Senate Republicans Block Bid To Raise Oil-Spill-Damages Limit

May 13 2010 - 3:36PM

Dow Jones News

An effort by a few Senate Democrats to raise the cap on damage

claims that BP Plc (BP) must pay for a a Gulf of Mexico oil spill

was blocked on Thursday after Republicans said the plan wouldn't

work.

Sen. Lisa Murkowski (R, Alaska) led the charge against the

measure, aimed at raising to $10 billion the limit on damage

claims. The current limit, of $75 million, has been widely

criticized by lawmakers as too low. Republicans blocked efforts to

proceed, saying independent offshore oil developers would not be

able to stay in business under the legislation because small

companies wouldn't be able to self-insure against claims.

"The only companies that are going to be able to self-insure

against this level of strict liability are the national oil

companies, the super majors," Murkowski said. She said that would

create a "monopoly" on offshore drilling among giant companies such

as BP. "We need to ensure that BP as the responsible party

pays."

BP has scrambled to stop oil from spilling from a well a mile

below the surface since a deadly oil-rig explosion on April 20. BP

officials have declined to estimate the extent of costs associated

with the spill. Earlier this week, Lamar McKay, the head of BP's

U.S. unit, said the company would pay all "legitimate" claims

related to the spill. He said that "claims have to have some

basis."

The White House came out ahead of the vote with an announcement

on Wednesday with proposed legislation to allow the federal

government to collect more damages from companies responsible for

the spill. But the Obama administration didn't propose a specific

increase in the cap on damages, and on Thursday refrained from

offering support for the measure from Sen. Bill Nelson (D., Fla.),

Sen. Bob Menendez (D., N.J.), and Sen. Frank Lautenberg (D., N.J.).

The Democrats must now go back to the drawing board.

"I'm really disappointed some of my colleagues decided to block

the legislation to hold BP accountable for this environmental

disaster," Nelson said in a statement. He said that Congress

"needed to raise the cap to $10 billion. And I'm not sure $10

billion is going to be enough."

-By Siobhan Hughes, Dow Jones Newswires; 202-862-6654;

siobhan.hughes@dowjones.com

(Jared Favole contributed to this report.)

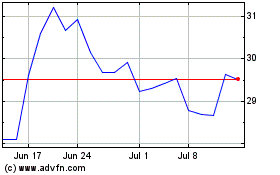

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

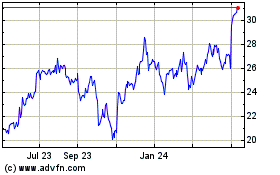

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Apr 2023 to Apr 2024