Reports that some banks have dropped out of the debt financing

for the rumored EUR25 billion leveraged buyout of Spanish

infrastructure group Abertis (ABE.MC) have underscored why

widespread LBO chatter from earlier in the year has hasn't yet

reached fever pitch.

LBO talk grew in March but has since diminished with increased

market volatility, leaving some market participants speculating

there is now more likelihood of strategic mergers and

acquisitions.

"The LBO screens keep coming around, and at any given time you

have companies that meet the criteria, but there is more wishful

thinking than anything," said Marty Fridson, global credit

strategist at BNP Paribas Asset Management.

Concern about the mounting debt of some European governments and

the potential effect that may have on banks owning that debt have

"put a damper on things, so whatever prospects were there were

dimmed by the upsurge in sovereign risk concerns," Fridson

added.

Financial sponsors are looking at LBO deals, but banks are being

pulled in two directions--risk appetite is recovering, with

shareholders demanding better returns at the same time regulators

are requiring banks to hold more capital against their assets. That

means they either have to lend at a slower pace or be more

disciplined about putting capital to work, favoring LBOs, where

fees are greater, over corporate financing.

Many banks have had trouble tapping debt markets themselves, let

alone to finance LBOs, said Olivia Frieser, a BNP credit analyst in

London covering European banks. "The market's been very difficult

or almost closed for about a month now, so it's not as easy or

obvious now," she said.

J.P. Morgan just lowered its forecast for second- and

third-quarter U.S. GDP to 3.2% and 3%, respectively, from 4%

previously in each case.

A spokesman for Abertis declined to comment, and representatives

of each member of the rumored buyout consortium--CVC Capital

Partners, Actividades de Construccion y Servicios SA (ACS.MC) and

Criteria, the investment arm of the Spanish savings bank La

Caixa--didn't return calls. The debt portion of the financing has

reportedly been cut to EUR5 billion from EUR8 billion, leaving the

sponsors to write a larger equity check.

Fidelity National Information Services (FIS) had been an LBO

target, but after those talks broke down, it came to market Tuesday

with $1.2 billion in new bonds and got loan to help fund part of a

$2.5 billion stock buyback and refinance debt from its acquisition

of Metavante Technologies (MV).

While not yet a trend, some point to that as a sign that

companies will increasingly find LBO alternatives on their own.

"There were lots of companies wondering after the 2006 and 2007

[LBO boom] why they didn't just lever up and do it themselves,"

said Adam Cohen, founder of Covenant Review, a research firm

focused on corporate bond covenants.

In mid-March, LBO rumors were fueled by pressure on

private-equity firms to put cash to work, a narrowing of credit

spreads, an increased demand for high-yield debt, and weakening

covenants. Existing debt was also trading at depressed prices, so

holders were agreeing to participate in tenders and exchanges more

readily, said Brian Yelvington, director of fixed-income research

at Knight Capital.

At the time, Barclays Capital suggested that possible LBO

targets would have had market capitalizations of no more than $7

billion based on equity contributions of 35% to 40% of the total

enterprise value and the institutional loan market not being able

to digest more than $2.5 billion in new debt. One LBO screen that

appeared on financial news website ZeroHedge.com listed 30

unconfirmed targets, and their average market cap was $6.7

billion.

Now the consensus is more like $10 billion, said Cohen, but

valuations don't seem to be attractive enough relative to

companies' earnings prospects to make LBOs a foregone

conclusion.

There have been $80.8 billion in global buyouts this year,

according to data provider Dealogic, on par with the $81.4 billion

for all of 2009 but far less than the $190.9 billion for 2008. The

largest of these was an all-cash bid in May for Extended Stay

Hotels, valued at $3.925 billion. Private equity exits in June via

trade sales to other strategic buyers or other financial sponsors

were the highest since June 2008.

When a company becomes the subject of LBO rumors, traders can

profit from the news as the risk premium, or spread, on the

acquiring company's bonds widen and the cost to insure its debt

increases because of the anticipated increased indebtedness;

meanwhile, the target company's spreads tighten.

Risk premiums are the extra return investors demand over

super-safe Treasurys to compensate for the additional default risk

of corporate debt. The premiums grow as the value of the underlying

securities falls.

Examples of this include Kraft Foods Inc.'s (KFT) purchase of

Cadbury Plc (CBRY.LN) and the rumored buyout of trash bags maker

Pactiv Corp (PAC). Credit default swaps to insure debt issued by

Kraft and Cadbury were trading around the same level in late

January, around 76 basis points--equivalent to $76,000 per year to

insure $10 million, according to CMA DataVision. But spreads on

both began to diverge as the acquisition progressed and was

confirmed.

Similarly, CDS spreads on Pactiv widened to 301 basis points

from 141.6 between May 14 and May 17 after a report in The Wall

Street Journal about Apollo Management and other potential

acquirers circling the company. Other names on LBO screens are US

Cellular (USM), Autozone (AZO), Supervalu (SVU), Lexmark (LXK) and

Western Union (WU).

Sponsors may begin to feel more confident about deals with

improved macroeconomic data and a better-than-expected

second-quarter earnings season. But uncertainty about the global

economic recovery and their ability to raise the necessary capital

has made it harder to complete deals, at least for now. Even

traditional M&A activity has slowed as companies choose a more

defensive route of paying down debt.

Some 46% of U.S. high-yield issuance proceeds have been used to

repay outstanding debt so far in 2010, compared with 36% in 2009,

according to Knight Research. Meanwhile, 19% of issue proceeds have

been used to pay down loans, compared with 25% in 2009.

-By Katy Burne, Dow Jones Newswires; 212-416-3084;

katy.burne@dowjones.com

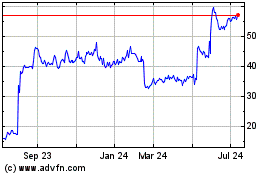

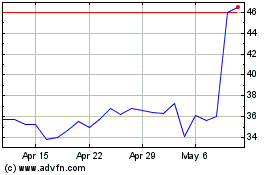

US Cellular (NYSE:USM)

Historical Stock Chart

From Aug 2024 to Sep 2024

US Cellular (NYSE:USM)

Historical Stock Chart

From Sep 2023 to Sep 2024