Current Report Filing (8-k)

January 15 2016 - 4:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 15, 2016 (January 15, 2016)

Date of Report (Date of earliest event reported)

Protective Life Corporation

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-11339 |

|

95-2492236 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

2801 Highway 280 South

Birmingham, Alabama 35223

(Address of principal executive offices and zip code)

(205) 268-1000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CF 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

(a) On January 15, 2016, Protective Life Insurance Company (“Protective Life”), a wholly-owned subsidiary of Protective Life Corporation (“Protective”), completed the transaction contemplated by the Master Agreement, dated September 30, 2015 (the “Master Agreement”), with Genworth Life and Annuity Insurance Company (“GLAIC”), as previously reported in our Current Report on Form 8-K filed October 1, 2015. Pursuant to the Master Agreement, on January 15, 2016, Protective Life entered into a reinsurance agreement (the “Reinsurance Agreement”) under the terms of which Protective Life coinsures certain term life insurance business of GLAIC (the “GLAIC Block”).

The above description of the Master Agreement and the Reinsurance Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Master Agreement and the form of Reinsurance Agreement, copies of which were filed as Exhibit 10 to Protective’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2015.

(b) On January 15, 2016, Golden Gate Captive Insurance Company (“Golden Gate”), a wholly-owned subsidiary of Protective Life, and Steel City, LLC (“Steel City”), a newly formed wholly-owned subsidiary of Protective, entered into an 18-year transaction to finance $2.188 billion of “XXX” reserves related to the acquired GLAIC Block and the other term life insurance business that is currently reinsured to Golden Gate by Protective Life and West Coast Life Insurance Company (“WCL”), a direct wholly-owned subsidiary of Protective Life. Steel City issued notes with an aggregate initial principal amount of $2.188 billion to Golden Gate in exchange for a surplus note issued by Golden Gate with an initial principal amount of $2.188 billion. Through the structure, Hannover Life Reassurance Company of America (Bermuda) Ltd., The Canada Life Assurance Company (Barbados Branch) and Nomura Americas Re Ltd. (collectively, the “Risk-Takers”) provide credit enhancement to the Steel City notes for the 18-year term in exchange for credit enhancement fees. The transaction is “non-recourse” to Protective Life, WCL and Protective, meaning that none of these companies are liable to reimburse the Risk-Takers for any credit enhancement payments required to be made. In connection with the transaction, Protective has entered into certain support agreements under which it guarantees or otherwise supports certain obligations of Golden Gate or Steel City, including a guarantee of the fees to the Risk-Takers. The estimated average annual expense of the credit enhancement under generally accepted accounting principles is approximately $3.1 million, after-tax.

(c) On January 15, 2016, Protective issued a press release entitled “Protective Closes Acquisition of Blocks of Business from Genworth”. A copy of such press release is attached to this Current Report on Form 8-K as Exhibit 99.1, and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

|

Exhibit |

|

|

|

No. |

|

Description |

|

|

|

|

|

2.1 |

|

Master Agreement by and among Protective Life Insurance Company and Genworth Life and Annuity Insurance Company, dated as of September 30, 2015, incorporated by reference to Exhibit 10 to Protective Life Corporation’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2015, filed November 6, 2015. |

|

|

|

|

|

99.1 |

|

Press Release issued by Protective Life Corporation, dated January 15, 2016. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

PROTECTIVE LIFE CORPORATION |

|

|

|

|

|

|

|

|

/s/ Steven G. Walker |

|

|

Steven G. Walker |

|

|

Executive Vice President, Controller and Chief Financial Officer |

Date: January 15, 2016

3

Exhibit 99.1

Protective Life Corporation

Post Office Box 2606

Birmingham, AL 35202

205-268-1000

FOR IMMEDIATE RELEASE

Protective Closes Acquisition of Blocks of Business from Genworth

BIRMINGHAM, Ala.—January 15, 2016 — Protective Life Corporation (“Protective”), a wholly owned U.S. subsidiary of The Dai-ichi Life Insurance Company, Limited (TSE:8750, “Dai-ichi Life”), today announced that its principal subsidiary, Protective Life Insurance Company (“Protective Life”), completed the acquisition via reinsurance of certain blocks of business from Genworth Life and Annuity Insurance Company (“Genworth”), Richmond, Virginia.

John D. Johns, Protective’s Chairman and CEO said, “We are very pleased to announce the closing of this transaction. It is the second largest acquisition in our history and the first after becoming part of Dai-ichi Life. Our ability to consummate this important transaction again demonstrates how our industry-leading acquisition capabilities can drive growth at Protective. Notwithstanding the significant capital investment in this transaction, we continue to have substantial available capital, and we are ready to pursue other acquisition opportunities.”

The transaction was originally announced on September 30, 2015. Please see the Acquisition Fact Sheet in the Newsroom section of the Company’s website for more details on Protective’s acquisition segment history.

ABOUT PROTECTIVE LIFE CORPORATION

Protective Life Corporation is headquartered in Birmingham, Alabama. The Company provides financial services through the production, distribution and administration of insurance and investment products throughout the U.S. As of September 30, 2015, Protective had assets of approximately $68.6 billion.

For more information about Protective, please visit http://www.protective.com

ABOUT DAI-ICHI LIFE INSURANCE COMPANY

The Dai-ichi Life Insurance Company, Limited (TSE: 8750) is one of the largest life insurance companies in Japan as measured by total assets as of June 30, 2015. Founded on September 15, 1902, Dai-ichi Life was the oldest mutual insurance company in Japan until it was demutualized and listed on the Tokyo Stock Exchange on April 1, 2010. As of June 30, 2015, total assets were ¥50.2 trillion (USD $410.4 billion) on a consolidated basis. Based in Tokyo, Dai-ichi Life has approximately 67,000 employees and 1,345 sales offices throughout Japan. It also has overseas life insurance businesses in Australia, Vietnam, Indonesia, India and Thailand, as well as offices in New York, Singapore, London, Beijing, and Shanghai.

For more information about Dai-ichi Life, please visit http://www.dai-ichi-life.co.jp/english/

CONTACT:

Eva Robertson

Vice President, Corporate Communications

Protective Life Corporation

(205) 268-3912

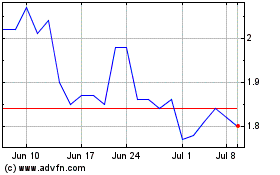

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Aug 2024 to Sep 2024

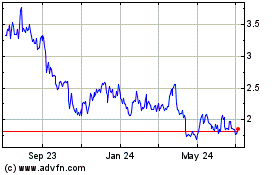

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Sep 2023 to Sep 2024