P&G Posts Higher Profit, but Sales Volume Declines -- Update

April 26 2016 - 1:52PM

Dow Jones News

By Sharon Terlep

Procter & Gamble Co. is slashing costs and commanding higher

prices for staples from shaving cream to paper towels. But one

important goal continues to elude the consumer-products company:

getting shoppers to buy more of its products.

The maker of Gillette razors and Pampers diapers on Tuesday

reported higher profit for its fiscal third quarter ended in March

and improvement in a core sales metric. Even so, sales volume

declined across nearly all of its businesses.

P&G, which has struggled for years to accelerate sales

growth, said economic woes in emerging markets coupled with the

company's moves to sell off dozens of brands further slowed sales

the past quarter. Finance chief Jon Moeller said it would be

another six months to a year before greater volume, rather than

higher prices and cost cuts, begin to drive profit increases.

"We're very happy about the progress that we're making but we

clearly understand we have more to do," Mr. Moeller said in a call

with financial analysts who pressed him to forecast when the

company would stem sales declines in the U.S. and abroad.

In the quarter ended March 31, P&G said organic sales, a

closely watched metric that strips out currency moves, acquisitions

and divestments, rose 1%. Overall pricing improved 1%, but volume

fell 2%. P&G logged the deepest volume decline in its grooming

segment, and reported volume drops in four of its five

segments.

The company attributed the volume declines to lower shipments in

developing markets, some brand divestitures and a write-down of its

Venezuelan operations even though it continues to do business

there. The company has ramped up spending on advertising and is

shedding brands so it can focus efforts on stronger-performing

products in more promising segments, such as diapers.

Overall, P&G said its profit for the quarter rose 28% to

$2.75 billion, thanks to earnings from discontinued operations

without which its income would have fallen. Revenue dropped 6.9% to

$15.76 billion.

The company has been working to slash costs, eliminating

thousands of jobs and trimming its marketing budget. It has also

sold off more than $20 billion of brands that it identified as

being outside of its current focus, such as its Duracell battery

business.

P&G continued to lose ground in China, its second-biggest

market outside the U.S., though the company managed to slow the

decline. Organic sales there fell 4% in the third quarter, compared

with 8% declines in previous quarters, Mr. Moeller said.

The SK-II luxury skin-care brand was a bright spot, increasing

sales by 20% in the country, he said. China's fast-growing market

for baby-care products, however, remains a struggle. P&G has

introduced a new line of Pampers diapers, complete with "Made in

Japan" labels and gold labels to appeal to customers who are

increasingly seeking premium products.

"Improvements in top-line growth won't happen overnight and they

won't happen in a straight line," Mr. Moeller said of China.

P&G also tightened its outlook for core earnings for its

full year. It expects core earnings to decline 3% to 6% from last

year's core earnings of $3.76 a share. P&G said earnings are

expected to be "significantly lower" than the prior year because of

increased advertising investments, a higher tax rate, and

foreign-exchange headwinds.

--Anne Steele contributed to this article.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

April 26, 2016 13:37 ET (17:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

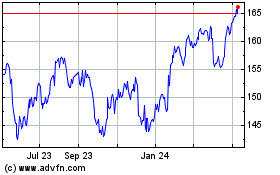

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

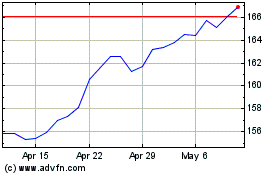

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024