Canadian National Railway Reports Higher Profit, Boosts Dividend

January 26 2016 - 5:40PM

Dow Jones News

Canadian National Railway Co. on Tuesday reported a higher

fourth-quarter profit and raised its dividend, bucking a weak trend

among major North American railroads.

The Montreal-based railroad operator said it earned 941 million

Canadian dollars ($669 million), or C$1.18 a share, up from C$844

million, or C$1.03, a year earlier. The latest results beat analyst

expectations, which were for earnings of C$1.11 a share, according

to Thomson Reuters.

Global economic uncertainty and slumping commodity prices have

weighed on the results of North America's big railroads. Last week,

Canadian Pacific Railway Co. and Union Pacific Corp. posted

lower-than-expected quarterly results on weak volumes.

CN credited its "industry-leading" efficiency for its strong

performance in a weak volume environment.

Its operating ratio—a measure of railway performance—improved to

57.2% from 60.7% a year earlier. The ratio indicates the percentage

of operating revenue consumed by operating costs, so a decrease is

an improvement.

CN said revenue fell 1% to C$3.17 billion. While revenue rose in

sectors including automotive,forest products and intermodal, it

fell in metals and minerals, coal, and petroleum and chemicals.

Carloadings overall declined 8%, but the railway said its operating

costs fell 7%.

The company said it met its guidance for double-digit

earnings-per-share growth in 2015, earning C$4.44 a share on an

adjusted basis versus C$3.76in 2014.

It said it expects to deliver mid-single digit

earnings-per-share growth in 2016.

Additionally, the company raised its quarterly dividend by 20%

to 37.5 Canadian cents a share.

Write to Carolyn King at carolyn.king@wsj.com

(END) Dow Jones Newswires

January 26, 2016 17:25 ET (22:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

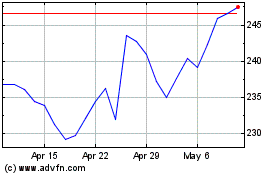

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

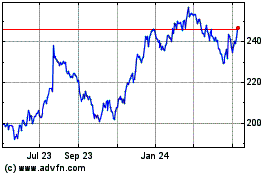

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024