Yum Brands Profit Climbs, Helped by China Strength

April 20 2016 - 5:24PM

Dow Jones News

By Maria Armental

Yum Brands Inc.'s profit rose in the March quarter as its China

business continued to show signs of recovery, posting its third

consecutive quarterly increase in a key sales metric.

Citing the results, the Louisville, Ky., company raised its

projections for growth in core operating profit to 12%, adjusted

for currency conversions, from its previous target of a 10%

improvement.

Shares, up 2% over the past 12 months, rose 4% to $85.80 in

after-hours trading.

The China business, which accounts for about half of the

company's revenue and that Yum plans to spin off by year's end,

reported an 11% system sales increase, adjusted for currency

conversions, and a 6% increase at restaurants open for at least a

year, the third consecutive quarterly increase. Restaurant margin,

meanwhile, improved 3.5 percentage points to 22.4%.

In addition to planning to spin off the once fast-growing

business, which had weakened by food-safety scares and stiffer

competition, Yum is considering selling a stake in the business,

The Wall Street Journal reported last month, citing people familiar

with the situation.

As part of the planned spinoff, Yum has pledged to return $6.2

billion to shareholders before the separation is complete.

Yum was the first major Western fast-food company in China,

opening a KFC near Beijing's Tiananmen Square in 1987 and building

the brand into the largest foreign-restaurant chain in the

country.

Over all, for the period ended March 19, Yum reported a profit

of $391 million, or 93 cents a share, compared with $362 million,

or 81 cents a share. Excluding certain items, including costs tied

to the planned separation of the China business, profit rose to 95

cents a share from 80 cents a year earlier.

Revenue, which includes franchise and license fees, eased 0.1%

to $2.62 billion.

Analysts surveyed by Thomson Reuters had projected 83 cents a

share on $2.65 billion in revenue.

System sales at KFC rose 5% in the latest quarter, also adjusted

for currency conversions, while Taco Bell reported a 3% increase

and Pizza Hut a 4% increase.

Company sales declined 7% at KFC division, 3% at Taco Bell at 8%

at Pizza Hut.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

April 20, 2016 17:09 ET (21:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

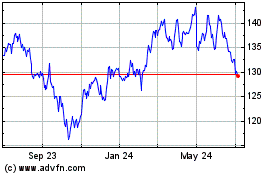

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

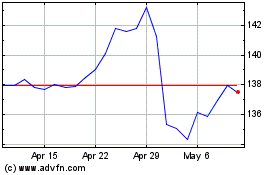

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024