UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): May 7, 2015

Commission File

Number |

Registrant; State of Incorporation;

Address and Telephone Number |

IRS Employer

Identification No. |

| |

|

|

| 1-11459 |

PPL Corporation

(Exact name of Registrant as specified in its charter)

(Pennsylvania)

Two North Ninth Street

Allentown, PA 18101-1179

(610) 774-5151 |

23-2758192 |

| |

|

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition

On May 7, 2015, PPL Corporation ("PPL") issued a press

release announcing its financial results for the quarter ended March 31, 2015 and other business matters. A copy of

the press release is furnished as Exhibit 99.1.

Section 7 - Regulation FD

Item 7.01 Regulation FD Disclosure

On May 7, 2015, at 8:30 a.m. (Eastern Time), members of PPL's

senior management will hold a teleconference and webcast with financial analysts to discuss PPL's financial results for the quarter

ended March 31, 2015 and other business matters. A copy of the slides to be used during the webcast is furnished as

Exhibit 99.2. The event will be available live, in audio format, along with the slides, on PPL's Internet Web site: www.pplweb.com. The

webcast will be available for replay on PPL's Web site for 30 days.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

| |

(d) |

|

Exhibits |

|

| |

|

|

|

|

| |

|

|

99.1 - |

Press Release, dated May 7, 2015, announcing PPL's financial results for the quarter ended March 31, 2015 and other business matters. |

| |

|

|

|

|

| |

|

|

99.2 - |

Slides to be used on the May 7, 2015 webcast among members of PPL's senior management and financial analysts. |

| |

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PPL CORPORATION |

| |

|

|

|

| |

By: |

/s/ Stephen K. Breininger |

|

| |

|

Stephen K. Breininger

Vice President and Controller |

|

Dated: May 7, 2015

Exhibit 99.1

| Contacts: |

For news media – Ryan Hill, 610-774-5997 |

| |

For financial analysts – Joseph P. Bergstein, 610-774-5609 |

| |

|

PPL Corporation Reports First-Quarter

Earnings

| · | Per-share regulated utility earnings from ongoing operations up 17 percent from first

quarter 2014. |

| · | Company reaffirms 2015 forecast of regulated utility earnings from ongoing operations. |

| · | PPL set to complete Supply business spinoff June 1. |

ALLENTOWN, Pa. (May 7, 2015) - - PPL Corporation (NYSE:

PPL) on Thursday (5/7) announced first-quarter 2015 reported earnings

of $647 million, or $0.96 per share, an increase from $316 million, or $0.49 per share, in the first quarter of 2014.

Adjusting for special items, including Supply segment earnings,

first-quarter 2015 regulated utility earnings from ongoing operations were $519 million, or $0.77 per share. This compares to regulated

utility earnings from ongoing operations (adjusted) of $426 million, or $0.66 per share, in the first quarter of 2014.

“Strong first-quarter earnings at our U.K. regulated segment

drove a 17 percent increase in per-share regulated utility earnings from ongoing operations, while our regulated businesses in

both Pennsylvania and Kentucky continued to perform well and benefited from ongoing infrastructure investments,” said William

H. Spence, PPL chairman, president and Chief Executive Officer.

The company’s first-quarter performance led PPL to reaffirm

its 2015 forecast range of $2.05 to $2.25 per share for regulated utility earnings from ongoing operations, with a midpoint of

$2.15 per share.

Meanwhile, Spence said PPL continues to move closer to completing

the spinoff of its competitive generation business, which will be combined with competitive generation assets of RJS Power Holdings

LLC, an affiliate of Riverstone Holdings LLC, to form a new independent power producer named Talen Energy Corporation.

The company recently announced that the transaction will close

June 1. PPL has received all of the necessary regulatory approvals to complete the transaction. After the close, PPL will focus

on the high-performing, award-winning regulated utilities it owns and operates in Pennsylvania, Kentucky and the United Kingdom.

“Moving forward as a purely regulated utility company,

we remain confident in our ability to achieve annual earnings growth of 4 to 6 percent through at least 2017, based on the continued

strong performance of our regulated businesses, the rate base growth expected from significant projected infrastructure investment

and $75 million in targeted, corporate support cost savings that have been identified as part of our corporate restructuring,”

Spence said.

First-Quarter 2015 Earnings Details

PPL’s reported earnings for

the first quarter of 2015 included net special item after-tax benefits of $128 million, or $0.19

per share, primarily due to Supply segment earnings and foreign currency-related economic hedges. Reported earnings for the first

quarter of 2014 included special item after-tax expenses of $133 million, or $0.20 per share. The 2014 special items included an

increase in accrued liability for U.K. line losses and were adjusted to include Supply segment losses.

Reported earnings are calculated in accordance with U.S. generally

accepted accounting principles (GAAP). “Regulated utility earnings from ongoing operations” is a non-GAAP financial

measure that is adjusted for special items, including the Supply segment’s earnings. The first quarter of 2014 has also been

adjusted to reflect the impact of dissynergies related to the spinoff of PPL Energy Supply. Special items and the dissynergies

are fully detailed at the end of this news release.

| (Dollars in millions, except for per share amounts) |

|

1st Quarter |

|

|

| |

|

2015 |

|

2014 |

|

% Change |

| |

|

|

|

|

|

|

|

|

|

|

| Reported earnings |

|

$ |

647 |

|

|

$ |

316 |

|

|

105% |

| Reported earnings per share |

|

$ |

0.96 |

|

|

$ |

0.49 |

|

|

96% |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

1st Quarter |

|

|

| |

|

2015 |

|

2014 (adjusted) |

|

% Change |

| Regulated utility earnings from ongoing operations |

|

$ |

519 |

|

|

$ |

426 |

|

|

22% |

Regulated utility earnings from ongoing operations

per share |

|

$ |

0.77 |

|

|

$ |

0.66 |

|

|

17% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

(See the tables at the end of this news release for a reconciliation

of reported earnings to regulated utility earnings from ongoing operations.)

First-Quarter Earnings by Segment1

| |

|

1st Quarter |

| Per share |

|

2015 |

|

2014 (adjusted) |

| Regulated Utility earnings from ongoing operations |

|

|

|

|

|

|

|

|

| U.K. Regulated |

|

$ |

0.50 |

|

|

$ |

0.41 |

|

| Kentucky Regulated |

|

|

0.16 |

|

|

|

0.16 |

|

| Pennsylvania Regulated |

|

|

0.13 |

|

|

|

0.13 |

|

| Corporate and Other2 |

|

|

(0.02 |

) |

|

|

(0.04 |

) |

| Total |

|

$ |

0.77 |

|

|

$ |

0.66 |

|

| |

|

|

|

|

| |

|

2015 |

|

2014 (adjusted) |

| Special items and dissynergy adjustments |

|

|

|

|

|

|

|

|

| Special items (expense) benefit: |

|

|

|

|

|

|

|

|

| U.K. Regulated |

|

$ |

0.06 |

|

|

$ |

(0.09 |

) |

| Kentucky Regulated |

|

|

– |

|

|

|

– |

|

| Pennsylvania Regulated |

|

|

– |

|

|

|

– |

|

| Corporate and Other2 |

|

|

(0.01 |

) |

|

|

– |

|

| Supply |

|

|

0.14 |

|

|

|

(0.11 |

) |

| Total Special items |

|

|

0.19 |

|

|

|

(0.20) |

|

| Dissynergy adjustments expense (benefit): |

|

|

|

|

|

|

|

|

| Corporate and Other2 |

|

|

– |

|

|

|

0.03 |

|

| Total special items and dissynergy adjustments |

|

$ |

0.19 |

|

|

$ |

(0.17 |

) |

| |

|

|

|

|

| |

|

2015 |

|

2014 |

| Reported earnings |

|

|

|

|

|

|

|

|

| U.K. Regulated |

|

$ |

0.56 |

|

|

$ |

0.32 |

|

| Kentucky Regulated |

|

|

0.16 |

|

|

|

0.16 |

|

| Pennsylvania Regulated |

|

|

0.13 |

|

|

|

0.13 |

|

| Corporate and Other2 |

|

|

(0.03 |

) |

|

|

(0.01 |

) |

| Supply1 |

|

|

0.14 |

|

|

|

(0.11 |

) |

| Total |

|

$ |

0.96 |

|

|

$ |

0.49 |

|

1 Supply earnings from ongoing operations are

discussed in a subsequent section of this news release.

2This category primarily includes unallocated

corporate-level financing and other costs. For 2014, regulated utility earnings from ongoing operations (adjusted) and special

items and dissynergy adjustments reflect the impact of dissynergies related to the spinoff of PPL Energy Supply: Indirect O&M

($0.02) and Interest ($0.01).

(For an itemization of special

items and dissynergy adjustments, see the reconciliation tables at the end of this news release.)

Key Factors Impacting Regulated Utility

Earnings from Ongoing Operations

U.K. Regulated Segment

PPL’s U.K. Regulated segment primarily consists of the

regulated electricity delivery operations of Western Power Distribution, serving Southwest and Central England and South Wales.

Regulated utility earnings from ongoing

operations in the first quarter of 2015 increased by $0.09

per share compared with a year ago. This increase was primarily due to higher utility revenues driven by an April 1, 2014,

price increase, lower depreciation expense, and lower income taxes.

Kentucky Regulated Segment

PPL’s Kentucky Regulated segment primarily consists of

the regulated electricity and natural gas operations of Louisville Gas and Electric Company and Kentucky Utilities Company.

Regulated utility earnings from ongoing operations in the first

quarter of 2015 were the same as a year ago. This was primarily due to returns on additional environmental capital investments,

offset by lower sales volumes and higher income taxes.

Pennsylvania Regulated Segment

PPL’s Pennsylvania Regulated segment consists of the regulated

electricity delivery operations of PPL Electric Utilities.

Regulated utility earnings from ongoing operations in the first

quarter of 2015 were the same as a year ago. This was primarily due to higher margins from additional transmission capital investments,

offset by higher depreciation expense and a benefit recorded in the first quarter of 2014 from a change in estimate of a regulatory

liability.

Corporate and Other

PPL’s Corporate and Other category primarily includes

unallocated corporate-level financing and other costs.

Corporate and Other improved by $0.02 per share in the first

quarter of 2015 compared to the first quarter of 2014 (adjusted). This was primarily due to the benefits of the corporate restructuring.

Forecast of Regulated Utility Earnings

from Ongoing Operations

| |

2015

forecast

midpoint |

|

2014 regulated utility earnings from ongoing operations (adjusted) |

| Per share |

|

|

|

|

|

| U.K. Regulated |

$ 1.38 |

|

|

$ 1.37 |

|

| Kentucky Regulated |

0.48 |

|

|

0.47 |

|

| Pennsylvania Regulated |

0.39 |

|

|

0.40 |

|

| Corporate and Other1 |

(0.10 |

) |

|

(0.21 |

) |

| Total |

$ 2.15 |

|

|

$ 2.03 |

|

1 This category primarily includes unallocated

corporate-level financing and other costs. For 2014, regulated utility earnings from ongoing operations (adjusted) reflects the

full impact of dissynergies related to the spinoff of PPL Energy Supply: Indirect O&M ($0.07), Interest ($0.05) and Depreciation

($0.01).

See the tables at the end of this news release for a reconciliation

of reported earnings to 2014 regulated utility earnings from ongoing operations (adjusted).

U.K. Regulated

Segment

PPL projects higher segment earnings

in 2015 compared with 2014, primarily driven by lower income taxes, lower depreciation expense and effects of foreign currency,

partially offset by lower utility revenue as Western Power Distribution transitions to a new eight-year price control period (RIIO-ED1)

effective April 1, 2015. The remaining 2015 foreign currency earnings exposure for this segment is 97 percent hedged.

Kentucky Regulated Segment

PPL projects higher segment earnings in 2015 compared with 2014,

primarily driven by anticipated electric and gas base rate increases and returns on additional environmental capital investments,

partially offset by higher operation and maintenance expense, higher depreciation and higher financing costs.

Pennsylvania Regulated Segment

PPL projects lower segment earnings in 2015 compared with 2014,

primarily driven by higher operation and maintenance expense, higher depreciation, higher financing costs, and a benefit recorded

in the first quarter of 2014 for a change in estimate of a regulatory liability, partially offset by higher transmission margins

and returns on distribution improvement capital investments.

Corporate and Other

PPL projects lower costs in this category in 2015 compared with

2014, primarily driven by the reduction of dissynergies related to the Supply business spinoff through corporate restructuring

efforts and lower income taxes.

First-Quarter Earnings for the Supply

Segment

Reported earnings are calculated in accordance with U.S. generally

accepted accounting principles (GAAP). “Supply earnings from ongoing operations” is a non-GAAP financial measure that

is adjusted for special items. Special items are fully detailed at the end of this news release.

| |

|

1st Quarter |

| |

|

2015 |

|

2014 |

| Supply earnings from ongoing operations per share |

|

$ |

0.11 |

|

|

$ |

0.11 |

|

| Supply special items per share |

|

|

0.03 |

|

|

|

(0.22 |

) |

| Supply reported earnings per share |

|

|

0.14 |

|

|

|

(0.11 |

) |

(See the tables at the end of the news release for details

as to the reconciliation of reported earnings to Supply earnings from ongoing operations.)

Key Factors Impacting the Supply Segment’s

Earnings from Ongoing Operations

Supply Segment

PPL’s Supply segment consists primarily of the

competitive domestic electricity generation and energy marketing operations of PPL Energy Supply.

Supply earnings from ongoing operations

in the first quarter of 2015 remained the same as a year ago despite the benefit from unusually

cold weather in the first quarter of 2014. Excluding the weather impact in 2014, the results were higher primarily due to higher

energy prices, favorable baseload generation and intermediate and peaking margins, offset by lower capacity prices, full-requirement

sales contracts and certain commodity positions.

PPL Corporation (NYSE: PPL), with 2014 revenues of $11.5 billion,

is one of the largest companies in the U.S. utility sector. The PPL family of companies delivers electricity and natural gas to

about 10 million customers in the United States and the United Kingdom. In June 2014, PPL announced an agreement to combine its

competitive generation business with the competitive generation business of Riverstone Holdings LLC to form Talen Energy Corporation,

an independent power producer. More information is available at www.pplweb.com.

# # #

(Note: All references to earnings per share in the text and

tables of this news release are stated in terms of diluted earnings per share unless otherwise noted.)

Conference Call and Webcast

PPL invites interested parties

to listen to a live Internet webcast of management’s teleconference with financial analysts about first-quarter 2015 financial

results at 8:30 a.m. Eastern time on Thursday, May 7. The meeting is available online live, in audio format, along with slides

of the presentation, on PPL’s website: www.pplweb.com. The webcast will be available for replay on the PPL website

for 30 days. Interested individuals also can access the live conference call via telephone at 866-346-8683.

International participants should call 1-412-902-4270.

# # #

“Regulated utility earnings from ongoing operations,”

should not be considered as an alternative to reported earnings, or net income, which is an indicator of operating performance

determined in accordance with U.S. generally accepted accounting principles (GAAP). PPL believes that “regulated utility

earnings from ongoing operations,” although a non-GAAP financial measure, is also useful and meaningful to investors because

it provides management’s view of PPL’s earnings as if the anticipated spinoff of PPL Energy Supply was completed. Other

companies may use different measures to present financial performance. “Regulated utility earnings from ongoing operations”

is adjusted for the impact of special items as described below, which includes the Supply segment’s earnings, as the segment

is expected to be disposed of upon completion of the announced spinoff of PPL Energy Supply. “Regulated utility earnings

from ongoing operations (adjusted)” for 2014 also reflects, within the Corporate and Other category, the impact of spinoff

dissynergies that would remain with PPL after the completion of the anticipated transaction, if left unmitigated. Due to the forward-looking

nature of any forecasted regulated utility earnings from ongoing operations for future periods, information to reconcile this non-GAAP

financial measure to the most directly comparable GAAP financial measure is not available at this time, as the company is unable

to forecast all special items.

“Regulated utility earnings from ongoing operations”

is adjusted for the impact of special items. Special items include:

| · | Unrealized gains or losses on foreign currency-related economic hedges. |

| · | Supply segment earnings. |

| · | Gains and losses on sales of assets not in the ordinary course of business. |

| · | Workforce reduction and other restructuring effects. |

| · | Acquisition and divestiture-related adjustments. |

| · | Other charges or credits that are, in management’s view, not reflective of the company’s

ongoing operations. |

“Supply earnings from ongoing operations” should

not be considered as an alternative to reported earnings, or net income, which is an indicator of operating performance determined

in accordance with U.S. generally accepted accounting principles (GAAP). PPL believes that “Supply earnings from ongoing

operations,” although a non-GAAP financial measure, is also useful and meaningful to investors because it provides management’s

view of the Supply segment’s fundamental earnings performance as another criterion in making investment decisions. Other

companies may use different measures to present financial performance.

“Supply earnings from ongoing operations” and

“earnings from ongoing operations” are adjusted for the impact of special items. Special items related to “Supply

earnings from ongoing operations” includes the items stated below, while “earnings from ongoing operations” additionally

includes a special item for unrealized gains or losses on foreign currency-related economic hedges.

| · | Adjusted energy-related economic activity (as discussed below). |

| · | Gains and losses on sales of assets not in the ordinary course of business. |

| · | Impairment charges (including impairments of securities in the company’s nuclear decommissioning

trust funds). |

| · | Workforce reduction and other restructuring effects. |

| · | Acquisition and divestiture-related adjustments. |

| · | Other charges or credits that are, in management’s view, not reflective of the company’s

ongoing operations. |

Adjusted energy-related economic activity includes the changes

in fair value of positions used to economically hedge a portion of the economic value of the competitive generation assets, full-requirement

sales contracts and retail activities. This economic value is subject to changes in fair value due to market price volatility of

the input and output commodities (e.g., fuel and power) prior to the delivery period that was hedged. Adjusted energy-related economic

activity also includes the ineffective portion of qualifying cash flow hedges and premium amortization associated with options.

This economic activity is deferred and included in earnings from ongoing operations over the delivery period of the item that was

hedged or upon realization. Management believes that adjusting for such amounts provides a better matching of earnings from ongoing

operations to the actual amounts settled for the Supply segment’s underlying hedged assets. Please refer to the Notes to

the Consolidated Financial Statements and MD&A in PPL Corporation’s periodic filings with the Securities and Exchange

Commission for additional information on adjusted energy-related economic activity.

Statements contained in this news release, including statements

with respect to future earnings, cash flows, financing, regulation and corporate strategy, are “forward-looking statements”

within the meaning of the federal securities laws. Although PPL Corporation believes that the expectations and assumptions reflected

in these forward-looking statements are reasonable, these statements are subject to a number of risks and uncertainties, and actual

results may differ materially from the results discussed in the statements. The following are among the important factors that

could cause actual results to differ materially from the forward-looking statements: market demand and prices for energy, capacity

and fuel; weather conditions affecting customer energy usage and operating costs; competition in power markets; the effect of any

business or industry restructuring, including the ability of PPL Corporation to realize all or a significant portion of the anticipated

cost savings from the planned corporate restructuring efforts following the Supply business spinoff; the profitability and liquidity

of PPL Corporation and its subsidiaries; new accounting requirements or new interpretations or applications of existing requirements;

operating performance of generating plants and other facilities; the length of scheduled and unscheduled outages at our generating

plants; environmental conditions and requirements and the related costs of compliance, including environmental capital expenditures

and emission allowance and other expenses; system conditions and operating costs; development of new projects, markets and technologies;

performance of new ventures; asset or business acquisitions and dispositions; any impact of hurricanes or other severe weather

on our business, including any impact on fuel prices; receipt of necessary government permits, approvals, rate relief and regulatory

cost recovery; capital market conditions and decisions regarding capital structure; the impact of state, federal or foreign investigations

applicable to PPL Corporation and its subsidiaries; the outcome of litigation against PPL Corporation and its subsidiaries; stock

price performance; the market prices of equity securities and the impact on pension income and resultant cash funding requirements

for defined benefit pension plans; the securities and credit ratings of PPL Corporation and its subsidiaries; political, regulatory

or economic conditions in states, regions or countries where PPL Corporation or its subsidiaries conduct business, including any

potential effects of threatened or actual terrorism or war or other hostilities; foreign exchange rates; new state, federal or

foreign legislation, including new tax legislation; and the commitments and liabilities of PPL Corporation and its subsidiaries.

Any such forward-looking statements should be considered in light of such important factors and in conjunction with PPL Corporation’s

Form 10-K and other reports on file with the Securities and Exchange Commission.

Note to Editors: Visit our media website at www.pplnewsroom.com

for additional news and background about PPL Corporation.

| PPL CORPORATION AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED FINANCIAL INFORMATION (a) |

| |

|

|

|

|

|

|

|

|

| Condensed Consolidated Balance Sheets (Unaudited) |

| (Millions of Dollars) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

March 31, |

|

December 31, |

| |

|

|

|

2015 |

|

2014 |

| Assets |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,335 |

|

$ |

1,751 |

| Short-term investments |

|

|

135 |

|

|

120 |

| Accounts receivable |

|

|

1,231 |

|

|

1,094 |

| Unbilled revenues |

|

|

621 |

|

|

735 |

| Fuel, materials and supplies |

|

|

687 |

|

|

836 |

| Price risk management assets - current |

|

|

1,119 |

|

|

1,158 |

| Other current assets |

|

|

571 |

|

|

465 |

| Investments |

|

|

999 |

|

|

985 |

| Property, Plant and Equipment |

|

|

|

|

|

|

| |

Regulated utility plant |

|

|

30,852 |

|

|

30,568 |

| |

Less: Accumulated depreciation - regulated utility plant |

|

|

5,413 |

|

|

5,361 |

| |

|

Regulated utility plant, net |

|

|

25,439 |

|

|

25,207 |

| |

Non-regulated property, plant and equipment |

|

|

12,951 |

|

|

12,819 |

| |

Less: Accumulated depreciation - non-regulated property, plant and equipment |

|

|

6,516 |

|

|

6,404 |

| |

|

Non-regulated property, plant and equipment, net |

|

|

6,435 |

|

|

6,415 |

| |

Construction work in progress |

|

|

3,085 |

|

|

2,975 |

| |

Property, Plant and Equipment, net |

|

|

34,959 |

|

|

34,597 |

| Regulatory assets - noncurrent |

|

|

1,610 |

|

|

1,562 |

| Goodwill and other intangibles |

|

|

4,884 |

|

|

4,930 |

| Price risk management assets - noncurrent |

|

|

437 |

|

|

319 |

| Other noncurrent assets |

|

|

333 |

|

|

312 |

| Total Assets |

|

$ |

48,921 |

|

$ |

48,864 |

| |

|

|

|

|

|

|

|

|

| Liabilities and Equity |

|

|

|

|

|

|

| Short-term debt |

|

$ |

1,595 |

|

$ |

1,466 |

| Long-term debt due within one year |

|

|

1,535 |

|

|

1,535 |

| Accounts payable |

|

|

1,128 |

|

|

1,356 |

| Price risk management liabilities - current |

|

|

1,073 |

|

|

1,126 |

| Other current liabilities |

|

|

1,886 |

|

|

1,960 |

| Long-term debt |

|

|

18,772 |

|

|

18,856 |

| Deferred income taxes and investment tax credits |

|

|

4,784 |

|

|

4,609 |

| Price risk management liabilities - noncurrent |

|

|

333 |

|

|

252 |

| Accrued pension obligations |

|

|

1,457 |

|

|

1,756 |

| Asset retirement obligations |

|

|

739 |

|

|

739 |

| Regulatory liabilities - noncurrent |

|

|

987 |

|

|

992 |

| Other noncurrent liabilities |

|

|

596 |

|

|

589 |

| Common stock and additional paid-in capital |

|

|

9,487 |

|

|

9,440 |

| Earnings reinvested |

|

|

6,860 |

|

|

6,462 |

| Accumulated other comprehensive loss |

|

|

(2,311) |

|

|

(2,274) |

| Total Liabilities and Equity |

|

$ |

48,921 |

|

$ |

48,864 |

| (a) |

The Financial Statements in this news release have been condensed and summarized for purposes of this presentation. Please refer to PPL Corporation’s periodic filings with the Securities and Exchange Commission for full financial statements, including note disclosure. |

| PPL CORPORATION AND SUBSIDIARIES |

| |

|

|

|

|

|

|

|

|

|

|

| Condensed Consolidated Statements of Income (Unaudited) |

| (Millions of Dollars, except share data) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Three Months Ended March 31, |

| |

|

|

|

|

|

2015 |

|

2014 |

| |

|

|

|

|

|

|

|

|

|

|

| Operating Revenues |

|

|

|

|

|

|

|

| |

Utility |

|

|

$ |

2,214 |

|

$ |

2,162 |

| |

Unregulated wholesale energy (a) |

|

|

|

521 |

|

|

(1,457) |

| |

Unregulated retail energy |

|

|

|

310 |

|

|

348 |

| |

Energy-related businesses |

|

|

|

120 |

|

|

141 |

| |

Total Operating Revenues |

|

|

|

3,165 |

|

|

1,194 |

| |

|

|

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

| |

Operation |

|

|

|

|

|

|

|

| |

|

Fuel |

|

|

|

604 |

|

|

758 |

| |

|

Energy purchases (b) |

|

|

|

321 |

|

|

(1,494) |

| |

|

Other operation and maintenance |

|

|

|

668 |

|

|

668 |

| |

Depreciation |

|

|

|

293 |

|

|

300 |

| |

Taxes, other than income |

|

|

|

101 |

|

|

101 |

| |

Energy-related businesses |

|

|

|

111 |

|

|

138 |

| |

Total Operating Expenses |

|

|

|

2,098 |

|

|

471 |

| |

|

|

|

|

|

|

|

|

|

|

| Operating Income |

|

|

|

1,067 |

|

|

723 |

| |

|

|

|

|

|

|

|

|

|

|

| Other Income (Expense) - net |

|

|

|

95 |

|

|

(23) |

| |

|

|

|

|

|

|

|

|

|

|

| Interest Expense |

|

|

|

247 |

|

|

262 |

| |

|

|

|

|

|

|

|

|

|

|

| Income from Continuing Operations Before Income Taxes |

|

|

|

915 |

|

|

438 |

| |

|

|

|

|

|

|

|

|

|

|

| Income Taxes |

|

|

|

268 |

|

|

114 |

| |

|

|

|

|

|

|

|

|

|

|

| Income from Continuing Operations After Income Taxes |

|

|

|

647 |

|

|

324 |

| |

|

|

|

|

|

|

|

|

|

|

| Income (Loss) from Discontinued Operations (net of income taxes) |

|

|

|

|

|

|

(8) |

| |

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

$ |

647 |

|

$ |

316 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Earnings Per Share of Common Stock: |

|

|

|

|

|

|

|

| |

Income from Continuing Operations After Income Taxes Available |

|

|

|

|

| |

to PPL Common Shareowners: |

|

|

|

|

|

|

|

| |

Basic |

|

|

$ |

0.97 |

|

$ |

0.51 |

| |

Diluted |

|

|

$ |

0.96 |

|

$ |

0.50 |

| |

Net Income Available to PPL Common Shareowners: |

|

|

|

|

|

|

|

| |

Basic |

|

|

$ |

0.97 |

|

$ |

0.50 |

| |

Diluted |

|

|

$ |

0.96 |

|

$ |

0.49 |

| |

|

|

|

|

|

|

|

|

|

|

| Weighted-Average Shares of Common Stock Outstanding |

|

|

|

|

|

|

|

| (in thousands) |

|

|

|

|

|

|

|

| |

Basic |

|

|

|

666,974 |

|

|

630,749 |

| |

Diluted |

|

|

|

668,732 |

|

|

663,939 |

|

(a)

(b) |

The period ended March 31, 2014 includes significant realized

and unrealized losses on physical and financial commodity sales contracts due to the unusually cold weather experienced in the

first quarter of 2014.

The period ended March 31, 2014 includes significant realized

and unrealized gains on physical and financial commodity purchase contracts due to the unusually cold weather experienced in the

first quarter of 2014. |

| PPL CORPORATION AND SUBSIDIARIES |

| |

|

|

|

|

|

|

|

|

|

| Condensed Consolidated Statements of Cash Flows (Unaudited) |

| (Millions of Dollars) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Three Months Ended March 31, |

| |

|

|

|

|

2015 |

|

2014 |

| Cash Flows from Operating Activities |

|

|

|

|

|

|

| |

Net income |

|

$ |

647 |

|

$ |

316 |

| |

Adjustments to reconcile net income to net cash provided by operating activities |

|

|

|

|

|

|

| |

|

Depreciation |

|

|

293 |

|

|

305 |

| |

|

Amortization |

|

|

57 |

|

|

60 |

| |

|

Defined benefit plans - expense |

|

|

28 |

|

|

21 |

| |

|

Deferred income taxes and investment tax credits |

|

|

124 |

|

|

(26) |

| |

|

Unrealized (gains) losses on derivatives, and other hedging activities |

|

|

(90) |

|

|

241 |

| |

|

Adjustment to WPD line loss accrual |

|

|

|

|

|

65 |

| |

|

Stock compensation expense |

|

|

28 |

|

|

28 |

| |

|

Other |

|

|

4 |

|

|

5 |

| |

Change in current assets and current liabilities |

|

|

|

|

|

|

| |

|

Accounts receivable |

|

|

(143) |

|

|

(185) |

| |

|

Accounts payable |

|

|

(139) |

|

|

93 |

| |

|

Unbilled revenues |

|

|

111 |

|

|

(33) |

| |

|

Fuel, material and supplies |

|

149 |

|

|

96 |

| |

|

Taxes payable |

|

|

44 |

|

|

126 |

| |

|

Other current liabilities |

|

|

(172) |

|

|

(59) |

| |

|

Other |

|

|

(43) |

|

|

(60) |

| |

Other operating activities |

|

|

|

|

|

|

| |

|

Defined benefit plans - funding |

|

|

(271) |

|

|

(135) |

| |

|

Other |

|

|

46 |

|

|

73 |

| |

|

|

Net cash provided by operating activities |

|

|

673 |

|

|

931 |

| Cash Flows from Investing Activities |

|

|

|

|

|

|

| |

Expenditures for property, plant and equipment |

|

|

(942) |

|

|

(892) |

| |

Expenditures for intangible assets |

|

|

(20) |

|

|

(16) |

| |

Purchases of nuclear plant decommissioning trust investments |

|

|

(43) |

|

|

(32) |

| |

Proceeds from the sale of nuclear plant decommissioning trust investments |

|

|

38 |

|

|

27 |

| |

Proceeds from the receipt of grants |

|

|

|

|

|

56 |

| |

Net increase in restricted cash and cash equivalents |

|

|

(10) |

|

|

(334) |

| |

Other investing activities |

|

|

(13) |

|

|

8 |

| |

|

|

Net cash used in investing activities |

|

|

(990) |

|

|

(1,183) |

| Cash Flows from Financing Activities |

|

|

|

|

|

|

| |

Retirement of long-term debt |

|

|

(1) |

|

|

(239) |

| |

Issuance of common stock |

|

|

35 |

|

|

15 |

| |

Payment of common stock dividends |

|

|

(250) |

|

|

(234) |

| |

Net increase in short-term debt |

|

|

133 |

|

|

878 |

| |

Other financing activities |

|

|

(14) |

|

|

(28) |

| |

|

|

Net cash provided by (used in) financing activities |

|

|

(97) |

|

|

392 |

| Effect of Exchange Rates on Cash and Cash Equivalents |

|

|

(2) |

|

|

14 |

| Net Increase (Decrease) in Cash and Cash Equivalents |

|

|

(416) |

|

|

154 |

| Cash and Cash Equivalents at Beginning of Period |

|

|

1,751 |

|

|

1,102 |

| Cash and Cash Equivalents at End of Period |

|

$ |

1,335 |

|

$ |

1,256 |

| Key Indicators (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

12 Months Ended |

| |

|

|

|

|

|

|

|

|

|

|

|

March 31, |

| Financial |

|

|

|

|

|

2015 |

|

2014 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends declared per share of common stock |

|

|

|

|

|

$1.49 |

|

$1.475 |

| Book value per share (a)(b) |

|

|

|

|

|

$21.02 |

|

$20.14 |

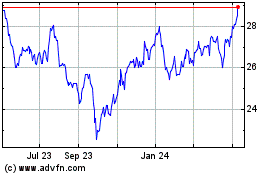

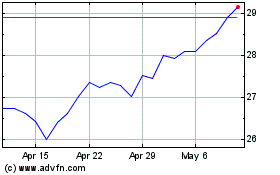

| Market price per share (a) |

|

|

|

|

|

$33.66 |

|

$33.14 |

| Dividend yield |

|

|

|

|

|

4.4% |

|

4.5% |

| Dividend payout ratio (c) |

|

|

|

|

|

48.2% |

|

92.2% |

| Dividend payout ratio - earnings from ongoing operations (c)(d) |

|

|

|

|

|

69.3% |

|

58.1% |

| Price/earnings ratio (c) |

|

|

|

|

|

10.9 |

|

20.7 |

| Price/earnings ratio - earnings from ongoing operations (c)(d) |

|

|

|

|

|

15.7 |

|

13.0 |

| Return on average common equity |

|

|

|

|

|

15.1% |

|

8.6% |

| Return on average common equity - earnings from ongoing operations (d) |

|

|

|

|

|

10.5% |

|

13.9% |

| (b) | Based on 667,713 and 631,417 shares of common stock outstanding (in thousands)

at March 31, 2015 and March 31, 2014. |

| (c) | Based on diluted earnings per share. |

| (d) | 2015 was calculated using regulated utility earnings from ongoing operations.

The calculation includes nine months of earnings from 2014 that were adjusted for Supply segment earnings and the impact of dissynergies

related to the spinoff of PPL Energy Supply. 2014 was calculated using actual earnings from ongoing operations and was not adjusted

for such items. Regulated earnings from ongoing operations and earnings from ongoing operations are non-GAAP financial measures

that include adjustments described in the text and tables of this news release. |

| Operating - Domestic & International Electricity Sales (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

3 Months Ended March 31, |

| |

|

|

|

|

|

|

|

|

Percent |

| (GWh) |

|

|

2015 |

|

2014 |

|

Change |

| |

|

|

|

|

|

|

|

|

|

| Domestic Retail Delivered |

|

|

|

|

|

|

|

| |

PPL Electric Utilities |

|

|

10,661 |

|

10,630 |

|

0.3% |

| |

LKE |

|

|

8,296 |

|

8,495 |

|

(2.3%) |

| |

|

Total |

|

|

18,957 |

|

19,125 |

|

(0.9%) |

| |

|

|

|

|

|

|

|

|

|

| Domestic Retail Supplied (a) |

|

|

|

|

|

|

|

| |

PPL EnergyPlus |

|

|

3,805 |

|

3,777 |

|

0.7% |

| |

LKE |

|

|

8,296 |

|

8,495 |

|

(2.3%) |

| |

|

Total |

|

|

12,101 |

|

12,272 |

|

(1.4%) |

| |

|

|

|

|

|

|

|

|

|

| International Delivered |

|

|

|

|

|

|

|

| |

United Kingdom |

|

|

20,793 |

|

21,015 |

|

(1.1%) |

| |

|

|

|

|

|

|

|

|

|

| Domestic Wholesale |

|

|

|

|

|

|

|

| |

PPL EnergyPlus - East |

|

|

12,821 |

|

15,747 |

|

(18.6%) |

| |

PPL EnergyPlus - West |

|

|

678 |

|

1,379 |

|

(50.8%) |

| |

LKE (b) |

|

|

684 |

|

730 |

|

(6.3%) |

| |

|

Total |

|

|

14,183 |

|

17,856 |

|

(20.6%) |

| (a) | Represents GWh supplied by PPL EnergyPlus to PPL Electric Utilities as

PLR, and to other retail customers in Pennsylvania, New Jersey, Montana, Delaware, Maryland, Ohio and Washington, D.C. Also includes

GWh supplied by LKE to retail customers in Kentucky, Virginia and Tennessee. |

| (b) | Represents FERC-regulated municipal and unregulated off-system sales. |

| Reconciliation of Segment Reported Earnings (Loss) to Regulated Utility Earnings from Ongoing Operations |

| (After-Tax) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1st Quarter 2015 |

|

(millions of dollars) |

| |

|

|

U.K. |

|

Kentucky |

|

Pennsylvania |

|

Corporate |

|

|

|

|

| |

|

|

Regulated |

|

Regulated |

|

Regulated |

|

and Other |

|

Supply |

|

Total |

| Reported Earnings (Loss) |

|

$ |

375 |

|

$ |

109 |

|

$ |

87 |

|

$ |

(19) |

|

$ |

95 |

|

$ |

647 |

| Special Items (expense) benefit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency-related economic hedges |

|

|

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

| Spinoff of PPL Energy Supply: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Supply segment earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

95 |

|

|

95 |

| |

Employee transitional services |

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

(2) |

| |

Transition and transaction costs |

|

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

(3) |

| |

Separation benefits |

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

(1) |

| Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

WPD Midlands acquisition-related adjustment |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

| Total Special Items |

|

|

39 |

|

|

|

|

|

|

|

|

(6) |

|

|

95 |

|

|

128 |

| Regulated Utility Earnings from Ongoing Operations |

|

$ |

336 |

|

$ |

109 |

|

$ |

87 |

|

$ |

(13) |

|

$ |

|

|

$ |

519 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

(per share - diluted) |

| |

|

|

U.K. |

|

Kentucky |

|

Pennsylvania |

|

Corporate |

|

|

|

|

| |

|

|

Regulated |

|

Regulated |

|

Regulated |

|

and Other |

|

Supply |

|

Total |

| Reported Earnings (Loss) |

|

$ |

0.56 |

|

$ |

0.16 |

|

$ |

0.13 |

|

$ |

(0.03) |

|

$ |

0.14 |

|

$ |

0.96 |

| Special Items (expense) benefit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency-related economic hedges |

|

|

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.06 |

| Spinoff of PPL Energy Supply: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Supply segment earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.14 |

|

|

0.14 |

| |

Transition and transaction costs |

|

|

|

|

|

|

|

|

|

|

|

(0.01) |

|

|

|

|

|

(0.01) |

| Total Special Items |

|

|

0.06 |

|

|

|

|

|

|

|

|

(0.01) |

|

|

0.14 |

|

|

0.19 |

| Regulated Utility Earnings from Ongoing Operations |

|

$ |

0.50 |

|

$ |

0.16 |

|

$ |

0.13 |

|

$ |

(0.02) |

|

$ |

|

|

$ |

0.77 |

| Reconciliation of Segment Reported Earnings (Loss) to Regulated Utility Earnings from Ongoing Operations (Adjusted) |

| (After-Tax) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1st Quarter 2014 |

|

(millions of dollars) |

| |

|

|

U.K. |

|

Kentucky |

|

Pennsylvania |

|

Corporate |

|

|

|

|

| |

|

|

Regulated |

|

Regulated |

|

Regulated |

|

and Other |

|

Supply |

|

Total |

| Reported Earnings (Loss) |

|

$ |

206 |

|

$ |

107 |

|

$ |

85 |

|

$ |

(7) |

|

$ |

(75) |

|

$ |

316 |

| Special Items (expense) benefit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency-related economic hedges |

|

|

(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6) |

| Spinoff of PPL Energy Supply: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Supply segment earnings (b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(75) |

|

|

(75) |

| Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Change in WPD line loss accrual |

|

|

(52) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(52) |

| Total Special Items |

|

|

(58) |

|

|

|

|

|

|

|

|

|

|

|

(75) |

|

|

(133) |

| Dissynergies related to the spinoff of PPL Energy Supply (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Indirect operation and maintenance |

|

|

|

|

|

|

|

|

|

|

|

(14) |

|

|

|

|

|

(14) |

| |

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

(7) |

|

|

|

|

|

(7) |

| |

Depreciation |

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

(2) |

| Total dissynergies related to the spinoff of PPL Energy Supply |

|

|

|

|

|

|

|

|

|

|

|

(23) |

|

|

|

|

|

(23) |

| Regulated Utility Earnings from Ongoing Operations (Adj.) |

|

$ |

264 |

|

$ |

107 |

|

$ |

85 |

|

$ |

(30) |

|

$ |

|

|

$ |

426 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(per share - diluted) (a) |

| |

|

|

U.K. |

|

Kentucky |

|

Pennsylvania |

|

Corporate |

|

|

|

|

| |

|

|

Regulated |

|

Regulated |

|

Regulated |

|

and Other |

|

Supply |

|

Total |

| Reported Earnings (Loss) |

|

$ |

0.32 |

|

$ |

0.16 |

|

$ |

0.13 |

|

$ |

(0.01) |

|

$ |

(0.11) |

|

$ |

0.49 |

| Special Items (expense) benefit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency-related economic hedges |

|

|

(0.01) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(0.01) |

| Spinoff of PPL Energy Supply: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Supply segment earnings (b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(0.11) |

|

|

(0.11) |

| Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Change in WPD line loss accrual |

|

|

(0.08) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(0.08) |

| Total Special Items |

|

|

(0.09) |

|

|

|

|

|

|

|

|

|

|

|

(0.11) |

|

|

(0.20) |

| Dissynergies related to the spinoff of PPL Energy Supply (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Indirect operation and maintenance |

|

|

|

|

|

|

|

|

|

|

|

(0.02) |

|

|

|

|

|

(0.02) |

| |

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

(0.01) |

|

|

|

|

|

(0.01) |

| Total dissynergies related to the spinoff of PPL Energy Supply |

|

|

|

|

|

|

|

|

|

|

|

(0.03) |

|

|

|

|

|

(0.03) |

| Regulated Utility Earnings from Ongoing Operations (Adj.) |

|

$ |

0.41 |

|

$ |

0.16 |

|

$ |

0.13 |

|

$ |

(0.04) |

|

$ |

|

|

$ |

0.66 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) | The "If-Converted Method" has been applied to PPL's 2011 Equity

Units, resulting in $9 million of interest charges (after-tax) being added back to earnings and approximately 32 million shares

of PPL Common Stock being treated as outstanding. Both adjustments are only for purposes of calculating diluted earnings per share. |

| (b) | To remove Supply segment earnings as the segment is expected to be disposed

of as a result of the announced spinoff of PPL Energy Supply. |

| (c) | Represents 2014 costs allocated to the Supply segment that will remain

with PPL after the expected spinoff of PPL Energy Supply, if left unmitigated. |

| Reconciliation of Supply Segment Reported Earnings (Loss) to Supply Earnings from Ongoing Operations |

| (After-Tax) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

1st Quarter 2015 |

|

|

|

1st Quarter 2014 |

|

|

|

|

| |

|

|

|

(Millions of Dollars) |

|

(Per Share- Diluted) |

|

|

|

(Millions of Dollars) |

|

(Per Share- Diluted) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supply Reported Earnings (Loss) |

|

|

$ |

95 |

$ |

0.14 |

|

|

$ |

(75) |

$ |

(0.11) |

|

|

|

|

| Special Items (expense) benefit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted energy-related economic activity, net |

|

|

|

27 |

|

0.03 |

|

|

|

(139) |

|

(0.20) |

|

|

|

|

| Kerr Dam Project impairment |

|

|

|

|

|

|

|

|

|

(10) |

|

(0.02) |

|

|

|

|

| Corette closure costs |

|

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

| Spinoff of PPL Energy Supply: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Transition costs |

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Employee transitional services |

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Special Items |

|

|

|

22 |

|

0.03 |

|

|

|

(149) |

|

(0.22) |

|

|

|

|

| Supply Earnings from Ongoing Operations |

|

|

$ |

73 |

$ |

0.11 |

|

|

$ |

74 |

$ |

0.11 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Segment Reported Earnings (Loss) to Regulated Utility Earnings from |

| Ongoing Operations (Adjusted) |

| (After-Tax) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year-to-Date December 31, 2014 |

|

(per share - diluted) (a) |

| |

|

|

U.K. |

|

Kentucky |

|

Pennsylvania |

|

Corporate |

|

|

|

|

| |

|

|

Regulated |

|

Regulated |

|

Regulated |

|

and Other |

|

Supply |

|

Total |

| Reported Earnings (Loss) |

|

$ |

1.48 |

|

$ |

0.47 |

|

$ |

0.39 |

|

$ |

(0.19) |

|

$ |

0.46 |

|

$ |

2.61 |

| Special Items (expense) benefit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency-related economic hedges |

|

|

0.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.19 |

| Spinoff of PPL Energy Supply: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Supply segment earnings (b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.46 |

|

|

0.46 |

| |

Change in tax valuation allowances |

|

|

|

|

|

|

|

|

|

|

|

(0.07) |

|

|

|

|

|

(0.07) |

| |

Transition and transaction costs |

|

|

|

|

|

|

|

|

|

|

|

(0.02) |

|

|

|

|

|

(0.02) |

| |

Separation benefits |

|

|

|

|

|

|

|

|

|

|

|

(0.02) |

|

|

|

|

|

(0.02) |

| Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Change in WPD line loss accrual |

|

|

(0.08) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(0.08) |

| |

Separation benefits - bargaining unit voluntary program |

|

|

|

|

|

|

|

|

(0.01) |

|

|

|

|

|

|

|

|

(0.01) |

| Total Special Items |

|

|

0.11 |

|

|

|

|

|

(0.01) |

|

|

(0.11) |

|

|

0.46 |

|

|

0.45 |

| Dissynergies related to the spinoff of PPL Energy Supply: (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Indirect operation and maintenance |

|

|

|

|

|

|

|

|

|

|

|

(0.07) |

|

|

|

|

|

(0.07) |

| |

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

(0.05) |

|

|

|

|

|

(0.05) |

| |

Depreciation |

|

|

|

|

|

|

|

|

|

|

|

(0.01) |

|

|

|

|

|

(0.01) |

| Total dissynergies related to the spinoff of PPL Energy Supply |

|

|

|

|

|

|

|

|

|

|

|

(0.13) |

|

|

|

|

|

(0.13) |

| Regulated Utility Earnings from Ongoing Operations (Adj.) |

|

$ |

1.37 |

|

$ |

0.47 |

|

$ |

0.40 |

|

$ |

(0.21) |

|

$ |

|

|

$ |

2.03 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) The "If-Converted Method" has been applied to PPL's 2011 Equity Units prior to settlement, resulting in $9 million of interest |

| charges (after-tax) being added back to earnings and approximately 11 million shares of PPL Common |

| Stock being treated as outstanding. Both adjustments are only for purposes of calculating diluted earnings per share. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (b) To remove Supply segment earnings as the segment is expected to be disposed of as a result of the announced spinoff |

| of PPL Energy Supply. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (c) Represents 2014 costs allocated to the Supply segment that will remain with PPL after the expected spinoff of PPL Energy |

| Supply, if left unmitigated. |

© PPL Corporation 2015 1st Quarter Earnings Call PPL Corporation May 7, 2015 U.K. Regulated KY Regulated PA Regulated Supply Exhibit 99.2

© PPL Corporation 2015 2 Cautionary Statements and Factors That May Affect Future Results Any statements made in this presentation about future operating results or other future events are forward-looking statements under the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from such forward-looking statements. A discussion of factors that could cause actual results or events to vary is contained in the Appendix to this presentation and in the Company’s SEC filings.

© PPL Corporation 2015 3 First Quarter Earnings Results, Operational Overview and 2015 Earnings Forecast Talen Update Segment Results and Financial Overview Q&A W. H. Spence V. Sorgi Agenda W. H. Spence

© PPL Corporation 2015 $0.66 $0.77 ($0.75) ($0.25) $0.25 $0.75 $1.25 $1.75 $2.25 $2.75 1Q 2014 (adj) 1Q 2015 First Quarter Regulated Utility Earnings from Ongoing Operations 4 P e r S h a r e Note: See Appendix for the reconciliation of reported earnings (loss) to Regulated Utility Earnings from ongoing operations. (1) 2014 was adjusted for Supply segment earnings and dissynergies related to the spinoff of PPL Energy Supply. 2015 excludes earning from the Supply segment. P e r S h a r e Earnings Results $0.49 $0.96 ($0.75) ($0.25) $0.25 $0.75 $1.25 $1.75 $2.25 $2.75 1Q 2014 1Q 2015 First Quarter Reported Earnings (1)

© PPL Corporation 2015 $0.00 $1.00 $2.00 $3.00 2014A 2014 Adj 2015E 5 P e r S h a r e 2015 Ongoing Earnings Forecast $2.45 $2.25 $2.03 Note: See Appendix for the reconciliation of 2014 reported earnings (loss) to earnings from ongoing operations to regulated utility earnings from ongoing operations (adjusted). (1) 2015 earnings and 2014 Regulated Utility Earnings (adjusted) presented here excludes any earnings from the Supply segment. However, the Supply segment will be part of PPL Corporation’s consolidated reported earnings for a portion of 2015, based on an expected closing in Q2 2015. (2) This category primarily includes unallocated corporate-level financing and other costs. For 2014, regulated utility earnings from ongoing operations (adjusted) reflects the full impact of dissynergies related to the spinoff of PPL Energy Supply: Indirect O&M ($0.07), Interest ($0.05) and Depreciation ($0.01). $2.05

© PPL Corporation 2015 6 • Kentucky Rate Case – Unanimous settlement agreement reached, subject to KPSC approval – Includes annual revenue increase of $132 million, including cost recovery for the new Cane Run gas plant – Provides for deferred cost recovery on a portion of costs associated with pensions and KU’s Green River plant, which is scheduled to be retired in April 2016 – 10% ROE on environmental cost recovery mechanism and gas line tracker • Cane Run Update Kentucky Operational Overview

© PPL Corporation 2015 7 • Pennsylvania Rate Case – Distribution Revenue Increase Requested $167.5 million – Future Test Year 2016 – Requested ROE 10.95% – 2016 Distribution Rate Base $3.16 billion – 2016 Common Equity Ratio 51.66% – Docket No. R-2015-2469275 Complete filings will be available at www.pplelectric.com • Susquehanna-Roseland Update Pennsylvania Operational Overview

© PPL Corporation 2015 8 Note: Total includes Residential, Commercial and Industrial customer classes as well as “Other”, which is not depicted on the charts above. U.S. Regulated Volume Variances Residential Commercial Industrial Total Residential Commercial Industrial Total Weather-Normalized (charted) -0.4% -0.5% -0.2% -0.5% -2.0% -1.0% 2.5% -0.2% Actual -3.8% -2.7% 0.2% -2.3% -2.9% -1.8% 2.5% -0.8% Residential Commercial Industrial Total Residential Commercial Industrial Total Weather-Normalized (charted) -2.0% 0.3% -1.9% -1.2% -0.8% 0.6% -0.1% -0.1% Actual 0.8% 0.8% -1.9% 0.3% -2.3% -0.1% -0.1% -1.0%