UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 3, 2015

VULCAN MATERIALS COMPANY

(Exact name of registrant as specified in its

charter)

| New Jersey |

|

001-33841 |

|

20-8579133 |

| |

|

|

|

|

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| of incorporation) |

|

|

|

|

1200 Urban Center Drive

Birmingham, Alabama 35242

(Address of principal executive offices) (zip

code)

(205) 298-3000

(Registrant's telephone number, including area

code)

Not Applicable

(Former name or former address if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations

and Financial Condition.

On August 3, 2015, the

Company announced its financial results for the second quarter ending June 30, 2015. The press release announcing the results is

furnished as Exhibit 99.1.

Item 9.01 Financial

Statements and Exhibits.

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release dated August 3, 2015. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

VULCAN MATERIALS COMPANY |

| |

(Registrant) |

| |

|

|

| Date: August 4, 2015 |

By: |

/s/ Michael R. Mills |

| |

|

Michael R. Mills |

| |

|

Senior Vice President and |

| |

|

General Counsel |

Exhibit 99.1

August 3, 2015

FOR IMMEDIATE RELEASE

Investor Contact: Mark Warren (205) 298-3220

Media Contact: David Donaldson (205) 298-3220

VULCAN

ANNOUNCES SECOND QUARTER 2015 RESULTS

Margins

Expand Despite Extreme Wet Weather

Aggregates

Pricing Momentum Continues – Pricing Up 6 Percent

Birmingham, Alabama – August 3, 2015 – Vulcan

Materials Company (NYSE:VMC), the nation's largest producer of construction aggregates, today announced results for the second

quarter ending June 30, 2015.

The Company's second quarter results reflect the continuation of

strong margin expansion and improvement in its industry-leading unit profitability in aggregates. Despite extremely wet weather

in many of our markets, second quarter revenues increased 13 percent and gross profit increased 34 percent from the prior year,

with gross profit and gross profit margins improving in all segments. Same-store aggregates shipments rose 5 percent and same-store

freight-adjusted aggregates pricing increased 6 percent from the prior year. Underlying demand recovery and pricing momentum remain

strong. Same-store incremental aggregates gross profits equaled 74 percent of incremental freight-adjusted revenues for the quarter

– and 72 percent for the trailing twelve months. Although weather impacts in the second quarter and first half may result

in full-year volumes below plan, pricing and margin improvements lead the Company to reconfirm its full-year EBITDA guidance. The

remainder of this release provides additional detail regarding the Company's second quarter results and full year outlook.

Second Quarter Summary (compared with prior year's second

quarter)

| ● | Total revenues increased $104 million, or 13 percent, to $895 million |

| ● | Gross profit increased $60 million in total, or 34 percent, to $234

million |

| ● | Aggregates freight-adjusted revenues increased $75 million, or 15

percent, to $558 million |

| o | Shipments increased 9 percent, or 3.8 million tons, to 47.5 million

tons |

| ▪ | Same-store shipments increased 5 percent, or 2.4 million tons |

| o | Segment gross profit increased $46 million, or 28 percent, to $207

million |

| o | Incremental gross profit as a percent of freight-adjusted revenues

was 61 percent |

| ▪ | On a same-store basis, this metric was 74 percent |

| o | Average freight-adjusted sales price increased 6 percent |

| ● | Asphalt Mix, Concrete and Calcium segment gross profit improved $14

million, collectively |

| ● | SAG remained in line with expectations and declined as a percentage

of total revenues |

| ● | Adjusted EBITDA was $229 million, an increase of $56 million, or 33

percent |

Page 2

August 3, 2015

FOR IMMEDIATE RELEASE

| ● | Earnings from continuing operations were $0.37 per diluted share versus

$0.35 per share in the second quarter of 2014. Included in these results are: |

| o | $0.24 per diluted share in the current year's quarter for net charges

related to debt refinancing in 2015 |

| o | $0.05 and $0.01 for net charges related to restructuring and business

development costs in 2015 and 2014 respectively |

| ● | Adjusted for these items, earnings from continuing operations were

$0.66 per diluted share in the second quarter of 2015 versus $0.36 per diluted share in the prior year |

Tom Hill, President and Chief Executive Officer, said, "The

continuing recovery in construction activity across most of our markets was masked by extremely wet weather, particularly in April

and May. Despite deferred shipments and operating cost challenges due to these weather conditions, our local teams delivered another

quarter of significant margin improvements – a pattern of performance sustained since the gradual recovery in shipments began

eight quarters ago. Customer confidence and the overall demand outlook continue to improve, and, as expected, pricing momentum

continues to strengthen. Looking forward, we remain well positioned to serve our customers and to achieve strong earnings growth

in 2015 and beyond."

Commentary on Quarterly Segment Results

Aggregates Segment

Severe wet weather disrupted shipments across many of the Company's

key markets. Same-store shipment growth of 5.4 percent in the quarter fell below both plan and recent trends. A monthly break-down

of shipping trends illustrates the weather impacts in the quarter. On a same-store basis, aggregates shipments in April and May

(when record rainfall was reported in several of our markets) increased 5 percent and 2 percent, respectively, versus the prior

year. In contrast, June same-store aggregates shipments increased 9 percent versus the prior year. Despite weather limiting available

construction days in several markets, the second quarter marked the eighth consecutive quarter of growth in trailing twelve month

shipments. For the quarter just ended, trailing twelve month shipments grew 9 percent over the prior year period on a same-store

basis. Both public and private demand for aggregates continue to recover across most of our markets; however, current consumption

levels remain well below historic trends.

Freight-adjusted average sales price for aggregates increased 6.4

percent on a same-store basis, or $0.71 per ton, versus the prior year's second quarter, with most markets realizing accelerating

price improvement. Product mix muted the impact of reported price increases in some key markets, including Virginia, where large

shipments of lower-priced fines product contributed to an approximately 1 percent decline in quarterly average selling price over

the prior year. In most markets, announced price increases have been well accepted. Customer service levels remain high, and as

noted below, the Company continues to invest to meeting rising customer requirements for product quantities and quality. Given

these and other indicators, we expect overall aggregates pricing to continue to rise throughout the year, with a higher rate of

increase in the second half.

Page 3

August 3, 2015

FOR IMMEDIATE RELEASE

Overall, aggregates operating costs approximated the prior year's

second quarter. During the second quarter, several markets experienced higher than expected costs pertaining to repair and maintenance

activities and overtime labor, with weather conditions also negatively impacting production efficiencies. Despite lower than planned

shipments in the current quarter, the company moved ahead with stripping and other expenditures geared toward meeting rising customer

demand. Diesel related cost-savings mostly offset these higher costs in the quarter. Compared to last year's second quarter, cost

of revenues for the Aggregates segment benefitted by approximately $9 million from lower fuel expenditures. The Company remains

focused, with a multi-quarter view, on balancing the several factors impacting production quality, service quality and cost. Over

the trailing twelve months, and excluding the impact of diesel price movements and newly acquired operations, aggregates unit cost

of sales have declined by approximately 1 percent.

During the second quarter, the Company's same-store unit margins

continued to expand faster than unit pricing. Gross profit per ton increased $0.76, or 21 percent, from the prior year. On a trailing

twelve month basis, same-store unit gross profit has increased 23 percent, while unit cash gross profit has increased 12 percent

to $5.04 per ton – a new twelve-month high despite cyclically low volumes. These results reflect the Company's continued

commitment to high customer service levels as well as plant-level cost controls and operating disciplines.

For the quarter, aggregates same-store freight-adjusted revenues

increased $59 million, while same-store gross profit for the segment increased $44 million, a flow-through rate of 74 percent.

Because quarterly results can be volatile due to seasonality and other factors, the Company encourages investors to also consider

longer-term trends. On a trailing-twelve-month basis, this flow-through rate has consistently exceeded the Company's stated goal

of 60 percent since volumes began to recover in the second half of 2013.

Asphalt, Concrete and Calcium Segments

In the second quarter, Asphalt segment gross profit was $21 million

versus $9 million in the prior year. This year-over-year improvement resulted from higher volumes, effective management of materials

margins, and earnings from acquisitions completed since the first half of last year. Same-store asphalt volumes increased 8 percent.

Concrete segment gross profit was $5 million versus $3 million in

the prior year's second quarter. Last year's second quarter results included the Company's California concrete business that was

divested via an asset swap in January 2015. On a same-store basis, sales volumes decreased 5 percent versus the prior year due

to unusually wet weather in Virginia and Texas. Pricing and unit profitability improved while same-store gross profit was flat

with the prior year due to the negative volume impact of wet weather.

The Company's Calcium segment reported gross profit of $1.1 million,

an improvement over the prior year.

Page 4

August 3, 2015

FOR IMMEDIATE RELEASE

In total, the year-to-date gross profit contribution of these three

segments has exceeded plan. Margin improvements resulting from both core operating disciplines and changes to our asset portfolio

have offset lower than anticipated volumes in certain markets.

Selling, Administrative and General (SAG) and Other Cost Items

Overall SAG expenses remain in line with expectations and largely

flat with the prior year. In the second quarter, legal and outside services expenses, primarily associated with business development

activities, were higher than the prior year. Although the company continues to invest in sales-related staff and support, overall

headcount-related costs were lower year-over-year. As a percentage of total revenues, SAG was approximately 80 basis points lower

than the prior year. The Company intends to further leverage SAG expenses to revenues as volumes recover.

The Company expects that full-year pension and post retirement-related

costs, a portion of which flow through SAG, will be approximately $10 million higher than the prior year due primarily to changes

in the assumptions used to value future obligations.

Other operating expense, generally consisting of various cost items

not included in cost of revenues, was $10 million versus $5 million in the second quarter of 2014. The year-over-year increase

resulted from a land parcel in California where the lease was not renewed. As a result, the associated reclamation obligation was

expensed in the second quarter. Over the past three years, other operating expenses, exclusive of significant items disclosed individually,

have averaged approximately $3 million each quarter.

Capital Allocation

During March and April, the Company completed major components of

the refinancing plan announced during its February 25, 2015 Investor Day. Refinancing expenses, including the acceleration of previously

deferred financing costs, were $67 million in total, of which $45 million, or $0.24 per diluted share, was incurred in the second

quarter and was reported as part of interest expense. The remainder ($22 million, or $0.12 per diluted share) was reported as part

of interest expense in the first quarter.

In June, the Company closed on a new $750 million unsecured credit

facility. As previously noted, the Company intends to use this credit facility to refinance the $150 million note due December

2015.

In total, the operations acquired by the Company since the first

half of 2014 contributed $11 million of EBITDA in the second quarter. These results were slightly below management expectations,

reflecting the impact of weather and marginally higher costs associated with increasing production capacity and efficiency at certain

operations.

The Company continues to pursue attractive bolt-on acquisitions.

In the second quarter, the Company completed the acquisition of three aggregates facilities and seven ready-mixed concrete operations

in Arizona and New Mexico for approximately $21 million.

Page 5

August 3, 2015

FOR IMMEDIATE RELEASE

Outlook

Regarding the Company's outlook for 2015, Mr. Hill stated, "Severe

weather in the first half of the year, particularly in the second quarter, masked improving fundamentals in construction activity.

Underlying demand remains strong and we are encouraged by the accelerating momentum in aggregates pricing throughout our markets.

As a result, we are reaffirming our expectation for Adjusted EBITDA of $775 to $825 million, driven by strong growth in aggregates

gross profit per ton, earnings improvement in our non-aggregates businesses and continuing leverage of our SAG expenses. Through

the first half of 2015, same-store aggregates volumes are up 7 percent and total aggregates pricing is up 5 percent. We expect

a higher rate of pricing growth in the second half. With respect to second half shipments, a key factor will be the ability of

our customers to recover weather-delayed volume from the first half, which can be a challenge in a growing market where scheduled

work is compressed into a shorter time period.

"Our performance in the first half of this year directly reflects

the great efforts of our people at all levels of the organization and the geographic diversification of our operational footprint.

Revenue growth is translating into expanding margins and higher unit profitability – and we intend to keep pushing for additional

improvement. We believe executing our sales and operating plans will achieve significant future earnings growth while delivering

quality products and services to our customers safely and efficiently. We remain focused on the execution of those plans."

Conference Call

Vulcan will host a conference call at 10:00 a.m. CDT on August 4,

2015. A webcast will be available via the Company's website at www.vulcanmaterials.com. Investors and other interested parties

in the U.S. may also access the teleconference live by calling 877-840-5321 approximately 10 minutes before the scheduled start.

International participants can dial 678-509-8772. The conference ID is 87603419. The conference call will be recorded and available

for replay at the Company's website approximately two hours after the call.

Vulcan Materials Company, a member of the S&P 500 Index, is

the nation's largest producer of construction aggregates, and a major producer of other construction materials.

FORWARD-LOOKING STATEMENT DISCLAIMER

This document contains forward-looking statements. Statements that

are not historical fact, including statements about Vulcan's beliefs and expectations, are forward-looking statements. Generally,

these statements relate to future financial performance, results of operations, business plans or strategies, projected or anticipated

revenues, expenses, earnings (including EBITDA and other measures), dividend policy, shipment volumes, pricing, levels of capital

expenditures, intended cost reductions and cost savings, anticipated profit improvements and/or planned divestitures and asset

sales. These forward-looking statements are sometimes identified by the use of terms and phrases such as "believe," "should,"

"would," "expect," "project," "estimate," "anticipate," "intend," "plan,"

"will," "can," "may" or similar expressions elsewhere in this document. These statements are subject

to numerous risks, uncertainties, and assumptions, including but not limited to general business conditions, competitive factors,

pricing, energy costs, and other risks and uncertainties discussed in the reports Vulcan periodically files with the SEC.

Page 6

August 3, 2015

FOR IMMEDIATE RELEASE

Forward-looking statements are not guarantees of future performance

and actual results, developments, and business decisions may vary significantly from those expressed in or implied by the forward-looking

statements. The following risks related to Vulcan's business, among others, could cause actual results to differ materially from

those described in the forward-looking statements: those associated with general economic and business conditions; the timing and

amount of federal, state and local funding for infrastructure; changes in Vulcan's effective tax rate that can adversely impact

results; the increasing reliance on information technology infrastructure for Vulcan's ticketing, procurement, financial statements

and other processes could adversely affect operations in the event such infrastructure does not work as intended or experiences

technical difficulties or is subjected to cyber attacks; the impact of the state of the global economy on Vulcan's businesses and

financial condition and access to capital markets; changes in the level of spending for private residential and private nonresidential

construction; the highly competitive nature of the construction materials industry; the impact of future regulatory or legislative

actions; the outcome of pending legal proceedings; pricing of Vulcan's products; weather and other natural phenomena; energy costs;

costs of hydrocarbon-based raw materials; healthcare costs; the amount of long-term debt and interest expense incurred by Vulcan;

changes in interest rates; the impact of Vulcan's below investment grade debt rating on Vulcan's cost of capital; volatility in

pension plan asset values and liabilities which may require cash contributions to the pension plans; the impact of environmental

clean-up costs and other liabilities relating to previously divested businesses; Vulcan's ability to secure and permit aggregates

reserves in strategically located areas; Vulcan's ability to successfully implement our new divisional structure and changes in

our management team; Vulcan's ability to manage and successfully integrate acquisitions; the potential of goodwill or long-lived

asset impairment; the potential impact of future legislation or regulations relating to climate change or greenhouse gas emissions

or the definition of minerals; and other assumptions, risks and uncertainties detailed from time to time in the reports filed by

Vulcan with the SEC. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

Vulcan disclaims and does not undertake any obligation to update or revise any forward-looking statement in this document except

as required by law.

Table A

Vulcan Materials Company

and Subsidiary Companies

| (in thousands, except per share data) |

| | |

Three Months Ended | | |

Six Months Ended | |

| Consolidated Statements of Earnings | |

June 30 | | |

June 30 | |

| (Condensed and unaudited) | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Total revenues | |

$ | 895,143 | | |

$ | 791,143 | | |

$ | 1,526,436 | | |

$ | 1,365,563 | |

| Cost of revenues | |

| 660,694 | | |

| 616,355 | | |

| 1,214,122 | | |

| 1,156,682 | |

| Gross profit | |

| 234,449 | | |

| 174,788 | | |

| 312,314 | | |

| 208,881 | |

| Selling, administrative and general expenses | |

| 69,197 | | |

| 67,615 | | |

| 135,960 | | |

| 133,733 | |

| Gain on sale of property, plant & equipment and businesses, net | |

| 249 | | |

| 1,162 | | |

| 6,624 | | |

| 237,526 | |

| Restructuring charges | |

| (1,280 | ) | |

| 0 | | |

| (4,098 | ) | |

| 0 | |

| Other operating expense, net | |

| (10,445 | ) | |

| (5,089 | ) | |

| (14,346 | ) | |

| (14,758 | ) |

| Operating earnings | |

| 153,776 | | |

| 103,246 | | |

| 164,534 | | |

| 297,916 | |

| Other nonoperating income (expense), net | |

| (439 | ) | |

| 1,798 | | |

| 542 | | |

| 4,622 | |

| Interest expense, net | |

| 83,651 | | |

| 40,551 | | |

| 146,132 | | |

| 160,639 | |

| Earnings from continuing operations before income taxes | |

| 69,686 | | |

| 64,493 | | |

| 18,944 | | |

| 141,899 | |

| Provision for income taxes | |

| 19,867 | | |

| 17,982 | | |

| 5,791 | | |

| 40,882 | |

| Earnings from continuing operations | |

| 49,819 | | |

| 46,511 | | |

| 13,153 | | |

| 101,017 | |

| Loss on discontinued operations, net of taxes | |

| (1,657 | ) | |

| (544 | ) | |

| (4,669 | ) | |

| (1,054 | ) |

| Net earnings | |

$ | 48,162 | | |

$ | 45,967 | | |

$ | 8,484 | | |

$ | 99,963 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic earnings (loss) per share | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

$ | 0.37 | | |

$ | 0.35 | | |

$ | 0.10 | | |

$ | 0.77 | |

| Discontinued operations | |

$ | (0.01 | ) | |

$ | 0.00 | | |

$ | (0.04 | ) | |

$ | (0.01 | ) |

| Net earnings | |

$ | 0.36 | | |

$ | 0.35 | | |

$ | 0.06 | | |

$ | 0.76 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted earnings (loss) per share | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

$ | 0.37 | | |

$ | 0.35 | | |

$ | 0.10 | | |

$ | 0.76 | |

| Discontinued operations | |

$ | (0.01 | ) | |

$ | 0.00 | | |

$ | (0.04 | ) | |

$ | (0.01 | ) |

| Net earnings | |

$ | 0.36 | | |

$ | 0.35 | | |

$ | 0.06 | | |

$ | 0.75 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average common shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 133,103 | | |

| 131,149 | | |

| 132,882 | | |

| 130,980 | |

| Assuming dilution | |

| 135,234 | | |

| 132,876 | | |

| 134,689 | | |

| 132,468 | |

| Cash dividends per share of common stock | |

$ | 0.10 | | |

$ | 0.05 | | |

$ | 0.20 | | |

$ | 0.10 | |

| Depreciation, depletion, accretion and amortization | |

$ | 68,384 | | |

$ | 68,323 | | |

$ | 135,108 | | |

$ | 137,702 | |

| Effective tax rate from continuing operations | |

| 28.5 | % | |

| 27.9 | % | |

| 30.6 | % | |

| 28.8 | % |

Table B

Vulcan Materials Company

and Subsidiary Companies

| (in thousands, except per share data) |

| Consolidated Balance Sheets | |

June 30 | | |

December 31 | | |

June 30 | |

| (Condensed and unaudited) | |

2015 | | |

2014 | | |

2014 | |

| | |

| | |

| | |

| |

| Cash and cash equivalents | |

$ | 74,736 | | |

$ | 141,273 | | |

$ | 227,684 | |

| Restricted cash | |

| 0 | | |

| 0 | | |

| 62,087 | |

| Accounts and notes receivable | |

| | | |

| | | |

| | |

| Accounts and notes receivable, gross | |

| 495,781 | | |

| 378,947 | | |

| 439,938 | |

| Less: Allowance for doubtful accounts | |

| (5,370 | ) | |

| (5,105 | ) | |

| (5,606 | ) |

| Accounts and notes receivable, net | |

| 490,411 | | |

| 373,842 | | |

| 434,332 | |

| Inventories | |

| | | |

| | | |

| | |

| Finished products | |

| 292,932 | | |

| 275,172 | | |

| 260,111 | |

| Raw materials | |

| 21,610 | | |

| 19,741 | | |

| 20,458 | |

| Products in process | |

| 1,461 | | |

| 1,250 | | |

| 1,104 | |

| Operating supplies and other | |

| 25,825 | | |

| 25,641 | | |

| 28,041 | |

| Inventories | |

| 341,828 | | |

| 321,804 | | |

| 309,714 | |

| Current deferred income taxes | |

| 39,562 | | |

| 39,726 | | |

| 40,858 | |

| Prepaid expenses | |

| 75,663 | | |

| 28,640 | | |

| 27,309 | |

| Assets held for sale | |

| 0 | | |

| 15,184 | | |

| 0 | |

| Total current assets | |

| 1,022,200 | | |

| 920,469 | | |

| 1,101,984 | |

| Investments and long-term receivables | |

| 41,603 | | |

| 41,650 | | |

| 42,128 | |

| Property, plant & equipment | |

| | | |

| | | |

| | |

| Property, plant & equipment, cost | |

| 6,752,916 | | |

| 6,608,842 | | |

| 6,396,658 | |

| Reserve for depreciation, depletion & amortization | |

| (3,637,392 | ) | |

| (3,537,212 | ) | |

| (3,494,896 | ) |

| Property, plant & equipment, net | |

| 3,115,524 | | |

| 3,071,630 | | |

| 2,901,762 | |

| Goodwill | |

| 3,094,824 | | |

| 3,094,824 | | |

| 3,081,521 | |

| Other intangible assets, net | |

| 767,995 | | |

| 758,243 | | |

| 633,442 | |

| Other noncurrent assets | |

| 153,737 | | |

| 154,281 | | |

| 150,001 | |

| Total assets | |

$ | 8,195,883 | | |

$ | 8,041,097 | | |

$ | 7,910,838 | |

| Liabilities | |

| | | |

| | | |

| | |

| Current maturities of long-term debt | |

| 14,124 | | |

| 150,137 | | |

| 158 | |

| Short-term debt | |

| 138,500 | | |

| 0 | | |

| 0 | |

| Trade payables and accruals | |

| 190,904 | | |

| 145,148 | | |

| 178,239 | |

| Other current liabilities | |

| 163,112 | | |

| 156,073 | | |

| 171,008 | |

| Liabilities of assets held for sale | |

| 0 | | |

| 520 | | |

| 0 | |

| Total current liabilities | |

| 506,640 | | |

| 451,878 | | |

| 349,405 | |

| Long-term debt | |

| 1,893,737 | | |

| 1,834,642 | | |

| 1,983,319 | |

| Noncurrent deferred income taxes | |

| 686,171 | | |

| 691,137 | | |

| 704,544 | |

| Deferred revenue | |

| 211,429 | | |

| 213,968 | | |

| 217,589 | |

| Other noncurrent liabilities | |

| 670,949 | | |

| 672,773 | | |

| 569,794 | |

| Total liabilities | |

$ | 3,968,926 | | |

$ | 3,864,398 | | |

$ | 3,824,651 | |

| Equity | |

| | | |

| | | |

| | |

| Common stock, $1 par value | |

| 132,984 | | |

| 131,907 | | |

| 130,910 | |

| Capital in excess of par value | |

| 2,791,232 | | |

| 2,734,661 | | |

| 2,665,793 | |

| Retained earnings | |

| 1,453,752 | | |

| 1,471,845 | | |

| 1,382,711 | |

| Accumulated other comprehensive loss | |

| (151,011 | ) | |

| (161,714 | ) | |

| (93,227 | ) |

| Total equity | |

$ | 4,226,957 | | |

$ | 4,176,699 | | |

$ | 4,086,187 | |

| Total liabilities and equity | |

$ | 8,195,883 | | |

$ | 8,041,097 | | |

$ | 7,910,838 | |

Table C

Vulcan Materials Company

and Subsidiary Companies

| (in thousands) |

| | |

Six Months Ended | |

| Consolidated Statements of Cash Flows | |

June 30 | |

| (Condensed and unaudited) | |

2015 | | |

2014 | |

| | |

| | |

| |

| Operating Activities | |

| | | |

| | |

| Net earnings | |

$ | 8,484 | | |

$ | 99,963 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities | |

| | | |

| | |

| Depreciation, depletion, accretion and amortization | |

| 135,108 | | |

| 137,702 | |

| Net gain on sale of property, plant & equipment and businesses | |

| (6,624 | ) | |

| (237,526 | ) |

| Contributions to pension plans | |

| (2,822 | ) | |

| (2,791 | ) |

| Share-based compensation | |

| 9,679 | | |

| 11,928 | |

| Excess tax benefits from share-based compensation | |

| (11,457 | ) | |

| (3,242 | ) |

| Deferred tax provision (benefit) | |

| (11,656 | ) | |

| 24 | |

| Cost of debt purchase | |

| 67,075 | | |

| 72,949 | |

| Changes in assets and liabilities before initial effects of business acquisitions and dispositions | |

| (109,790 | ) | |

| (59,893 | ) |

| Other, net | |

| (13,360 | ) | |

| 3,786 | |

| Net cash provided by operating activities | |

$ | 64,637 | | |

$ | 22,900 | |

| | |

| | | |

| | |

| Investing Activities | |

| | | |

| | |

| Purchases of property, plant & equipment | |

| (148,721 | ) | |

| (116,312 | ) |

| Proceeds from sale of property, plant & equipment | |

| 3,419 | | |

| 20,454 | |

| Proceeds from sale of businesses, net of transaction costs | |

| 0 | | |

| 719,089 | |

| Payment for businesses acquired, net of acquired cash | |

| (21,387 | ) | |

| (207 | ) |

| Increase in restricted cash | |

| 0 | | |

| (62,087 | ) |

| Other, net | |

| (334 | ) | |

| 0 | |

| Net cash provided by (used for) investing activities | |

$ | (167,023 | ) | |

$ | 560,937 | |

| | |

| | | |

| | |

| Financing Activities | |

| | | |

| | |

| Proceeds from line of credit | |

| 284,000 | | |

| 0 | |

| Payment of current maturities, long-term debt and line of credit | |

| (676,445 | ) | |

| (579,694 | ) |

| Proceeds from issuance of long-term debt | |

| 400,000 | | |

| 0 | |

| Debt and line of credit issuance costs | |

| (7,382 | ) | |

| 0 | |

| Proceeds from issuance of common stock | |

| 0 | | |

| 27,539 | |

| Dividends paid | |

| (26,549 | ) | |

| (13,074 | ) |

| Proceeds from exercise of stock options | |

| 50,769 | | |

| 12,095 | |

| Excess tax benefits from share-based compensation | |

| 11,457 | | |

| 3,242 | |

| Other, net | |

| (1 | ) | |

| 1 | |

| Net cash provided by (used for) financing activities | |

$ | 35,849 | | |

$ | (549,891 | ) |

| Net increase (decrease) in cash and cash equivalents | |

| (66,537 | ) | |

| 33,946 | |

| Cash and cash equivalents at beginning of year | |

| 141,273 | | |

| 193,738 | |

| Cash and cash equivalents at end of period | |

$ | 74,736 | | |

$ | 227,684 | |

Table D

Segment Financial Data and

Unit Shipments

| (in thousands, except per unit data) |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30 | | |

June 30 | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Total Revenues | |

| | | |

| | | |

| | | |

| | |

| Aggregates 1 | |

$ | 733,379 | | |

$ | 628,870 | | |

$ | 1,236,888 | | |

$ | 1,057,591 | |

| Asphalt Mix 2 | |

| 128,998 | | |

| 109,349 | | |

| 232,069 | | |

| 193,563 | |

| Concrete 2,3 | |

| 78,598 | | |

| 93,834 | | |

| 138,387 | | |

| 189,843 | |

| Calcium 4 | |

| 2,396 | | |

| 2,174 | | |

| 4,251 | | |

| 20,307 | |

| Segment sales | |

$ | 943,371 | | |

$ | 834,227 | | |

$ | 1,611,595 | | |

$ | 1,461,304 | |

| Aggregates intersegment sales | |

| (48,228 | ) | |

| (43,084 | ) | |

| (85,159 | ) | |

| (86,516 | ) |

| Cement intersegment sales | |

| 0 | | |

| 0 | | |

| 0 | | |

| (9,225 | ) |

| Total revenues | |

$ | 895,143 | | |

$ | 791,143 | | |

$ | 1,526,436 | | |

$ | 1,365,563 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| | | |

| | | |

| | | |

| | |

| Aggregates | |

$ | 207,285 | | |

$ | 161,706 | | |

$ | 274,950 | | |

$ | 200,184 | |

| Asphalt Mix 2 | |

| 21,135 | | |

| 9,027 | | |

| 29,953 | | |

| 13,738 | |

| Concrete 2,3 | |

| 4,892 | | |

| 3,223 | | |

| 5,702 | | |

| (6,003 | ) |

| Calcium 4 | |

| 1,137 | | |

| 832 | | |

| 1,709 | | |

| 962 | |

| Total | |

$ | 234,449 | | |

$ | 174,788 | | |

$ | 312,314 | | |

$ | 208,881 | |

| | |

| | | |

| | | |

| | | |

| | |

| Depreciation, Depletion, Accretion and Amortization | |

| | | |

| | | |

| | | |

| | |

| Aggregates | |

$ | 57,003 | | |

$ | 56,347 | | |

$ | 112,519 | | |

$ | 110,970 | |

| Asphalt Mix 2 | |

| 4,098 | | |

| 2,421 | | |

| 8,007 | | |

| 4,820 | |

| Concrete 2,3 | |

| 2,774 | | |

| 4,759 | | |

| 5,502 | | |

| 10,796 | |

| Calcium 4 | |

| 164 | | |

| 155 | | |

| 326 | | |

| 1,213 | |

| Other | |

| 4,345 | | |

| 4,641 | | |

| 8,754 | | |

| 9,903 | |

| Total | |

$ | 68,384 | | |

$ | 68,323 | | |

$ | 135,108 | | |

$ | 137,702 | |

| | |

| | | |

| | | |

| | | |

| | |

| Average Unit Sales Price and Unit Shipments | |

| | | |

| | | |

| | | |

| | |

| Aggregates | |

| | | |

| | | |

| | | |

| | |

| Freight-adjusted revenues 5 | |

$ | 558,382 | | |

$ | 483,620 | | |

$ | 938,262 | | |

$ | 807,502 | |

| Aggregates - tons 6 | |

| 47,452 | | |

| 43,648 | | |

| 80,955 | | |

| 73,276 | |

| Freight-adjusted sales price 7 | |

$ | 11.77 | | |

$ | 11.08 | | |

$ | 11.59 | | |

$ | 11.02 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other Products | |

| | | |

| | | |

| | | |

| | |

| Asphalt Mix - tons | |

| 2,480 | | |

| 1,857 | | |

| 4,248 | | |

| 3,299 | |

| Asphalt Mix - sales price | |

$ | 54.20 | | |

$ | 53.52 | | |

$ | 53.76 | | |

$ | 53.32 | |

| | |

| | | |

| | | |

| | | |

| | |

| Ready-mixed concrete - cubic yards | |

| 743 | | |

| 949 | | |

| 1,316 | | |

| 1,907 | |

| Ready-mixed concrete - sales price | |

$ | 105.79 | | |

$ | 98.82 | | |

$ | 105.12 | | |

$ | 97.10 | |

| | |

| | | |

| | | |

| | | |

| | |

| Calcium - tons | |

| 90 | | |

| 84 | | |

| 158 | | |

| 154 | |

| Calcium - sales price | |

$ | 27.07 | | |

$ | 25.55 | | |

$ | 26.87 | | |

$ | 26.23 | |

| 1 | Includes crushed stone, sand and gravel, sand, other aggregates, as well as freight, delivery and transportation revenues,

and other revenues related to services. |

| 2 | In January 2015, we exchanged our California ready-mixed concrete operations for 13 asphalt mix plants, primarily in Arizona. |

| 3 | Includes ready-mixed concrete. In March 2014, we sold our concrete business in the Florida area which in addition to ready-mixed

concrete, included concrete block, precast concrete, as well as building materials purchased for resale. See Appendix 5 for adjusted

segment data. |

| 4 | Includes cement and calcium products. In March 2014, we sold our cement business. See Appendix 5 for adjusted segment data. |

| 5 | Freight-adjusted revenues are Aggregates segment sales excluding freight, delivery and transportation revenues, and other revenues

related to services, such as landfill tipping fees that are derived from our aggregates business. |

| 6 | Includes tons marketed and sold on behalf of a third-party pursuant to volumetric production payment (VPP) agreements and tons

shipped to our down-stream operations (i.e., asphalt mix and ready-mixed concrete). |

| 7 | Freight-adjusted sales price is calculated as freight-adjusted revenues divided by aggregates unit shipments. |

Appendix 1

1. Supplemental Cash Flow

Information

Supplemental information referable to the Condensed Consolidated

Statements of Cash Flows is summarized below:

| (in thousands) |

| | |

Six Months Ended | |

| | |

June 30 | |

| | |

2015 | | |

2014 | |

| | |

| | |

| |

| Cash Payments | |

| | | |

| | |

| Interest (exclusive of amount capitalized) | |

$ | 134,215 | | |

$ | 162,110 | |

| Income taxes | |

| 31,755 | | |

| 13,867 | |

| | |

| | | |

| | |

| Noncash Investing and Financing Activities | |

| | | |

| | |

| Accrued liabilities for purchases of property, plant & equipment | |

| 13,651 | | |

| 12,482 | |

| Amounts referable to business acquisitions | |

| | | |

| | |

| Liabilities assumed | |

| 2,426 | | |

| 755 | |

| Fair value of noncash assets and liabilities exchanged | |

| 20,000 | | |

| 0 | |

| Fair value of equity consideration | |

| 0 | | |

| 1,094 | |

2. Reconciliation of Non-GAAP

Measures

Gross profit margin excluding freight and delivery revenues

is not a Generally Accepted Accounting Principle (GAAP) measure. We present this metric as it is consistent with the basis by which

we review our operating results. Likewise, we believe that this presentation is consistent with the basis by which investors analyze

our operating results considering that freight and delivery services represent pass-through activities. Reconciliation of this

metric to its nearest GAAP measure is presented below:

Gross Profit Margin in Accordance with GAAP

| (dollars in thousands) |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30 | | |

June 30 | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Gross profit | |

$ | 234,449 | | |

$ | 174,788 | | |

$ | 312,314 | | |

$ | 208,881 | |

| Total revenues | |

$ | 895,143 | | |

$ | 791,143 | | |

$ | 1,526,436 | | |

$ | 1,365,563 | |

| Gross profit margin | |

| 26.2 | % | |

| 22.1 | % | |

| 20.5 | % | |

| 15.3 | % |

Gross Profit Margin Excluding Freight and Delivery Revenues

| (dollars in thousands) |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30 | | |

June 30 | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Gross profit | |

$ | 234,449 | | |

$ | 174,788 | | |

$ | 312,314 | | |

$ | 208,881 | |

| Total revenues | |

$ | 895,143 | | |

$ | 791,143 | | |

$ | 1,526,436 | | |

$ | 1,365,563 | |

| Freight and delivery revenues 1 | |

| 136,527 | | |

| 126,807 | | |

| 242,899 | | |

| 215,747 | |

| Total revenues excluding freight and delivery revenues | |

$ | 758,616 | | |

$ | 664,336 | | |

$ | 1,283,537 | | |

$ | 1,149,816 | |

| Gross profit margin excluding freight and delivery revenues | |

| 30.9 | % | |

| 26.3 | % | |

| 24.3 | % | |

| 18.2 | % |

1 Includes freight to remote distributions sites.

Appendix 2

Reconciliation of Non-GAAP

Measures (Continued)

Aggregates segment gross profit margin as a percentage of freight-adjusted

revenues is not a GAAP measure. We present this metric as it is consistent with the basis by which we review our operating results.

We believe that this presentation is more meaningful to our investors as it excludes freight, delivery and transportation revenues

which are pass-through activities. It also excludes immaterial other revenues related to services, such as landfill tipping fees,

that are derived from our aggregates business. Incremental gross profit as a percentage of freight-adjusted revenues represents

the year-over-year change in gross profit divided by the year-over-year change in freight-adjusted revenues. Reconciliation of

these metrics to their nearest GAAP measures are presented below:

Aggregates Segment Gross Profit Margin in Accordance with

GAAP

| (dollars in thousands) |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30 | | |

June 30 | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Aggregates segment | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

$ | 207,285 | | |

$ | 161,706 | | |

$ | 274,950 | | |

$ | 200,184 | |

| Segment sales | |

$ | 733,379 | | |

$ | 628,870 | | |

$ | 1,236,888 | | |

$ | 1,057,591 | |

| Gross profit margin | |

| 28.3 | % | |

| 25.7 | % | |

| 22.2 | % | |

| 18.9 | % |

| Incremental gross profit margin | |

| 43.6 | % | |

| | | |

| 41.7 | % | |

| | |

Aggregates Segment Gross Profit as a Percentage of Freight-Adjusted

Revenues

| (dollars in thousands) |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30 | | |

June 30 | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Aggregates segment | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

$ | 207,285 | | |

$ | 161,706 | | |

$ | 274,950 | | |

$ | 200,184 | |

| Segment sales | |

$ | 733,379 | | |

$ | 628,870 | | |

$ | 1,236,888 | | |

$ | 1,057,591 | |

| Excluding: | |

| | | |

| | | |

| | | |

| | |

| Freight, delivery and transportation revenues 1 | |

$ | 170,516 | | |

$ | 139,206 | | |

$ | 287,914 | | |

$ | 239,749 | |

| Other revenues | |

| 4,481 | | |

| 6,044 | | |

| 10,712 | | |

| 10,340 | |

| Freight-adjusted revenues | |

$ | 558,382 | | |

$ | 483,620 | | |

$ | 938,262 | | |

$ | 807,502 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit as a percentage of freight-adjusted revenues | |

| 37.1 | % | |

| 33.4 | % | |

| 29.3 | % | |

| 24.8 | % |

| Incremental gross profit as a percentage of freight-adjusted revenues | |

| 61.0 | % | |

| | | |

| 57.2 | % | |

| | |

| 1 | At the segment level, freight, delivery and transportation revenues include intersegment freight & delivery revenues, which

are eliminated at the consolidated level. |

Appendix 3

Reconciliation of Non-GAAP

Measures (Continued)

GAAP does not define "free cash flow," "Aggregates

segment cash gross profit" and "Earnings Before Interest, Taxes, Depreciation and Amortization" (EBITDA). Thus,

free cash flow should not be considered as an alternative to net cash provided by operating activities or any other liquidity measure

defined by GAAP. Likewise, Aggregates segment cash gross profit and EBITDA should not be considered as alternatives to earnings

measures defined by GAAP. We present these metrics for the convenience of investment professionals who use such metrics in their

analyses and for shareholders who need to understand the metrics we use to assess performance and to monitor our cash and liquidity

positions. The investment community often uses these metrics as indicators of a company's ability to incur and service debt and

to assess the operating performance of a company's businesses. We use free cash flow, Aggregates segment cash gross profit, EBITDA

and other such measures to assess liquidity and the operating performance of our various business units and the consolidated company.

Additionally, we adjust EBITDA for certain items to provide a more consistent comparison of performance from period to period.

We do not use these metrics as a measure to allocate resources. Reconciliations of these metrics to their nearest GAAP measures

are presented below:

Free Cash Flow

Free cash flow deducts purchases of property, plant & equipment

from net cash provided by operating activities.

| (in thousands) |

| | |

Six Months Ended | |

| | |

June 30 | |

| | |

2015 | | |

2014 | |

| | |

| | |

| |

| Net cash provided by operating activities | |

$ | 64,637 | | |

$ | 22,900 | |

| Purchases of property, plant & equipment | |

| (148,721 | ) | |

| (116,312 | ) |

| Free cash flow | |

$ | (84,084 | ) | |

$ | (93,412 | ) |

Aggregates Segment Cash Gross Profit

Aggregates segment cash gross profit adds back noncash charges

for depreciation, depletion, accretion and amortization (DDA&A) to Aggregates segment gross profit.

| (in thousands) |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30 | | |

June 30 | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Aggregates segment | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

$ | 207,285 | | |

$ | 161,706 | | |

$ | 274,950 | | |

$ | 200,184 | |

| DDA&A | |

| 57,003 | | |

| 56,347 | | |

| 112,519 | | |

| 110,970 | |

| Aggregates segment cash gross profit | |

$ | 264,288 | | |

$ | 218,053 | | |

$ | 387,469 | | |

$ | 311,154 | |

Appendix 4

Reconciliation of Non-GAAP

Measures (Continued)

EBITDA and Adjusted EBITDA

EBITDA is an acronym for Earnings Before Interest, Taxes, Depreciation

and Amortization and excludes discontinued operations. We adjust EBITDA for certain items to provide a more consistent comparison

from period to period.

| (in thousands) |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30 | | |

June 30 | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Reconciliation of Net Earnings to EBITDA | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Net earnings | |

$ | 48,162 | | |

$ | 45,967 | | |

$ | 8,484 | | |

$ | 99,963 | |

| Provision for income taxes | |

| 19,867 | | |

| 17,982 | | |

| 5,791 | | |

| 40,882 | |

| Interest expense, net | |

| 83,651 | | |

| 40,551 | | |

| 146,132 | | |

| 160,639 | |

| Loss on discontinued operations, net of taxes | |

| 1,657 | | |

| 544 | | |

| 4,669 | | |

| 1,054 | |

| EBIT | |

$ | 153,337 | | |

$ | 105,044 | | |

$ | 165,076 | | |

$ | 302,538 | |

| Depreciation, depletion, accretion and amortization | |

| 68,384 | | |

| 68,323 | | |

| 135,108 | | |

| 137,702 | |

| EBITDA | |

$ | 221,721 | | |

$ | 173,367 | | |

$ | 300,184 | | |

$ | 440,240 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA and Adjusted EBIT | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| EBITDA | |

$ | 221,721 | | |

$ | 173,367 | | |

$ | 300,184 | | |

$ | 440,240 | |

| Gain on sale of real estate and businesses | |

| 0 | | |

| (1,087 | ) | |

| (5,886 | ) | |

| (237,107 | ) |

| Charges associated with acquisitions and divestitures | |

| 2,608 | | |

| 1,832 | | |

| 5,037 | | |

| 10,939 | |

| Asset impairment | |

| 5,190 | | |

| 0 | | |

| 5,190 | | |

| 0 | |

| Amortization of deferred revenue | |

| (1,558 | ) | |

| (1,357 | ) | |

| (2,539 | ) | |

| (2,341 | ) |

| Restructuring charges | |

| 1,280 | | |

| 0 | | |

| 4,098 | | |

| 0 | |

| Adjusted EBITDA | |

$ | 229,241 | | |

$ | 172,755 | | |

$ | 306,084 | | |

$ | 211,731 | |

| Depreciation, depletion, accretion and amortization | |

| (68,384 | ) | |

| (68,323 | ) | |

| (135,108 | ) | |

| (137,702 | ) |

| Amortization of deferred revenue | |

| 1,558 | | |

| 1,357 | | |

| 2,539 | | |

| 2,341 | |

| Adjusted EBIT | |

$ | 162,415 | | |

$ | 105,789 | | |

$ | 173,515 | | |

$ | 76,370 | |

Appendix 5

Adjusted Concrete and

Calcium Segment Financial Data

Comparative financial data after adjusting for both the January

2015 exchange of our California concrete business and the March 2014 sale of our concrete and cement businesses in the Florida

area is presented below:

| (in thousands) |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

2015 | | |

2014 | |

| | |

YTD

1 | | |

Q1 | | |

Q1 | | |

Q2 | | |

Q3 | | |

Q4 | |

| Concrete Segment | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Segment sales | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As reported | |

$ | 138,387 | | |

$ | 59,789 | | |

$ | 96,009 | | |

$ | 93,834 | | |

$ | 98,949 | | |

$ | 87,014 | |

| Adjusted | |

| 133,273 | | |

| 54,675 | | |

| 48,186 | | |

| 74,360 | | |

| 79,697 | | |

| 70,316 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total revenues | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As reported | |

$ | 138,387 | | |

$ | 59,789 | | |

$ | 96,009 | | |

$ | 93,834 | | |

$ | 98,949 | | |

$ | 87,014 | |

| Adjusted | |

| 133,273 | | |

| 54,675 | | |

| 48,186 | | |

| 74,360 | | |

| 79,697 | | |

| 70,316 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As reported | |

$ | 5,702 | | |

$ | 810 | | |

$ | (9,226 | ) | |

$ | 3,221 | | |

$ | 5,486 | | |

$ | 2,753 | |

| Adjusted | |

| 6,494 | | |

| 1,602 | | |

| (4,370 | ) | |

| 4,921 | | |

| 7,161 | | |

| 4,245 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation, depletion, accretion and amortization | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As reported | |

$ | 5,502 | | |

$ | 2,728 | | |

$ | 6,037 | | |

$ | 4,686 | | |

$ | 4,955 | | |

$ | 4,214 | |

| Adjusted | |

| 5,402 | | |

| 2,628 | | |

| 3,930 | | |

| 3,905 | | |

| 4,239 | | |

| 3,577 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shipments - cubic yards | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As reported | |

| 1,316 | | |

| 573 | | |

| 958 | | |

| 949 | | |

| 978 | | |

| 847 | |

| Adjusted | |

| 1,260 | | |

| 517 | | |

| 483 | | |

| 733 | | |

| 765 | | |

| 668 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Calcium Segment | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Segment sales | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As reported | |

$ | 4,251 | | |

$ | 1,855 | | |

$ | 18,133 | | |

$ | 2,174 | | |

$ | 2,273 | | |

$ | 2,451 | |

| Adjusted | |

| 4,251 | | |

| 1,855 | | |

| 2,137 | | |

| 2,174 | | |

| 2,273 | | |

| 2,451 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total revenues | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As reported | |

$ | 4,251 | | |

$ | 1,855 | | |

$ | 8,908 | | |

$ | 2,174 | | |

$ | 2,273 | | |

$ | 2,451 | |

| Adjusted | |

| 4,251 | | |

| 1,855 | | |

| 2,165 | | |

| 2,174 | | |

| 2,273 | | |

| 2,451 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As reported | |

$ | 1,709 | | |

$ | 572 | | |

$ | 130 | | |

$ | 949 | | |

$ | 989 | | |

$ | 1,131 | |

| Adjusted | |

| 1,709 | | |

| 572 | | |

| 424 | | |

| 949 | | |

| 989 | | |

| 1,131 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation, depletion, accretion and amortization | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As reported | |

$ | 326 | | |

$ | 162 | | |

$ | 1,058 | | |

$ | 191 | | |

$ | 157 | | |

$ | 148 | |

| Adjusted | |

| 326 | | |

| 162 | | |

| 97 | | |

| 191 | | |

| 157 | | |

| 148 | |

1 Year-to-date 2015 amounts include adjustments for

Q1 2015 transactions. There were no adjustments for Q2 2015.

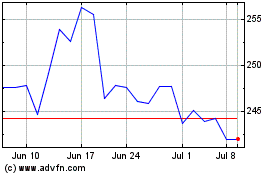

Vulcan Materials (NYSE:VMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

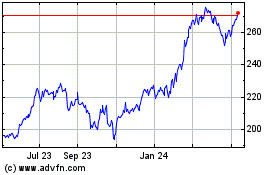

Vulcan Materials (NYSE:VMC)

Historical Stock Chart

From Apr 2023 to Apr 2024