UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| |

Date of Report (Date of earliest event reported) | February 3, 2016 |

|

| | |

Commission File Number | Registrant, State of Incorporation, Address and Telephone Number | I.R.S. Employer Identification No. |

| | |

1-3526 | The Southern Company (A Delaware Corporation) 30 Ivan Allen Jr. Blvd., N.W. Atlanta, Georgia 30308 (404) 506-5000 | 58-0690070 |

1-3164 | Alabama Power Company (An Alabama Corporation) 600 North 18th Street Birmingham, Alabama 35203 (205) 257-1000 | 63-0004250 |

1-6468 | Georgia Power Company (A Georgia Corporation) 241 Ralph McGill Boulevard, N.E. Atlanta, Georgia 30308 (404) 506-6526 | 58-0257110 |

001-31737 | Gulf Power Company (A Florida Corporation) One Energy Place Pensacola, Florida 32520 (850) 444-6111 | 59-0276810 |

001-11229 | Mississippi Power Company (A Mississippi Corporation) 2992 West Beach Boulevard Gulfport, Mississippi 39501 (228) 864-1211 | 64-0205820 |

333-98553 | Southern Power Company (A Delaware Corporation) 30 Ivan Allen Jr. Blvd., N.W. Atlanta, Georgia 30308 (404) 506-5000 | 58-2598670 |

The names and addresses of the registrants have not changed since the last report.

This combined Form 8-K is furnished separately by six registrants: The Southern Company, Alabama Power Company, Georgia Power Company, Gulf Power Company, Mississippi Power Company and Southern Power Company. Information contained herein relating to each registrant is furnished by each registrant solely on its own behalf. Each registrant makes no representation as to information relating to the other registrants.

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions:

|

| |

[ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition |

The information in this Current Report on Form 8-K, including the exhibits attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities under that Section. Furthermore, such information, including the exhibits attached hereto, shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

On February 3, 2016, The Southern Company (“Southern Company”) issued a press release regarding its earnings for the three-month and twelve-month periods ended December 31, 2015. A copy of this release is being furnished as Exhibit 99.01 to this Current Report on Form 8-K. In addition, certain additional information regarding the financial results for the three-month and twelve-month periods ended December 31, 2015 is being furnished as Exhibits 99.02 through 99.07 to this Current Report on Form 8-K.

Use of Non-GAAP Financial Measures

Exhibits 99.01, 99.02, 99.03 and 99.04 to this Current Report on Form 8-K, in addition to including earnings and earnings per share in accordance with generally accepted accounting principles (“GAAP”) for the three-month and twelve-month periods ended December 31, 2015 and 2014, also include earnings and earnings per share (1) for the three-month and twelve-month periods ended December 31, 2015 and 2014 excluding charges for estimated probable losses relating to Mississippi Power Company’s construction of the integrated coal gasification combined cycle facility in Kemper County, Mississippi (the “Kemper IGCC”), (2) for the three-month and twelve-month periods ended December 31, 2014 excluding the effect of reversing revenues previously recognized in 2014 and 2013 as a result of the 2015 Mississippi Supreme Court decision that reversed the Mississippi Public Service Commission’s March 2013 Kemper IGCC rate order, (3) for the three-month and twelve-month periods ended December 31, 2015 excluding costs related to the proposed acquisition of AGL Resources Inc. and (4) for the twelve-month period ended December 31, 2015 excluding additional costs related to the discontinued operations of Mirant Corporation and the March 2009 settlement agreement with MC Asset Recovery, LLC (“MCAR”). The estimated probable losses relating to the Kemper IGCC significantly impacted the presentation of earnings and earnings per share for the three-month and twelve-month periods ended December 31, 2015 and 2014, and similar charges may occur with uncertain frequency in the future. Further costs related to the proposed acquisition of AGL Resources Inc. are expected to continue to occur in connection with closing the proposed acquisition and supporting the related integration. Further costs related to the settlement agreement with MCAR are not expected to occur. Southern Company believes the presentation of earnings and earnings per share, excluding these charges, is useful to investors because it provides investors with additional information to evaluate the performance of Southern Company’s ongoing business activities. Southern Company management also uses earnings and earnings per share, excluding the effect of these charges, to evaluate the performance of Southern Company’s ongoing business activities. The presentation of this additional information is not meant to be considered a substitute for financial measures prepared in accordance with GAAP.

Exhibits

The exhibits hereto contain business segment information for Alabama Power Company, Georgia Power Company, Gulf Power Company, Mississippi Power Company and Southern Power Company. Accordingly, this report is also being furnished on behalf of each such registrant.

The following exhibits relate to the three-month and twelve-month periods ended December 31, 2015:

|

| | |

| Exhibit 99.01 | Press Release. |

| Exhibit 99.02 | Financial Highlights. |

| Exhibit 99.03 | Significant Factors Impacting EPS. |

| Exhibit 99.04 | EPS Earnings Analysis. |

| Exhibit 99.05 | Consolidated Earnings. |

| Exhibit 99.06 | Kilowatt-Hour Sales. |

| Exhibit 99.07 | Financial Overview. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each of the registrants has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

Date:February 3, 2016 | THE SOUTHERN COMPANY

|

| By | /s/Ann P. Daiss |

| | Ann P. Daiss Comptroller |

| | |

| ALABAMA POWER COMPANY GEORGIA POWER COMPANY GULF POWER COMPANY MISSISSIPPI POWER COMPANY SOUTHERN POWER COMPANY

|

| By | /s/Melissa K. Caen |

| | Melissa K. Caen Assistant Secretary |

- 2 -

|

| | |

| | Exhibit 99.01 |

| |

News |

|

| | |

Media Contact: | Southern Company Media Relations | |

| 404-506-5333 or 1-866-506-5333 | |

| www.southerncompany.com | |

| | |

Investor Relations Contact: | |

| Aaron Abramovitz | |

| 404-506-0780 | |

| apabramo@southernco.com | |

| | |

| Feb. 3, 2016 |

Southern Company reports fourth quarter and full year 2015 earnings

ATLANTA - Southern Company today reported fourth quarter 2015 earnings of $271 million, or 30 cents per share, compared with earnings of $283 million, or 31 cents per share, in the fourth quarter of 2014. Southern Company also reported full year 2015 earnings of $2.4 billion, or $2.60 per share, compared with earnings of $2 billion, or $2.19 per share, for the same period in 2014.

Earnings for the fourth quarter and the full year 2015 include after-tax charges of $113 million (12 cents per share) and $226 million (25 cents per share), respectively, related to increased cost estimates for the construction of Mississippi Power’s Kemper County integrated gasification combined cycle (IGCC) project. Earnings for the fourth quarter and the full year 2014 include after-tax charges of $60 million (7 cents per share) and $553 million (61 cents per share), respectively, related to Kemper IGCC impacts. Earnings for the fourth quarter and the full year 2015 also include after-tax charges of $19 million and $31 million, respectively, related to the proposed acquisition of AGL Resources Inc. Furthermore, earnings for the full year 2015 include a $4 million after-tax charge related to the discontinued operations of Mirant and the March 2009 settlement agreement with MC Asset Recovery, LLC.

Excluding these items, Southern Company earned $403 million, or 44 cents per share, during the fourth quarter of 2015, compared with $343 million, or 38 cents per share, during the fourth quarter of 2014. For the full year 2015, excluding these items, Southern Company earned $2.63 billion, or $2.89 per share, compared with earnings of $2.52 billion, or $2.80 per share, for the same period in 2014.

Earnings for the fourth quarter and full year 2015 were positively influenced by retail revenue effects at Southern Company’s traditional operating companies and success with renewable energy projects at wholesale subsidiary Southern Power. These positive drivers were partially offset by higher depreciation and warmer weather during the fourth quarter. Earnings for the full year 2015 were further positively influenced by residential and commercial sales growth, partially offset by increased share issuances and increased operation and maintenance costs.

“2015 was a tremendous year for Southern Company,” said Chairman, President and CEO Thomas A. Fanning. “We saw strong financial performance both from our wholesale subsidiary, Southern Power, and our traditional operating companies. Our state-regulated utilities delivered these 2015 results despite the warmest December on record in the last 120 years. We also improved our overall risk profile by

addressing several issues related to our large construction projects, including the settlement of litigation concerning Plant Vogtle and the approval of rate recovery for the in-service assets at the Kemper IGCC.”

Fourth quarter 2015 operating revenues were $3.61 billion, compared with $4.02 billion for the same period in 2014, a decrease of 10.2 percent. Operating revenues for the full year 2015 were $17.53 billion, compared with $18.47 billion for the same period in 2014, a 5.1 percent decrease. These operating revenue decreases were primarily due to lower fuel costs being passed on to customers.

Kilowatt-hour sales to retail customers in Southern Company’s four-state service area decreased 5.7 percent in the fourth quarter of 2015, compared with the fourth quarter of 2014. Residential energy sales decreased 13.5 percent, commercial energy sales decreased 1.5 percent and industrial energy sales decreased 2.7 percent. For the full year 2015, retail sales decreased 0.7 percent, compared with the same period in 2014. Residential energy sales decreased 2.3 percent, commercial energy sales increased 0.5 percent and industrial energy sales decreased 0.4 percent.

Weather-adjusted kilowatt-hour sales to retail customers in Southern Company’s four-state service area decreased 0.4 percent in the fourth quarter of 2015, compared with the fourth quarter of 2014. Weather-adjusted residential energy sales increased 0.3 percent and weather-adjusted commercial energy sales increased 1.3 percent.

For the full year 2015, weather-adjusted retail sales increased 0.3 percent compared with the same period in 2014. Weather-adjusted residential energy sales increased 0.4 percent and weather-adjusted commercial energy sales increased 0.9 percent.

Total energy sales to the Southern Company system’s customers in the Southeast, including wholesale sales, decreased 6.3 percent in the fourth quarter of 2015, compared with the same period in 2014. For the full year 2015, total energy sales decreased 1.8 percent, compared with the same period in 2014.

Southern Company’s financial analyst call will begin at 1 p.m. Eastern time today, during which Fanning and Chief Financial Officer Art P. Beattie will discuss earnings and provide a general business update. Investors, media and the public may listen to a live webcast of the call and view associated slides at http://investor.southerncompany.com/webcasts. A replay of the webcast will be available at the site for 12 months.

Southern Company has also posted on its website detailed financial information on its fourth quarter and full year performance. These materials are also available at http://investor.southerncompany.com/webcasts.

With more than 4.5 million customers and approximately 46,000 megawatts of generating capacity, Atlanta-based Southern Company (NYSE: SO) is the premier energy company serving the Southeast through its subsidiaries. A leading U.S. producer of clean, safe, reliable and affordable electricity, Southern Company owns electric utilities in four states and a growing competitive generation company, as well as fiber optics and wireless communications. Southern Company brands are known for excellent customer service, high reliability and affordable prices that are below the national average. Through an industry-leading commitment to innovation, Southern Company and its subsidiaries are inventing America’s energy future by developing the full portfolio of energy resources, including nuclear, 21st century coal, natural gas, renewables and energy efficiency, and creating new products and services for the benefit of customers. Southern Company has been named by the U.S. Department of Defense and G.I. Jobs magazine as a top military employer, listed by Black Enterprise magazine as one of the 40 Best Companies for Diversity and designated a 2014 Top Employer for Hispanics by Hispanic Network. The company earned the 2014 National Award of Nuclear Science and History from the National Atomic

Museum Foundation for its leadership and commitment to nuclear development, and is continually ranked among the top utilities in Fortune's annual World’s Most Admired Electric and Gas Utility rankings. Visit our website at www.southerncompany.com.

Cautionary Notes Regarding Forward-Looking Statements:

Certain information contained in this release is forward-looking information based on current expectations and plans that involve risks and uncertainties. Forward-looking information includes, among other things, statements concerning Southern Company’s risk profile. Southern Company cautions that there are certain factors that can cause actual results to differ materially from the forward-looking information that has been provided. The reader is cautioned not to put undue reliance on this forward-

looking information, which is not a guarantee of future performance and is subject to a number of uncertainties and other factors, many of which are outside the control of Southern Company; accordingly, there can be no assurance that such suggested results will be realized. The following factors, in addition to those discussed in Southern Company’s Annual Report on Form 10-K for the year ended December 31, 2014, and subsequent securities filings, could cause actual results to differ materially from management expectations as suggested by such forward-looking information: the impact of recent and future federal and state regulatory changes, including legislative and regulatory initiatives regarding deregulation and restructuring of the electric utility industry, environmental laws including regulation of water, coal combustion residuals, and emissions of sulfur, nitrogen, carbon dioxide, soot, particulate matter, hazardous air pollutants, including mercury, and other substances, and also changes in tax and other laws and regulations to which Southern Company and its subsidiaries are subject, as well as changes in application of existing laws and regulations; current and future litigation, regulatory investigations, proceedings, or inquiries, including Federal Energy Regulatory Commission matters and Internal Revenue Service and state tax audits; the effects, extent, and timing of the entry of additional competition in the markets in which Southern Company’s subsidiaries operate; variations in demand for electricity, including those relating to weather, the general economy and recovery from the last recession, population and business growth (and declines), the effects of energy conservation and efficiency measures, including from the development and deployment of alternative energy sources such as self-generation and distributed generation technologies, and any potential economic impacts resulting from federal fiscal decisions; available sources and costs of fuels; effects of inflation; the ability to control costs and avoid cost overruns during the development and construction of facilities, which include the development and construction of generating facilities with designs that have not been finalized or previously constructed, including changes in labor costs and productivity, adverse weather conditions, shortages and inconsistent quality of equipment, materials, and labor, contractor or supplier delay, non-performance under construction or other agreements, operational readiness, including specialized operator training and required site safety programs, unforeseen engineering or design problems, start-up activities (including major equipment failure and system integration), and/or operational performance (including additional costs to satisfy any operational parameters ultimately adopted by any Public Service Commission (“PSC”); the ability to construct facilities in accordance with the requirements of permits and licenses, to satisfy any environmental performance standards and the requirements of tax credits and other incentives, and to integrate facilities into the Southern Company system upon completion of construction; investment performance of Southern Company’s employee and retiree benefit plans and the Southern Company system’s nuclear decommissioning trust funds; advances in technology; state and federal rate regulations and the impact of pending and future rate cases and negotiations, including rate actions relating to fuel and other cost recovery mechanisms; legal proceedings and regulatory approvals and actions related to Plant Vogtle units 3 and 4, including Georgia PSC approvals and Nuclear Regulatory Commission actions and related legal proceedings involving the commercial parties; actions related to cost recovery for the Kemper IGCC, including the ultimate impact of the 2015 decision of the Mississippi Supreme Court, the Mississippi PSC’s December 2015 rate order, and related legal or regulatory proceedings, Mississippi

PSC review of the prudence of Kemper IGCC costs and approval of permanent rate recovery plans, actions relating to proposed securitization, satisfaction of requirements to utilize investment tax credits and grants, and the ultimate impact of the termination of the proposed sale of an interest in the Kemper IGCC to South Mississippi Electric Power Association; the ability to successfully operate the electric utilities’ generating, transmission, and distribution facilities and the successful performance of necessary corporate functions; the inherent risks involved in operating and constructing nuclear generating facilities, including environmental, health, regulatory, natural disaster, terrorism, and financial risks; the performance of projects undertaken by the non-utility businesses and the success of efforts to invest in and develop new opportunities; internal restructuring or other restructuring options that may be pursued; potential business strategies, including acquisitions or dispositions of assets or businesses, which cannot be assured to be completed or beneficial to Southern Company or its subsidiaries; the expected timing, likelihood, and benefits of completion of the proposed acquisition of AGL Resources Inc., including the failure to receive, on a timely basis or otherwise, the required approvals by government or regulatory agencies (including the terms of such approvals), the possibility that long-term financing for the acquisition may not be put in place prior to the closing, the risk that a condition to closing of the acquisition or funding of the bridge financing may not be satisfied, the possibility that the anticipated benefits from the acquisition cannot be fully realized or may take longer to realize than expected, the possibility that costs related to the integration of Southern Company and AGL Resources will be greater than expected, the credit ratings of the combined company or its subsidiaries may be different from what the parties expect, the ability to retain and hire key personnel and maintain relationships with customers, suppliers, or other business partners, the diversion of management time on acquisition-related issues, and the impact of legislative, regulatory, and competitive changes; the ability of counterparties of Southern Company and its subsidiaries to make payments as and when due and to perform as required; the ability to obtain new short- and long-term contracts with wholesale customers; the direct or indirect effect on the Southern Company system’s business resulting from cyber intrusion or terrorist incidents and the threat of terrorist incidents; interest rate fluctuations and financial market conditions and the results of financing efforts; changes in Southern Company’s and any of its subsidiaries’ credit ratings, including impacts on interest rates, access to capital markets, and collateral requirements; the impacts of any sovereign financial issues, including impacts on interest rates, access to capital markets, impacts on currency exchange rates, counterparty performance, and the economy in general, as well as potential impacts on the benefits of the U.S. Department of Energy loan guarantees; the ability of Southern Company’s subsidiaries to obtain additional generating capacity at competitive prices; catastrophic events such as fires, earthquakes, explosions, floods, hurricanes and other storms, droughts, pandemic health events such as influenzas, or other similar occurrences; the direct or indirect effects on the Southern Company system’s business resulting from incidents affecting the U.S. electric grid or operation of generating resources; and the effect of accounting pronouncements issued periodically by standard-setting bodies. Southern Company expressly disclaims any obligation to update any forward-looking information.

# # #

|

| | | | | | | | | | | | | | | | |

| Exhibit 99.02 | |

Southern Company |

Financial Highlights |

(In Millions of Dollars Except Earnings Per Share) |

| | | | | | | | |

| | Three Months Ended December | | Year-to-Date December |

| | 2015 | | 2014 | | 2015 | | 2014 |

Consolidated Earnings–As Reported | | | | | | | | |

(See Notes) | | | | | | | | |

Traditional Operating Companies | | $ | 274 |

| | $ | 240 |

| | $ | 2,186 |

| | $ | 1,797 |

|

Southern Power | | 34 |

| | 44 |

| | 215 |

| | 172 |

|

Total | | 308 |

| | 284 |

| | 2,401 |

| | 1,969 |

|

Parent Company and Other | | (37 | ) | | (1 | ) | | (34 | ) | | (6 | ) |

Net Income–As Reported | | $ | 271 |

| | $ | 283 |

| | $ | 2,367 |

| | $ | 1,963 |

|

| | | | | | | | |

Basic Earnings Per Share | | $ | 0.30 |

| | $ | 0.31 |

| | $ | 2.60 |

| | $ | 2.19 |

|

| | | | | | | | |

Average Shares Outstanding (in millions) | | 911 |

| | 906 |

| | 910 |

| | 897 |

|

End of Period Shares Outstanding (in millions) | | | | | | 912 |

| | 908 |

|

| | | | | | | | |

| | Three Months Ended December | | Year-to-Date

December |

| | 2015 | | 2014 | | 2015 | | 2014 |

Consolidated Earnings–Excluding Items | | | | | | | | |

(See Notes) | | | | | | | | |

Net Income–As Reported | | $ | 271 |

| | $ | 283 |

| | $ | 2,367 |

| | $ | 1,963 |

|

Kemper IGCC Impacts | | 113 |

| | 60 |

| | 226 |

| | 553 |

|

AGL acquisition costs | | 19 |

| | — |

| | 31 |

| | — |

|

Additional MCAR settlement costs | | — |

| | — |

| | 4 |

| | — |

|

Net Income–Excluding Items | | $ | 403 |

| | $ | 343 |

| | $ | 2,628 |

| | $ | 2,516 |

|

| | | | | | | | |

Basic Earnings Per Share–Excluding Items | | $ | 0.44 |

| | $ | 0.38 |

| | $ | 2.89 |

| | $ | 2.80 |

|

| | | | | | | | |

Notes | | | | | | | | |

- For the three and twelve months ended December 31, 2015 and 2014, dilution does not change basic earnings per share by more than 1 cent and is not material. |

| | | | | | | | |

- Earnings for the three and twelve months ended December 31, 2015 and 2014 include estimated probable losses relating to Mississippi Power Company's construction of the integrated coal gasification combined cycle facility in Kemper County, Mississippi (Kemper IGCC) which significantly impacted the presentation of earnings and earnings per share. Similar charges may occur with uncertain frequency. In addition, earnings for the three and twelve months ended December 31, 2014 include the effect of reversing revenues previously recognized in 2014 and 2013 as a result of the 2015 Mississippi Supreme Court decision that reversed the Mississippi Public Service Commission's March 2013 Kemper IGCC rate order. |

|

- Earnings for the three and twelve months ended December 31, 2015 include costs related to the proposed acquisition of AGL Resources Inc. Further costs are expected to continue to occur in connection with closing the proposed acquisition and supporting the related integration.

|

|

- Earnings for the twelve months ended December 31, 2015 include additional costs related to the discontinued operations of Mirant Corporation and the March 2009 litigation settlement with MC Asset Recovery, LLC. Further charges are not expected to occur. |

|

- All figures in this earnings release are preliminary and remain subject to the completion of normal quarter-end accounting procedures and adjustments, which could result in changes to these preliminary results. In addition, certain classifications and rounding may be different from final results published in the Form 10-K. |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Exhibit 99.03 | |

Southern Company |

Significant Factors Impacting EPS |

| | | | | | | | |

| | Three Months Ended December | | Year-to-Date

December |

| | 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Consolidated Earnings Per Share– | | | | | | | | | | | | |

As Reported (See Notes) | | $ | 0.30 |

| | $ | 0.31 |

| | $ | (0.01 | ) | | $ | 2.60 |

| | $ | 2.19 |

| | $ | 0.41 |

|

| | | | | | | | | | | | |

Significant Factors: | | | | | | | | | | | | |

Traditional Operating Companies | | | | | | $ | 0.04 |

| | | | | | $ | 0.43 |

|

Southern Power | | | | | | (0.01 | ) | | | | | | 0.05 |

|

Parent Company and Other | | | | | | (0.04 | ) | | | | | | (0.03 | ) |

Increase in Shares | | | | | | — |

| | | | | | (0.04 | ) |

Total–As Reported | | | | | | $ | (0.01 | ) | | | | | | $ | 0.41 |

|

| | | | | | | | | | | | |

| | Three Months Ended December | | Year-to-Date

December |

| | 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Consolidated Earnings Per Share– | | | | | | | | | | | | |

Excluding Items (See Notes) | | $ | 0.44 |

| | $ | 0.38 |

| | $ | 0.06 |

| | $ | 2.89 |

| | $ | 2.80 |

| | $ | 0.09 |

|

| | | | | | | | | | | | |

Total–As Reported | | | | | | $ | (0.01 | ) | | | | | | $ | 0.41 |

|

Kemper IGCC impacts | | | | | | 0.05 |

| | | | | | (0.36 | ) |

AGL acquisition costs | | | | | | 0.02 |

| | | | | | 0.03 |

|

Additional MCAR settlement costs | | | | | | — |

| | | | | | 0.01 |

|

Total–Excluding Items | | | | | | $ | 0.06 |

| |

|

| |

|

| | $ | 0.09 |

|

| | | | | | | | | | | | |

Notes | | | | | | | | | | | | |

- For the three and twelve months ended December 31, 2015 and 2014, dilution does not change basic earnings per share by more than 1 cent and is not material. |

| | | | | | | | | | | | |

- Earnings for the three and twelve months ended December 31, 2015 and 2014 include estimated probable losses relating to Mississippi Power Company's construction of the integrated coal gasification combined cycle facility in Kemper County, Mississippi (Kemper IGCC) which significantly impacted the presentation of earnings and earnings per share. Similar charges may occur with uncertain frequency. In addition, earnings for the three and twelve months ended December 31, 2014 include the effect of reversing revenues previously recognized in 2014 and 2013 as a result of the 2015 Mississippi Supreme Court decision that reversed the Mississippi Public Service Commission's March 2013 Kemper IGCC rate order. |

| | | | | | | | | | | | |

- Earnings for the three and twelve months ended December 31, 2015 include costs related to the proposed acquisition of AGL Resources Inc. Further costs are expected to continue to occur in connection with closing the proposed acquisition and supporting the related integration.

|

| | | | | | | | | | | | |

- Earnings for the twelve months ended December 31, 2015 include additional costs related to the discontinued operations of Mirant Corporation and the March 2009 litigation settlement with MC Asset Recovery, LLC. Further charges are not expected to occur. |

| | | | | | | | | | | | |

- All figures in this earnings release are preliminary and remain subject to the completion of normal quarter-end accounting procedures and adjustments, which could result in changes to these preliminary results. In addition, certain classifications and rounding may be different from final results published in the Form 10-K. |

|

| | | | |

| Exhibit 99.04 |

Southern Company |

EPS Earnings Analysis |

| | | | |

| | | | |

Description | | Three Months Ended

December 2015 vs. 2014 | | Year-to-Date

December 2015 vs. 2014 |

| | | | |

Retail Sales | | —¢ | | 3¢ |

| | | | |

Retail Revenue Impacts | | 7 | | 24 |

| | | | |

Weather | | (8) | | (4) |

| | | | |

Wholesale Operations | | (2) | | (7) |

| | | | |

Other Operating Revenues | | 2 | | 1 |

| | | | |

Non-Fuel O&M | | 14 | | (3) |

| | | | |

Depreciation and Amortization | | (6) | | (5) |

| | | | |

Taxes Other Than Income Taxes | | — | | (1) |

| | | | |

Other Income and Deductions | | 2 | | (1) |

| | | | |

Interest Expense | | — | | 1 |

| | | | |

Income Taxes | | — | | (1) |

| | | | |

Total Traditional Operating Companies | | 9¢ | | 7¢ |

| | | | |

Southern Power | | (1) | | 5 |

| | | | |

Parent and Other | | (2) | | 1 |

| | | | |

Increase in Shares | | — | | (4) |

| | | | |

Total Change in EPS (Excluding Items) | | 6¢ | | 9¢ |

| | | | |

Kemper IGCC Impacts | | (5) | | 36 |

| | | | |

AGL Acquisition Costs | | (2) | | (3) |

| | | | |

Additional MCAR settlement costs | | — | | (1) |

| | | | |

Total Change in EPS (As Reported) | | (1)¢ | | 41¢ |

| | | | |

Notes | | | | |

- Earnings for the three and twelve months ended December 31, 2015 and 2014 include estimated probable losses relating to Mississippi Power Company's construction of the integrated coal gasification combined cycle facility in Kemper County, Mississippi (Kemper IGCC) which significantly impacted the presentation of earnings and earnings per share. Similar charges may occur with uncertain frequency. In addition, earnings for the three and twelve months ended December 31, 2014 include the effect of reversing revenues previously recognized in 2014 and 2013 as a result of the 2015 Mississippi Supreme Court decision that reversed the Mississippi Public Service Commission's March 2013 Kemper IGCC rate order. |

| | | | |

- Earnings for the three and twelve months ended December 31, 2015 include costs related to the proposed acquisition of AGL Resources Inc. Further costs are expected to continue to occur in connection with closing the proposed acquisition and supporting the related integration.

|

| | | | |

- Earnings for the twelve months ended December 31, 2015 include additional costs related to the discontinued operations of Mirant Corporation and the March 2009 litigation settlement with MC Asset Recovery, LLC. Further charges are not expected to occur. |

| | | | |

- All figures in this earnings release are preliminary and remain subject to the completion of normal quarter-end accounting procedures and adjustments, which could result in changes to these preliminary results. In addition, certain classifications and rounding may be different from final results published in the Form 10-K. |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Exhibit 99.05 | |

Southern Company |

Consolidated Earnings |

As Reported |

(In Millions of Dollars) |

| | | | | | | | |

| | Three Months Ended December | | Year-to-Date December |

| | 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Income Account- | | | | | | | | | | | | |

Retail Revenues- | | | | | | | | | | | | |

Fuel | | $ | 786 |

| | $ | 1,141 |

| | $ | (355 | ) | | $ | 4,437 |

| | $ | 5,396 |

| | $ | (959 | ) |

Non-Fuel | | 2,243 |

| | 2,223 |

| | 20 |

| | 10,550 |

| | 10,154 |

| | 396 |

|

Wholesale Revenues | | 363 |

| | 465 |

| | (102 | ) | | 1,798 |

| | 2,184 |

| | (386 | ) |

Other Electric Revenues | | 201 |

| | 169 |

| | 32 |

| | 695 |

| | 672 |

| | 23 |

|

Other Revenues | | 13 |

| | 19 |

| | (6 | ) | | 47 |

| | 61 |

| | (14 | ) |

Total Revenues | | 3,606 |

| | 4,017 |

| | (411 | ) | | 17,527 |

| | 18,467 |

| | (940 | ) |

Fuel and Purchased Power | | 956 |

| | 1,398 |

| | (442 | ) | | 5,395 |

| | 6,677 |

| | (1,282 | ) |

Non-Fuel O & M | | 1,134 |

| | 1,328 |

| | (194 | ) | | 4,454 |

| | 4,354 |

| | 100 |

|

Depreciation and Amortization | | 519 |

| | 430 |

| | 89 |

| | 2,034 |

| | 1,945 |

| | 89 |

|

Taxes Other Than Income Taxes | | 236 |

| | 230 |

| | 6 |

| | 997 |

| | 981 |

| | 16 |

|

Estimated Loss on Kemper IGCC | | 183 |

| | 70 |

| | 113 |

| | 365 |

| | 868 |

| | (503 | ) |

Total Operating Expenses | | 3,028 |

| | 3,456 |

| | (428 | ) | | 13,245 |

| | 14,825 |

| | (1,580 | ) |

Operating Income | | 578 |

| | 561 |

| | 17 |

| | 4,282 |

| | 3,642 |

| | 640 |

|

Allowance for Equity Funds Used During Construction | | 63 |

| | 63 |

| | — |

| | 226 |

| | 245 |

| | (19 | ) |

Interest Income | | 6 |

| | 6 |

| | — |

| | 23 |

| | 19 |

| | 4 |

|

Interest Expense, Net of Amounts Capitalized | | 228 |

| | 212 |

| | 16 |

| | 840 |

| | 835 |

| | 5 |

|

Other Income (Expense), net | | (18 | ) | | (30 | ) | | 12 |

| | (62 | ) | | (63 | ) | | 1 |

|

Income Taxes | | 118 |

| | 88 |

| | 30 |

| | 1,194 |

| | 977 |

| | 217 |

|

Consolidated Net Income | | 283 |

| | 300 |

| | (17 | ) | | 2,435 |

| | 2,031 |

| | 404 |

|

Dividends on Preferred and Preference Stock of Subsidiaries | | 12 |

| | 17 |

| | (5 | ) | | 54 |

| | 68 |

| | (14 | ) |

Less: Net Income Attributable to Noncontrolling Interests | | — |

| | — |

| | — |

| | 14 |

| | — |

| | 14 |

|

CONSOLIDATED NET INCOME ATTRIBUTABLE TO SOUTHERN COMPANY | | $ | 271 |

| | $ | 283 |

| | $ | (12 | ) | | $ | 2,367 |

| | $ | 1,963 |

| | $ | 404 |

|

| | | | | | | | | | | | |

Notes | | | | | | | | | | | | |

- Certain prior year data may have been reclassified to conform with current year presentation. |

| | | | | | | | | | | | |

- All figures in this earnings release are preliminary and remain subject to the completion of normal quarter-end accounting procedures and adjustments, which could result in changes to these preliminary results. In addition, certain classifications and rounding may be different from final results published in the Form 10-K. |

| | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Exhibit 99.06 | |

Southern Company |

Kilowatt-Hour Sales |

(In Millions of KWHs) |

| | | | | | | | | | | | | | | | |

| | Three Months Ended December | | Year-to-Date December |

As Reported | | 2015 | | 2014 | | Change | | Weather Adjusted Change* | | 2015 | | 2014 | | Change | | Weather Adjusted Change* |

Kilowatt-Hour Sales- | | | | | | | | | | | | | | | | |

Total Sales | | 41,945 |

| | 44,775 |

| | (6.3 | )% | | | | 190,989 |

| | 194,425 |

| | (1.8 | )% | | |

| | | | | | | | | | | | | | | | |

Total Retail Sales- | | 35,589 |

| | 37,727 |

| | (5.7 | )% | | (0.4 | )% | | 160,484 |

| | 161,639 |

| | (0.7 | )% | | 0.3 | % |

Residential | | 10,196 |

| | 11,782 |

| | (13.5 | )% | | 0.3 | % | | 52,121 |

| | 53,347 |

| | (2.3 | )% | | 0.4 | % |

Commercial | | 12,166 |

| | 12,349 |

| | (1.5 | )% | | 1.3 | % | | 53,525 |

| | 53,242 |

| | 0.5 | % | | 0.9 | % |

Industrial | | 13,003 |

| | 13,369 |

| | (2.7 | )% | | (2.7 | )% | | 53,941 |

| | 54,140 |

| | (0.4 | )% | | (0.3 | )% |

Other | | 224 |

| | 227 |

| | (1.2 | )% | | (0.9 | )% | | 897 |

| | 910 |

| | (1.4 | )% | | (1.3 | )% |

| | | | | | | | | | | | | | | | |

Total Wholesale Sales | | 6,356 |

| | 7,048 |

| | (9.8 | )% | | N/A |

| | 30,505 |

| | 32,786 |

| | (7.0 | )% | | N/A |

|

| | | | | | | | | | | | | | | | |

Note | | | | | | | | | | | | | | | | |

*Also reflects adjustment of 2014 KWH sales consistent with Mississippi Power's updated methodology to estimate the unbilled revenue allocation among customer classes implemented in the first quarter 2015. |

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | |

| Exhibit 99.07 | |

Southern Company |

Financial Overview |

As Reported |

(In Millions of Dollars) |

| | | | | | | | | | | | |

| | Three Months Ended December | | Year-to-Date December |

| | 2015 | | 2014 | | % Change | | 2015 | | 2014 | | % Change |

Consolidated – | | | | | | | | | | | | |

Operating Revenues | | $ | 3,606 |

| | $ | 4,017 |

| | (10.2 | )% | | $ | 17,527 |

| | $ | 18,467 |

| | (5.1 | )% |

Earnings Before Income Taxes | | 401 |

| | 388 |

| | 3.4 | % | | 3,629 |

| | 3,008 |

| | 20.6 | % |

Net Income Available to Common | | 271 |

| | 283 |

| | (4.2 | )% | | 2,367 |

| | 1,963 |

| | 20.6 | % |

| | | | | | | | | | | | |

Alabama Power – | | | | | | | | | | | | |

Operating Revenues | | $ | 1,217 |

| | $ | 1,328 |

| | (8.4 | )% | | $ | 5,768 |

| | $ | 5,942 |

| | (2.9 | )% |

Earnings Before Income Taxes | | 204 |

| | 211 |

| | (3.3 | )% | | 1,317 |

| | 1,312 |

| | 0.4 | % |

Net Income Available to Common | | 120 |

| | 119 |

| | 0.8 | % | | 785 |

| | 761 |

| | 3.2 | % |

| | | | | | | | | | | | |

Georgia Power – | | | | | | | | | | | | |

Operating Revenues | | $ | 1,679 |

| | $ | 1,902 |

| | (11.7 | )% | | $ | 8,364 |

| | $ | 8,988 |

| | (6.9 | )% |

Earnings Before Income Taxes | | 312 |

| | 196 |

| | 59.2 | % | | 2,046 |

| | 1,971 |

| | 3.8 | % |

Net Income Available to Common | | 196 |

| | 123 |

| | 59.3 | % | | 1,260 |

| | 1,225 |

| | 2.9 | % |

| | | | | | | | | | | | |

Gulf Power – | | | | | | | | | | | | |

Operating Revenues | | $ | 313 |

| | $ | 361 |

| | (13.3 | )% | | $ | 1,483 |

| | $ | 1,590 |

| | (6.7 | )% |

Earnings Before Income Taxes | | 47 |

| | 39 |

| | 20.5 | % | | 249 |

| | 237 |

| | 5.1 | % |

Net Income Available to Common | | 28 |

| | 23 |

| | 21.7 | % | | 148 |

| | 140 |

| | 5.7 | % |

| | | | | | | | | | | | |

Mississippi Power – | | | | | | | | | | | | |

Operating Revenues | | $ | 245 |

| | $ | 246 |

| | (0.4 | )% | | $ | 1,138 |

| | $ | 1,243 |

| | (8.4 | )% |

Earnings (Loss) Before Income Taxes | | (130 | ) | | (56 | ) | | N/M |

| | (78 | ) | | (612 | ) | | N/M |

|

Net Income (Loss) Available to Common | | (70 | ) | | (24 | ) | | N/M |

| | (8 | ) | | (329 | ) | | N/M |

|

| | | | | | | | | | | | |

Southern Power – | | | | | | | | | | | | |

Operating Revenues | | $ | 304 |

| | $ | 386 |

| | (21.2 | )% | | $ | 1,390 |

| | $ | 1,501 |

| | (7.4 | )% |

Earnings Before Income Taxes | | 41 |

| | 18 |

| | 127.8 | % | | 250 |

| | 172 |

| | 45.3 | % |

Net Income Available to Common | | 34 |

| | 44 |

| | (22.7 | )% | | 215 |

| | 172 |

| | 25.0 | % |

| | | | | | | | | | | | |

N/M - not meaningful | | | | | | | | | | | | |

| | | | | | | | | | | | |

Note | | | | | | | | | | | | |

- All figures in this earnings release are preliminary and remain subject to the completion of normal quarter-end accounting procedures and adjustments, which could result in changes to these preliminary results. In addition, certain classifications and rounding may be different from final results published in the Form 10-K. |

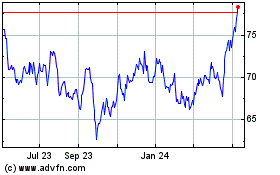

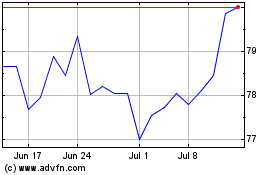

Southern (NYSE:SO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Southern (NYSE:SO)

Historical Stock Chart

From Apr 2023 to Apr 2024