UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 9, 2015

SCHLUMBERGER N.V. (SCHLUMBERGER LIMITED)

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Curaçao |

|

1-4601 |

|

52-0684746 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

42, rue Saint-Dominique, Paris, France 75007

5599 San Felipe, 17th Floor, Houston, Texas 77056

62 Buckingham Gate, London SW1E 6AJ

Parkstraat 83, The Hague, The Netherlands 2514 JG

(Addresses of principal executive offices and zip or postal codes)

Registrant’s telephone number in the United States, including area code: (713) 513-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events.

On September 9, 2015, Paal Kibsgaard, Chairman and Chief Executive Officer of Schlumberger Limited (“Schlumberger”), addressed

the oil and gas investment community at the CEO Energy-Power Conference in New York, New York. A copy of the presentation and slides is attached as Exhibit 99. Schlumberger has also posted this information on its website at

http://investorcenter.slb.com/phoenix.zhtml?c=97513&p=irol-presentations and at http://www.slb.com/news/presentations.aspx.

Additional Information

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a

solicitation of any vote or approval. The attached presentation relates in part to a proposed business combination between Schlumberger and Cameron International Corporation (“Cameron”). In connection with this proposed business

combination, Schlumberger and Cameron may file one or more proxy statements, registration statements, proxy statement/prospectus or other documents with the Securities and Exchange Commission (the “SEC”). This communication is not a

substitute for any proxy statement, registration statement, proxy statement/prospectus or other document Schlumberger or Cameron may file with the SEC in connection with the proposed transaction.

STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE REGISTRATION STATEMENT AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC

REGARDING THE PROPOSED TRANSACTION CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION THAT SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS MADE WITH

RESPECT TO THE PROPOSED TRANSACTION. These materials will be made available to stockholders of Cameron at no expense to them. Investors will be able to obtain free copies of these documents (if and when available) and other documents filed with the

SEC by Schlumberger and/or Cameron through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Schlumberger will be available free of charge on Schlumberger’s internet website at

http://www.slb.com. Copies of the documents filed with the SEC by Cameron will be available free of charge on Cameron’s internet website at http://www.c-a-m.com. You may also read and copy any reports, statements and other information filed by

Cameron or Schlumberger with the SEC at the SEC public reference room at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at (800) 732-0330 or visit the SEC’s website for further information on its public reference

room.

Participants in the Solicitation

Cameron, Schlumberger, their respective directors and certain of their respective executive officers may be considered, under SEC rules,

participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Schlumberger is set forth in its Annual Report on Form 10-K for the year ended December 31, 2014,

which was filed with the SEC on January 29, 2015, and its proxy statement for its 2015 annual general meeting of stockholders, which was filed with the SEC on February 19, 2015. Information about the directors and executive officers of

Cameron is set forth in its Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 20, 2015, and its proxy statement for its 2015 annual meeting of stockholders, which was filed with the

SEC on March 27, 2015. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests in the

transaction, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Forward-Looking Statements

The attached

presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The opinions, forecasts, projections

regarding whether the proposed Schlumberger/Cameron merger will close and the expected timing thereof; the expected benefits and synergies of the proposed transaction; future opportunities for the combined company and its products and services;

future financial performance; and any other statements regarding Schlumberger’s or the combined company’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance, that are not

statements of historical fact, are forward-looking statements within the meaning of the federal securities laws. Schlumberger can give no assurance that such expectations will prove to have been correct. These statements are subject to, among other

things, satisfaction of the closing conditions to the proposed merger, the risk that the proposed merger does not occur, negative effects from the pendency of the proposed merger, the ability to successfully integrate the merged businesses and to

realize expected synergies and other benefits, failure to obtain the required votes of Cameron’s stockholders, the timing to consummate the proposed transaction, and other risk factors that are discussed in Schlumberger’s and

Cameron’s most recent 10-Ks as well as each company’s other filings with the SEC available at the SEC’s Internet site (http://www.sec.gov). Actual results may differ materially from those expected, estimated or projected.

Forward-looking statements speak only as of the date they are made, and we undertake no obligation to publicly update or revise any of them in light of new information, future events or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The exhibit listed

below is furnished pursuant to Item 9.01 of this Form 8-K.

99 Presentation at the Barclays CEO Energy-Power Conference

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly

authorized undersigned.

|

| SCHLUMBERGER LIMITED |

|

| /s/ Howard Guild |

| Howard Guild |

| Chief Accounting Officer |

|

| Date: September 9, 2015 |

Exhibit 99.1

Thank you and good morning ladies and gentlemen.

Let me start by thanking Barclays, and David Anderson in particular, for the invitation to speak here today.

In my talk I will aim to demonstrate that Schlumberger, in spite of the current industry turmoil, continues to deliver very strong financial results and that

we, at the same time, are actively looking to further strengthen and extend our business portfolio.

I will do that by first reviewing the key aspects of

our recent technical and financial results and how our corporate transformation program remains the key driver behind our strong performance.

I will also

show you how we continue to expand our technical offering by leveraging our core areas of expertise, combined with targeted M&A activity, always looking to create more value for our customers and shareholders.

As part of this I will outline the rationale for the recently announced Cameron transaction and why the move into surface equipment represents a compelling

extension to our existing capabilities.

And finally, I will review how we see the oilfield services market evolving as we start preparing for 2016 and

why Schlumberger will come out of this downturn stronger than ever.

1

2

But before we start let’s get the formalities out of the way.

Some of the statements I will be making today are forward-looking. Our results could differ materially from those projected in these statements.

I therefore refer you to our latest 10-K filing and our other SEC filings.

3

Looking first at our recent financial performance the main challenge over the past three quarters has been to navigate the

commercial landscape, and to manage our cost and resource base while facing an unprecedented drop in E&P activity and mounting pricing pressure amidst falling demand for oilfield services.

Through proactive planning quick implementation and by keeping focus on what we control we have managed to minimize the impact on our financial performance

and, at the same time, maintained the quality of our customer-facing operations during a very tough period for the industry.

The results can be seen in

our decremental margins which are significantly better than those achieved in the 2009 downturn in spite of the revenue drop being even more severe.

In

North America, we have maintained decremental margins well below 40% and delivered H1 operating margins in excess of 10%, while in the international market decremental margins were well below 20%, and operating margins resilient at around 24%.

By reacting quickly we were able to complete most of the headcount reductions in the first quarter thereby avoiding additional restructuring charges in the

second quarter which also helped stabilize our organization and maintain focus on serving our customers.

4

Our proactive approach is also reflected in our relative performance where we are clearly extending our trend of financial

outperformance.

We continue to take a balanced approach to market share and margins, knowing very well from previous downturns that permanent pricing

concessions for basic technologies are very difficult to recover from.

Still, even with our balanced approach, we have outgrown the rest of the field in

terms of total revenue over the past four and a half years.

And in terms of operating margins, we have maintained overall profitability levels over the

same period while our competitors have seen margin erosion of 900 basis points, or more, creating a gap in our favor that has never been larger.

As we

continue to focus on our financial performance, we are not ignoring our customers’ need to lower operating costs.

We are actively working with them

both in the planning and execution phase to help drive costs out of the system.

And in some cases, we offer pricing concessions for higher market share

and better terms and conditions, which we can leverage to further improve our internal operating efficiency.

5

Looking at earnings-per-share and free-cash-flow, our results also set us apart from our peer group.

In the past four-and-a-half years, our cumulative free-cash-flow is close to $17 billion, which dwarfs the amount generated by our two main competitors

combined.

In 2014, we converted more than 80% of our earnings into free-cash-flow and for the first half of 2015 the number is close to 100%.

This has allowed us to consistently return cash to our shareholders through both dividends and stock buy-backs.

We have, for instance, raised our dividend in each of the past 5 years, and the current dividend of $2.5 billion per year is double of what we offered five

years ago.

In terms of stock re-purchases, we have over the same period bought back more than $13 billion of stock, and we expect our current $10 billion

program to be completed early next year.

And the key driver behind our strong financial performance is clearly our corporate transformation program.

6

As outlined in our 2014 Investor Conference, the transformation program is designed to create a step-change in our

corporate performance by focusing on the four areas of new technology, reliability, efficiency, and integration.

The program is now embraced by our

entire organization and continues to gain pace as seen by the multi-year improvement trends in all four focus areas.

We are clearly increasing the rate

of innovation per R&E dollar spent, as seen by strong new technology sales as a percentage of total revenue.

Our focus on improving both product

reliability through better engineering design, and maintenance and process reliability through a fully upgraded management system, is delivering steady reductions in the rate of Non-Productive Time generated for our customers.

And the ongoing initiatives around capital efficiency and asset utilization are further strengthening our already strong balance sheet while the share of

revenue generated from integrated operations also continues to grow.

The design and implementation of our transformation program is one of the largest

undertakings we have faced as a company.

7

But given the maturity of our organization, our effective management structure, and a company culture founded on

innovation and driving industry change, I am very pleased with the progress we are making and I am confident that the program will offer up a significant performance upside to our business for years to come.

Next, I would like to switch focus to our business portfolio and show you how we, through our core capabilities and

well-established business principles, continue to evolve our offering and how the recently announced Cameron transaction is a compelling and natural extension of our current portfolio.

The foundation for Schlumberger’s success since our creation in 1926 has been our reservoir expertise, which today is housed in our Reservoir

Characterization Group.

This includes our market-leading product lines in wireline, seismic, well testing, core and fluid analysis, data processing and

reservoir modelling software, as well as the industry’s largest petro-technical community, counting around 10,000 experts.

In addition to our

unmatched reservoir expertise, the Reservoir Characterization Group has also established leadership positions in sensor and instrumentation design, numerical modelling, and development of software and control systems.

Enabled by more than 30 petaflops of computing power, these disciplines represent the fundamental technology backbone of Schlumberger.

8

Building on the unique capabilities of our Reservoir Characterization Group, we have over the past two decades built an

industry-leading downhole drilling offering.

We did this by first transferring wireline technologies into the measurement and logging-while-drilling

services of our D&M product line, and by using our downhole tool design capabilities to build the industry’s leading rotary-steerable systems.

In 2010, we further extended our downhole drilling offering through the Smith and Geoservices transactions, which gave us a complete range of drillbits,

drilling tools, drilling fluids, and mud logging capabilities.

With this, we brought together all the individual hardware components of the

bottom-hole-assembly into a fully integrated downhole system, leveraging our deep knowledge of instrumentation software optimization and automation.

Following a highly successful integration process, our Drilling Group has in recent years, posted industry-leading growth rates and, at the same time,

improved profitability to now be in-line with the rest of Schlumberger, whereas in the beginning it was clearly dilutive.

9

In parallel with expanding our Drilling offering, we have also continuously evolved our production portfolio, again

building on our core scientific platforms together with targeted M&A activity.

In hydraulic fracturing we have, for years, combined our reservoir

expertise with the latest advances in fluid chemistry to drive well production and recovery through innovative stimulation services such as HiWAY and BroadBand.

Our geo-engineered shale completions, which consistently deliver higher production compared to conventional techniques, are built directly on our unique

formation evaluation measurements combined with our Mangrove reservoir and completion modelling software.

In coiled tubing, we have used wireline sensors

and innovative telemetry technology to help establish our industry-leading ACTive platform.

And through the acquisition of Camco in 1998, we added

completion hardware to our offering which we have evolved into our industry-leading Manara intelligent completions system, which once again, leverages measurement and control capabilities from Reservoir Characterization.

We also established, in artificial lift, a leading position in ESP and gas lift, which we, in recent years have augmented by a series of acquisitions in rod

lift and progressive cavity pumps, to build a complete life-of-well artificial lift offering.

10

The evolution of our technology offering that I just outlined has three common threads.

First, the driving force behind the technology evolution is the core expertise coming from our Reservoir Characterization Group.

Second, the overarching value proposition continues to be the evolution of individual hardware components into integrated systems thereby setting new

standards of performance, facilitated by instrumentation software, modelling, control and automation.

Third, in the evolution of our offering, we have

successfully used targeted M&A activity to complement our own organic growth efforts.

Up until now, our focus as a company has been largely on the

subsurface through the reservoir and the well, and the success of our overall approach can be seen by our leadership position in almost every downhole market segment we participate in.

11

As we continue to seek new ways to drive total system performance in the areas of both drilling and production, it has

become very clear to us that there is huge potential in a much closer integration between the surface and subsurface parts of both the drilling and production systems.

The surface drilling components, including the BOP and rig equipment, are critical elements in the drilling process.

In a similar way, the surface and seafloor production equipment, including wellheads valves and processing hardware, are critical components in the production

system.

We aim to drive both drilling and production performance to the next level by introducing new surface sensors and instrumentation, which together

with the static and dynamic data from the reservoir and the well, will feed into a common optimization software that controls all the key surface and downhole parameters.

So building on this, the rationale behind the recently announced Cameron transaction is to create technology-driven growth by integrating Schlumberger’s

leading reservoir and well technology with Cameron’s leading wellhead and surface technology.

Through this combination, we will create the

industry’s first complete drilling and production systems, fully enabled by our unique expertise in instrumentation data processing, software optimization, and system integration.

12

Before I explain in more detail the exciting growth opportunities that will emerge from the combined company, I would like

to say a few words about Cameron and what drove us to pursue this transaction.

Cameron, with its proud 90-year history that began in pressure-control

technology, is one of the premier engineering and manufacturing companies in our industry, with a broad portfolio of surface-related drilling and production products, which is well-balanced between offshore and land markets.

Today, Cameron holds well-established market leadership positions in each of their product lines, and has an unprecedented global installed-base with Cameron

wellheads, found on one-third of the world’s accessible producing wells.

When you add to this a company culture focused on the integrity and quality

of their products, and a management team open to new ideas, it became clear to us that the basis for a fruitful combination of our two companies was not only compelling but also culturally very feasible.

13

Turning next to the organizational integration, the technology offerings of Schlumberger and Cameron are highly

complementary with very little overlap.

Based on this, Cameron with its current product line structure, will join Schlumberger as a complete new product

group on par with our existing Characterization, Drilling, and Production Groups. This will significantly simplify the overall integration process.

In

terms of the initial integration priorities after the close, the focus will be on streamlining the corporate and back-office support functions leveraging our common infrastructure and supply chain buying-power, as well as establishing a coordinated

customer interface.

Following this, we will shift our integration focus on to research, engineering, and manufacturing as we pursue our stated goals of

creating the industry’s first complete drilling and production systems.

So building on all of this, let me summarize the four elements that make

this transaction so compelling.

14

First, is the broad opportunity for technology-led growth through the integration of Schlumberger’s subsurface

technology with Cameron’s surface technology, enabled by our unique strengths in instrumentation software and automation, all together launching a new era of total drilling and production system performance.

Second, is the cost synergies that can be achieved through efficiency improvements in operating costs, engineering and manufacturing processes, and supply

chain performance strongly supported by our established corporate transformation program.

Third, is the value we will create for our customers through

technology system innovation, improved operational performance, higher levels of cost efficiency, and much closer commercial alignment through new and more risk-based business models, all contributing towards improving production, increasing

recovery, and lowering cost per barrel.

Last, the transaction will create value for shareholders through profitable, technology-driven growth in

complementary businesses with virtually no product line overlap between Schlumberger and Cameron.

We aim to generate $300 million in synergies in the

first year after the close, and $600 million in the second year.

And, in terms of earnings-per-share, the transaction will be accretive by the end of the

first year.

So let’s take a brief look at the synergies starting with costs.

15

Schlumberger and Cameron have broad global footprints.

As Cameron becomes the fourth Schlumberger product group, support functions and operating locations will be integrated to drive efficiency, and to enable a

fully coordinated customer interface.

This process will be further enhanced by the maturity of the Schlumberger shared services organization.

Second, while Schlumberger has grown its manufacturing portfolio in recent years, Cameron brings best-in-class manufacturing expertise, and hence, there are

significant opportunities to share knowledge and also to combine our two supply chain organizations and save costs.

Third, as we accelerate deployment of

our transformation program, we will also extend its reach to Cameron under Scott Rowe’s management.

And, in extracting all of these synergies, we

will fully leverage the experience we gained during the successful integration of Smith International.

16

While the early synergies are driven by cost efficiencies, the long-term value of the transaction is fully focused on

revenue growth.

We will create this growth by expanding Cameron’s geographical reach and customer, and by combining our complementary technology

offerings to ultimately benefit our customers in the form of higher production, increased recovery, and lower cost-per-barrel.

The growth opportunities

include accelerating the implementation of the OneSubsea vision and plans.

Addressing the significant non-productive-time related to BOPs, which is an

industry-wide issue, in particular for offshore operations.

Extending the integration of today’s drilling systems to include all surface and

sub-surface components operating on a common planning, monitoring, and optimization software.

And, further strengthening our offering in fracturing

services by combining the CAMShale offering with our ongoing developments in both downhole and surface fracturing technologies.

So let’s look closer

at each of these opportunities.

17

First, the OneSubsea joint-venture was created to combine subsea design infrastructure and processing capabilities with

reservoir modelling, well completions, and flow assurance expertise to help our customers maximize production and recovery.

The approach and offering

from OneSubsea is still unique in the industry and has led to new levels of engagement with several customers in the past year.

Going forward, we see

clear potential to further accelerate the implementation of a wide range of the OneSubsea business plans.

This includes expanding both the customer base

and geographical coverage, building on our extensive global footprint.

By acquiring 100% of OneSubsea, we will also look to accelerate the joint R&D

efforts between OneSubsea and our Completions and Artificial Lift product lines, as we look to integrate the hardware in the well and on the seafloor, through a common control system.

And finally, we see significant opportunity to introduce performance-based boosting contracts for new and existing subsea fields, leveraging our leading

multi-phase pump-technology, our strong balance sheet, and our ability to manage both reservoir and production risk.

18

Next are the BOPs, which are one of the industry’s most critical control technologies, and at the same time also one

of the main causes of non-productive time, in particular for offshore operations.

Cameron’s installed base of BOP’s is the largest in the

industry, and they have pioneering expertise in both building and maintaining BOP’s.

Cameron’s BOP expertise and customer base, combined with

the high-quality service-based business model of Schlumberger, and by leveraging our instrumentation and software technologies, we believe we can bring game-changing efficiencies to this business, both on land and offshore.

In the longer-term, the integration of the Schlumberger and Cameron R&D platforms will enable development of the next-generation BOP, combining hydraulic

control with sensor and software technologies to help determine the health operating status and performance of the BOP.

19

Third, is land drilling where our Drilling Group offers a complete range of industry-leading product lines covering all

aspects of downhole tools, drilling fluids, and mud logging.

As stated previously, we see a significant business opportunity in combining our integrated

downhole drilling technology with a new generation of highly efficient land rigs, creating an integrated drilling platform driven by a common software system with automated end-to-end workflows.

We are currently in the process of translating this vision into reality by addressing the following elements.

We have for the past two years been working on a new land rig design, and supported by the recent acquisition of Houston-based T&T Engineering, a leading

land rig design firm, we are now finalizing our new designs and making them ready for manufacturing.

To address the manufacturing side, I am pleased to

announce that we are forming a joint-venture with Bauer Deep Drilling from Germany, which brings both the required manufacturing expertise and footprint.

From Cameron, we will get all the required drilling equipment including top drives, pipe-handling, and BOPs.

While the entire software backbone is developed by our SIS product line, built directly on top of the Petrel earth model and including all aspects of well

design and planning, drilling optimization and control, and supported by our Big Data and Cloud Computing technology center, recently established in Palo Alto, California.

20

We are confident that our new land rig system will create the next step-change in drilling performance for our

customers, as well as new growth opportunities for Schlumberger in a market segment overdue for both re-capitalization and introduction of new technology.

Fourth, is unconventional resources, where Cameron has the world’s largest rental fleet of hydraulic fracturing

pressure-control equipment, providing everything between the pressure pumping fleet and the well.

The combination of our existing fracturing fleet

footprint with CAMSHALE, and a number of other surface technology R&D projects, represent a significant opportunity to optimize and automate today’s capital intensive surface set-up.

So with these synergy examples let’s next turn to the market outlook.

21

So far this year, global GDP growth has faced a series of headwinds, but in spite of slower US growth in the first quarter,

uncertainty in the Eurozone linked to Greece and a continuing slowdown in China, the growth is still expected to end up around 2.6%.

Looking forward to

2016, the global GDP growth forecast is still higher than 2015 at 3.2% driven by stronger growth in the US.

In line with this, the IEA sees continued

growth in global oil demand and has, since March this year, upgraded growth estimates to 1.6 million barrels per day in 2015 and 1.4 million barrels per day in 2016, even with continued growth concerns in China.

And, while oil demand is revised upwards, the dramatic reductions in E&P investments over the past year is starting to have an impact on the various

sources of oil supply.

22

In North America, 2015 full-year oil production will show growth year-over-year, however, with E&P investments

continuing to drop during the year and production peaking already in April we expect either flat or lower full-year production in 2016.

Non-OPEC, non-NAM

supply will, in 2015, end up flat year-over-year, but we expect it to decline in 2016 as the full impact of lower E&P investments is felt in the aging production base.

Within OPEC, the significant growth in marketed supply is offset by an even larger drop in spare capacity leaving OPEC’s total production capacity flat

to slightly down today versus 12 months ago, and excluding Iran, this trend is not expected to change in the near, or even the medium term.

Based on

this, the combined 2016 production outlook for the three global supply sources is flat to down versus 2015, which given the strong demand outlook, is why we maintain that the physical balance in the oil market continues to tighten.

The flattening production we are now seeing is just the starting point of what could come if E&P investments and oilfield activity is not increased soon.

23

We believe that the market is currently under-estimating the oil industry’s annual production replacement challenge,

which is defined on one side by the natural decline of the aging production base, and the demand growth on the other side.

This supply gap is, each year,

filled by investments made in the mature production base to reduce the natural decline rate to a managed decline rate, while investments in new reserves brings production back to the baseline and addresses demand growth.

The magnitude of the annual production replacement challenge is in the range of 8-10 million barrels per day, which is an order of magnitude higher than

the average growth in demand.

The dramatic reduction in global E&P investments will, with some delay, have a significant impact on the

industry’s ability to meet this significant replacement challenge.

At this stage, we are still in the delay period with only early signs of a

weakening supply base, but the longer the investment cuts are upheld, the more severe the impact will be on the replacement capacity.

Based on this, we

continue to expect upwards movement in oil prices, either later this year or in the first part of next year, when the market fully realizes the tightness of the physical balances and the pending supply impact from lower investments.

24

We further believe that OPEC will continue to focus on protecting market share and will aim to stabilize oil

prices above where they are today, but well below the $100 level, by shifting more of their spare capacity to marketed production and potentially further helped by additional exports from Iran.

So what does this mean for the oilfield services markets?

First of all, given the magnitude of the annual production replacement challenge and the ongoing tightening of the oil market, there will be a strong need for

higher E&P investments to meet demand in the coming years.

Still, we believe our customers will take a conservative approach to their 2016 budgets,

so if the anticipated oil price increase slips into early parts of next year, it is not expected to have a major impact on the initial budgets for next year.

We expect the underlying activity in the first half of next year to be in line with the second half of this year, excluding the seasonal impact in the first

quarter.

If oil price permits, some customers could increase budgets in the second half of next year, with general focus on land operations in various

parts of the world due to the faster mobilization times for these types of operations.

Given the longer planning cycle for offshore work, we see a

continuation of the trend from this year in 2016, with focus on shallow water work in mature basins and already committed deep-water projects.

25

While for exploration we expect subdued activity for yet another year, although activity and discovery levels are

already down to unsustainable levels for the industry.

In terms of pricing, we believe the pressure will continue into next year but, with higher oil

prices, is likely to ease quicker overseas, while the massive overcapacity in North America land will delay any significant pricing traction for some time.

26

Ladies and gentlemen, I would like to conclude by reinforcing the following key points.

Schlumberger continues its multi-year run of financial outperformance, and by focusing on prompt and proactive resource management, we have minimized the

impact on our financial performance and maintained the quality of our operations.

The proposed Cameron transaction is a compelling extension to our

business portfolio, building on our proven formula for evolving our technical offering, and will lead to significant value for our customers through improved production, increased recovery, and lower cost per barrel.

The physical balance of the oil market continues to tighten as the under-investment and decline in the global production base poses far greater challenges to

supply than the headline growth in demand, and potentially higher exports from Iran.

While there is clearly a strong need for higher E&P investments

to meet the production replacement challenge in coming years, our customers are still expected to, initially, take a conservative approach to their 2016 budgets.

In Schlumberger, we remain confident in our capacity to weather this downturn better than our surroundings.

Through our global reach, the strength of our technology offering, and our corporate transformation program, we are creating a great platform to increase

revenue market share, post superior earnings, and continue to deliver unmatched levels of free cash flow. Thank you very much.

27

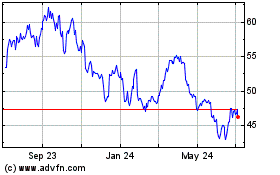

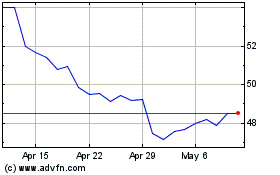

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024