Airbus Helicopter Deliveries Up Over 5% in 2016's Tough Market

January 27 2017 - 3:59AM

Dow Jones News

By Robert Wall

LONDON--Airbus SE (AIR.FR) helicopter deliveries rose more than

5% in 2016 in a difficult year marred by a sustained slump in

commercial customer demand and the widespread grounding of one of

the European rotorcraft maker's most lucrative models.

Airbus, principally known for its large jetliner business that

competes with Boeing Co. (BA), Friday said it delivered 418

helicopters last year, up from 395 the year prior.

The prolonged slump in oil and gas prices that began mid-2014

caused exploration companies to curtail spending. That forced

helicopter makers that ferry oil workers to offshore rigs to cut

back and reduce purchases of new models.

"For the rotorcraft industry as a whole, 2016 was probably the

most difficult year of the last decade," Airbus Helicopter Chief

Executive Guillaume Faury said.

The industry's woes were compounded at Airbus after one of its

Super Pumas crashed in Norway in April killing all 13 people on

board. The tragedy grounded much of the Super Puma fleet used

heavily in servicing North Sea rigs. British and Norwegian

authorities still haven't allowed the type to resume flying in

commercial operations, though some regulators lifted restrictions

imposed immediately after the incident.

Marillyn Hewson, CEO of Lockheed Martin Corp. (LMT), which

acquired helicopter maker Sikorsky in 2015, this week said: "We do

expect at some point, the commercial business will come back." She

called the area an "opportunity for growth."

Signs of recovery may be emerging. Scott C. Donnelly, CEO of

Textron Inc. (TXT), which owns helicopter maker Bell, this week

told investors that "after a difficult period in the market with

several quarters of very low order flow, we saw a significant

increase in order activity in the back half of 2016, and we're

looking to carry that momentum into 2017." Demand for foreign

military helicopters also should gain pace, he said, with the Trump

administration now in place. Momentum for some of those deals

slowed during the transition period in Washington.

Airbus also saw signs the market for rotorcraft is no longer

worsening. Fewer customers last year cancelled orders. Airbus

suffered 35 helicopter cancellations last year for a net order

intake of 353 units. Last year its net order intake of 333

helicopters reflected 50 cancellations.

To help damp the effect of a slump in commercial business,

Airbus has been ramping up efforts to secure more military work.

The company said it last year won deals in Singapore and Kuwait for

a military version of the embattled Super Puma. It also secured a

deal for U.K. military training helicopters.

Airbus exited 2016 with a backlog of 766 helicopters, it

said.

-Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

January 27, 2017 03:44 ET (08:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

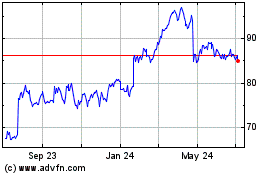

Textron (NYSE:TXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Textron (NYSE:TXT)

Historical Stock Chart

From Apr 2023 to Apr 2024