U.S. Government Bonds Strengthen

November 28 2016 - 4:06PM

Dow Jones News

By Sam Goldfarb

U.S. government bonds strengthened Monday, showing some signs of

positive momentum after three consecutive weeks of yield

increases.

In late-afternoon trading, the yield on the benchmark 10-year

Treasury note was 2.319%, compared with 2.359% Friday. Yields fall

when bond prices rise.

Bonds have sold off sharply since Donald Trump's victory in the

Nov. 8 presidential election, as investors respond to the increased

chances of fiscal stimulus next year.

Investors have calculated that large tax cuts, increased deficit

spending, and the rollback of regulations should boost economic

growth in the coming years, leading to higher inflation and a

faster pace of interest-rate increases by the Federal Reserve.

A flood of new bonds to finance a growing budget deficit would

dilute the value of outstanding government debt. So would higher

inflation and interest rates, while faster growth could lead

investors to sell government debt in favor of riskier assets.

If current projections prove accurate, Mr. Trump's victory could

represent a turning point for bond yields, which reached record

lows earlier this year on concerns that the world was stuck in a

low-growth, low-inflation environment, accompanied by ultraloose

monetary policies from central banks.

Still, some investors and analysts have cautioned that the

selloff may be due for a pause, partly due to the hazards of

predicting government policy even with Republicans controlling

Congress and the White House.

In a sign that buyers might be returning to the market, an

auction of seven-year Treasury notes drew robust demand Wednesday,

after sales of two-year and five-year notes met with soft

receptions earlier in the week. The highlight was 72.7% indirect

bidding, the highest on record, according to Jefferies LLC. The

category is a proxy of demand from foreign investors including both

private investors and foreign central banks.

The yield on the 10-year note reached 2.417% Wednesday morning,

its highest intraday level since July 2015, but declined

immediately following the auction, according to Tradeweb.

As bonds continued to strengthen Monday, pre-auction yields are

looking like "a near-term top," said John Herrmann, rates

strategist at MUFG Securities in New York.

Eventually, though, Mr. Herrmann still expects yields to climb

higher as the economy picks up strength next year.

Apart from the outlook for fiscal policy, economic data released

in November has pointed to a brighter growth outlook and added to

the selling in the bond market.

Among the highlights were the best two-month stretch of retail

sales in at least two years, the fastest pace of housing starts

since 2007, and strong demand for long-lasting manufactured

goods.

Any rally in the bond market this week should be supported by

the typical buying that occurs at the end of each month, as some

investors add government bonds to their portfolios to match the

swelling volume in indexes they track. But it could be tested by

new economic data, including the Fed's preferred measure of

inflation Wednesday and employment numbers Friday.

COUPON ISSUE Price CHANGE YIELD CHANGE

1% 2-year 99 25/32 up 1/32 1.111% -1.2BPS

1% 3-year 98 30/32 up 3/32 1.370% -2.9BPS

1 3/4% 5-year 99 24/32 up 6/32 1.801% -3.6BPS

2 1/8% 7-year 99 31/32 up 10/32 2.132% -4.6BPS

2% 10-year 97 6/32 up 11/32 2.319% -3.9BPS

2 7/8% 30-year 97 29/32 up 16/32 2.982% -2.5BPS

2-10-Yr Yield Spread: +120.8BPS Vs + 123.6BPS

Source: Tradeweb/WSJ Market Data Group

(END) Dow Jones Newswires

November 28, 2016 15:51 ET (20:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

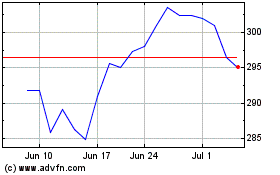

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

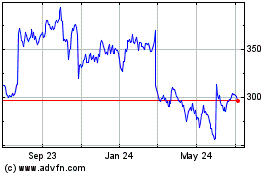

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Apr 2023 to Apr 2024