Philips Lighting Business Sale Halted by Regulatory Concerns -- Update

January 22 2016 - 5:01AM

Dow Jones News

By Maarten van Tartwijk

AMSTERDAM--Royal Philips NV said Friday it has terminated the

planned sale of its lighting components and automotive-lighting

unit to a Chinese investor because of regulatory concerns in the

U.S.

The Dutch electronics group said the Committee on Foreign

Investment in the U.S., or CFIUS, didn't clear the planned disposal

of an 80% stake in its Lumileds business despite "extensive

efforts" to mitigate its concerns. Chief Executive Frans van Houten

said he was "very disappointed" about the committee's decision and

that Philips will now engage with other potential buyers who have

shown an interest in the business.

Shares in Philips fell 1.6% in early trading in Amsterdam.

Philips said in October that the committee had expressed

"certain unforeseen concerns" over the proposed transaction with Go

Scale Capital, an investment fund led by Chinese venture-capital

firm GSR Ventures. The deal valued the business at $3.3 billion at

the time and was an important step for Philips in its plan to exit

its lighting activities. The Dutch company is currently preparing

to dispose of its remaining lighting business through a listing or

sale.

A Philips spokesman said he couldn't elaborate on the concerns

raised by CFIUS, citing the confidentiality of the talks with the

committee. Philips still aims to sell the Lumileds business

separate from the remaining lighting division, he added.

Go Scale Capital couldn't immediately be reached for

comment.

CFIUS reviews international transactions on national security

grounds and has increased scrutiny of technology deals in the U.S.

involving Chinese buyers. Last year, Chinese state-owned chip maker

Tsinghua Unigroup Ltd. tried unsuccessfully to buy Micron

Technology Inc. for $23 billion, with people familiar with the

discussions saying talks fell through in part because of the dim

prospect of gaining U.S. regulatory approval.

Kepler Cheuvreux analyst Peter Olofsen said the CFIUS concerns

may relate to the potential transfer of technology from the U.S. to

China. The Lumileds business has a large patent portfolio and

operates several manufacturing and research-and-development

facilities in the U.S.

The selling price for Lumileds could be markedly lower with a

new buyer as the unit's earnings appear to have come under pressure

recently, Mr. Olofsen said.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

January 22, 2016 04:46 ET (09:46 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

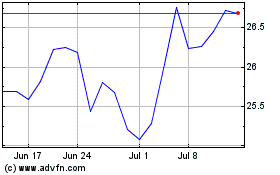

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

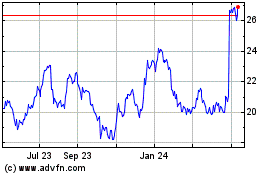

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024