Union Pacific Profit Falls 19% as Demand Remains Under Pressure -- Update

July 21 2016 - 4:43PM

Dow Jones News

By Imani Moise and Tess Stynes

Union Pacific Corp. said its second-quarter earnings fell 19% as

freight demand remains pressured, a trend the railroad operator

expects to continue throughout the second half of the year.

Chief Executive Lance Fritz cited the negative impact of the

strong U.S. dollar on exports, and relatively weak demand for

consumer goods. In an interview, he also said business was being

affected by competition due to excess capacity in all modes of

freight transport, including barges, trucking, shipping and

rail.

"To varying degrees all of our commodities are subject to modal

competition," Mr. Fritz said. A vast amount of commodities

transported by rail are subject to competition from trucks, he

said, and some commodities that can't, such as grain, can be

carried by barge.

Mr. Fritz said he expects capacity surpluses to tighten over

time, due to shipping consolidations and driver shortages.

Freight revenue dropped 13% as weaker freight volume and fuel

surcharge revenue more than offset higher core pricing.

Union Pacific took a $240 million hit on fuel surcharge revenue

in the second quarter compared with last year. However, Mr. Fritz

said during a call with analysts Thursday that the trend is

beginning to turn around as fuel prices get higher. "Assuming fuel

prices remain where they are today we will collect fuel surcharge

revenue at some level on almost all of our programs going forward,"

he said.

Although consumer spending surged this spring, railroads have

not felt the effects, Mr. Fritz said.

"If consumers are consuming more services like travel, data

plans or health care, that doesn't really impact our top line," he

said. "We need consumers to buy a house and fill it with

goods."

The company said it is considering a reduction in ongoing future

capital spending to about 15% of revenue from roughly 17% of

revenue.

It said its operating ratio rose 1.1 percentage point to 65.2%.

In the long run, the company expects to reach its goal of 60% by

2019.

For the three months ended June 30, Union Pacific's total

freight volume fell 11% as a 2% increase in shipments of

agricultural products was offset by declines in volume for other

commodities. Coal volume slumped 21% and industrial products volume

dropped 11%. Volume in its intermodal business, which moves freight

using a combination of trains and trucks, fell 14%.

In April, Union Pacific said it expected total volumes for the

year to decline in the mid-single digits.

Over all, Union Pacific reported a profit of $979 million, or

$1.17 a share, down from $1.2 billion, or $1.38 a share, a year

earlier. Revenue decreased 12% to $4.77 billion.

Analysts polled by Thomson Reuters expected per-share profit of

$1.17 and revenue of $4.8 billion.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

July 21, 2016 16:28 ET (20:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

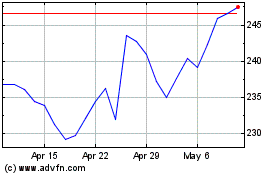

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

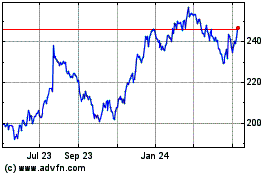

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024