Germany's Merck Lifted by Sigma-Aldrich Deal

May 19 2016 - 3:40AM

Dow Jones News

FRANKFURT—German chemicals and pharmaceuticals group Merck KGaA

said Thursday that net profit for the first quarter of 2016 more

than doubled, boosted in part by the integration of U.S. laboratory

equipment maker Sigma-Aldrich.

Net profit for the period ended March 31 was €591 million

($674.48 million), compared with €282 million during the same

period last year.

Earnings per share also more than doubled, to €1.36, but fell

short of analysts' forecasts. Analysts had expected EPS of €1.41,

according to a recent poll conducted by The Wall Street

Journal.

"The integration of Sigma-Aldrich is progressing quickly,"

newly-appointed Chief Executive Stefan Oschmann said.

The $17 billion deal, which closed in November 2015, was the

largest in Merck's history. The acquisition came as part of a

larger effort by the company's former CEO, Karl-Ludwig Kley, to

move the group away from its traditionally core pharmaceuticals

business and build up its specialty chemicals and life science

divisions.

Sales climbed by 21% to €3.67 billion, boosted primarily by the

integration of Sigma-Aldrich.

The company's closely watched earnings before interest, taxes,

depreciation and amortization before one-time items jumped by 27%

to €1.08 billion, a result of strong growth at the health care and

life sciences division, as well as the Sigma-Aldrich

integration.

Ebitda before one-time items at the health care division, which

includes pharmaceutical and over-the-counter drugs, grew by 10%, to

€508 million. That was a result of both organic growth and the

conclusion of commission expenses related to the co-promotion of

multiple sclerosis drug Rebif with Pfizer Inc. in the U.S. However,

that blockbuster drug saw a slight sales decline due to increased

competition from generic alternatives.

At the life science division, Ebitda before one-time items more

than doubled to €393 million, mainly as a result of the

incorporation of Sigma-Aldrich into that unit.

Sales and earnings at the performance materials business, which

produces liquid crystals used in televisions and smartphones, were

flat.

Merck reiterated its guidance for the current year, saying it

expects sales to increase to between €14.8 billion and €15 billion.

The company said it anticipates Ebitda before one-time items

between €4.1 billion and €4.3 billion.

Write to Christopher Alessi at christopher.alessi@wsj.com

(END) Dow Jones Newswires

May 19, 2016 03:25 ET (07:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

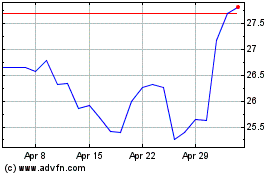

Pfizer (NYSE:PFE)

Historical Stock Chart

From Aug 2024 to Sep 2024

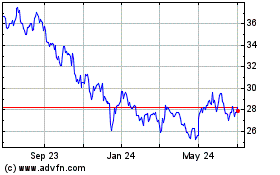

Pfizer (NYSE:PFE)

Historical Stock Chart

From Sep 2023 to Sep 2024