Navistar Finds Rough Road To Higher Truck Market Share

February 03 2012 - 8:04AM

Dow Jones News

Navistar's International Corp.'s (NAV) competitors have managed

to plant doubts about Navistar's engines that have held down the

company's market share gains, says Chairman and Chief Executive Dan

Ustian.

Navistar made reaching a 25% share of the heavy-duty commercial

truck market a focal point of its message to Wall Street last year.

Ustian believed the company could grab truck volume by exploiting

rivals' higher truck prices for additional pollution-reduction

components. Navistar opted to use a less expensive exhaust

treatment system, but ended 2011 with a 21.4% market share, up

about four percentage points from the end of 2010.

Ustian said his company has had difficulty fending off rival

truck and engine manufacturers' attacks on the pollution-reduction

technology used on the company's new 13-liter and 15-liter engines.

None of the other truck makers in North America use the same system

for reducing nitrogen oxide in engine exhaust, making Navistar an

easy target for cut-throat comparison marketing by competitors.

Ustian said they've managed to generate enough suspicion and

anxiety about the fuel economy, power and durability of Navistar's

engines to cause trucking companies to be cautious about Navistar

trucks.

"They've put doubt in people's mind," said Ustian during an

interview Wednesday with Dow Jones Newswires. "That part has been

tougher to overcome than we thought. If you're a trucking company,

you may believe our story, but can you take the risk? They've been

reluctant to take that risk. Their livelihood depends on that truck

being right."

Ustian said he's confident that Navistar will eventually be able

to convert more of the market to Navistar trucks as the company's

engines develop a positive track record.

"We've got more work to do in that area" he said.

Navistar is the third-largest seller of heavy-duty trucks in the

North America behind Paccar Inc. (PCAR) and Daimler AG's (DDAIY,

DAI.XE) Freightliner brand. After decades of giving truck buyers a

choice of engine manufacturers, Navistar two years ago decided to

offer only its own engines in its trucks, effectively severing its

relationship with engine maker Cummins Inc. (CMI).

Ustian and other Navistar executives spent Wednesday trying to

ease stock analysts' concerns about Navistar's engines complying

with federal standards for nitrogen oxide emissions. Since 2010 the

company has been using pollution credits to meet with the ultra-low

level prescribed by the U.S. Environmental Protection Agency.

"There's a degree of skepticism regarding how the investment

community has looked at their ability to deliver on their engine

strategy," said Brian Spronheimer, an analyst for Gabelli &

Co., who believes that company's engines will meet the EPA's

standards.

Navistar's stock price is down 33.4% in the past nine months,

despite surging demand for commercial trucks in North America. The

stock Thursday closed up 1.3%, at $45.91 a share.

The company said it has submitted its l3-liter engine for

certification at 0.2-gram of nitrogen oxide per brake-horsepower

hour, the EPA's latest standard. Navistar said it also will soon be

ready to pursue certification for its 15-liter engine. Navistar's

engines have been at about 0.50-gram of nitrogen oxide, which is an

ingredient in greenhouse gas blamed for global warming.

Environmental regulators warned last month that Navistar is

quickly running out of pollution credits for its noncompliant

heavy-duty engines. The EPA established a set of fines for Navistar

to pay in the event that the company exhausts its credits before

its engines are certified. The fines, which could be as much as

$2,000 an engine, would allow Navistar to continue selling its

engines in the U.S.

"I don't like what they determined as the penalties," said

Ustian. "But their intentions are good."

Ustian believes any fines the company pays will be minimal and

short-lived. He insists the company's engines will be able to reach

the 0.20-gram level with exhaust gas recirculation, or ERG. The

process recirculates exhaust through an engine's combustion

process, burning the nitrogen oxide that otherwise would be sent

into the atmosphere from a truck's exhaust pipe. Although

Navistar's EGR engines haven't reached the 0.20-gram standard

previously, the company maintains it has modified the controls on

the system to reach the standard.

Navistar contends ERG is more user-friendly than competitors'

pollution-reduction systems and does not sacrifice fuel economy, a

key argument used against EGR. The rest of the truck industry

reduces nitrogen oxide through a process known as selective

catalytic reduction, or SCR.

SCR filters engine exhaust through a urea solution that turns

nitrogen oxide into water and nitrogen. The system is widely used

on cars and trucks in Europe, but requires truck operators to

maintain a reservoir of urea to keep the system functioning

properly. Navistar has repeatedly complained that EPA's regulations

on SCR permit drivers to operate their trucks for long distances

without sufficient levels of urea, releasing untreated engine

exhaust into the atmosphere.

-By Bob Tita, Dow Jones Newswires; 312 750 4129;

robert.tita@dowjones.com

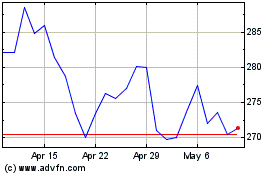

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From Aug 2024 to Sep 2024

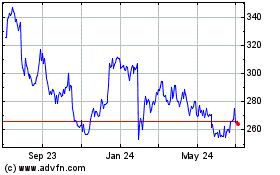

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From Sep 2023 to Sep 2024