HERSHEY

Profit Outlook Rises Along With Snacking

Hershey Co. said Friday that Americans are snacking more,

helping the chocolate maker to post higher quarterly sales and

raise its profit outlook.

The company, which reported a better-than-expected third-quarter

profit, pointed to increased spending, despite mixed signals about

consumer confidence during the quarterly earnings season and

competition from rivals targeting health-conscious consumers.

"I think we can see that there's firming in the category," Chief

Executive J.P. Bilbrey said on a call Friday with analysts. "We

think people are, across all income cohorts, beginning to spend a

little more confidently than they have before."

The company rejected a takeover approach from Oreo cookie maker

Mondelez International Inc. earlier this year.

Mr. Bilbrey is to step down in July. Michele Buck, promoted last

summer to chief operating officer and a likely CEO candidate, is

taking on such challenges as an increased presence of

health-focused snacks at checkout lanes and rival chocolate brands

upping their game.

"There has been a bit more competition" from healthy items, Ms.

Buck said Friday.

Hershey, which also makes Reese's Peanut Butter Cups and Jolly

Ranchers, reported a 46% rise in third-quarter profit as sales rose

2.2% from a year earlier to $2 billion.

Hershey now expects full-year earnings, adjusted to exclude

certain items, of $4.28 to $4.32 a share; that is four cents higher

than its previous estimate.

Shares rose 7.2% to $102.40 in Friday trading.

Over the summer, Mondelez made an offer, but Hershey's board

wanted more money for the iconic company. In August, Mondelez

announced an end to its pursuit, leaving Hershey to pursue alone an

expansion overseas and into the snack aisle.

Over the past couple of years, Hershey has bought Krave beef

jerky, created a line of protein bars and squeeze pouches called

SoFit, and come out with snack mixes of chocolate, pretzels and

nuts, in an effort to broaden its reach.

Meanwhile, M&M's maker Mars Inc. is merging operations with

its Wrigley gum division, giving it more leverage with retailers.

And Mondelez is bringing its European chocolate brand Milka to the

U.S., with its Oreo chocolate bar coming out around the same time

as Hershey's Cookie Layer Crunch.

Hershey reported profit of $227.4 million, or $1.06 a share, in

the latest quarter, compared with $154.8 million, or 70 cents a

share, a year prior. Excluding certain one-time factors, earnings

were $1.29 a share, up 10% from the prior year and topping

analysts' estimate of $1.18 a share, according to Thomson

Reuters.

Hershey's relatively new Chinese business contributed to the

performance with a 15% rise in sales during the quarter in local

currency terms.

In North America, which accounts for nearly 90% of sales,

revenue rose 1.8% to $1.76 billion.

India and Canada were trouble spots, though, with sales falling

7.7% in Canada and 21% in India in local currency terms.

--Annie Gasparro

ELECTROLUX

Efficiency Buoys Appliance Maker

Electrolux AB, one of the world's largest household-appliance

makers, Friday posted a 25% rise in third-quarter net profit,

reflecting improved profitability in most business areas and

improved efficiency.

The Swedish company said net profit for the three-month period

ended Sept. 30 rose to 1.27 billion Swedish kronor ($140.9

million), from 1.01 billion Swedish kronor in the same period last

year, beating analysts' expectations.

Revenue amounted to 30.85 billion Swedish kronor, down slightly

from 31.28 billion Swedish kronor a year earlier. Analysts polled

by Factset expected net profit of 1.21 billion Swedish kronor on

revenue of 31.48 billion Swedish kronor.

Electrolux, which also makes appliances under brand names such

as AEG, Zanussi, Molteni and Frigidaire, said results improved in

most business areas, such as North America, Europe and Asia, while

Latin America remained weak.

Jonas Samuelson, Electrolux's Chief Executive, said the

profitability in North America of its major appliances business,

which include washing machines, refrigerators and other large

kitchen equipment, was positively impacted by improved operational

efficiency and lower raw material costs.

Major appliances sales in the region, which account for 37% of

the company's revenue, were down slightly. Electrolux also lowered

its market outlook for 2016, saying it expects market demand for

appliances in North America to grow by 3% to 4% this year, down

from 4 to 5% earlier.

The company said sales of major appliances in Europe, the Middle

East and Africa, Electrolux's second-biggest market, increased,

mainly driven by Eastern Europe, adding it suffered currency

headwinds related to the depreciation of the British pound.

Electrolux confirmed its expectations of European market demand

growth of 2 to 4% for this year, but added it will be likely in the

lower end of that range.

Electrolux's sales of small appliances, which account for 6% of

its revenue and are mostly vacuum cleaners, declined 10%, as the

company continued to exit unprofitable product categories and

markets.

--Matthias Verbergt

GOODYEAR TIRE & RUBBER

Results Miss Expectations

Goodyear Tire & Rubber Co. cut its outlook for yearly volume

and said its revenue and earnings came in below Wall Street

expectations amid what it said was a volatile U.S. commercial

truck-tire business.

Shares fell 7% to $28.80 in premarket trading.

The tire maker now expects annual global volume to grow between

1% and 2%, down from expectations of 3% growth previously. Chief

Executive Richard Kramer said the reduced outlook is due to "recent

volatility impacting our U.S. commercial truck tire business."

U.S. commercial tire volumes fell 12% in the quarter. Canada

also had lower sales.

Earlier last week, Goodyear said it was planning to shut down a

plant in Germany as part of its broader realignment plan to focus

on more profitable premium, large-rim tires. The plant targeted for

closing employs about 890 workers and makes passenger car and light

truck tires, Goodyear said.

For the quarter, Goodyear earned $317 million, or $1.19 a share,

compared with $271 million, or 99 cents a share, a year earlier. On

an adjusted basis, the company made $1.17 a share. Revenue fell

8.1% to $3.85 billion.

Analysts polled by Thomson Reuters had expected $1.18 in

adjusted earnings per share on $3.97 billion in revenue.

The company sold 8.4% fewer tires in America as replacement tire

shipments fell 6% and original equipment volume fell 15%. It

shipped 4.9% fewer tires in Europe, Middle East and Africa due to

increased competition in smaller rim consumer tires.

--Austen Hufford

ROYAL CARIBBEAN CRUISES

Royal Caribbean Cruises Ltd. said its third-quarter earnings

rose 13%, beating expectations amid strong demand for North

American itineraries.

Shares climbed 5% to $71.46 in premarket trading.

Royal Caribbean also pointed to strong 2017 bookings that are

ahead of last year's by rate and volume as an indicator for a solid

outlook for the next fiscal year. Some investors have become

skeptical of the cruise industry as prices stalled in the

Mediterranean and Chinese markets last month. Banks slashed

estimates for Royal Caribbean earlier this month and downgraded its

smaller competitor Norwegian Cruise Line Holdings Ltd.

Royal Caribbean's eEarnings for the quarter rose to $693.3

million, or $3.21 a share, from $228.8 million, or $1.03 a share,

in the same period a year ago. Excluding certain items, adjusted

earnings per share came to $3.20, above the $3.10 estimated by

analysts polled by Thomson Reuters. Revenue increased 1.6% to $2.56

billion, just under consensus estimates of $2.58 billion.

The Miami-based company backed its 2016 guidance of earnings

between $6 and $6.10 per share. Analysts polled by Thomson Reuters

are expecting $6.02.

--Imani Moise

(END) Dow Jones Newswires

October 31, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

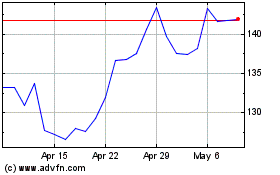

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

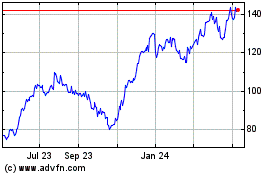

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Apr 2023 to Apr 2024