Harry's Cuts Into Gillette's Razor Turf -- WSJ

November 11 2016 - 3:02AM

Dow Jones News

Online startup steals in-store sales after it gets shelf space

alongside P&G

By Sharon Terlep and Khadeeja Safdar

When Target Corp. opened its razor aisles to an online upstart,

Gillette paid the price.

In August, Harry's Razor Co., a three-year-old business that

started out selling razors online, put up prominent displays in

Target's nearly 1,800 stores that included four-foot-tall, orange

fixtures in the shape of a razor.

Within weeks, Harry's grabbed a 10% share of the retailer's

cartridge sales and about 50% of razor handle sales, according to

Nielsen data covering the four-week period after the displays

launched in August. Procter & Gamble Co.'s Gillette sales in

Target stores declined in September from a year ago, according to

Target spokesman Joshua Thomas.

Those are outsize numbers given that Harry's had a 2% share of

the overall market for men's razors last year in the U.S.,

according to Euromonitor.

Jefferies analyst Kevin Grundy said Harry's presence in Target

represents a clear challenge to P&G. "Any time you have a

supplier and they have some 75% of market share, it benefits you to

kind of keep that supplier off balance," Mr. Grundy said.

The once-steady $3 billion market for razors and cartridges is

in upheaval. Gillette's overall share of the U.S. market has

dropped from about 70% to 60% since Harry's and its larger online

rival, Dollar Shave Club, came on the scene a few years ago. In

response, P&G started selling subscriptions directly to

consumers with its own online service, the Gillette Shave Club.

P&G declined to discuss Harry's presence in Target. A

P&G spokeswoman noted that Gillette's razor subscription

service gives consumers the option to make the purchase through

Target's website. The company in a statement said it is working to

connect with consumers in "meaningful and relevant ways."

Target executives expressed concern in meetings in the months

after P&G announced its direct-to-consumer offering in 2014,

according to a person familiar with the matter. In January 2015,

Gillette poked fun at the idea of having to go inside a store to

buy razors in social media posts.

"Going to the store to buy blades is so 2014," read the ads,

which ran on Facebook and Twitter.

Retailers like Target have been trying to lure customers who are

increasingly going online to buy household staples. Razor sales

produce slim profits for the chain but are important because they

draw consumers to the store where they buy higher-margin products

like apparel and home items.

In recent months, Target has seen fewer shoppers coming in for

fill-in trips, which are usually made to buy consumables. The

retailer recently reported its first decline in existing store

sales in two years and its stock has fallen about 12% over the past

year. Sales of Target's shaving products, excluding electric

razors, are down 5% for the 52-week period ended Oct. 1 compared

with a year ago, according to Nielsen figures.

"The guest is asking for something different," said John

Butcher, Target's senior vice president of beauty and personal

care. "We think Harry's is filling a niche that wasn't currently

being met."

The idea to sell Harry's blades and cartridges in Target stores

came from Target executives, said Harry's co-Chief Executive Andy

Katz-Mayfield. The two companies started seriously discussing a

partnership around the summer of 2015, he said. Harry's executives

kept the Target talks quiet, giving it the code name "Project

Wildcat."

Harry's viewed Target as a way to expand sales beyond its online

niche, he said. The company has limited offerings at other

retailers and, Mr. Katz-Mayfield said, could continue to increase

its in-store presence. Harry's has a roughly 10% share of the

online razor market, behind Dollar Shave Club's 51% and Gillette

Shave Club's 23%, according to Slice Intelligence, a market

research firm.

Harry's, which collects rafts of data and feedback on its

subscribers, found that many men like buying razors and refills at

stores, but are turned off by the high price of quality razors and

the hassle of the process.

Jefferies' Mr. Grundy attributed the success to the prominent

displays and demand for razors that are seen as a middle ground

between ultra-pricey and cheap. Harry's products on Target's

website range between $5.99 and $15.99, while Gillette products run

from $1.89 to $44.99. But he said Harry's share will likely decline

once the flashy display runs its course.

Write to Sharon Terlep at sharon.terlep@wsj.com and Khadeeja

Safdar at khadeeja.safdar@wsj.com

(END) Dow Jones Newswires

November 11, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

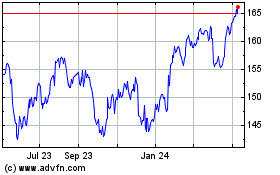

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

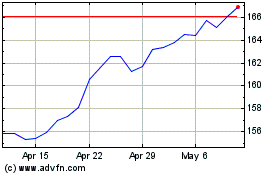

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024