Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

September 15 2015 - 6:05AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-204066

September 14, 2015

Pentair Finance S.A.

Pricing Term Sheet

|

|

|

| Issuer: |

|

Pentair Finance S.A. |

| Guarantors: |

|

Pentair plc and Pentair Investments Switzerland GmbH |

| Offering Format: |

|

SEC Registered |

| Security: |

|

2.450% Senior Notes due 2019 |

| Size: |

|

€500,000,000 |

| Maturity: |

|

September 17, 2019 |

| Coupon: |

|

2.450% |

| Day Count Fraction: |

|

ACTUAL/ACTUAL (ICMA) |

| Price to Public: |

|

99.868% of face amount |

| Yield to Maturity: |

|

2.485% |

| Benchmark Bund: |

|

OBL 0.500% due April 12, 2019 |

| Benchmark Bund Yield: |

|

-0.150% |

| Spread to Benchmark Bund: |

|

+263.5 basis points |

| Mid-Swap Yield: |

|

0.235% |

| Spread to Mid-Swap Yield: |

|

+225 basis points |

| Interest Payment Dates: |

|

Annually on September 17, commencing September 17, 2016 |

| Use of Proceeds: |

|

The issuer intends to use (i) the net proceeds from the offering, (ii) the net proceeds from the Concurrent Offering of $1,150,000,000 in aggregate principal amount of senior notes, and (iii) borrowings of approximately $109.4

million under its revolving credit facility to finance the ERICO acquisition, including the repayment of outstanding ERICO debt for $1,800,000,000. |

|

|

|

|

In the event that the issuer is unable to consummate the Concurrent Offering, the issuer intends to borrow under its $1,800,000,000 committed bridge facility to obtain any additional funds needed to finance the ERICO acquisition.

The amount of financing available under the bridge facility decreases to the extent the issuer obtains financing through the offering and the Concurrent Offering. |

|

|

|

|

If the ERICO acquisition is not consummated on or prior to December 31, 2015 or the merger agreement relating to the acquisition of ERICO is terminated on or prior to December 31, 2015, the issuer intends to use the net proceeds

from the offering and cash on hand to fund the mandatory redemption of all outstanding notes. |

| Redemption Provisions: |

|

|

| Make-Whole Call: |

|

At any time at a discount rate of comparable government bond rate plus 40 basis points |

|

|

|

| Tax Call: |

|

At any time at par if certain events occur involving changes in taxation |

| Special Mandatory Redemption: |

|

The offering is not contingent upon the consummation of the ERICO acquisition but, in the event that the ERICO acquisition is not consummated on or prior to December 31, 2015 or the merger agreement relating to the acquisition of

ERICO is terminated on or prior to December 31, 2015, then Pentair Finance will be required to redeem all of the outstanding notes on the Special Mandatory Redemption Date at a redemption price equal to 101% of the principal amount of the notes plus

accrued and unpaid interest, if any, from the date of initial issuance to, but excluding, the Special Mandatory Redemption Date. |

| Listing: |

|

The issuer intends to apply to list the notes on the New York Stock Exchange. There can be no assurance that any such application will be successful or that any such listing will be granted or maintained. |

| Stabilization: |

|

Stabilization / FCA |

| Trade Date: |

|

September 14, 2015 |

| Settlement Date: |

|

September 17, 2015 (T+3) |

| CUSIP: |

|

709629 AQ2 |

| ISIN: |

|

XS1117287398 |

| Common Code: |

|

111728739 |

| Minimum Denomination: |

|

€100,000 and integral multiples of €1,000 in excess thereof |

| Ratings*: |

|

Baa3 (stable outlook) / BBB (negative outlook) (Moody’s/S&P) |

| Joint Book-Running Managers: |

|

Citigroup Global Markets Limited |

|

|

J.P. Morgan Securities plc |

|

|

Merrill Lynch International |

|

|

Mitsubishi UFJ Securities International plc |

|

|

U.S. Bancorp Investments, Inc. |

| Co-Managers: |

|

HSBC Bank plc |

|

|

Wells Fargo Securities International Limited |

|

|

Deutsche Bank AG, London Branch |

|

|

Banco Santander, S.A. |

| Junior Co-Managers: |

|

Banco Bilbao Vizacaya Argentaria, S.A. |

|

|

Bank of Montreal, London Branch |

|

|

BNP Paribas |

|

|

ING Financial Markets LLC |

|

|

ANZ Securities, Inc. |

|

|

Loop Capital Markets LLC |

|

|

PNC Capital Markets LLC |

|

|

SMBC Nikko Capital Markets Limited |

|

|

The Williams Capital Group, L.P. |

| * |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be revised or withdrawn at any time. |

The issuer and the guarantors have filed a registration statement (including a prospectus) with the SEC for

the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer, the guarantors

and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you

request it by calling Citigroup Global Markets Limited toll-free at 1-800-831-9146 or e-mailing at prospectus@citi.com, calling J.P. Morgan Securities plc toll-free at +44-20-7134-2468 or calling Merrill Lynch International toll-free at

1-800-294-1322 or emailing at dg.prospectus_requests@baml.com.

Any legends, disclaimers or other notices that may appear below are not applicable

to this communication and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this communication having been sent via Bloomberg or another e-mail system.

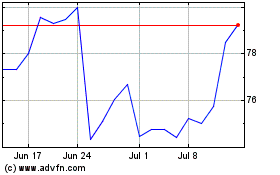

Pentair (NYSE:PNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pentair (NYSE:PNR)

Historical Stock Chart

From Apr 2023 to Apr 2024