 374p | | 6% | | |

+--------------------------------------+----------+------------+---------+----------+----------+----------+

| IGD solvency surplus | GBP4.4bn | GBP4.5bn | | (2)% | | |

+--------------------------------------+----------+------------+---------+----------+----------+----------+

1. All references to sales in this announcement refer to the present value of

new business premiums (PVNBP) unless otherwise stated. PVNBP is the present

value of new regular premiums plus 100% of single premiums

2. Investment sales are calculated as new single premium plus the annualised

value of new regular premiums

Information

+-----------------+------------------+-----------------+-----------------------------+

| Investor | Media contacts | Timings | Contents |

| contacts | | | |

+-----------------+------------------+-----------------+-----------------------------+

| Andrew Moss | Hayley Stimpson | Real time media | News release |

| +44 (0)20 7662 | +44 (0)20 7662 | conference call | |

| 2286 | 7544 | 0745 hrs (BST) | Overview..................1 |

| | | | |

| Pat Regan | Sue Winston | Analyst | Business |

| +44 (0)20 7662 | +44 (0)20 7662 | conference call | review..................2 |

| 2228 | 8221 | 0930hrs (BST) | |

| | | | Statistical |

| Charles Barrows | Conor | | supplement...........8 |

| +44 (0)20 7662 | McClafferty/Nick | | |

| 8115 | Woodruff | | |

| | (Finsbury) | | |

| Jonathan Price | +44 (0)20 7251 | | |

| +44 (0)20 7662 | 3801 | | |

| 2111 | | | |

+-----------------+------------------+-----------------+-----------------------------+

Media

There will be a conference call today for real-time media at 0745 hrs (BST).

The conference call will be hosted by Andrew Moss, group chief executive.

The Aviva media centre at www.aviva.com/media includes images, company

information and news release archive. Photographs are available on the Aviva

media centre at www.aviva.com/media.

Analysts

There will be a conference call today for analysts and investors at 0930 hrs

(BST) on +44 (0)20 7162 0192 (quoting "Aviva, Andrew Moss"). This conference

call will be hosted by Andrew Moss, group chief executive.

A replay will be available until 25 May 2010 on +44 (0)20 7031 4064. The pass

code for the whole conference call, including the question and answer session,

is 865267 and for the question and answer session only the pass code is 762568.

Page 1

Overview

I am pleased to report a second consecutive quarter of growth for Aviva.

Long-term savings sales for the first three months of this year have recovered

to over GBP10 billion and are 16% higher than the previous quarter, and in line

with the first quarter of 2009. Within this, life and pension sales continued to

gain momentum from the low point in the third quarter of last year to reach just

over GBP9 billion and the group margin has been maintained in line with the full

year 2009. Investment sales also increased, to over GBP1 billion and general

insurance and health premiums rose to GBP2.5 billion, a strong improvement over

the previous quarter. Our capital position remains strong and this second

quarter of growth bodes well for the rest of the year, even though there is

still a degree of economic uncertainty in some markets.

Strong performance across the group

Europe and the UK accounted for 85% of our long-term savings new business, with

sales increasing by 16% on a sterling basis compared to the previous quarter.

North America and Asia Pacific also reported strong first quarter sales.

One of the benefits of our global diversity is that we are well-positioned to

benefit from economic recovery as it happens at differing rates across a range

of geographies. We've responded by introducing products which meet customers'

new approach to saving, because they have told us that having the option to

minimise risk is now the most important factor in their buying decision.

Sales through bancassurance account for around one third of Aviva's life and

pensions sales. In the first quarter our bancassurance sales continued to grow

across all regions, increasing by 44% compared to the previous three months and

underlining Aviva's competitive advantage in this channel.

General insurance returning to growth

General insurance and health sales returned to growth in the first quarter. Net

written premiums were up 16% at GBP2.5 billion, compared to the previous quarter

as we began to reap the benefits of the initiatives that we put in place such as

the reshaping of our UK portfolio and our strategy of increasing our general

insurance sales through Aviva's European existing bancassurance relationships.

Claims were higher than expected in the first quarter, because of adverse

weather in the UK and Europe, but these were partly offset by better than

expected claims levels in Canada. We continue to focus on a group combined

operating ratio of 98% for the full year.

Good strategic progress

Aviva's programme to create a single operating model across Europe is delivering

benefits. We have successfully piloted our pan-European product development

centre in Ireland and cross-selling initiatives in a number of continental

markets. We're also optimistic about our plans to increase general insurance

sales through our European bancassurance partners, following some early success

with sales in Italy in the first quarter.

In the UK, where financial advisers have voted us Money Marketing Company of the

Year, we are also making good progress in bringing our life and general

insurance businesses closer together. Already this is helping us to eliminate

duplication on major programmes, such as Solvency II and will give us the

opportunity to harmonise terms and conditions for our employees in these

businesses.

Aviva Investors' strategy of increasing the proportion of third party business

has successfully delivered significant mandates from several pension schemes and

financial institutions in the UK, Europe and the United States.

Strong capital position maintained

Aviva's capital position remains strong. Our estimated IGD solvency surplus was

GBP4.4 billion as at 31 March 2010 (31 December 2009: GBP4.5 billion), after

allowing for the 2009 final dividend. We remain focused on cost management, with

our total cost base down 7% (excluding discontinued operations) and

like-for-like costs down 2% on the same period last year.

Our estimated net asset value per share on an MCEV basis was 505 pence at 31

March 2010 (31 December 2009: 471 pence). On an IFRS basis the estimated net

asset value per share was 395 pence at 31 March 2010 (31 December 2009: 374

pence). The provisions we put in place last year for potential defaults on debt

securities have not been used and we have not experienced any material

deterioration in commercial mortgage defaults.

Aviva continues to have a firm focus on capital. In 2010 we expect to generate

approximately GBP1.3 billion of net operating capital 1 ,an increase of 30% on

2009. We expect to achieve the increase through a combination of higher

in-force profits, an increase in general insurance profitability, disciplined

cost management and a continued focus on capital efficiency.

Outlook

Aviva has made an encouraging start to 2010, delivering a second consecutive

quarter of long-term savings growth. We will continue to focus on profitability

and capital, managing Aviva's new business flows in a disciplined way,

throughout the coming year.

1. Operational capital generated, net of investment in new business

---------------------------------------------------------------------

Page 2

Business Review

Long-term savings

United Kingdom

In the UK, our life and pensions business continued the momentum built-up at the

end of 2009. Life and pension sales were GBP2,557 million, an increase of 14%

compared to the previous quarter and in line with the first quarter of 2009

(4Q09 GBP2,250 million: 1Q09: GBP2,505 million). These sales were achieved

while maintaining our focus on profitability. Collective investment sales

increased to GBP426 million in the first three months of the year (4Q09: GBP418

million: 1Q09: GBP175 million), reflecting increased confidence among UK

investors.

Significant developments in the first quarter included record levels of

protection and annuity applications, strong individual pension sales and

particular success in the bulk purchase annuity market. We were also delighted

to be awarded the title of Money Marketing 'Company of the Year' for 2009. This

is a prestigious award for life insurance companies, voted for by financial

advisers, and demonstrates the value of our brand, product innovation and

service excellence.

The first quarter of 2010 saw record weekly core protection 2 applications

driven by the continued success of Aviva's Simplified Life offering through IFAs

and our partnerships with Barclays and the Post Office. Sales were GBP165

million, 1% above the previous quarter (4Q09: GBP164 million), achieved without

compromising our focus on profitability. Overall protection sales were GBP231

million (4Q09: GBP258 million) having been impacted by lower group life sales,

as competition in this market increased and we strengthened our focus on value

creation.

Total annuity sales of GBP877 million, are 35% higher than the fourth quarter of

2009 (4Q09: GBP648 million). Our well-developed bulk purchase annuity offering

delivered sales of GBP344 million (4Q09: GBP28 million) and it is pleasing that

we have been able to maintain our pricing discipline while winning new business.

Sales of individual annuities were GBP533 million (4Q09: GBP620 million)

reflecting the seasonal market fall in application levels during December and

January. However average weekly applications are now 19% higher than during

2009, as we continue to see the benefit of our pricing expertise and risk

selection.

Aviva's pension sales have remained resilient. Sales were 10% higher than the

fourth quarter of 2009 at GBP941 million (4Q09: GBP859 million) as customers'

propensity to save began to return and group schemes that we secured during 2009

converted into new business volumes.

Capitalising on Aviva's market leading position our equity release sales

increased by 52% to GBP96 million (4Q09: GBP63 million). In-line with our

strategy of focusing on creating value, bond sales were marginally lower at

GBP412 million (4Q09 GBP422 million).

First quarter life and pension sales through our joint venture with the Royal

Bank of Scotland were GBP250 million (4Q09: GBP274 million) primarily driven by

subdued bond sales as investors preferred the bank's strong ISA offering and the

reduction in guaranteed bond sales when compared with the first quarter of 2009

(1Q09: GBP382 million). Aviva's share of the joint venture's total sales was

GBP327 million, representing 1% growth over the fourth quarter of 2009 (4Q09:

GBP323 million).

Over the next three years the Retail Distribution Review (RDR) will have a major

impact on the market we operate in and we have put in place a number of

initiatives to ensure that we adapt successfully to these changes. We continue

to support advisers in their transition through to the post-RDR market, with

initiatives such as our Business Transformation Programme and our market-leading

Financial Adviser Academy. We are continuing to prepare for the changes with an

RDR-compliant Sipp and Wrap proposition, one of the few that conforms to the

current Platform discussion paper proposals. Furthermore we have delivered

adviser-charging for our individual pension products and will be introducing

this capability on other products in the coming months.

On 20 April we advised UK staff, and the Trustees of the Aviva Staff Pension

Scheme (ASPS) and the RAC staff pension scheme that we intend to begin

consultation with them regarding our proposal to close the final salary sections

of these pension schemes. The review is in light of future funding requirements,

and our desire to provide an equitable, sustainable and competitive pension for

all our UK employees.

While market conditions remain challenging, the momentum we've seen building

over the past three quarters is encouraging, and we are well-positioned to

benefit from increased market activity and the gradual return of consumer

confidence.

Europe

We delivered a strong performance in Europe, despite some continued challenging

economic conditions in a number of our markets. Long term savings sales were

GBP5,683 million, an increase of 19% on the previous quarter (4Q09: GBP4,791

million) and up 9% on the first quarter of 2009 (1Q09: GBP5,035 million). Within

this total, life and pensions sales were up 13% at GBP5,168 million (4Q09:

GBP4,583 million, 1Q09: GBP4,735 million), a 12% increase on a local currency

basis. Investment sales were GBP515 million an increase of 72% on the first

quarter of 2009.

2. Core protection - Mortgage Life Insurance and Term Assurance with or without

Critical Illness options, Simplified Life, Whole of Life cover and 50+ cover

=------------------------------------------------------------

Page 3

Aviva Europe

Life and pensions sales increased by 14% on the previous quarter to GBP4,285

million (4Q09: GBP3,753 million), and 13% compared to the first quarter of last

year. On a local currency basis this was 13% and 15% respectively.

We have responded to customer preference for savings products that have a

guaranteed element by developing products which are both attractive to customers

and meet our profitability criteria.

We have continued to make good progress with our European transformation

programme and are successfully embedding our pan-European operating model, which

includes the creation of a single bancassurance platform, a central procurement

capability, development of a common product suite and the piloting of our cross

selling and product initiatives in Poland, Ireland and a number of our emerging

markets. Compliance and legal projects are underway to finalise regulatory

approval for our European headquarters in Ireland and the groundwork for our

branch structure is well advanced.

Bancassurance

We continue to leverage our bancassurance franchise, which now includes 51

arrangements and makes Aviva the market leader in this distribution channel.

Sales increased by 48% from the previous quarter to GBP2,611 million (4Q09:

GBP1,762 million).

Sales performance in Italy, one of our major bancassurance markets, was very

strong up 150% to GBP1,542 million (4Q09: GBP618 million). Existing with-profit

and unit-linked products have been redesigned, making them more attractive to

customers while also adjusting surrender conditions to improve long term

retention. Sales have benefitted from some seasonal effects and we do not

expect volumes to continue at this level throughout the year. We have actions

in place to rebalance our sales mix to include a greater proportion of unit

linked products.

In France, sales have increased by 54% to GBP393 million (4Q09: GBP255 million).

In partnership with Credit du Nord, we introduced a new product, "Antarius

Duo", which has enabled us to capture sales from customers who are choosing to

transfer their savings from lower return, short-term deposits, into more

attractive insurance products.

In Spain the challenging market environment and resulting low levels of consumer

propensity to invest, combined with the beneficial effect of seasonality in the

prior quarter's sales, led to lower sales of GBP530 million, down 28% (4Q09:

GBP734 million). We are focused on increasing sales of our protection products,

which have grown by 56% since the previous quarter and in this sector we now

have the second largest market share in Spain.

In Ireland, sales were 13% lower at GBP117 million (4Q09: GBP134 million),

reflecting seasonal patterns in an economic environment that remains tough.

However, sales have increased by 43% on the same period last year, reflecting

the benefits of our partnership with Allied Irish Bank, who following their

reorganisation have increased their focus on life and pensions sales.

Retail

We continue to build on our significant retail franchise as we develop a single

pan-European retail operating model supported by centralised sales support.

Retail sales were 16% lower than the previous quarter at GBP1,674 million (4Q09:

GBP1,991 million), a 17% decrease on a local currency basis, but up 8% on the

same period last year.

France has delivered an excellent sales performance increasing sales by 6% to

GBP1,157 million (4Q09: GBP1,096 million). Sales through our partnership with

AFER increased by 56% on the previous year, as customers continued to be

attracted by our range of simple, easy to understand products. We have made

good progress on our strategic aim to grow unit linked product sales, with sales

up by 25% compared to the same period last year.

In Poland retail sales were 39% lower at GBP203 million (4Q09: GBP334 million,

equivalent to a 44% decrease on a local currency basis), largely as a result of

a one-off beneficial impact of assumption changes in the 2009 figure and some

seasonal sales effects. Pension sales in Poland have declined by 52% compared

to the previous year, as a result of Polish pension legislation changes. We are

developing a number of savings and protection initiatives and are focusing on

promoting unit linked products to existing customers, which has already

increased sales.

In Ireland retail sales were 48% lower at GBP130 million (4Q09: GBP248 million),

reflecting seasonal trends. However, we are encouraged by the fact that sales

were 24% higher than the same period last year and we have recently launched

several new protection and savings products.

Delta Lloyd

Life and pensions sales were up 6% at GBP883 million on the previous quarter

(4Q09: GBP830 million), supported by seasonal trends in pension and annuity

sales. Compared to the same period last year, sales were 6% lower, representing

a 4% decrease on a local currency basis.

Sales in Germany were predictably lower, following the announcement that Delta

Lloyd intends to close its loss-making German operation to new business.

Pensions and annuity sales were at a similar level to the same period last year

with no large contracts sold. However, we believe that the future prospects for

large group pension sales remain positive.

Investment sales were GBP173 million, 7% higher than the first quarter of last

year and equivalent to a 10% increase on a local currency basis. This reflects

an increased appetite for single premium investments in the Dutch market.

Page 4

North America

In North America our focus is on profitable growth, which we aim to achieve

through diversifying our business mix, increasing internal rates of return and

capital efficiency in this business. In the first three months of this year we

generated good life and pension sales growth compared to the previous quarter.

However, sales were lower than at the start of 2009 because of the specific

actions we took last year to moderate the pace of our annuity sales and focus on

capital efficiency, while driving growth in our life insurance business.

Compared to the fourth quarter of last year, sales rose by 24% to GBP997 million

(4Q09: GBP803 million), which equates to an increase of 14% on a local currency

basis. Measured against the same period last year, sales were 48% lower on a

sterling basis and 44% lower on a local currency basis (1Q09: GBP1,929 million).

Annuity sales grew by 49% in the first quarter, compared to the previous three

months (4Q09: GBP507 million), with good momentum in our application pipeline.

Viewed against the first quarter of 2009, annuity sales were 57% lower at GBP755

million (1Q09: GBP1,752 million), for the strategic reasons outlined above.

We delivered strong life sales of GBP242 million in the first quarter, although

following established seasonal patterns, sales were 18% lower than the fourth

quarter of 2009 (4Q09: GBP296 million). Against the same period last year, our

life sales have grown by 37%.

Asia Pacific

In Asia Pacific our strategy is one of organic investment for long-term value

creation, with particular focus on the key markets of China and India.

Life and pensions sales in the region increased by 33% (27% on a local currency

basis), compared with the previous quarter to GBP409 million (4Q09: GBP307

million). This reflects the improving economic environment and recovering

investor confidence, with most of our businesses contributing towards this

positive trend. Compared to the first quarter of last year, sales were up 26%

on a sterling and local currency basis (excluding the Australian life business

which we sold on 1 October 2009). Investment sales in the Asia Pacific region

were GBP102 million (4Q09: GBP99 million).

Our joint venture in China, Aviva-COFCO, increased sales by 51% to GBP134

million (4Q09: GBP89 million), driven by our strong multi-channel distribution

network and the opening of our tenth provincial branch in the last quarter of

2009. Sales were 65% higher than the same period in the previous year and

contributed 33% of our total life and pension sales in the region.

In India sales were up 106% to GBP37 million (4Q09: GBP18 million) reflecting

the successful relaunch of our investment linked product suite, improved

consumer sentiment and a more buoyant market leading up to the end of the tax

year.

Our joint venture in South Korea recorded sales of GBP101 million, an increase

of 28% on the previous quarter (4Q09: GBP79 million) led by robust bancassurance

sales through our partner Woori Bank and the successful expansion of our agency

force.

In Hong Kong, sales increased by 14% to GBP41 million (4Q09: GBP36 million),

driven by strong investment linked sales, via our bancassurance channel,

underpinned by improvements in both consumer sentiment and investment market

outlook.

Sales in Singapore and most of our other Asian markets were higher than the

previous quarter, reflecting the steady economic recovery and growth in the

region.

On 18 March we announced our entry into the fast growing Indonesian insurance

market through a joint venture agreement with PT Asuransi Wahana Tata. Aviva

acquired a 60% share of this company, which has gross assets of GBP15 million

(as at 31 December 2008).

Page 5

General Insurance

United Kingdom

We are seeing signs of a return to volume growth in 2010, reflecting the impact

of our marketing initiatives, including our "Get the Aviva Deal" marketing

campaign, rolling out direct pricing to insurance brokers and the success of the

RAC panel. As expected, following the actions we took last year to reshape our

UK portfolio, we are seeing good levels of retention in both personal and

commercial lines business. There is also clear evidence that the personal motor

market is starting to harden. The decline in net written premiums stopped in the

first quarter, with premiums of GBP913 million. This represents a 4% increase

over the last quarter of 2009 (4Q09: GBP880 million) and is a potential sign of

a return to growth.

Aviva Europe

In the first quarter of 2010 sales increased by 33% to GBP597 million (4Q09:

GBP448 million), broadly in line with the equivalent period last year (1Q09:

GBP610 million). One of our key strategic aims is to increase general insurance

sales through our leading bancassurance capability and this quarter we have had

some early success with strong sales growth in Italy.

We are also now piloting our pan-European product centre in Ireland. Together

with our claims transformation project this initiative will increase our ability

to write business more profitably.

North America

Our Canadian business applied targeted rate increases and focused on business

initiatives to improve our operational and underwriting effectiveness.

At GBP397 million, sales in the first quarter of 2010 were lower than the

previous quarter (4Q09: GBP449 million), in keeping with established seasonal

trends, but were 10% higher compared to the same period a year ago on a sterling

basis (1Q09: GBP360 million) and level on a local currency basis. This is a good

result in a highly competitive market.

Asia Pacific

On 9 April we re-entered the general insurance market in Singapore with the

launch of the first, dedicated, direct online car insurance website. This builds

upon our existing brand presence in Singapore and presents an attractive

proposition for customers in thecurrent market. Aviva's investment in this

initiative was in the region of GBP5 million.

Combined operating ratio

The Group general insurance combined operating ratio (COR) for the first quarter

of 2010 was impacted by adverse weather in the UK and Europe, although this was

partially offset by milder weather in Canada. We remain focused on delivery of a

98% COR for 2010.

Fund Management

Aviva Investors

Aviva Investors attracted net new business inflows of GBP0.7 billion in the

first quarter of 2010. Net inflows from external clients were GBP0.4 billion.

The most significant external inflows were to our UK cash and real estate

products and our absolute tactical asset allocation fund via the European SICAV,

reflecting improved performance and growing investor confidence in higher risk

assets.

A highlight of the quarter was our acquisition of River Road Asset Management a

leading value-oriented US equity manager. The acquisition supports the expansion

of our third party institutional business by combining existing fixed income

expertise in North America with River Road's equity investment capability.

Our focus on building third party business is beginning to deliver results. We

won a number of significant, unfunded mandates from notable pension schemes and

financial institutions in the UK, Europe and the US in the first quarter.

Importantly, these sales have been in line with our strategy to deliver higher

revenue generating mandates for Aviva Investors core capabilities including,

fixed income, convertible bonds, real estate and real estate securities.

We continue to focus on growing external assets under management and pursuing

higher margin opportunities with our target client groups.

Page 6

Capital Management

Sound risk management is a key part of our business and integral to maintaining

financial stability for our stakeholders. Through the first quarter we have

further strengthened our risk management operating model and governance in line

with recommendations from the Walker Review.

We continue to protect the balance sheet to large equity shocks through

appropriate hedging strategies and hold high quality diverse debt securities and

commercial mortgages portfolios. We have not experienced any material defaults

during the first quarter.

Capital generation

We remain focused on capital generation in our business and in 2010 we expect to

generate approximately GBP1.3 billion of net operating capital, an increase of

30% compared with 2009. We aim to generate the additional capital through a

combination of higher in-force profits, an increase in general insurance

profitability and a focus on greater capital efficiency.

IGD solvency

Our capital position remains strong. The estimated group regulatory capital

surplus position based on the EU Insurance Groups Directive was GBP4.4 billion

as at 31 March 2010 (31 December 2009: GBP4.5 billion), after accounting for the

payment of the 2009 full year dividend of GBP0.3 billion (net of scrip).

There have been positive developments on Solvency II with the publication of the

draft technical specifications for the fifth quantitative impact study (QIS5),

as part of the Solvency II consultation process. We are actively preparing for

the transition to Solvency II and we continue to be optimistic about the

proposed treatment of capital and the inclusion of a liquidity premium, as laid

out in QIS5, which we believe should form the basis for the final Solvency II

framework.

Sovereign debt

Our shareholder exposure (net of minority interests) to debt securities of the

governments of Greece, Spain and Portugal (including local authorities and

agencies) at 31 March 2010 is GBP0.9 billion (including our expected exposure to

those securities held within participating funds). Within this our exposure to

Greek debt securities is GBP150 million.

Net asset value

Our estimated net asset value per share on an MCEV basis was 505 pence as at 31

March 2010 (31 December 2009: 471 pence). On an IFRS basis estimated net asset

value per share was 395 pence at 31 March 2010 (31 December 2009: 374 pence).

These do not include the impact of the final dividend declared in March 2010.

Proposed changes to UK pension schemes

A long-term funding plan for the deficit in the Aviva Staff Pension Scheme

(ASPS) has now been agreed with the pension scheme Trustees, where

contributions, together with the anticipated growth in scheme investments are

expected to eliminate the ASPS deficit over time. As part of this funding plan,

Aviva will make a contribution of GBP365 million in 2010 towards the funding of

the ASPS deficit.

Page 7

Notes to editors

- Aviva is a leading provider of life and pension products in Europe (including

the UK) with substantial positions in other markets around the world, making it

the world's fifth largest insurance group based on gross worldwide premiums at

31 December 2008.

- Aviva's principal business activities are long-term savings, fund management

and general insurance, with worldwide total sales* of GBP45.1 billion and funds

under management of GBP379 billion at 31 December 2009.

* Based on 2009 published life and pensions PVNBP on an MCEV basis, total

investment sales and general insurance and health net written premiums,

including share of associates' premiums.

The Aviva media centre at www.aviva.com/media includes images, company and

product information and a news release archive.

- All figures have been translated at average exchange rates applying for the

period. The average rates employed in this announcement are 1 euro = GBP0.88 (3

months to 31 March 2009: 1 euro = GBP0.91) and GBP1 = US$1.57 (3 months to 31

March 2009: GBP1 = US$1.44).

- Growth rates in the press release have been provided in sterling terms unless

stated otherwise. The supplements following present this information on both a

sterling and local currency basis.

- Definition: Present value of new business premiums (PVNBP)

PVNBP is

derived from the single and regular premiums of the products sold during the

financial period and are expressed at the point of sale. The PVNBP calculation

is equal to total single premium sales received in the period plus the

discounted value of regular premiums expected to be received over the term of

the new contracts. The discount rate used reflects the appropriate risk-free

rate for the country and duration of business. The projection assumptions used

to calculate PVNBP for each product are the same as those used to calculate new

business contribution. The discounted value of regular premiums is also

expressed as annualised regular premiums multiplied by a Weighted Average

Capitalisation Factor (WACF). The WACF will vary over time depending on the mix

of new products sold, the average outstanding term of the new contracts and the

projection assumptions.

- Cautionary statements:

This should be read in conjunction with the documents filed by Aviva plc (the

"Company" or "Aviva") with the United States Securities and Exchange Commission

("SEC").

This announcement contains, and we may make verbal statements containing,

"forward-looking statements" with respect to certain of Aviva's plans and

current goals and expectations relating to future financial condition,

performance, results, strategic initiatives and objectives. Statements

containing the words "believes", "intends", "expects", "plans", "seeks", "aims",

"may", "could", "outlook", "estimates" and "anticipates", and words of similar

meaning, are forward-looking. By their nature, all forward-looking statements

involve risk and uncertainty. Accordingly, there are or will be important

factors that could cause actual results to differ materially from those

indicated in these statements. Aviva believes these factors include, but are

not limited to: the impact of difficult conditions in the global capital markets

and the economy generally; the impact of new government initiatives related to

the financial crisis; defaults in our bond, mortgage and structured credit

portfolios; the impact of volatility in the equity, capital and credit markets

on our profitability and ability to access capital and credit; changes in

general economic conditions, including foreign currency exchange rates, interest

rates and other factors that could affect our profitability; risks associated

with arrangements with third parties, including joint ventures; inability of

reinsurers to meet obligations or unavailability of reinsurance coverage; a

decline in our ratings with Standard & Poor's, Moody's, Fitch and A.M. Best;

increased competition in the U.K. and in other countries where we have

significant operations; changes in assumptions in pricing and reserving for

insurance business (particularly with regard to mortality and morbidity trends,

lapse rates and policy renewal rates), longevity and endowments; a cyclical

downturn of the insurance industry; changes in local political, regulatory and

economic conditions, business risks and challenges which may impact demand for

our products, our investment portfolio and credit quality of counterparties; the

impact of actual experience differing from estimates on amortisation of deferred

acquisition costs and acquired value of in-force business; the impact of

recognising an impairment of our goodwill or intangibles with indefinite lives;

changes in valuation methodologies, estimates and assumptions used in the

valuation of investment securities; the effect of various legal proceedings and

regulatory investigations; the impact of operational risks; the loss of key

personnel; the impact of catastrophic events on our results; changes in

government regulations or tax laws in jurisdictions where we conduct business;

funding risks associated with our pension schemes; the effect of undisclosed

liabilities, integration issues and other risks associated with our

acquisitions; and the timing impact and other uncertainties relating to

acquisitions and disposals and relating to other future acquisitions,

combinations or disposals within relevant industries.

For a more detailed description of these risks, uncertainties and other factors,

please see Item 3, "Risk Factors", and Item 5, "Operating and Financial Review

and Prospects" in Aviva's Annual Report on Form 20-F as filed with the SEC on 30

March 2010. Aviva undertakes no obligation to update the forward-looking

statements in this announcement or any other forward-looking statements we may

make. Forward-looking statements in this announcement are current only as of

the date on which such statements are made.

Aviva plc is a company registered in England No. 2468686.

Registered

office

St Helen's

1 Undershaft

London

EC3P 3DQ

Page 8

Contents

Analyses

1. Trend analysis of PVNBP - discrete

2. Trend analysis of PVNBP - cumulative

3. Geographical analysis of life, pension and investment sales

4. Product analysis of life and pension sales

5. Analysis of sales via bancassurance channels

6. Geographical analysis of regular and single premiums - life and pensions

sales

7. Geographical analysis of regular and single premiums - investment sales

8. Europe analysis for bancassurance and retail sales

9. Trend analysis of general insurance net written premiums - discrete and

cumulative

Page 9

1 - Trend analysis of PVNBP - discrete

+--------------------+--------+----------+----------+-------+-------+--------+--+----------+----------+-----+

| | Present value of new business premiums1 | | | | |

+--------------------+-------------------------------------------------------+--+----------+----------+-----+

| | 1Q09 | 2Q09 | 3Q09 | | | | % Growth | |

| | GBPm | GBPm | GBPm | 4Q09 | 1Q10 | | on 4Q09 | |

| | | | | GBPm | GBPm | | | |

+--------------------+--------+----------+------------------+-------+--------+--+---------------------+-----+

| Life and pensions | | | | | | | Sterling | Local2 | |

| business | | | | | | | | currency | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Pensions | 989 | 1,100 | 804 | 859 | 941 | | 10% | 10% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Annuities | 475 | 358 | 416 | 648 | 877 | | 35% | 35% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Bonds | 713 | 506 | 383 | 422 | 412 | | (2)% | (2)% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Protection | 245 | 216 | 246 | 258 | 231 | | (10)% | (10)% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Equity release | 83 | 50 | 80 | 63 | 96 | | 52% | 52% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| United Kingdom | 2,505 | 2,230 | 1,929 | 2,250 | 2,557 | | 14% | 14% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| | | | | | | | | | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| France | 1,270 | 1,170 | 1,100 | 1,351 | 1,550 | | 15% | 15% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Ireland | 187 | 239 | 264 | 382 | 247 | | (35)% | (35)% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Italy | 1,136 | 1,062 | 651 | 758 | 1,567 | | 107% | 107% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Poland | 351 | 203 | 189 | 336 | 206 | | (39)% | (44)% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Spain | 737 | 508 | 397 | 812 | 590 | | (27)% | (27)% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Other Europe | 112 | 96 | 98 | 114 | 125 | | 10% | 6% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Aviva Europe | 3,793 | 3,278 | 2,699 | 3,753 | 4,285 | | 14% | 13% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Of which: | 2,243 | 1,850 | 1,291 | 1,762 | 2,611 | | 48% | 48% | |

| Bancassurance | | | | | | | | | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Retail | 1,550 | 1,428 | 1,408 | 1,991 | 1,674 | | (16)% | (17)% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Aviva Europe | 3,793 | 3,278 | 2,699 | 3,753 | 4,285 | | 14% | 13% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| | | | | | | | | | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Delta Lloyd 3 | 942 | 838 | 1,055 | 830 | 883 | | 6% | 6% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Europe | 4,735 | 4,116 | 3,754 | 4,583 | 5,168 | | 13% | 12% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| | | | | | | | | | |

+--------------------+--------+---------------------+-------+-------+--------+--+----------+----------+-----+

| North America | 1,929 | 1,260 | 553 | 803 | 997 | | 24% | 24% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| | | | | | | | | | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Asia Pacific5 | 325 | 207 | 256 | 307 | 409 | | 33% | 27% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Australia | 75 | 91 | 95 | - | - | | - | - | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| | | | | | | | | | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Total life and | 9,569 | 7,904 | 6,587 | 7,943 | 9,131 | | 15% | 14% | |

| pensions | | | | | | | | | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| | | | | | | | | | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Investment sales4 | 744 | 1,204 | 1,094 | 830 | 1,043 | | 26% | 22% | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| | | | | | | | | | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| Total long term | 10,313 | 9,108 | 7,681 | 8,773 | 10,174 | | 16% | 15% | |

| saving sales | | | | | | | | | |

+--------------------+--------+----------+------------------+-------+--------+--+----------+----------+-----+

| | | | | | | | | | | |

+--------------------+--------+----------+----------+-------+-------+--------+--+----------+----------+-----+

1. All references to sales in this announcement refer to the present value of

new business premiums (PVNBP) unless otherwise stated.

PVNBP is the present value of new regular premiums plus 100% of single

premiums

2. Growth rates are calculated based on constant rates of exchange.

3. Delta Lloyd, which operates in the Netherlands, Belgium and Germany, is

managed independently from our other European businesses

4. Investment sales are calculated as new single premium plus the annualised

value of new regular premiums

5 Asia Pacific excludes the Australian life business that was sold on 1 October

2009

Page 10

2 - Trend analysis of PVNBP - cumulative

+-------------------+--------+----------+----------+--------+--------+------+

| | Present value of new business premiums1 | |

+-------------------+------------------------------------------------+------+

| | 1Q09 | 2Q09 YTD | 3Q09 YTD | | | |

| | YTD | GBPm | GBPm | 4Q09 | 1Q10 | |

| | GBPm | | | YTD | YTD | |

| | | | | GBPm | GBPm | |

+-------------------+--------+----------+----------+--------+--------+------+

| Life and pensions | | | | | | |

| business | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

| | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

| Pensions | 989 | 2,089 | 2,893 | 3,752 | 941 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Annuities | 475 | 833 | 1,249 | 1,897 | 877 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Bonds | 713 | 1,219 | 1,602 | 2,024 | 412 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Protection | 245 | 461 | 707 | 965 | 231 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Equity release | 83 | 133 | 213 | 276 | 96 | |

+-------------------+--------+----------+----------+--------+--------+------+

| United Kingdom | 2,505 | 4,735 | 6,664 | 8,914 | 2,557 | |

+-------------------+--------+----------+----------+--------+--------+------+

| | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

| France | 1,270 | 2,440 | 3,540 | 4,891 | 1,550 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Ireland | 187 | 426 | 690 | 1,072 | 247 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Italy | 1,136 | 2,198 | 2,849 | 3,607 | 1,567 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Poland | 351 | 554 | 743 | 1,079 | 206 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Spain | 737 | 1,245 | 1,642 | 2,454 | 590 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Other Europe | 112 | 208 | 306 | 420 | 125 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Aviva Europe | 3,793 | 7,071 | 9,770 | 13,523 | 4,285 | |

+-------------------+--------+----------+----------+--------+--------+------+

| | 2,243 | 4,093 | 5,384 | 7,146 | 2,611 | |

| Of which: | | | | | | |

| Bancassurance | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

| Retail | 1,550 | 2,978 | 4,386 | 6,377 | 1,674 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Aviva Europe | 3,793 | 7,071 | 9,770 | 13,523 | 4,285 | |

+-------------------+--------+----------+----------+--------+--------+------+

| | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

| Delta Lloyd 2 | 942 | 1,780 | 2,835 | 3,665 | 883 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Europe | 4,735 | 8,851 | 12,605 | 17,188 | 5,168 | |

+-------------------+--------+----------+----------+--------+--------+------+

| | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

| North America | 1,929 | 3,189 | 3,742 | 4,545 | 997 | |

+-------------------+--------+----------+----------+--------+--------+------+

| | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

| Asia Pacific4 | 325 | 532 | 788 | 1,095 | 409 | |

+-------------------+--------+----------+----------+--------+--------+------+

| Australia | 75 | 166 | 261 | 261 | - | |

+-------------------+--------+----------+----------+--------+--------+------+

| | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

| Total life and | 9,569 | 17,473 | 24,060 | 32,003 | 9,131 | |

| pensions | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

| | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

| Investment sales3 | 744 | 1,948 | 3,042 | 3,872 | 1,043 | |

+-------------------+--------+----------+----------+--------+--------+------+

| | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

| Total long term | 10,313 | 19,421 | 27,102 | 35,875 | 10,174 | |

| saving sales | | | | | | |

+-------------------+--------+----------+----------+--------+--------+------+

1. All references to sales in this announcement refer to the present value of

new business premiums (PVNBP) unless otherwise stated.

PVNBP is the present value of new regular premiums plus 100% of single

premiums

2. Delta Lloyd, which operates in the Netherlands, Belgium and Germany, is

managed independently from our other European businesses

3. Investment sales are calculated as new single premium plus the annualised

value of new regular premiums

4. Asia Pacific excludes the Australian life business that was sold on 1

October 2009

Page 11

3 - Geographical analysis of life, pension and investment sales

+----------+-------------------------------+----------+----------+-------------------------------+----------+-------------------------------+

| | Present value of new business |

| | premiums1 |

+ +-------------------------------------------------------------------------------------+

| | 3 months | 3 months 2009 | % Growth |

| | | GBPm | |

| | 2010 | | |

| | GBPm | | |

+ + + +------------------------------------------+

| | | | Sterling | Local2 currency |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Life and pensions business | | | | |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| | | | | |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| United Kingdom | 2,557 | 2,505 | 2 % | 2 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| | | | | |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| France | 1,550 | 1,270 | 22 % | 25 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Ireland | 247 | 187 | 32 % | 36 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Italy | 1,567 | 1,136 | 38 % | 42 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Poland | 206 | 351 | (41)% | (46)% |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Spain | 590 | 737 | (20)% | (18)% |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Other Europe | 125 | 112 | 12 % | 11 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Aviva Europe | 4,285 | 3,793 | 13 % | 15 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Delta Lloyd3 | 883 | 942 | (6)% | (4)% |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Europe | 5,168 | 4,735 | 9 % | 11 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| | | | | |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| North America | 997 | 1,929 | (48)% | (44)% |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| | | | | |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| China | 134 | 81 | 65 % | 81 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Hong Kong | 41 | 28 | 46 % | 58 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| India | 37 | 34 | 9 % | 9 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Singapore | 59 | 59 | - | 2 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| South Korea | 101 | 92 | 10 % | (2)% |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Other Asia | 37 | 31 | 19 % | 19 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Asia Pacific | 409 | 325 | 26 % | 26 % |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Australia | - | 75 | (100)% | (100)% |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| | | | | |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| TOTAL LIFE AND PENSIONS | 9,131 | 9,569 | (5)% | (2)% |

+-----------------------------------------------------+----------+-------------------------------+----------+-------------------------------+

| Investment sales4 | | | | |

+------------------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | | | | | |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | United Kingdom | 426 | 175 | 143 % | 143 % |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | | | | | |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | Aviva Europe | 342 | 138 | 148 % | 151% |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | Delta Lloyd3 | 173 | 162 | 7 % | 10 % |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | Europe | 515 | 300 | 72 % | 75 % |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | | | | | |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | Australia | 55 | 17 | 224 % | 189 % |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | Singapore | 47 | 82 | (43)% | (42)% |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | Asia Pacific | 102 | 99 | 3 % | 2 % |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | Australia | - | 170 | (100)% | (100)% |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | | | | | |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | Total investment sales | 1,043 | 744 | 40 % | 34 % |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | | | | | |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | TOTAL LONG-TERM SAVINGS SALES | 10,174 | 10,313 | (1)% | - |

+----------+-------------------------------+---------------------+-------------------------------+----------+-------------------------------+

| | | | | | | |

+----------+-------------------------------+----------+----------+-------------------------------+----------+-------------------------------+

1. All references to sales in this announcement refer to the present value of

new business premiums (PVNBP) unless otherwise stated.

PVNBP is the present value of new regular premiums plus 100% of single

premiums

2. Growth rates are calculated based on constant rates of exchange.

3. Delta Lloyd, which operates in the Netherlands, Belgium and Germany, is

managed independently from our other European businesses

4. Investment sales are calculated as new single premium plus the annualised

value of new regular premiums

Further analysis of the European bancassurance and retail sales are given on

page 16.

Page 12

4 - Product analysis of life, pension and investment sales

+------------------------------+------------------------------+--------+------------------------------+----------+

| | Present value of new |

| | business premiums1 |

+ +---------------------------------------------------------------------------------+

| | 3 months | 3 | % Growth |

| | 2010 | months | |

| | GBPm | 2009 | |

| | | GBPm | |

+ + + +-----------------------------------------+

| | | | Sterling | Local2 |

| | | | | currency |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Life and pensions business | | | | |

+------------------------------+------------------------------+--------+------------------------------+----------+

| | | | | |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Pensions | 941 | 989 | (5)% | (5)% |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Annuities | 877 | 475 | 85 % | 85 % |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Bonds | 412 | 713 | (42)% | (42)% |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Protection | 231 | 245 | (6)% | (6)% |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Equity release | 96 | 83 | 16 % | 16 % |

+------------------------------+------------------------------+--------+------------------------------+----------+

| United Kingdom | 2,557 | 2,505 | 2 % | 2 % |

+------------------------------+------------------------------+--------+------------------------------+----------+

| | | | | |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Pensions | 457 | 663 | (31)% | (30)% |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Savings | 3,561 | 2,803 | 27 % | 31 % |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Annuities | 20 | 29 | (31)% | (29)% |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Protection | 247 | 298 | (17)% | (15)% |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Aviva Europe | 4,285 | 3,793 | 13 % | 15 % |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Delta Lloyd3 | 883 | 942 | (6)% | (4)% |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Europe | 5,168 | 4,735 | 9 % | 11 % |

+------------------------------+------------------------------+--------+------------------------------+----------+

| | | | | |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Life | 242 | 177 | 37 % | 49 % |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Annuities | 755 | 1,752 | (57)% | (53)% |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Funding agreements | - | - | - | - |

+------------------------------+------------------------------+--------+------------------------------+----------+

| North America | 997 | 1,929 | (48)% | (44)% |

+------------------------------+------------------------------+--------+------------------------------+----------+

| | | | | |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Asia Pacific4 | 409 | 325 | 26 % | 25 % |

+------------------------------+------------------------------+--------+------------------------------+----------+

| Australia | - | 75 | (100)% | (100)% |

+------------------------------+------------------------------+--------+------------------------------+----------+

| | | | | |

+------------------------------+------------------------------+--------+------------------------------+----------+

| TOTAL LIFE AND PENSIONS | 9,131 | 9,569 | (5)% | (2)% |

+------------------------------+------------------------------+--------+------------------------------+----------+

1. Present value of new business premiums (PVNBP) is the present value of new

regular premiums plus 100% of single premiums, calculated using assumptions

consistent with those used to determine new business contribution.

2. Growth rates are calculated based on constant rates of exchange.

3. Delta Lloyd, which operates in the Netherlands, Belgium and Germany, is

managed independently from our other European businesses

4. Asia Pacific excludes the Australian life business that was sold on 1 October

2009

Page 13

5 - Analysis of sales via bancassurance channels

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | Present value of new |

| | business premiums1 |

+ +-----------------------------------------------------------------------+

| | 3 months 2010 | 3 | Sterling | Local |

| | GBPm | months | growth | currency |

| | | 2009 | | growth2 |

| | | GBPm | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Bancassurance | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| United Kingdom - RBS | 250 | 382 | (35)% | (35)% |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| France - Credit du Nord | 393 | 379 | 4 % | 7 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Ireland - Allied Irish Bank | 117 | 82 | 43 % | 46 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| UniCredit Group | 854 | 667 | 28 % | 32 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Eurovita | 217 | 66 | 229 % | 239 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Unione di Banche | 418 | 328 | 27 % | 31 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Other | 53 | 25 | 112 % | 121 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Italy | 1,542 | 1,086 | 42 % | 46 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Poland | 3 | 17 | (82)% | (84)% |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Bancaja | 180 | 188 | (4)% | (2)% |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Caixa Galicia | 45 | 65 | (31)% | (29)% |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Unicaja | 133 | 272 | (51)% | (50)% |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Caja España | 110 | 82 | 34 % | 38 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Other | 62 | 63 | (2)% | 2 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Spain | 530 | 670 | (21)% | (19)% |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Other Europe | 26 | 9 | 189 % | 189 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Aviva Europe | 2,611 | 2,243 | 16 % | 20 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Delta Lloyd 3- ABN Amro | 132 | 121 | 9% | 12% |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Europe | 2,743 | 2,364 | 16 % | 19 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| North America | - | - | - | - |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Asia Pacific | 203 | 159 | 28 % | 26 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Total life and pensions | 3,196 | 2,905 | 10 % | 12 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| Investment sales4 | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| United Kingdom - RBS | 77 | 44 | 75 % | 75 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| | | | | |

+----------------------------------------+----------------------------------------+--------+----------+----------+

| TOTAL BANCASSURANCE SALES | 3,273 | 2,949 | 11 % | 13 % |

+----------------------------------------+----------------------------------------+--------+----------+----------+

1. Present value of new business premiums (PVNBP) is the present value of new

regular premiums plus 100% of single premiums, calculated using assumptions

Consistent with those used to determine new business contribution.

2. Growth rates are calculated based on constant rates of exchange.

3. Delta Lloyd, which operates in the Netherlands, Belgium and Germany, is

managed independently from our other European businesses

4. Investment sales are calculated as new single premium plus annualised value

of new regular premiums.

Page 14

6 - Geographical analysis of regular and single premiums - life and pensions

sales

+------------+--------+----------+------+---------+--------+---------+---------+----------+--------+--------+----------+

| | Regular premiums | | Single |

| | | | premiums |

+------------+-----------------------------------------------------------------+----------+----------------------------+

| | 3 | Local | WACF | Present | 3 | WACF | Present | | 3 | 3 | Local |

| | months | currency | | value | months | | value | | months | months | currency |

| | 2010 | growth | | GBPm | 2009 | | GBPm | | 2010 | 2009 | growth |

| | GBPm | | | | GBPm | | | | GBPm | GBPm | |

+------------+--------+----------+------+---------+--------+---------+---------+----------+--------+--------+----------+

| | | | | | | | | | | | |