Table of Contents

As filed with the Securities and Exchange Commission on January 15, 2016

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VENTAS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

61-1055020 |

|

(State or Other Jurisdiction of

Incorporation of Organization) |

|

(IRS Employer

Identification No.) |

353 N. Clark Street, Suite 3300

Chicago, Illinois 60654

(877) 483-6827

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

T. Richard Riney, Esq.

General Counsel

Ventas, Inc.

10350 Ormsby Park Place, Suite 300

Louisville, Kentucky 40223

(502) 357-9000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copy to:

Robin Panovka, Esq.

Trevor S. Norwitz, Esq.

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, New York 10019

(212) 403-1352

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x |

Accelerated filer o |

|

|

|

|

Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered |

|

Amount

to be

Registered (1) |

|

Proposed

Maximum

Offering

Price Per

Share (2) |

|

Proposed

Maximum

Aggregate

Offering Price (2) |

|

Amount of

Registration Fee (2) |

|

|

Common stock, par value $0.25 per share |

|

2,075,709 |

|

$ |

56.11 |

|

$ |

116,468,032 |

|

$ |

11,729 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended, this Registration Statement shall be deemed to cover an indeterminate number of additional shares of common stock that may become issuable as a result of stock splits, stock dividends or similar transactions pursuant to the provisions of the Amended and Restated Agreement of Limited Partnership of NHP/PMB L.P., as amended. |

|

|

|

|

(2) |

Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based upon the average of the high and low prices of the common stock reported by the New York Stock Exchange on January 12, 2016. |

Table of Contents

PROSPECTUS

VENTAS, INC.

2,075,709 Shares of Common Stock, Par Value $0.25 Per Share

This prospectus relates to the issuance, from time to time, of up to 2,075,709 shares of our common stock, par value $0.25 per share, in exchange for Class A Partnership Units (the “Class A Units”) of NHP/PMB L.P. (the “Partnership”), if and to the extent that the holders of such Class A Units tender them for redemption and we elect to issue shares of our common stock in exchange therefor, all in accordance with the terms of the Amended and Restated Agreement of Limited Partnership of NHP/PMB L.P., as amended (the “Partnership Agreement”). However, we cannot assure you that the holders of Class A Units will redeem their Class A Units or that, upon any such redemption, we will elect to pay cash rather than shares of our common stock for some or all of such Class A Units. We will not receive any cash proceeds from the issuance of shares of our common stock covered by this prospectus or upon the subsequent sale of such shares by the recipients thereof.

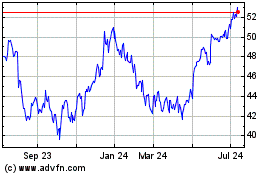

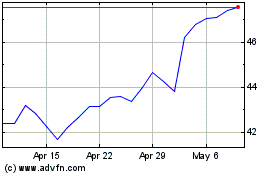

Our common stock is listed on the New York Stock Exchange under the symbol “VTR.” On January 12, 2016, the last reported sales price for our common stock was $55.89 per share.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 15, 2016.

Table of Contents

ABOUT THIS PROSPECTUS

You should read this prospectus and any accompanying prospectus supplement together with the additional information described under the heading “Where You Can Find More Information and Incorporation by Reference.” You should rely only on the information contained or incorporated by reference in this prospectus or any such prospectus supplement. We have not authorized anyone to provide you with any other information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell or soliciting an offer to buy these securities in any jurisdiction where it is unlawful. You should assume that the information in this prospectus or any accompanying prospectus supplement, as well as the information we file with the Securities and Exchange Commission (the “SEC”) and incorporate by reference in this prospectus, is accurate only as of its date or the date that is specified in the documents containing the information.

Statements contained or deemed to be incorporated by reference in this prospectus or any accompanying prospectus supplement as to the contents of any contract or other document are not necessarily complete, and in each instance we refer you to the copy of the contract or other document filed as an exhibit to a document incorporated or deemed to be incorporated by reference in this prospectus or any such prospectus supplement, each such statement being qualified in all respects by such reference.

Unless the context otherwise requires, the following terms used in this prospectus will have the meanings below:

· the terms “we,” “us,” “our,” “our company” or similar terms and “Ventas” refer to Ventas, Inc., a Delaware corporation, together with its consolidated subsidiaries;

· the term “Lillibridge” refers to Lillibridge Healthcare Services, Inc., an Illinois corporation;

· the term “Sunrise” refers to Sunrise Senior Living, LLC, a Delaware limited liability company, together with its subsidiaries;

· the term “Atria” refers to Atria Senior Living, Inc., a Delaware corporation; and

· the term “AHS” refers to Ardent Medical Services, Inc.

1

Table of Contents

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements regarding our or our tenants’, operators’, borrowers’ or managers’ expected future financial condition, results of operations, cash flows, funds from operations, dividends and dividend plans, financing opportunities and plans, capital markets transactions, business strategy, budgets, projected costs, operating metrics, capital expenditures, competitive positions, acquisitions, investment opportunities, dispositions, merger integration, growth opportunities, expected lease income, continued qualification as a real estate investment trust (“REIT”), plans and objectives of management for future operations, and statements that include words such as “anticipate,” “if,” “believe,” “plan,” “estimate,” “expect,” “intend,” “may,” “could,” “should,” “will,” and other similar expressions are forward-looking statements. These forward-looking statements are inherently uncertain, and actual results may differ from our expectations. All forward-looking statements, expressed or implied, included in this prospectus are expressly qualified in their entirety by this cautionary note. We do not undertake a duty to update these forward-looking statements, which speak only as of the date on which they are made.

Our actual future results and trends may differ materially from expectations depending on a variety of factors discussed in our filings with the SEC. These factors include without limitation:

· The ability and willingness of our tenants, operators, borrowers, managers and other third parties to satisfy their obligations under their respective contractual arrangements with us, including, in some cases, their obligations to indemnify, defend and hold us harmless from and against various claims, litigation and liabilities;

· The ability of our tenants, operators, borrowers and managers to maintain the financial strength and liquidity necessary to satisfy their respective obligations and liabilities to third parties, including without limitation obligations under their existing credit facilities and other indebtedness;

· Our success in implementing our business strategy and our ability to identify, underwrite, finance, consummate and integrate diversifying acquisitions and investments, and investments in different asset types and outside the United States;

· Macroeconomic conditions such as a disruption of or lack of access to the capital markets, changes in the debt rating on U.S. government securities, default or delay in payment by the United States of its obligations, and changes in the federal or state budgets resulting in the reduction or nonpayment of Medicare or Medicaid reimbursement rates;

· The nature and extent of future competition, including new construction in the markets in which our seniors housing communities and medical office buildings (“MOBs”) are located;

· The extent of future or pending healthcare reform and regulation, including cost containment measures and changes in reimbursement policies, procedures and rates;

· Increases in our borrowing costs as a result of changes in interest rates and other factors;

· The ability of our operators and managers, as applicable, to comply with laws, rules and regulations in the operation of our properties, to deliver high-quality services, to attract and retain qualified personnel and to attract residents and patients;

· Changes in general economic conditions or economic conditions in the markets in which we may, from time to time, compete, and the effect of those changes on our revenues, earnings and funding sources;

· Our ability to pay down, refinance, restructure or extend our indebtedness as it becomes due;

2

Table of Contents

· Our ability and willingness to maintain our qualification as a REIT in light of economic, market, legal, tax and other considerations;

· Final determination of our taxable net income for the year ending December 31, 2015;

· The ability and willingness of our tenants to renew their leases with us upon expiration of the leases, our ability to reposition our properties on the same or better terms in the event of nonrenewal or in the event we exercise our right to replace an existing tenant or manager, and obligations, including indemnification obligations, we may incur in connection with the replacement of an existing tenant or manager;

· Risks associated with our senior living operating portfolio, such as factors that can cause volatility in our operating income and earnings generated by those properties, including without limitation national and regional economic conditions, costs of food, materials, energy, labor and services, employee benefit costs, insurance costs and professional and general liability claims, and the timely delivery of accurate property-level financial results for those properties;

· Changes in exchange rates for any foreign currency in which we may, from time to time, conduct business;

· Year-over-year changes in the Consumer Price Index or the UK Retail Price Index and the effect of those changes on the rent escalators contained in our leases and on our earnings;

· Our ability and the ability of our tenants, operators, borrowers and managers to obtain and maintain adequate property, liability and other insurance from reputable, financially stable providers;

· The impact of increased operating costs and uninsured professional liability claims on our liquidity, financial condition and results of operations or that of our tenants, operators, borrowers and managers and our ability and the ability of our tenants, operators, borrowers and managers to accurately estimate the magnitude of those claims;

· Risks associated with our MOB portfolio and operations, including our ability to successfully design, develop and manage MOBs, to accurately estimate our costs in fixed fee-for-service projects and to retain key personnel;

· The ability of the hospitals on or near whose campuses our MOBs are located and their affiliated health systems to remain competitive and financially viable and to attract physicians and physician groups;

· Our ability to build, maintain and expand our relationships with existing and prospective hospital and health system clients;

· Risks associated with our investments in joint ventures and unconsolidated entities, including our lack of sole decision-making authority and our reliance on our joint venture partners’ financial condition;

· The impact of market or issuer events on the liquidity or value of our investments in marketable securities;

· Merger and acquisition activity in the seniors housing and healthcare industries resulting in a change of control of, or a competitor’s investment in, one or more of our tenants, operators, borrowers or managers or significant changes in the senior management of our tenants, operators, borrowers or managers;

· The impact of litigation or any financial, accounting, legal or regulatory issues that may affect us or our tenants, operators, borrowers or managers;

3

Table of Contents

· Changes in accounting principles, or their application or interpretation, and our ability to make estimates and the assumptions underlying the estimates, which could have an effect on our earnings; and

· Uncertainties as to the impact of our recently completed spin-off of Care Capital Properties, Inc. on our business.

Many of these factors are beyond our control and the control of our management.

We describe some of these risks and uncertainties in greater detail below under “Risk Factors” and in the risk factors that are incorporated or deemed to be incorporated by reference in this prospectus. These risks could cause actual results of our industry, or our actual results for the year 2015 and beyond, to differ materially from those expressed in any forward-looking statement we make. Our future financial performance is dependent upon factors discussed elsewhere in this prospectus and the documents incorporated by reference herein. For a discussion of factors that could cause actual results to differ, see “Risk Factors” and the risk factors and other information contained in our filings with the SEC that are incorporated or deemed to be incorporated by reference in this prospectus. These filings are described under “Where You Can Find More Information and Incorporation by Reference.”

4

Table of Contents

ABOUT VENTAS, INC.

We are an S&P 500 company that is a REIT, with a highly diversified portfolio of seniors housing and healthcare properties located throughout the United States, Canada and the United Kingdom. As of September 30, 2015, we owned approximately 1,300 properties (including properties classified as held for sale), consisting of seniors housing communities, MOBs, skilled nursing and other facilities, and hospitals, and we had one new property under development. Our company was originally founded in 1983 and is currently headquartered in Chicago, Illinois.

We primarily invest in seniors housing and healthcare properties through acquisitions and lease our properties to unaffiliated tenants or operate them through independent third-party managers. We lease properties to various healthcare operating companies under “triple-net” or “absolute-net” leases that obligate the tenants to pay all property-related expenses, including maintenance, utilities, repairs, taxes, insurance and capital expenditures, and we engage independent operators, such as Atria and Sunrise, to manage our seniors housing communities for us pursuant to long-term management agreements.

Through our Lillibridge subsidiary and our ownership interest in PMB Real Estate Services LLC, we also provide MOB management, leasing, marketing, facility development and advisory services to highly rated hospitals and health systems throughout the United States. In addition, from time to time, we make secured and unsecured loans and other investments relating to seniors housing and healthcare operators or properties.

Our principal executive offices are located at 353 North Clark Street, Suite 3300, Chicago, Illinois, 60654, and our telephone number is (877) 483-6827. We maintain a website on the Internet at www.ventasreit.com. Information on our website is not incorporated by reference herein and our web address is included in this prospectus as an inactive textual reference only.

5

Table of Contents

RISK FACTORS

Investing in our common stock will provide you with an equity ownership in Ventas. As one of our stockholders, you will be subject to risks inherent in our business. The trading price of your shares will be affected by the performance of our business relative to, among other things, competition, market conditions and general economic and industry conditions. The value of your investment may decrease, resulting in a loss.

These risks include, but are not limited to:

· the risks described below;

· the risks described in Ventas’s Annual Report on Form 10-K for the year ended December 31, 2014 and Ventas’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015, June 30, 2015 and September 30, 2015, each of which is incorporated by reference in this prospectus; and

· any risks that may be described in other filings we make with the SEC.

You should carefully consider the following factors, as well as the risk factors and other information contained in our filings with the SEC, including our most recent Annual Report on Form 10-K and our subsequently filed Quarterly Reports on Form 10-Q, that are incorporated or deemed to be incorporated by reference herein, before deciding to invest in shares of our common stock.

Risks Relating to Our Common Stock

Purchasers of our common stock could incur substantial losses.

Although our common stock is listed on the New York Stock Exchange, such listing does not provide any assurance that an active public market for the common stock will be sustained. The stock market has experienced, and could experience in the future, price and volume fluctuations that are unrelated or disproportionate to the operating performance of companies. These fluctuations, as well as general economic and market conditions, may adversely affect the market price of our common stock.

If there are sales of substantial amounts of our common stock in the future, the price of our common stock could decline.

As of January 8, 2016, we had approximately 334,342,519 shares of our common stock outstanding. Substantially all of these shares of common stock are available for immediate sale unless held by our affiliates. Sales of significant amounts of our common stock, or the perception that such sales could occur, could adversely affect prevailing market prices of the common stock.

Additional issuances of equity securities by us would dilute the ownership of our existing stockholders.

We may issue equity securities in the future in connection with acquisitions or strategic transactions, to adjust our ratio of debt to equity, including through repayment of outstanding debt, to fund expansion of our operations or for other purposes. We may issue shares of our common stock at prices or for consideration that is greater than or less than the prevailing market price of our common stock. To the extent we issue additional equity securities, your percentage ownership of our common stock would be reduced.

6

Table of Contents

USE OF PROCEEDS

We will not receive any cash proceeds from the issuance of shares of our common stock in exchange for Class A Units tendered for redemption or upon the subsequent sale of such shares of common stock by the recipients thereof. The exchange of shares of our common stock for Class A Units will increase our ownership interest in the Partnership.

7

Table of Contents

REDEMPTION OF CLASS A UNITS IN EXCHANGE FOR COMMON STOCK

Terms of the Exchange

Under the Partnership Agreement, each holder of Class A Units has the right, commencing on the first anniversary of the issuance of such Class A Units, to require the Partnership to redeem such Class A Units for cash within ten business days following written notice to the general partner of the Partnership (the “General Partner”). Upon receipt of such notice, the General Partner, in its sole and absolute discretion, may elect to assume the Partnership’s obligation with respect to the redemption and satisfy the redemption by paying the redemption price in cash, by delivering shares of our common stock, or by any combination thereof, in any case within ten business days following receipt of written notice by the holder. For more information regarding the terms of redemption, see “Description of Class A Units — Redemption Rights.” For a discussion of certain U.S. federal income tax consequences in connection with the redemption of Class A Units in exchange for shares of our common stock, see “Certain United States Federal Income Tax Consequences.”

Each limited partner that tenders Class A Units for redemption will continue to own all such Class A Units subject to redemption, and will be treated as a limited partner or assignee, as the case may be, with respect to all such Class A Units, until the earlier of (1) the date such holder receives shares of our common stock in exchange for the Class A Units and (2) ten business days following written notice to the General Partner of the exercise of the redemption right. Until a limited partner receives shares of our common stock in exchange for his or her Class A Units, the limited partner will have no rights as one of our stockholders with respect to the shares issuable under this prospectus.

Conditions to the Exchange

To effect a redemption, a limited partner must give the General Partner written notice of redemption, along with (i) such information or certification as the General Partner may reasonably require in connection with the ownership limitation and other restrictions in our Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”), that may apply to such limited partner’s acquisition of shares of our common stock and (ii) such written representations, legal opinions, investment letters or other similar instruments reasonably necessary, in the General Partner’s opinion, to comply with the Securities Act. A redemption may be effected only if each of the following conditions is satisfied or waived:

· the redemption is for at least 500 Class A Units or, if less than 500 Class A Units, all of the Class A Units held by the limited partner effecting such redemption;

· the limited partner effecting such redemption has not effected any previous redemptions in the same fiscal quarter; and

· any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, has expired or been terminated.

We will not issue shares of our common stock in exchange for Class A Units if the exchange would cause the limited partner effecting such redemption or any other person to violate the ownership limitations or any other provision set forth in our Certificate of Incorporation.

Registration Agreement

The shares of our common stock offered by this prospectus are being registered in accordance with the terms of a registration rights agreement with the holders of the Class A Units. It is possible that the holders of Class A Units will not redeem their units. It is also possible that, upon any redemption, we will elect to pay cash rather than shares of our common stock for some or all of the Class A Units. We will not receive any cash proceeds from any issuance of the shares of our common stock covered by this prospectus or upon the subsequent sale of those shares by their recipients.

8

Table of Contents

We have agreed to pay the following expenses in connection with the registration of shares of our common stock that we may elect to issue upon redemption of Class A Units:

· all registration, filing and listing fees;

· fees and disbursements of our counsel and our independent public accountants;

· fees and expenses for complying with federal and state securities or real estate syndication laws;

· fees and expenses incurred in connection with the listing of the shares of our common stock on the New York Stock Exchange;

· fees and expenses associated with any Financial Industry Regulatory Authority filing required to be made in connection with the registration statement relating to shares of our common stock issuable upon redemption of Class A Units;

· fees and expenses of other persons reasonably necessary in connection with the registration of the shares of our common stock, including any experts retained by us; and

· printing, messenger, telephone, shipping and delivery expenses.

We have no obligation to pay any out-of-pocket expenses of the holders of Class A Units, stock transfer taxes, underwriting or brokerage commissions or discounts associated with the exchange of Class A Units for shares of our common stock.

9

Table of Contents

DESCRIPTION OF COMMON STOCK

The summary set forth below describes the general terms and provisions of our common stock. It does not purport to be complete and is subject to and qualified in its entirety by reference to our Certificate of Incorporation and our Fourth Amended and Restated Bylaws, as amended (the “Bylaws”), each of which is filed or incorporated by reference as an exhibit to the registration statement of which this prospectus is a part and incorporated by reference herein. You should read our Certificate of Incorporation and Bylaws for additional information before you purchase any shares of our common stock or notify the General Partner of your election to redeem any Class A Units.

General

Our Certificate of Incorporation authorizes us to issue up to 600,000,000 shares of common stock, par value $0.25 per share. As of January 8, 2016, 334,342,519 shares of our common stock were issued and outstanding.

All shares of our common stock offered hereby, when issued, will be duly authorized, fully paid and nonassessable. Subject to the preferential rights of any other shares of our capital stock and to certain provisions of our Certificate of Incorporation, holders of shares of our common stock are entitled to receive distributions if, as and when authorized and declared by our Board of Directors out of assets legally available therefor and to share ratably in our assets legally available for distribution to our stockholders in the event of our liquidation, dissolution or winding-up after payment of, or adequate provision is made for, all of our known debts and liabilities. We currently expect to continue to make quarterly distributions, and from time to time we may make additional distributions.

Holders of shares of our common stock are entitled to one vote per share on all matters on which the holders of our common stock are entitled to vote. Holders of shares of our common stock have no conversion, sinking fund, redemption or preemptive rights, or rights to subscribe for any of our securities. Subject to certain provisions of our Certificate of Incorporation, shares of our common stock have equal distribution, liquidation and other rights.

Certain Anti-Takeover Provisions

In order to preserve our ability to maintain REIT status, our Certificate of Incorporation provides that if a person acquires beneficial ownership of more than 9%, in number or value, of the outstanding shares of our common stock, the shares that are beneficially owned in excess of the 9% limit are considered to be “excess shares.” Excess shares are automatically deemed transferred to a trust for the benefit of a charitable institution or other qualifying organization selected by our Board of Directors. The trust is entitled to all dividends with respect to the excess shares, and the trustee may exercise all voting power over the excess shares. We have the right to buy the excess shares for a purchase price equal to the lesser of (1) the price per share in the transaction that created the excess shares or (2) the market price on the date we buy the shares and we may defer payment of the purchase price for up to five years. If we do not purchase the excess shares, the trustee of the trust is required to transfer the excess shares at the direction of our Board of Directors. The owner of the excess shares is entitled to receive the lessor of the proceeds from the sale of the excess shares or the original purchase price for such excess shares and any additional amounts are payable to the beneficiary of the trust. Our Board of Directors may grant waivers from the excess share limitations.

10

Table of Contents

DESCRIPTION OF CLASS A UNITS

The following description sets forth the general terms and provisions of the Partnership Agreement. This description is subject to and qualified in its entirety by reference to the terms of the Partnership Agreement, which is filed or incorporated by reference as an exhibit to the registration statement of which this prospectus forms a part.

Certain capitalized terms used in this section are defined below under “— Certain Defined Terms.”

General

The Partnership is a limited partnership organized under the Delaware Revised Uniform Limited Partnership Act. NHP/PMB GP LLC, a Delaware limited liability company and our wholly owned, indirect subsidiary, is the General Partner. The term of the Partnership commenced on February 29, 2008, and will continue in perpetuity unless the Partnership is dissolved under the provisions of the Partnership Agreement or as otherwise provided by law. The General Partner and the limited partners of the Partnership are referred to herein, collectively, as the “Partners” and each, individually, as a “Partner.”

Interests in the Partnership are represented as either Class A Units or Class B Partnership Units (“Class B Units”). Class B Units are interests in the Partnership held by the General Partner and the limited partners who are affiliated with the General Partner, including our subsidiary, NHP Operating Partnership L.P., a Delaware limited partnership. Class A Units are interests in the Partnership held by all other limited partners. Except as expressly provided in the Partnership Agreement, Class A Units and Class B Units entitle the holders thereof to equal rights under the Partnership Agreement. As of January 8, 2016, 2,812,318 Class A Units were issued and outstanding and 6,917,009 Class B Units were issued and outstanding, all of which Class B Units were owned by our subsidiaries.

Purpose and Business

The sole purpose and nature of the business to be conducted by the Partnership is: (i) to acquire, own, manage, operate, repair, renovate, maintain, improve, expand, redevelop, finance, encumber, sell, lease, hold for appreciation, or otherwise dispose of, in accordance with the terms of the Partnership Agreement, the properties acquired pursuant to certain agreements with Pacific Medical Buildings LLC and its affiliates (collectively, the “Pacific Agreements”) and any other properties acquired by the Partnership, and to invest and ultimately distribute funds, including, without limitation, funds obtained from owning or otherwise operating properties and the proceeds from the sale or other disposition of properties, all in the manner permitted by the Partnership Agreement; (ii) to enter into any partnership, joint venture or other similar arrangement to engage in any of the foregoing or to own interests in any entity engaged in any of the foregoing, all in the manner permitted by the Partnership Agreement; and (iii) to do anything necessary or incidental to the foregoing.

Management by the General Partner

Authority of the General Partner. Except as expressly provided in the Partnership Agreement, all management powers over the business and affairs of the Partnership are exclusively vested in the General Partner. No limited partner has any right to participate in or exercise control or management power over the business and affairs of the Partnership, and no limited partner has any right, power or authority to act for or on behalf of, or otherwise bind or obligate, the Partnership. Except as expressly provided for in the Partnership Agreement or required by any non-waivable provisions of applicable law, no limited partner, in its capacity as a limited partner, has any right to vote on or consent to any matter, act, decision or document involving the Partnership and its business. The General Partner may not be removed by the limited partners with or without cause.

In addition to the powers granted a general partner of a limited partnership under applicable law or that are granted to the General Partner under any other provision of the Partnership Agreement, the General Partner, subject to the other provisions of the Partnership Agreement, has full power and authority to do all things deemed necessary or desirable by it to conduct the business of the Partnership, to exercise all powers set forth in the Partnership Agreement and to effectuate the purposes of the Partnership set forth in the Partnership Agreement. The General Partner is authorized to execute, deliver and perform specific agreements and transactions on behalf of the

11

Table of Contents

Partnership without any further act, approval or vote of the limited partners. The General Partner has the power and authority to delegate to one or more other persons the General Partner’s rights and powers to manage and control the business and affairs of the Partnership.

Restrictions on the General Partner’s Authority. The General Partner may not take any action in contravention of the Partnership Agreement. The General Partner also may not, without the prior consent or approval of limited partners holding a majority of the outstanding Class A Units (the “Consent of Class A Limited Partners”), undertake, on behalf of the Partnership, any of the following actions or enter into any transaction that would have the effect of such transactions:

· except as specifically provided in the Partnership Agreement, amend, modify or terminate the Partnership Agreement other than to reflect the admission, substitution, termination or withdrawal of Partners;

· make a general assignment for the benefit of creditors or appoint or acquiesce in the appointment of a custodian, receiver or trustee for all or any part of the assets of the Partnership;

· institute any proceeding for bankruptcy on behalf of the Partnership;

· except as specifically provided in the Partnership Agreement, admit into the Partnership any additional Partners;

· except as specifically provided in the Partnership Agreement, approve or acquiesce to the transfer of the Partnership interest of the General Partner, or admit into the Partnership any additional or successor general partners;

· acquire any properties other than the properties to be acquired pursuant to the Pacific Agreements or any property acquired in a tax-free disposition of another property, and any assets or other properties that are related to or incidental to such properties; or

· incur any debt or transfer, sell, assign or otherwise dispose of any property, whether directly or indirectly, if, after giving effect to such incurrence or transfer, sale, assignment or other disposition (a) the Partnership’s ratio of consolidated total debt to the fair market value of its properties would exceed 65% or (b) the Partnership’s ratio of (x) Available Cash for the most recent four consecutive fiscal quarters to (y) the Class A Preferred Return for such period would be less than 1.15, in each case, on a pro forma basis after giving effect to such incurrence, transfer, sale, assignment or disposition.

Additional Limited Partners. The General Partner is authorized to admit additional limited partners to the Partnership from time to time, in accordance with and subject to the terms of the Partnership Agreement, on terms and conditions and for such capital contributions as may be established by the General Partner in its reasonable discretion. No person will be admitted as an additional limited partner without the consent of the General Partner (which consent has been given to those persons to whom Class A Units may be issued pursuant to the Pacific Agreements) and the Consent of Class A Limited Partners, which consent may be given or withheld by each Partner in its sole and absolute discretion, except that the General Partner may, without the Consent of Class A Limited Partners, admit and issue Class A Units to one or more additional limited partners in connection with the closing of any transactions contemplated by the Pacific Agreements or consummated in connection therewith.

Subject to the terms and conditions of the Partnership Agreement, a person who makes a capital contribution to the Partnership in accordance with the Partnership Agreement will be admitted to the Partnership as an additional limited partner only upon furnishing to the General Partner (i) evidence of such person’s acceptance of all of the terms and conditions of the Partnership Agreement in a form reasonably satisfactory to the General Partner and (ii) such other documents and instruments as the General Partner requires in its sole and absolute discretion to effect such person’s admission as an additional limited partner.

12

Table of Contents

Additional Partnership Units

Subject to the terms and conditions of the Partnership Agreement, the General Partner is authorized to cause the Partnership from time to time to issue to the Partners (including the General Partner) or other persons (i) Class A Units or Class B Units, or (ii) additional Partnership units in one or more new classes or series, with such designations, preferences and relative, participating, optional or other special rights, powers and duties, including, rights, powers and duties senior to the holders of Class A Units that are approved with the Consent of Class A Limited Partners. No person, including, without limitation, any partner or assignee, has any preemptive, preferential, participation or similar right or rights to subscribe for or acquire any Partnership units. Without the Consent of Class A Limited Partners, except in connection with a closing under the Pacific Agreements, no additional Partnership units may be issued to the General Partner, or to an affiliate of the General Partner, unless (x) such units are Class B Units, and (y) the additional units are issued for a fair economic consideration.

Distributions

Distributions of Available Cash. On each date established by the General Partner for distributions of Available Cash, which date must be the same as the date we establish for the payment of ordinary dividends to holders of our common stock, the General Partner will cause the Partnership to distribute to the persons who were Partners on the relevant record date an amount equal to the Available Cash, if any, generated by the Partnership during the calendar quarter that ended immediately prior to the record date, as follows: (i) first, to the holders of Class A Units in accordance with each such holder’s Preferred Return Per Unit with respect to all Class A Units held by such holder, less the aggregate amount of Available Cash previously distributed with respect to such holder’s Class A Units pursuant to this clause (i); and (ii) second, 1% to the holders of Class A Units and 99% to the holders of Class B Units, in each case, allocated among the holders of such Partnership units in accordance with the weighted average number of Partnership units held by them during the calendar quarter that ended immediately prior to the record date.

Distributions of Disposition Proceeds and Financing Proceeds. In the event of either (i) a taxable disposition of any of the Partnership’s properties other than as part of a sale, transfer or other disposition of all or substantially all of the Partnership’s assets or a related series of transactions that, taken together, result in the sale or disposition of all or substantially all of the assets of the Partnership, or (ii) an incurrence of debt, the General Partner will cause the Partnership to reinvest the proceeds therefrom (including loaning such proceeds to us or one of our affiliates at an interest rate that is the same as the interest rate then in effect under our then existing credit facility and on market terms), to the extent the General Partner elects to do so and in the amount determined by the General Partner to be appropriate, and to distribute the balance of such net proceeds (after deducting all costs and expenses of the Partnership in connection therewith) as follows: (x) first, to the holders of Class A Units in accordance with their relative Preferred Return Shortfalls until the Preferred Return Shortfall for each such holder is zero; (y) second, to the holders of Class B Units in accordance with their Preferred Return Shortfalls until the Preferred Return Shortfall for each such holder is zero; and (z) third, 1% to the holders of Class A Units and 99% to the holders of the Class B Units, in each case, in proportion to the number of Partnership units held by them.

Distributions in Kind. No Partner has any right to demand or receive property other than cash. The General Partner may determine, with the Consent of Class A Limited Partners, to make a distribution in kind of Partnership assets to the holders of Partnership units.

Allocations of Net Income and Net Loss

Net income and net loss of the Partnership will be determined and allocated with respect to each taxable year or other period of the Partnership as of the end of such year or period.

Net income for a particular period will be allocated as follows: (i) first, Allocable Net Income to the holders of Class A Units and Class B Units in an amount that will cause such allocation, together with the amount of all previous allocations of Allocable Net Income pursuant to this clause (i) to be in proportion to, and to the extent of, cumulative distributions received by such Partners of Available Cash and disposition and financing proceeds for the current and all prior taxable years; (ii) second, any remaining net income, to holders of Class A Units and Class B Units in proportion to, and to the extent that, the amount of cumulative net loss previously allocated to such Partners

13

Table of Contents

exceeds the cumulative amount of net income previously allocated to such Partners pursuant to this clause (ii); and (iii) third, any remaining net income, (a) 100% to the holders of Class B Units to the extent such net income relates to or is generated by a taxable disposition of any property and (b) with respect to all other net income, 99% to the holders of Class B Units and 1% to the holders of Class A Units, on a pari passu basis.

Net loss for a particular period will be allocated 99% to the holders of Class B Units and 1% to the holders of Class A Units, on a pari passu basis.

If a Liquidating Event (as defined below under “—Dissolution and Winding Up—Dissolution”) occurs in a Partnership taxable year, net income or net loss (or, if necessary, separate items of income, gain, loss and deduction) for such taxable year and any prior taxable years (to the extent permitted under the Internal Revenue Code of 1986, as amended (the “Code”)) will be allocated among the Partners in such amounts as will cause, to the greatest extent possible, the distributions to the Partners pursuant to the Partnership Agreement to be made in accordance with the following liquidating distribution priority:

· first, to the holders of Class A Units in accordance with their relative Preferred Return Shortfalls until the Preferred Return Shortfall for each such holder is zero;

· second, to the holders of Class A Units in an amount equal to the number of Class A Units held by such holders multiplied by the fair market value of a share of our common stock as of the applicable valuation date, multiplied by the Adjustment Factor;

· third, to the holders of Class B Units in accordance with their relative Preferred Return Shortfalls until the Preferred Return Shortfall for each such holder is zero;

· fourth, to the holders of Class B Units in an amount equal to the number of Class B Units held by such holders multiplied by the fair market value of a share of our common stock as of the applicable valuation date, multiplied by the Adjustment Factor; and

· fifth, (i) 1% to the holders of Class A Units, and (ii) 99% to the holders of Class B Units, in each case, in proportion to the total number of Partnership units held by them.

Withholding

The Partnership is authorized to withhold from or pay on behalf of, or with respect to, each Partner any amount of federal, state, local or foreign taxes that the General Partner reasonably determines that the Partnership is required to withhold or pay with respect to any amount distributable or allocable to such Partner under the Partnership Agreement.

Return of Capital

Except pursuant to the rights of redemption set forth in the Partnership Agreement, no limited partner will be entitled to the withdrawal or return of its capital contribution, except to the extent of distributions made pursuant to the Partnership Agreement or upon termination of the Partnership, as provided in the Partnership Agreement. Except to the extent otherwise expressly provided in the Partnership Agreement, no limited partner or assignee will have priority over any other limited partner or assignee either as to the return of capital contributions or as to profits, losses or distributions.

Redemption Rights

At any time following the first anniversary of the issuance of a Class A Unit to a limited partner, such limited partner or its assignee will have the right to require the Partnership to redeem such Class A Unit for the Cash Amount, payable within ten business days following written notice to the General Partner of the exercise of the redemption right. The General Partner, in its sole and absolute discretion, may elect to assume the Partnership’s obligation with respect to the redemption and satisfy the redemption (i) by paying the redemption price in cash equal

14

Table of Contents

to the Cash Amount, (ii) by delivering a number of shares of our common stock equal to the REIT Shares Amount, or (iii) by any combination thereof, in any case within ten business days following the General Partner’s receipt of written notice by the holder.

In connection with a redemption, the limited partner or its assignee must submit (i) such information or certification as the General Partner may reasonably require in connection with the ownership limitation and other restrictions in the Certificate of Incorporation that may apply to such limited partner’s acquisition of shares of our common stock, and (ii) such written representations, legal opinions, investment letters or other similar instruments reasonably necessary, in the General Partner’s reasonable opinion, to comply with the Securities Act. No holder of any Class A Units may effect a redemption for less than 500 Class A Units or, if such holder holds less than 500 Class A Units, all of the Class A Units held by such holder. Furthermore, each holder of Class A Units may effect a redemption only once in each fiscal quarter.

If (i) we engage in any merger, consolidation or other combination with another entity, a sale of all or substantially all of our assets or stock, or any conversion into another form of entity, and the shares of our common stock are converted into or exchanged for stock or other securities of another entity, or cash or other property, (ii) we fail to qualify as a REIT, or (iii) shares of our common stock cease to be listed on any national securities exchange (any event described in clauses (i), (ii) or (iii) being a “Fundamental Event”), then, from and after the occurrence of such Fundamental Event and, in the case of a Fundamental Event described in (ii) or (iii) above, only for so long as we fail to qualify as a REIT or the shares of our common stock cease to be listed on a national securities exchange, respectively:

· if the shares of our common stock are converted into, or exchanged for, only common equity securities of a REIT that are listed on a national securities exchange and cash paid in lieu of fractional shares, the Class A Units will thereafter become redeemable for such new REIT shares, or cash equal to their market value; and

· in all other cases:

· upon a subsequent redemption of a Class A Unit, the holder will be entitled to receive, for each Class A Unit, in lieu of the Cash Amount or the REIT Shares Amount, cash in an amount equal to (a) if we fail to qualify as a REIT, the fair market value of a share of our common stock as of the date of such failure, (b) if the shares of our common stock cease to be listed on any national securities exchange, the fair market value of a share of our common stock, or (c) in the case of any other Fundamental Event, the fair market value of the cash, securities or other property into which shares of our common stock were converted, or for which shares of our common stock were exchanged, in each case, subject to adjustment based on changes in the value of an index of publicly-traded healthcare REITs; and

· the Preferred Return Per Unit will be subsequently calculated with a cumulative increase occurring on the 10th day of each of February, May, August and November of each year in an amount equal to the regular quarterly cash dividend most recently paid by us prior to such Fundamental Event, subject to adjustment based on changes in the regular quarterly dividend paid by a group of publicly-traded healthcare REITs.

Partnership Right to Call Class A Units

On and after the date on which the aggregate Class A Units outstanding represent less than 5% of all outstanding Partnership units, the Partnership will have the right, but not the obligation, from time to time and at any time, to redeem some or all of the outstanding Class A Units by treating the holder thereof as having exercised its redemption right under the Partnership Agreement for the amount of Class A Units specified by the General Partner, in its sole and absolute discretion. In addition, the Partnership has the right, but not the obligation, from time to time and at any time, to redeem all outstanding Class A Units by treating all holders thereof as having exercised their redemption rights under the Partnership Agreement for all of their Class A Units, on condition that, in addition to the redemption price, the Partnership pays a make-whole payment to the extent required by the Pacific Agreements.

15

Table of Contents

Transfers and Withdrawals

Restrictions on Transfer. The Partnership Agreement restricts the transferability of Class A Units. Any transfer or purported transfer of an interest in the Partnership not made in accordance with the Partnership Agreement will be null and void ab initio. Under the Partnership Agreement, subject to certain exceptions, a limited partner cannot transfer or pledge any portion of its Partnership interest or any of its economic rights as a limited partner without the prior written consent of the General Partner, which may be withheld in the General Partner’s sole discretion. A limited partner or assignee may, subject to the provisions of the Partnership Agreement, but without first obtaining the written consent of the General Partner, transfer any portion of its Partnership interest or any of its economic rights as a limited partner:

· to a partner in such limited partner or assignee in liquidation of such partner’s interest in such limited partner or assignee;

· to an immediate family member;

· to a family planning trust, a corporation, general or limited partnership, limited liability company or other legal entity in which the limited partner or assignee (together with their immediate family members) has a 50% or greater economic interest; or

· to certain charitable organizations.

In addition, a limited partner may, subject to the provisions of the Partnership Agreement, but without first obtaining the consent of the General Partner, pledge all or any portion of its Class A Units to a qualifying lending institution as collateral or security for a bona fide loan or other extension of credit and transfer such pledged Partnership interest to such lending institution in connection with the exercise of remedies under such loan or extension of credit. A limited partner pledging Class A Units must provide the Partnership with written notice of such pledge at least 20 days prior to undertaking such pledge, and must notify the Partnership of any default on the loan secured by such units promptly and of any foreclosure event with respect to any pledged Class A Units at least 10 days prior to the occurrence of such foreclosure event.

No transfer or assignment of an interest in the Partnership may be made by a Partner:

· to any person or entity who lacks the legal right, power or capacity to own a Partnership interest;

· if such transfer or assignment would, in the reasonable opinion of legal counsel to the Partnership or the General Partner, require registration under the Securities Act or would otherwise violate any applicable laws or regulations;

· of any component portion of an interest in the Partnership, such as the capital account, or rights to distributions, separate and apart from all other components of an interest in the Partnership;

· if such transfer would, based on the advice of legal counsel to the Partnership or the General Partner, adversely affect our ability to continue to qualify as a REIT or to comply with the requirements of the Code and Internal Revenue Service (“IRS”) regulations applicable to REITs or subject the General Partner or us to certain additional taxes;

· if such transfer would, in the reasonable opinion of counsel to the Partnership or the General Partner, cause a termination of the Partnership for federal or state income tax purposes (except as a result of the redemption (or acquisition by the General Partner) of all Class A Units held by all limited partners);

· if such transfer would, in the reasonable opinion of counsel to the Partnership or the General Partner, cause the Partnership to cease to be classified as a Partnership for federal income tax purposes (except as a result of the redemption (or acquisition by the General Partner) of all Class A Units held by all limited partners);

16

Table of Contents

· if such transfer would cause the Partnership to become, with respect to any employee benefit plan subject to Title I of the Employee Retirement Income Security Act (“ERISA”), a “party-in-interest” or a “disqualified person”;

· if such transfer would, in the reasonable opinion of counsel to the Partnership or the General Partner, cause any portion of the assets of the Partnership to constitute assets of any employee benefit plan;

· if such transfer requires the registration of such Partnership interest pursuant to any applicable federal or state securities laws;

· if such transfer is effectuated through an “established securities market” or a “secondary market (or the substantial equivalent thereof)” within the meaning of Section 7704 of the Code, or causes the Partnership to become a “publicly traded partnership,” unless certain conditions specified in the Partnership Agreement are satisfied; or

· if such transfer subjects the Partnership to regulation under the Investment Company Act of 1940, the Investment Advisers Act of 1940 or ERISA, each as amended.

Substituted Limited Partners. Except for a transferee permitted pursuant to the Partnership Agreement, no limited partner will have the right to substitute a transferee as a limited partner in its place. Any transferee permitted pursuant to the Partnership Agreement will be admitted to the Partnership as a substituted limited partner. In addition, the General Partner will have the right to consent to the admission of any other transferee of the interest of a limited partner as a substituted limited partner, which consent may be given or withheld by the General Partner in its sole and absolute discretion. A transferee who has been admitted as a substituted limited partner in accordance with the Partnership Agreement will have all the rights and powers and be subject to all the restrictions and liabilities of a limited partner under the Partnership Agreement.

Assignees. An assignee of a Partnership interest who is not admitted as a substitute limited partner will be entitled to all the rights of an assignee of a limited partnership interest under Delaware law, including the right to receive distributions from the Partnership and the share of net income, net losses, recapture income and any other items of gain, loss, deduction and credit of the Partnership attributable to the Partnership interest assigned to such assignee, the rights to transfer its interest in accordance with the Partnership Agreement, and the right of redemption provided in the Partnership Agreement, but will not be deemed to be a limited partner for any purpose under the Partnership Agreement, and will not be entitled to vote any Partnership units on any matter presented to the limited partners for a vote (such units will be deemed to have been voted on such matters in the same proportion as all other units held by limited partners are voted).

Withdrawals. No limited partner may withdraw from the Partnership other than: (i) as a result of a permitted transfer of all of such limited partner’s Partnership units in accordance with the Partnership Agreement; (ii) as a result of a redemption of all of such limited partner’s Partnership units in accordance with the Partnership Agreement; or (iii) pursuant to any agreement consented to by the Partnership pursuant to which the limited partner’s interests in the Partnership are conveyed and the limited partner’s withdrawal is provided for.

Restrictions on the General Partner. The General Partner may not transfer any of its general partner interest or withdraw from the Partnership except for a withdrawal or transfer effected with the Consent of Class A Limited Partners, or a transfer of all of the General Partner’s interest to an affiliate of NHP LLC so long as NHP LLC remains obligated pursuant to its guarantee obligations under the Partnership Agreement.

Amendments of the Partnership Agreement

Amendments to the Partnership Agreement may be proposed by the General Partner or by limited partners holding a majority of the outstanding Class A Units.

17

Table of Contents

Generally, the Partnership Agreement may be amended, modified or terminated only with the approval of the General Partner and the Consent of Class A Limited Partners. However, the General Partner has the power to amend the Partnership Agreement without obtaining the Consent of Class A Limited Partners to:

· add to the obligations of the General Partner or surrender any right or power granted to the General Partner or any affiliate of the General Partner for the benefit of the limited partners;

· reflect the admission, substitution, or withdrawal of Partners or the termination of the Partnership in accordance with the terms of the Partnership Agreement;

· reflect a change of an inconsequential nature that does not adversely affect the limited partners in any material respect;

· cure any ambiguity, correct or supplement any provision in the Partnership Agreement not inconsistent with law or with other provisions of the Partnership Agreement, or make other changes concerning matters under the Partnership Agreement that will not otherwise be inconsistent with the Partnership Agreement or law;

· satisfy any requirements, conditions or guidelines of any federal or state agency or contained in any federal or state law;

· reflect changes that are reasonably necessary for us to maintain our status as a REIT;

· modify the manner in which capital accounts are computed to the extent set forth in the Partnership Agreement, the Code or IRS regulations; or

· issue additional Partnership units in accordance with the Partnership Agreement.

Amendments that would convert a limited partner’s interest into a general partner interest, adversely affect the limited liability of a limited partner, alter a Partner’s right to receive any distributions or allocations of profits or losses (other than a change that is expressly permitted by the Partnership Agreement), alter or modify the redemption rights described above, alter or modify certain provisions of the Partnership Agreement restricting the General Partner’s ability to transfer its general partner interest, or change the rights described in this paragraph must be approved by each limited partner that would be adversely affected by such amendment, except that the unanimous consent of all of the limited partners that are adversely affected is not required for any amendment that affects all limited partners holding the same class or series of Partnership units on a uniform or pro rata basis.

Procedures for Actions and Consents of the Partners

Meetings of the Partners may be called by the General Partner and will be called upon the receipt by the General Partner of a written request by limited partners holding a majority of the outstanding Class A Units. Notice of any such meeting will be given to all Partners not less than seven days nor more than 30 days prior to the date of such meeting. Partners may vote in person or by proxy at such meeting. Each meeting of Partners will be conducted by the General Partner or such other person as the General Partner may appoint under such rules for the conduct of the meeting as the General Partner or such other person deems appropriate. Whenever the vote or consent of Partners is permitted or required under the Partnership Agreement, such vote or consent may be given at a meeting of Partners or without a meeting if a written consent setting forth the action so taken is signed by the General Partner and limited partners holding a majority of the outstanding Class A Units (or such other percentage as is expressly required by the Partnership Agreement).

Records and Accounting; Fiscal Year

The Partnership Agreement requires the General Partner to keep or cause to be kept at the principal office of the Partnership those records and documents required to be maintained by Delaware law and other books and records deemed by the General Partner to be appropriate with respect to the Partnership’s business. The books of

18

Table of Contents

the Partnership will be maintained, for financial and tax reporting purposes, on an accrual basis in accordance with generally accepted accounting principles in the United States (“GAAP”). The fiscal year of the Partnership is the calendar year.

Tax Matters Partner

The General Partner is the “tax matters partner” of the Partnership for U.S. federal income tax purposes. As such, the General Partner is authorized, but not required, to take certain actions on behalf of the Partnership with respect to tax matters and is responsible for the preparation and timely filing of Partnership tax returns.

Indemnification and Exculpation

To the extent permitted by applicable law, the Partnership Agreement provides that the Partnership will indemnify the General Partner, its officers, directors, members, managers, employees, agents, partners, representatives and affiliates, and other persons the General Partner may designate from and against losses and liabilities arising from claims, suits and proceedings relating to the operations of the Partnership. Similarly, the Partnership Agreement provides that neither the General Partner nor any of its partners, members, officers or directors will be liable for damages to the Partnership for losses sustained, liabilities incurred or benefits not derived as a result of errors in judgment or mistakes of fact or law, or any act or omissions if the General Partner or such partner, member, officer or director acted in good faith.

Dissolution and Winding Up

Dissolution. The Partnership will not be dissolved by the admission of substituted limited partners or additional limited partners or by the admission of a successor general partner in accordance with the terms of the Partnership Agreement. The Partnership will dissolve, and its affairs will be wound up, only upon the first to occur of any of the following (each a “Liquidating Event”):

· other than an event of bankruptcy, the incapacity of the General Partner or an event of withdrawal of the General Partner unless, within 90 days after such incapacity or event of withdrawal, the remaining Partners holding a majority in interest of the issued and outstanding Partnership units agree in writing to continue the business of the Partnership and to the appointment of a substitute general partner;

· entry of a decree of judicial dissolution of the Partnership under the provisions of Delaware law;

· any sale, transfer or other disposition of all or substantially all of the assets of the Partnership or a related series of transactions that, taken together, result in the sale or other disposition of all or substantially all of the assets of the Partnership; or

· a final and non-appealable judgment is entered by a court of competent jurisdiction ruling that the General Partner is bankrupt or insolvent, or a final and non-appealable order for relief is entered by a court with appropriate jurisdiction against the General Partner, in each case, under any federal or state bankruptcy or insolvency laws as now or hereafter in effect, unless prior to the entry of such order or judgment, the remaining Partners holding a majority in interest of the issued and outstanding Partnership units agree in writing to continue the business of the Partnership and to the appointment of a substitute General Partner.

Winding Up. Upon the occurrence of a Liquidating Event, the Partnership will continue solely for the purposes of winding up its affairs in an orderly manner, liquidating its assets and satisfying the claims of its creditors and Partners. After the occurrence of a Liquidating Event, no Partner will take any action that is inconsistent with, or not necessary to or appropriate for, the winding up of the Partnership’s business and affairs. The General Partner or, in the event that there is no remaining general partner, any person elected by a majority in interest of the limited partners (the General Partner or such other person being referred to as the “Liquidator”) will be responsible for overseeing the winding up and dissolution of the Partnership and will take full account of the Partnership’s liabilities and property, and the Partnership property will be liquidated as promptly as is consistent

19

Table of Contents

with obtaining the fair value thereof, and the proceeds therefrom will be applied and distributed in the following order: (i) first, to the satisfaction of all of the Partnership’s debts and liabilities to creditors other than the Partners and their affiliates (whether by payment or the making of reasonable provision for payment thereof); (ii) second, pari passu to the satisfaction of all of the Partnership’s debts and liabilities to the Partners and their affiliates (whether by payment or the reasonable provision for payment thereof); and (iii) the balance, if any, to the General Partner, the limited partners and their assignees in accordance with and in proportion to their positive capital account balances, after giving effect to all contributions, distributions and allocations for all periods.

If, prior to or upon dissolution of the Partnership, the Liquidator determines that an immediate sale of part or all of the Partnership’s assets would be impractical or would cause undue loss to the Partners, the Liquidator may defer for a reasonable time the liquidation of any assets, except those necessary to satisfy liabilities of the Partnership, or distribute to the Partners, in lieu of cash, as tenants in common and in accordance with the Partnership Agreement, undivided interests in such Partnership assets as the Liquidator deems not suitable for liquidation.

Adjustment Factor

We calculate that the “Adjustment Factor,” as that term is used in this prospectus and the Partnership Agreement, is currently 0.9051. However, the Adjustment Factor is subject to adjustment, in certain cases in accordance with the terms of the Partnership Agreement, if: (i) we declare or pay a stock dividend on our outstanding common stock or make a distribution of common stock to all holders of our outstanding common stock; (ii) we split or subdivide our outstanding common stock; (iii) we effect a reverse stock split or otherwise combine our outstanding common stock into a smaller number of shares of common stock; (iv) we distribute to all holders of our common stock any rights, options or warrants to subscribe for or to purchase or to otherwise acquire shares of our common stock (or other securities or rights convertible into, exchangeable for or exercisable for our common stock) at a price per share less than the fair market value of a share of our common stock on the record date for such distribution; or (v) by dividend or otherwise, we distribute to all holders of our common stock evidences of our indebtedness or assets (including securities, but excluding cash and excluding any dividend or distribution referred to in clause (i) above), other than evidences of indebtedness or assets we receive, directly or indirectly, pursuant to a distribution by the Partnership. Under certain circumstances, the Partnership may issue to each limited partner additional Class A Units (or fractions thereof) in lieu of an adjustment to the Adjustment Factor.

Certain Defined Terms

“Allocable Net Income” means, for any taxable period, an amount equal to the Partnership’s net income or net loss for such period computed without regard to the following items: (i) loss resulting from any disposition of Partnership property; and (ii) depreciation; provided, however, (x) that Allocable Net Income of the Partnership for any taxable period shall be limited to and shall not exceed the Partnership’s taxable income for such taxable period; and (y) if Allocable Net Income is a negative number, it shall be treated as zero.

“Applicable Percentage” means a percentage specified in the Partnership Agreement that varies depending on the percentage of all outstanding Partnership units that are represented by Class A Units. The Applicable Percentage ranges from 89.6% (if Class A Units represent 12.4% or less of all Partnership units) to 98.7% (if the Class A Units represent 57.5% or more of all Partnership units).

“Available Cash” means, with respect to any period for which such calculation is being made:

(a) the sum, without duplication, of:

(i) net income, if any, determined in accordance with GAAP;

(ii) depreciation and all other non-cash charges deducted in determining net income or net loss for such period;

(iii) the amount of any reduction in the reserves or other cash or similar balances referred to in clause (b)(vi) below; and

20

Table of Contents

(iv) all other cash received by the Partnership for such period that was not included in determining net income or net loss for such period;

(b) less the sum, without duplication, of:

(i) net loss, if any, determined in accordance with GAAP;

(ii) all regularly scheduled principal debt payments made by the Partnership during such period (excluding balloon payments);

(iii) capital expenditures made by the Partnership during such period for maintenance, repairs and tenant improvements but not for development or expansion;

(iv) all other expenditures and payments not deducted in determining net income or net loss for such period (excluding balloon payments on indebtedness and capital expenditures for development or expansion);

(v) any amount included in determining net income or net loss for such period that does not correspond to a cash amount actually received by the Partnership during such period; and

(vi) the amount of any reserves or other cash or similar balances (including, but not limited to, working capital reserves, debt reserve funds, and capital improvements reserves) established during such period (or if previously established, the amount of any increase therein) that the General Partner determines in good faith to be necessary or appropriate for a legitimate business purpose of the Partnership and not for the purpose of depriving limited partners of distributions of Available Cash.

Notwithstanding the foregoing, “Available Cash” does not include (i) any cash received or reductions in reserves, or take into account any disbursements made, or reserves established, after dissolution and the commencement of the liquidation and winding up of the Partnership, (ii) any capital contributions, whenever received, (iii) any proceeds from the disposition of a property or (iv) any proceeds from a financing.

“Cash Amount” means an amount of cash per Class A Unit equal to the product of (i) the fair market value of a share of our common stock multiplied by (ii) the REIT Shares Amount, determined as of the applicable valuation date.

“Partnership Record Date” means a date established by the General Partner for the determination of Partners entitled to receive distributions of Available Cash, which date shall be the same as the record date established by us for the payment of ordinary dividends to holders of our common stock.

“Preferred Return Per Unit” means with respect to each Partnership unit outstanding on a specified Partnership Record Date, an amount initially equal to zero, and increased cumulatively on each Partnership Record Date by an amount equal to the product of (i) the cash dividend per share of common stock we declare for holders of our common stock on such Partnership Record Date, multiplied by (ii) the Applicable Percentage in effect on such Partnership Record Date, multiplied by (iii) the Adjustment Factor in effect on such Partnership Record Date; provided, however, that, for each Partnership unit, the increase that shall occur in accordance with the foregoing on the first Partnership Record Date that occurs on or after the date on which such Partnership unit was first issued shall be the foregoing product of (i), (ii) and (iii) above, multiplied by a fraction, the numerator of which shall be the number of days that such Partnership unit was outstanding up to and including such first Partnership Record Date, and the denominator of which shall be the total number of days in the period from but excluding the immediately preceding Partnership Record Date to and including such first Partnership Record Date; provided, further, that the Preferred Return Per Unit may be calculated differently if a Fundamental Event occurs. If we declare a dividend on our outstanding common stock in which holders of common stock may elect to receive all or a portion of such dividend in cash, additional shares of common stock, or a combination thereof, then, for purposes of this definition, the “cash dividend per share of common stock” shall be deemed to equal the quotient obtained by dividing (x) the

21

Table of Contents