UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8‑K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 3, 2015

VERIFONE SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-32465

Delaware

(State or Other Jurisdiction of Incorporation or Organization)

04-3692546

(IRS Employer Identification No.)

88 West Plumeria Drive

San Jose, CA 95134

(Address of principal executive offices, including zip code)

408-232-7800

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On September 3, 2015, VeriFone Systems, Inc. (the "Company") announced its financial results for the fiscal quarter ended July 31, 2015. A copy of the Company's press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

During the Company's conference call and webcast to report these financial results on September 3, 2015, the Company will present certain supplemental financial information regarding its financial results for the fiscal quarter ended July 31, 2015. A copy of this supplemental financial information is attached hereto as Exhibit 99.2 and is incorporated herein by reference. This information is also available on the Company's investor relations website at http://ir.verifone.com.

The information in this Form 8-K provided under Item 2.02 and Exhibits 99.1 and 99.2 attached hereto are furnished to, but shall not be deemed filed with, the Securities and Exchange Commission or incorporated by reference into the Company's filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

99.1 Press release, dated September 3, 2015, titled "Verifone Reports Results for the Third Quarter of Fiscal 2015"

99.2 Financial Results for the Third Quarter Ended July 31, 2015 – Supplemental Financial Information

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| VERIFONE SYSTEMS, INC. |

| |

Date: September 3, 2015 | By: /s/ Albert Liu Name: Albert Liu Title: Executive Vice President, Corporate Development and General Counsel |

| |

EXHIBIT INDEX

Exhibit No. Description

| |

99.1 | Press release, dated September 3, 2015, titled "Verifone Reports Results for the Third Quarter of Fiscal 2015" |

| |

99.2 | Financial Results for the Third Quarter Ended July 31, 2015 – Supplemental Financial Information |

Exhibit 99.1

Verifone Reports Results for the Third Quarter of Fiscal 2015

Revenues and Earnings per Share Exceed Guidance

SAN JOSE, Calif. - (BUSINESS WIRE) - VeriFone Systems, Inc. (NYSE: PAY):

Third Quarter Financial Highlights

| |

• | GAAP and non-GAAP net revenues of $510 million |

| |

• | GAAP net income per diluted share of $0.08 |

| |

• | Non-GAAP net income per diluted share of $0.47 |

| |

• | Operating cash flow of $71 million |

VeriFone Systems, Inc., the global leader in secure electronic payment solutions, today announced financial results for the three months ended July 31, 2015. GAAP and non-GAAP net revenues for the quarter were $510 million, compared to $476 million a year ago, a 7% increase, and an 18% increase on a constant currency basis. GAAP net income per diluted share for the quarter was $0.08, compared to a net loss of $0.26 a year ago. Non-GAAP net income per diluted share was $0.47, compared to $0.40 a year ago, a 18% increase.

“Q3 was a record quarter for Verifone,” said Paul Galant, Chief Executive Officer of Verifone. “We saw the first half-billion-dollar revenue quarter in the company’s history; grew our non-GAAP earnings per share by 18 percent over last year; and outpaced both market expectations and the industry. In addition, we will begin to launch our next generation solutions at the end of this year. As we continue to make the turn from mostly shipping terminals to delivering fully integrated solutions, our next-generation of connected devices, services, and digital commerce applications will drive unprecedented value for our clients, and long-term growth for Verifone.”

The table below provides additional summary GAAP and non-GAAP financial information and comparisons.

|

| | | | | | | | | | |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AND PERCENTAGES) | | |

| Three Months Ended July 31, |

| 2015 | | 2014 | | Change (2) |

GAAP: | | | | | |

Net revenues | $ | 510 |

| | $ | 476 |

| | 7 | % |

Gross margin as a % of net revenues | 40.5 | % | | 38.4 | % | | 2.1 pts |

|

Net income (loss) per diluted share | $ | 0.08 |

| | $ | (0.26 | ) | | nm |

|

| | | | | |

Non-GAAP (1): | | | | | |

Net revenues | $ | 510 |

| | $ | 476 |

| | 7 | % |

Gross margin as a % of net revenues | 41.7 | % | | 41.6 | % | | 0.1 pts |

|

Net income per diluted share | $ | 0.47 |

| | $ | 0.40 |

| | 18 | % |

(1) Reconciliations for the non-GAAP measures are provided at the end of this press release

(2) "nm" means not meaningful

Financial and Business Highlights

| |

• | Achieved record North America net revenues for the third consecutive quarter driven by security needs and EMV migration, and increased demand for Petroleum, Media, and our Payment as a Service offerings |

| |

• | Grew share in Europe, with six European markets achieving double-digit revenue gains on a year-over-year constant currency basis |

| |

• | Grew Asia Pacific business by 11 percent sequentially; appointed accomplished leaders for the Asia Pacific region; and achieved important NCCA certification for our China subsidiary |

| |

• | Improved net revenues in Latin America 8 percent sequentially and launched next-generation global gateway offering in Mexico |

| |

• | Expanded footprint of connected devices to build an integrated network for delivering payment services and digital commerce applications, including targeted media, loyalty, and offers |

| |

• | Awarded mobile POS business of a top four U.S. wireless carrier to deploy the O/S agnostic e355 in all of its retail stores |

| |

• | Signed more than 25 U.S. merchants for Secure Commerce Architecture, expanding EMV compliance and device connectivity |

| |

• | Increased media revenues and grew global installed base of our taxi and fuel dispenser consumer-facing media screens |

Guidance

Fourth fiscal quarter of 2015:

| |

• | Non-GAAP net revenues of $510 million to $513 million |

| |

• | Non-GAAP net income per diluted share of $0.47 to $0.48 |

Full fiscal year 2015:

| |

• | Non-GAAP net revenues of $1.997 billion to $2.0 billion |

| |

• | Non-GAAP net income per diluted share of $1.82 to $1.83 |

Conference Call

Verifone will hold its earnings conference call today, September 3rd, at 1:30 pm (PT) / 4.30pm (ET). To listen to the call and view the slides, visit Verifone’s website http://ir.verifone.com. The recorded audio webcast will be available on Verifone's website until September 10, 2015.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This press release includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations or beliefs and on currently available competitive, financial and economic data and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the forward-looking statements herein due to changes in economic, business, competitive, technological, and/or regulatory factors, and other risks and uncertainties affecting the operation of the business of VeriFone Systems, Inc., including many factors beyond our control. These risks and uncertainties include, but are not limited to, those associated with: execution of our strategic plan and business and operational initiatives, including whether the expected benefits of our plan and initiatives are achieved within expected timeframes or at all, short product cycles and rapidly changing technologies and customer preferences, our ability to maintain competitive leadership position with respect to our payment solution offerings, our dependence on a limited number of customers, the conduct of our business and operations internationally, our ability to protect our computer systems and networks from fraud, cyber-attacks or security breaches, our assumptions, judgments and estimates regarding the impact on our business of political instability in markets where we conduct business, uncertainty in the global economic environment and financial markets, the status of our relationships with and condition of third parties such as our contract manufacturers, key customers, distributors and key suppliers and service providers upon whom we rely in the conduct of our business, the impact of foreign currency exchange rate fluctuations on our business and results and our ability to effectively hedge our exposure to foreign currency exchange rate fluctuations, and our dependence on a limited number of key employees. For a further list and description of the risks and uncertainties affecting the operations of our business, see our filings with the Securities and Exchange Commission, including our annual report on Form 10-K and our quarterly reports on Form 10-Q. The forward-looking statements speak only as of the date such statements are made. Verifone is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise.

About Verifone

Verifone is transforming everyday transactions into opportunities for connected commerce. We’re connecting more than 27 million payment devices to the cloud-merging the online and in-store shopping experience and creating the next generation of digital engagement between merchants and consumers. We are built on a 30-year history of uncompromised security. Our people are known as trusted experts that work with our clients and partners, helping to

solve their most complex payments challenges. We have clients and partners in more than 150 countries, including the world’s best-known retail brands, financial institutions and payment providers.

Verifone.com | (NYSE: PAY) | @verifone

Additional Resources:

http://ir.verifone.com

|

| | | | | | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE DATA AND PERCENTAGES) |

| | | | | | |

| | | | Three Months Ended July 31, | | Nine Months Ended July 31, |

| | | | 2015 | | 2014 | | % Change (1) | | 2015 | | 2014 | | % Change (1) |

Net revenues: | | | | | | | | | | | | |

| System solutions | | $ | 333.0 |

| | $ | 299.4 |

| | 11.2 | % | | $ | 970.7 |

| | $ | 851.3 |

| | 14.0 | % |

| Services | | 176.9 |

| | 176.5 |

| | 0.2 | % | | 515.6 |

| | 527.1 |

| | (2.2 | )% |

| | Total net revenues | | 509.9 |

| | 475.9 |

| | 7.1 | % | | 1,486.3 |

| | 1,378.4 |

| | 7.8 | % |

| | | | | | | |

|

| | | | | | |

Cost of net revenues: | | | | | | | | | | | | |

| System solutions | | 201.2 |

| | 186.8 |

| | 7.7 | % | | 575.9 |

| | 541.9 |

| | 6.3 | % |

| Services | | 102.2 |

| | 106.3 |

| | (3.9 | )% | | 300.8 |

| | 308.2 |

| | (2.4 | )% |

| | Total cost of net revenues | 303.4 |

| | 293.1 |

| | 3.5 | % | | 876.7 |

| | 850.1 |

| | 3.1 | % |

| | | | | | | | | | | | | | |

Total gross margin | | 206.5 |

| | 182.8 |

| | 13.0 | % | | 609.6 |

| | 528.3 |

| | 15.4 | % |

| | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | |

| Research and development | | 54.2 |

| | 53.2 |

| | 1.9 | % | | 150.7 |

| | 153.7 |

| | (2.0 | )% |

| Sales and marketing | | 56.6 |

| | 54.1 |

| | 4.6 | % | | 169.4 |

| | 161.2 |

| | 5.1 | % |

| General and administrative | | 55.4 |

| | 58.5 |

| | (5.3 | )% | | 152.2 |

| | 158.1 |

| | (3.7 | )% |

| Litigation settlement and loss contingency expense | | — |

| | — |

| | nm |

| | 1.2 |

| | 9.0 |

| | (86.7 | )% |

| Amortization of purchased intangible assets | | 20.0 |

| | 24.5 |

| | (18.4 | )% | | 62.9 |

| | 73.9 |

| | (14.9 | )% |

| | Total operating expenses | | 186.2 |

| | 190.3 |

| | (2.2 | )% | | 536.4 |

| | 555.9 |

| | (3.5 | )% |

Operating income (loss) | | 20.3 |

| | (7.5 | ) | | nm |

| | 73.2 |

| | (27.6 | ) | | nm |

|

Interest expense, net | | (8.2 | ) | | (14.4 | ) | | (43.1 | )% | | (23.5 | ) | | (35.3 | ) | | (33.4 | )% |

Other income (expense), net

| | (0.6 | ) | | (0.4 | ) | | nm |

| | (3.5 | ) | | (6.7 | ) | | nm |

|

Income (loss) before income taxes | | 11.5 |

| | (22.3 | ) | | nm |

| | 46.2 |

| | (69.6 | ) | | nm |

|

Income tax provision (benefit) | | 1.4 |

| | 5.8 |

| | nm |

| | 4.3 |

| | (1.8 | ) | | nm |

|

Consolidated net income (loss) | | 10.1 |

| | (28.1 | ) | | nm |

| | 41.9 |

| | (67.8 | ) | | nm |

|

Net income attributable to noncontrolling interests | | (0.6 | ) | | (0.9 | ) | | nm |

| | (1.0 | ) | | (1.4 | ) | | nm |

|

Net income (loss) attributable to VeriFone Systems, Inc. stockholders | | $ | 9.5 |

| | $ | (29.0 | ) | | nm |

| | $ | 40.9 |

| | $ | (69.2 | ) | | nm |

|

| | | | | | | | | | | | |

Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders: | | | | | | | | | | | | |

| Basic | | $ | 0.08 |

| | $ | (0.26 | ) | | | | $ | 0.36 |

| | $ | (0.62 | ) | | |

| Diluted | | $ | 0.08 |

| | $ | (0.26 | ) | | | | $ | 0.35 |

| | $ | (0.62 | ) | | |

| | | | | | | | | | | | | | |

Weighted average number of shares used in computing net income (loss) per share: | | | | | | | | | | | | |

| Basic | | 114.4 |

| | 112.0 |

| | | | 113.9 |

| | 111.2 |

| | |

| Diluted | | 116.4 |

| | 112.0 |

| | | | 116.0 |

| | 111.2 |

| | |

| | | | | | | | | | | | | | |

| | (1) "nm" means not meaningful | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

NET REVENUES INFORMATION |

(UNAUDITED, IN MILLIONS, EXCEPT PERCENTAGES) |

| | | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

| Note | | July 31, 2015 | | April 30, 2015 | | July 31, 2014 | | % Change (1) SEQ | | % Change (1) YoY | | July 31, 2015 | | July 31, 2014 | | % Change (1) |

GAAP net revenues: | | | | | | | | | | | | | | |

North America | | | $ | 208.6 |

| | $ | 193.0 |

| | $ | 129.8 |

| | 8.1 | % | | 60.7 | % | | $ | 561.8 |

| | $ | 377.1 |

| | 49.0 | % |

Latin America | | | 73.7 |

| | 68.1 |

| | 89.2 |

| | 8.2 | % | | (17.4 | )% | | 212.9 |

| | 241.0 |

| | (11.7 | )% |

EMEA | | | 172.6 |

| | 179.4 |

| | 190.0 |

| | (3.8 | )% | | (9.2 | )% | | 532.2 |

| | 565.4 |

| | (5.9 | )% |

Asia-Pacific | | | 55.0 |

| | 49.6 |

| | 66.9 |

| | 10.9 | % | | (17.8 | )% | | 179.4 |

| | 194.9 |

| | (8.0 | )% |

Total | | | $ | 509.9 |

| | $ | 490.1 |

| | $ | 475.9 |

| | 4.0 | % | | 7.1 | % | | $ | 1,486.3 |

| | $ | 1,378.4 |

| | 7.8 | % |

| | | | | | | | | | | | | | | | | |

Non-GAAP net revenues: (2) | | | | | | | | | | | | | | |

North America | A | | $ | 208.6 |

| | $ | 193.0 |

| | $ | 129.8 |

| | 8.1 | % | | 60.7 | % | | $ | 561.9 |

| | $ | 377.1 |

| | 49.0 | % |

Latin America | | | 73.7 |

| | 68.1 |

| | 89.2 |

| | 8.2 | % | | (17.4 | )% | | 212.9 |

| | 241.0 |

| | (11.7 | )% |

EMEA | A | | 172.7 |

| | 179.6 |

| | 190.2 |

| | (3.8 | )% | | (9.2 | )% | | 532.9 |

| | 567.0 |

| | (6.0 | )% |

Asia-Pacific | A | | 55.0 |

| | 49.6 |

| | 67.2 |

| | 10.9 | % | | (18.2 | )% | | 179.5 |

| | 195.2 |

| | (8.0 | )% |

Total | | | $ | 510.0 |

| | $ | 490.3 |

| | $ | 476.4 |

| | 4.0 | % | | 7.1 | % | | $ | 1,487.2 |

| | $ | 1,380.3 |

| | 7.7 | % |

| | | | | | | | | | | | | | | | | |

GAAP net revenues | | $ | 509.9 |

| | $ | 490.1 |

| | $ | 475.9 |

| | 4.0 | % | | 7.1 | % | | $ | 1,486.3 |

| | $ | 1,378.4 |

| | 7.8 | % |

Plus: Non-GAAP net revenues adjustments | A | | 0.1 |

| | 0.2 |

| | 0.5 |

| | nm |

| | nm |

| | 0.9 |

| | 1.9 |

| | nm |

|

Non-GAAP net revenues (2) | | $ | 510.0 |

| | $ | 490.3 |

| | $ | 476.4 |

| | 4.0 | % | | 7.1 | % | | $ | 1,487.2 |

| | $ | 1,380.3 |

| | 7.7 | % |

(1) "nm" means not meaningful.

(2) Reconciliations for the non-GAAP measures are provided at the end of this press release.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For three months ended July 31, 2015 compared with three months ended July 31, 2014 | For nine months ended July 31, 2015 compared with nine months ended July 31, 2014 |

| Net revenues growth | | Impact due to Non-GAAP net revenues adjustments (A) | | Non-GAAP net revenues growth | | Impact due to foreign currency (B) | | Non-GAAP net revenues at constant currency growth | Net revenues growth | | Impact due to Non-GAAP net revenues adjustments (A) | | Non-GAAP net revenues growth | | Impact due to foreign currency (B) | | Non-GAAP net revenues at constant currency growth |

North America | 60.7 | % | | 0.0pts | | 60.7 | % | | (0.4)pts |

| | 61.1 | % | 49.0 | % | | 0.0pts | | 49.0pts |

| | (0.3)pts |

| | 49.3 | % |

Latin America | (17.4 | )% | | 0.0pts | | (17.4 | )% | | (17.0)pts |

| | (0.4 | )% | (11.7 | )% | | 0.0pts | | (11.7)pts |

| | (13.7)pts |

| | 2.0 | % |

EMEA | (9.2 | )% | | 0.0pts | | (9.2 | )% | | (14.3)pts |

| | 5.1 | % | (5.9 | )% | | 0.1pts | | (6.0)pts |

| | (11.6)pts |

| | 5.6 | % |

Asia-Pacific | (17.8 | )% | | 0.4pts | | (18.2 | )% | | (10.7)pts |

| | (7.5 | )% | (8.0 | )% | | 0.0pts | | (8.0)pts |

| | (6.6)pts |

| | (1.4 | )% |

Total | 7.1 | % | | 0.0pts | | 7.1 | % | | (10.5)pts |

| | 17.6 | % | 7.8 | % | | 0.1pts | | 7.7pts |

| | (8.2)pts |

| | 15.9 | % |

|

| | | | | | | | |

VERIFONE SYSTEMS, INC. |

CONDENSED CONSOLIDATED BALANCE SHEETS |

(UNAUDITED, IN MILLIONS) |

| | July 31, 2015 | | October 31, 2014 |

ASSETS | | | |

Current assets: | | | |

| Cash and cash equivalents | $ | 242.1 |

| | $ | 250.2 |

|

| Accounts receivable, net of allowances of $9.4 and $9.9 | 322.4 |

| | 305.5 |

|

| Inventories | 121.8 |

| | 124.3 |

|

| Prepaid expenses and other current assets | 111.7 |

| | 105.6 |

|

Total current assets | 798.0 |

| | 785.6 |

|

Fixed assets, net | 183.1 |

| | 177.7 |

|

Purchased intangible assets, net | 335.9 |

| | 457.6 |

|

Goodwill | 1,083.8 |

| | 1,185.9 |

|

Deferred tax assets, net | 12.0 |

| | 30.4 |

|

Other long-term assets | 74.2 |

| | 65.0 |

|

Total assets | $ | 2,487.0 |

| | $ | 2,702.2 |

|

| | | |

LIABILITIES AND EQUITY | | | |

Current liabilities: | | | |

| Accounts payable | $ | 150.1 |

| | $ | 161.2 |

|

| Accruals and other current liabilities | 213.9 |

| | 207.0 |

|

| Deferred revenue, net | 85.8 |

| | 92.1 |

|

| Short-term debt | 32.0 |

| | 32.1 |

|

Total current liabilities | 481.8 |

| | 492.4 |

|

Long-term deferred revenue, net | 53.6 |

| | 51.0 |

|

Long-term debt | 781.6 |

| | 851.0 |

|

Long-term deferred tax liabilities, net | 121.4 |

| | 136.1 |

|

Other long-term liabilities | 73.8 |

| | 101.0 |

|

Total liabilities | 1,512.2 |

| | 1,631.5 |

|

| | | |

Redeemable noncontrolling interest in subsidiary | — |

| | 0.8 |

|

| | | |

Stockholders’ equity: | | | |

Common stock | 1.1 |

| | 1.1 |

|

Additional paid-in capital | 1,718.4 |

| | 1,675.7 |

|

Accumulated deficit | (497.3 | ) | | (538.2 | ) |

Accumulated other comprehensive loss | (282.3 | ) | | (104.8 | ) |

Total VeriFone Systems, Inc. stockholders’ equity | 939.9 |

| | 1,033.8 |

|

Noncontrolling interest in subsidiaries | 34.9 |

| | 36.1 |

|

Total equity | 974.8 |

| | 1069.9 |

|

Total liabilities and equity | $ | 2,487.0 |

| | $ | 2,702.2 |

|

|

| | | | | | | | | |

VERIFONE SYSTEMS, INC. |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

(UNAUDITED, IN MILLIONS) |

|

| | | Nine Months Ended July 31, |

| | | 2015 | | 2014 |

Cash flows from operating activities | | | |

Consolidated net income (loss) | $ | 41.9 |

| | $ | (67.8 | ) |

Adjustments to reconcile consolidated net income (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization, net | 127.7 |

| | 161.0 |

|

| Stock-based compensation expense | 32.2 |

| | 40.9 |

|

| Deferred income taxes, net | (8.7 | ) | | (20.6 | ) |

| Write-off of debt issuance cost upon extinguishment | — |

| | 7.2 |

|

| Other | 14.5 |

| | 11.0 |

|

| Net cash provided by operating activities before changes in operating assets and liabilities | 207.6 |

| | 131.7 |

|

| Changes in operating assets and liabilities: | | | |

| | Accounts receivable, net | (33.4 | ) | | (17.2 | ) |

| | Inventories | (6.7 | ) | | 24.6 |

|

| | Prepaid expenses and other assets | (20.8 | ) | | 12.5 |

|

| | Accounts payable | (0.2 | ) | | 24.3 |

|

| | Deferred revenue, net | 10.1 |

| | 20.7 |

|

| | Other current and long-term liabilities | 12.2 |

| | (49.2 | ) |

| | Net change in operating assets and liabilities | (38.8 | ) | | 15.7 |

|

Net cash provided by operating activities | 168.8 |

| | 147.4 |

|

| | | | | |

Cash flows from investing activities | | | |

Capital expenditures | (78.5 | ) | | (62.8 | ) |

Acquisition of businesses, net of cash and cash equivalents acquired | (13.6 | ) | | — |

|

Other investing activities, net | 0.1 |

| | 2.4 |

|

Net cash used in investing activities | (92.0 | ) | | (60.4 | ) |

| | | | | |

Cash flows from financing activities | | | |

Proceeds from debt, net of issuance costs | 60.0 |

| | 1,081.1 |

|

Repayments of debt | (130.3 | ) | | (1,199.7 | ) |

Proceeds from issuance of common stock through employee equity incentive plans | 12.7 |

| | 31.6 |

|

Other financing activities, net | (2.5 | ) | | (2.1 | ) |

Net cash used in financing activities | (60.1 | ) | | (89.1 | ) |

| | | | | |

Effect of foreign currency exchange rate changes on cash and cash equivalents | (24.8 | ) | | (2.3 | ) |

| | | | | |

Net decrease in cash and cash equivalents | (8.1 | ) | | (4.4 | ) |

Cash and cash equivalents, beginning of period | 250.2 |

| | 268.2 |

|

Cash and cash equivalents, end of period | $ | 242.1 |

| | $ | 263.8 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AMOUNTS AND PERCENTAGES) |

| | Note | Net revenues | | Gross margin | | Gross margin percentage | | Operating income | | Income tax provision | | Net income attributable to VeriFone Systems, Inc. stockholders |

Three Months Ended July 31, 2015 | | | | | | | | | | | | |

GAAP | | $ | 509.9 |

| | $ | 206.5 |

| | 40.5 | % | | $ | 20.3 |

| | $ | 1.4 |

| | $ | 9.5 |

|

Adjustments: | | | | | | | | | | | | |

| Amortization of step-down in deferred services net revenues at acquisition | A | 0.1 |

| | 0.1 |

| | | | 0.1 |

| | — |

| | 0.1 |

|

| Amortization of purchased intangible assets | C | — |

| | 4.5 |

| | | | 24.5 |

| | — |

| | 24.5 |

|

| Other merger and acquisition related expenses | C | — |

| | 0.5 |

| | | | 1.7 |

| | — |

| | 3.2 |

|

| Stock based compensation | D | — |

| | 0.4 |

| | | | 11.2 |

| | — |

| | 11.2 |

|

| Restructuring charges | E | — |

| | 0.2 |

| | | | 6.0 |

| | — |

| | 6.0 |

|

| Other charges and income | E | — |

| | 0.5 |

| | | | 7.7 |

| | — |

| | 7.7 |

|

| Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate | E | — |

| | — |

| | | | — |

| | 7.9 |

| | (7.9 | ) |

Non-GAAP | | $ | 510.0 |

| | $ | 212.7 |

| | 41.7 | % | | $ | 71.5 |

| | $ | 9.3 |

| | $ | 54.3 |

|

| | | | | | | | | | | | | |

| | | Weighted average number of shares used in computing net income per share: | | | | | | Net income per share attributable to VeriFone Systems, Inc. stockholders (1) |

| | | Basic | | Diluted | | | | | | Basic | | Diluted |

GAAP | | 114.4 |

| | 116.4 |

| | | | | | $ | 0.08 |

| | $ | 0.08 |

|

Non-GAAP | | 114.4 |

| | 116.4 |

| | | | | | $ | 0.47 |

| | $ | 0.47 |

|

(1) Net income per share is calculated by dividing the Net income attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AMOUNTS AND PERCENTAGES) |

| | Note | Net revenues | | Gross margin | | Gross margin percentage | | Operating income | | Income tax provision | | Net income attributable to VeriFone Systems, Inc. stockholders |

Three Months Ended April 30, 2015 | | | | | | | | | | | | |

GAAP | | $ | 490.1 |

| | $ | 203.9 |

| | 41.6 | % | | $ | 29.7 |

| | $ | 1.4 |

| | $ | 17.6 |

|

Adjustments: | | | | | | | | | | | | |

| Amortization of step-down in deferred services net revenues at acquisition | A | 0.2 |

| | 0.2 |

| |

|

| | 0.2 |

| | — |

| | 0.2 |

|

| Amortization of purchased intangible assets | C | — |

| | 4.6 |

| | | | 25.2 |

| | — |

| | 25.2 |

|

| Other merger and acquisition related expenses | C | — |

| | 0.4 |

| | | | 0.5 |

| | — |

| | 1.5 |

|

| Stock based compensation | D | — |

| | 0.4 |

| | | | 8.9 |

| | — |

| | 8.9 |

|

| Restructuring charges | E | — |

| | — |

| | | | 0.2 |

| | — |

| | 0.2 |

|

| Other charges and income | E | — |

| | 0.2 |

| | | | 4.6 |

| | — |

| | 4.6 |

|

| Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate | E | — |

| | — |

| | | | — |

| | 7.3 |

| | (7.3 | ) |

Non-GAAP | | $ | 490.3 |

| | $ | 209.7 |

| | 42.8 | % | | $ | 69.3 |

| | $ | 8.7 |

| | $ | 50.9 |

|

| | | | | | | | | | | | | |

| | | Weighted average number of shares used in computing net income per share: | | | | | | Net income per share attributable to VeriFone Systems, Inc. stockholders (1) |

| | | Basic | | Diluted | | | | | | Basic | | Diluted |

GAAP | | 113.9 |

| | 115.9 |

| | | | | | $ | 0.15 |

| | $ | 0.15 |

|

Non-GAAP | | 113.9 |

| | 115.9 |

| | | | | | $ | 0.45 |

| | $ | 0.44 |

|

(1) Net income per share is calculated by dividing the Net income attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AMOUNTS AND PERCENTAGES) |

| | Note | Net revenues | | Gross margin | | Gross margin percentage | | Operating income (loss) | | Income tax provision | | Net income (loss) attributable to VeriFone Systems, Inc. stockholders |

Three Months Ended July 31, 2014 | | | | | | | | | | | | |

GAAP | | $ | 475.9 |

| | $ | 182.8 |

| | 38.4 | % | | $ | (7.5 | ) | | $ | 5.8 |

| | $ | (29.0 | ) |

Adjustments: | | | | | | | | | | | | |

| Amortization of step-down in deferred services net revenues at acquisition | A | 0.5 |

| | 0.5 |

| | | | 0.5 |

| | — |

| | 0.5 |

|

| Amortization of purchased intangible assets | C | — |

| | 10.1 |

| | | | 34.6 |

| | — |

| | 34.6 |

|

| Other merger, acquisition and divestiture related expenses | C | — |

| | 0.6 |

| | | | 1.2 |

| | — |

| | 1.9 |

|

| Stock based compensation | D | — |

| | 0.5 |

| | | | 13.2 |

| | — |

| | 13.2 |

|

| Restructuring charges | E | — |

| | 1.8 |

| | | | 10.9 |

| | — |

| | 10.9 |

|

| Cost of debt refinancing | E | — |

| | — |

| | | | 4.1 |

| | — |

| | 9.3 |

|

| Other charges and income | E | — |

| | 1.9 |

| | | | 5.9 |

| | — |

| | 5.9 |

|

| Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate | E | — |

| | — |

| | | | — |

| | 2.0 |

| | (2.0 | ) |

Non-GAAP | | $ | 476.4 |

| | $ | 198.2 |

| | 41.6 | % | | $ | 62.9 |

| | $ | 7.8 |

| | $ | 45.3 |

|

| | | | | | | | | | | | | |

| | | Weighted average number of shares used in computing net income (loss) per share: | | | | | | Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders (1) |

| | | Basic | | Diluted | | | | | | Basic | | Diluted |

GAAP | | 112.0 |

| | 112.0 |

| | | | | | $ | (0.26 | ) | | $ | (0.26 | ) |

| Adjustment for diluted shares | F | — |

| | 2.3 |

| | | | | | | | |

Non-GAAP | | 112.0 |

| | 114.3 |

| | | | | | $ | 0.40 |

| | $ | 0.40 |

|

(1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AMOUNTS AND PERCENTAGES) |

| | Note | Net revenues | | Gross margin | | Gross margin percentage | | Operating income | | Income tax provision | | Net income attributable to VeriFone Systems, Inc. stockholders |

Nine Months Ended July 31, 2015 | | | | | | | | | | | | |

GAAP | | $ | 1,486.3 |

| | $ | 609.6 |

| | 41.0 | % | | $ | 73.2 |

| | $ | 4.3 |

| | $ | 40.9 |

|

Adjustments: | | | | | | | | | | | | |

| Amortization of step-down in deferred services net revenues at acquisition | A | 0.9 |

| | 0.9 |

| | | | 0.9 |

| | — |

| | 0.9 |

|

| Amortization of purchased intangible assets | C | — |

| | 13.8 |

| | | | 76.7 |

| | — |

| | 76.7 |

|

| Other merger and acquisition related expenses | C | — |

| | 1.1 |

| | | | 3.2 |

| | — |

| | 2.9 |

|

| Stock based compensation | D | — |

| | 1.6 |

| | | | 32.2 |

| | — |

| | 32.2 |

|

| Restructure charges | E | — |

| | 0.3 |

| | | | 7.5 |

| | — |

| | 7.5 |

|

| Other charges and income | E | — |

| | 1.4 |

| | | | 17.3 |

| | — |

| | 17.3 |

|

| Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate | E | — |

| | — |

| | | | — |

| | 22.5 |

| | (22.5 | ) |

Non-GAAP | | $ | 1,487.2 |

| | $ | 628.7 |

| | 42.3 | % | | $ | 211.0 |

| | $ | 26.8 |

| | $ | 155.9 |

|

| | | | | | | | | | | | | |

| | | Weighted average number of shares used in computing net income per share: | | | | | | Net income per share attributable to VeriFone Systems, Inc. stockholders (1) |

| | | Basic | | Diluted | | | | | | Basic | | Diluted |

GAAP | | 113.9 |

| | 116.0 |

| | | | | | $ | 0.36 |

| | $ | 0.35 |

|

Non-GAAP | | 113.9 |

| | 116.0 |

| | | | | | $ | 1.37 |

| | $ | 1.34 |

|

(1) Net income per share is calculated by dividing the Net income attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AMOUNTS AND PERCENTAGES) |

| | Note | Net revenues | | Gross margin | | Gross margin percentage | | Operating income (loss) | | Income tax provision (benefit) | | Net income (loss) attributable to VeriFone Systems, Inc. stockholders |

Nine Months Ended July 31, 2014 | | | | | | | | | | | | |

GAAP | | $ | 1,378.4 |

| | $ | 528.3 |

| | 38.3 | % | | $ | (27.6 | ) | | $ | (1.8 | ) | | $ | (69.2 | ) |

Adjustments: | | | | | | | | | | | | |

| Amortization of step-down in deferred net revenues at acquisition | A | 1.9 |

| | 1.9 |

| | | | 1.9 |

| | — |

| | 1.9 |

|

| Amortization of purchased intangible assets | C | — |

| | 32.7 |

| | | | 106.5 |

| | — |

| | 106.5 |

|

| Other merger and acquisition related expenses | C | — |

| | 4.3 |

| | | | 7.3 |

| | — |

| | 10.1 |

|

| Stock based compensation | D | — |

| | 1.3 |

| | | | 40.9 |

| | — |

| | 40.9 |

|

| Restructuring charges | E | — |

| | 2.7 |

| | | | 16.6 |

| | — |

| | 16.6 |

|

| Cost of debt refinancing | E | — |

| | — |

| | | | 4.1 |

| | — |

| | 11.2 |

|

| Other charges and income | E | — |

| | 5.6 |

| | | | 26.4 |

| | — |

| | 26.2 |

|

| Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate | E | — |

| | — |

| | | | — |

| | 22.5 |

| | (22.5 | ) |

Non-GAAP | | $ | 1,380.3 |

| | $ | 576.8 |

| | 41.8 | % | | $ | 176.1 |

| | $ | 20.7 |

| | $ | 121.7 |

|

| | | | | | | | | | | | | |

| | | Weighted average number of shares used in computing net income (loss) per share: | | | | | | Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders (1) |

| | | Basic | | Diluted | | | | | | Basic | | Diluted |

GAAP | | 111.2 |

| | 111.2 |

| | | | | | $ | (0.62 | ) | | $ | (0.62 | ) |

| Adjustment for diluted shares | F | — |

| | 2.2 |

| | | | | | | | |

Non-GAAP | | 111.2 |

| | 113.4 |

| | | | | | $ | 1.09 |

| | $ | 1.07 |

|

(1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares.

|

| | | | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS) |

| | | | | | | | | | | | |

| | | | GAAP net revenues | | Amortization of step-down in deferred revenue at acquisition | | Non-GAAP net revenues | | Constant currency adjustment | | Non-GAAP net revenues at constant currency |

| | Note | | | | (A) | | (A) | | (B) | | (B) |

| | | | | | | | | | | | |

Three Months Ended July 31, 2015 |

North America | | $ | 208.6 |

| | $ | — |

| | $ | 208.6 |

| | $ | 0.5 |

| | $ | 209.1 |

|

Latin America | | 73.7 |

| | — |

| | 73.7 |

| | 15.1 |

| | 88.8 |

|

EMEA | | 172.6 |

| | 0.1 |

| | 172.7 |

| | 27.2 |

| | 199.9 |

|

Asia-Pacific | | 55.0 |

| | — |

| | 55.0 |

| | 7.2 |

| | 62.2 |

|

| | Total | | $ | 509.9 |

| | $ | 0.1 |

| | $ | 510.0 |

| | $ | 50.0 |

| | $ | 560.0 |

|

| | | | | | | | | | |

System Solutions | | $ | 333.0 |

| | $ | — |

| | $ | 333.0 |

| | | | |

Services | | 176.9 |

| | 0.1 |

| | 177.0 |

| | | | |

| | Total | | $ | 509.9 |

| | $ | 0.1 |

| | $ | 510.0 |

| |

| |

|

|

| | | | | | | | | | | | | | | | | | |

Three Months Ended April 30, 2015 |

North America | | $ | 193.0 |

| | $ | — |

| | $ | 193.0 |

| | | | |

Latin America | | 68.1 |

| | — |

| | 68.1 |

| | | | |

EMEA | | 179.4 |

| | 0.2 |

| | 179.6 |

| | | | |

Asia-Pacific | | 49.6 |

| | — |

| | 49.6 |

| | | | |

| | Total | | $ | 490.1 |

| | $ | 0.2 |

| | $ | 490.3 |

| | | | |

| | | | | | | | | | | | |

System Solutions | | $ | 324.3 |

| | $ | — |

| | $ | 324.3 |

| | | | |

Services | | 165.8 |

| | 0.2 |

| | 166.0 |

| | | | |

| | Total | | $ | 490.1 |

| | $ | 0.2 |

| | $ | 490.3 |

| | | | |

|

| | | | | | | | | | | | | | | | | | |

Three Months Ended July 31, 2014 |

North America | | $ | 129.8 |

| | $ | — |

| | $ | 129.8 |

| | | | |

Latin America | | 89.2 |

| | — |

| | 89.2 |

| | | | |

EMEA | | 190.0 |

| | 0.2 |

| | 190.2 |

| | | | |

Asia-Pacific | | 66.9 |

| | 0.3 |

| | 67.2 |

| | | | |

| | Total | | $ | 475.9 |

| | $ | 0.5 |

| | $ | 476.4 |

| | | | |

| | | | | | | | | | | | |

System Solutions | | $ | 299.4 |

| | $ | — |

| | $ | 299.4 |

| | | | |

Services | | 176.5 |

| | 0.5 |

| | 177.0 |

| | | | |

| | Total | | $ | 475.9 |

| | $ | 0.5 |

| | $ | 476.4 |

| | | | |

|

| | | | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS) |

| | | | | | | | | | | | |

| | | | GAAP net revenues | | Amortization of step-down in deferred revenue at acquisition | | Non-GAAP net revenues | | Constant currency adjustment | | Non-GAAP net revenues at constant currency |

| | Note | | | | (A) | | (A) | | (B) | | (B) |

| | | | | | | | | | | | |

Nine Months Ended July 31, 2015 |

North America | | $ | 561.8 |

| | $ | 0.1 |

| | $ | 561.9 |

| | $ | 1.3 |

| | $ | 563.2 |

|

Latin America | | 212.9 |

| | — |

| | 212.9 |

| | 32.9 |

| | 245.8 |

|

EMEA | | 532.2 |

| | 0.7 |

| | 532.9 |

| | 65.9 |

| | 598.8 |

|

Asia-Pacific | | 179.4 |

| | 0.1 |

| | 179.5 |

| | 12.8 |

| | 192.3 |

|

| | Total | | $ | 1,486.3 |

| | $ | 0.9 |

| | $ | 1,487.2 |

| | $ | 112.9 |

| | $ | 1,600.1 |

|

| | | | | | | | | | |

System Solutions | | $ | 970.7 |

| | $ | — |

| | $ | 970.7 |

| | | | |

Services | | 515.6 |

| | 0.9 |

| | 516.5 |

| | | | |

| | Total | | $ | 1,486.3 |

| | $ | 0.9 |

| | $ | 1,487.2 |

| | | | |

|

| | | | | | | | | | | | | | | | | | | |

Nine Months Ended July 31, 2014 |

North America | | $ | 377.1 |

| | $ | — |

| | | $ | 377.1 |

| | | | |

Latin America | | 241.0 |

| | — |

| | | 241.0 |

| | | | |

EMEA | | 565.4 |

| | 1.6 |

| | | 567.0 |

| | | | |

Asia-Pacific | | 194.9 |

| | 0.3 |

| | | 195.2 |

| | | | |

| | Total | | $ | 1,378.4 |

| | $ | 1.9 |

| | | $ | 1,380.3 |

| | | | |

| | | | | | | | | | | |

System Solutions | | $ | 851.3 |

| | $ | — |

| | | $ | 851.3 |

| | | | |

Services | | 527.1 |

| | 1.9 |

| | | 529.0 |

| | | | |

| | Total | | $ | 1,378.4 |

| | $ | 1.9 |

| | | $ | 1,380.3 |

| | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. | | | | | | |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES | | | | | | |

(UNAUDITED, IN MILLIONS) | | | | | | |

| | | | | | | | | | | |

| | | Three Months Ended | | Years Ended |

| Note | | July 31, 2015 | | April 30, 2015 | | July 31, 2014 | | % Change SEQ | | % Change YoY | | July 31, 2015 | | July 31, 2014 | | % Change |

Free Cash Flow | | | | | | | | | | | | | | | | | |

GAAP net cash provided by operating activities | G | | $ | 71.4 |

| | $ | 56.3 |

| | $ | 58.9 |

| | 26.8 | % | | 21.2 | % | | $ | 168.8 |

| | $ | 147.4 |

| | 14.5 | % |

Less: GAAP capital expenditures | G | | (29.6 | ) | | (29.3 | ) | | (20.9 | ) | | 1.0 | % | | 41.6 | % | | (78.5 | ) | | (62.8 | ) | | 25.0 | % |

Free cash flow | G | | $ | 41.8 |

| | $ | 27.0 |

| | $ | 38.0 |

| | 54.8 | % | | 10.0 | % | | $ | 90.3 |

| | $ | 84.6 |

| | 6.7 | % |

| | | | | | | | | | | | | | | | | |

| | | Three Months Ending October 31, 2015 | | Year Ending October 31, 2015 | | | | | | | | |

Guidance | | | Range of Guidance | | Range of Guidance | | | | | | | | |

GAAP net revenues | | | $ | 510 |

| | $ | 513 |

| | $ | 1,996 |

| | $ | 1,999 |

| | | | | | | | |

Adjustments to net revenues | A | | — |

| | — |

| | 1 |

| | 1 |

| | | | | | | | |

Non-GAAP net revenues | | | $ | 510 |

| | $ | 513 |

| | $ | 1,997 |

| | $ | 2,000 |

| | | | | | | | |

NON-GAAP FINANCIAL MEASURES

This press release and its attachments include several non-GAAP financial measures, including non-GAAP net revenues; non-GAAP Services net revenues; non-GAAP net revenues at constant currency; non-GAAP gross margin as a percentage of non-GAAP net revenues; non-GAAP net income (loss) per diluted share, and free cash flow. This press release also includes certain forward-looking non-GAAP financial measures, specifically projected non-GAAP net revenues and non-GAAP net income per diluted share for the fourth fiscal quarter and full fiscal year 2015. The corresponding reconciliations of these non-GAAP financial measures to the most comparable GAAP financial measures, to the extent available without unreasonable effort, are included in this press release.

Management uses non-GAAP financial measures only in addition to and in conjunction with results presented in accordance with GAAP. Management believes that these non-GAAP financial measures help it to evaluate Verifone's performance and operations and to compare Verifone's current results with those for prior periods as well as with the results of peer companies. Verifone incurs, due to differences in debt, capital structure and investment history, certain income and expense items, such as stock based compensation, amortization of acquired intangibles and other non-cash expenses, that differ significantly from Verifone's competitors. The non-GAAP financial measures reflect Verifone's reported operating performance without such items. Management also uses these non-GAAP financial measures in Verifone's budget and planning process. Management believes that the presentation of these non-GAAP financial measures is useful to investors in comparing Verifone's operating performance in any period with its performance in other periods and with the performance of other companies that represent alternative investment opportunities. These non-GAAP financial measures contain limitations and should be considered as a supplement to, and not as a substitute for, or superior to, disclosures made in accordance with GAAP.

These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and may therefore differ from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures do not reflect all amounts and costs, such as acquisition related costs, employee stock-based compensation costs, cash that may be expended for future capital expenditures or contractual commitments, working capital needs, cash used to service interest or principal payments on Verifone's debt, income taxes and the related cash requirements, and restructuring charges, associated with Verifone's results of operations as determined in accordance with GAAP.

Furthermore, Verifone expects to continue to incur income and expense items that are similar to those that are excluded by the non-GAAP adjustments described herein. Management compensates for these limitations by also relying on the comparable GAAP financial measures.

Our GAAP and non-GAAP net revenues are presented for our geographic regions: North America, Latin America, EMEA and Asia-Pacific. North America includes the US and Canada. Latin America includes South America, Central America, Mexico and the Caribbean. EMEA includes Europe, Russia, the Middle East, and Africa. Asia-Pacific includes Australia, New Zealand, China, India and throughout the rest of Greater Asia, including other Asia-Pacific Rim countries.

Note A: Non-GAAP net revenues. Non-GAAP net revenues exclude the fair value decrease (step-down) in deferred revenue at acquisition. Although the step-down of deferred revenue fair value at acquisition is reflected in our GAAP financial statements, it results in net revenues immediately post-acquisition that are lower than net revenues that would be recognized in accordance with GAAP on those same services if they were sold under contracts entered into post-acquisition. We adjust the step-down to achieve comparability to net revenues of the acquired entity earned pre-acquisition and to our GAAP net revenues to be earned on contracts sold in future periods. These non-GAAP net revenues amounts are not intended to be a substitute for our GAAP disclosures of net revenues, and should be read together with our GAAP disclosures.

Note B: Non-GAAP net revenues at constant currency. Verifone determines non-GAAP net revenues at constant currency by recomputing non-GAAP net revenues denominated in currencies other than U.S. Dollars in the current fiscal period using average exchange rates for that particular currency during the corresponding financial period of the prior year. Verifone uses this non-GAAP measure to evaluate performance on a comparable basis excluding the impact of foreign currency fluctuations.

Note C: Merger and Acquisition Related. Verifone adjusts certain revenues and expenses for items that are the result of merger and acquisitions.

Acquisition related adjustments include the amortization of intangible assets, fixed asset fair value adjustments, contingent consideration adjustments, incremental costs associated with acquisitions (such as legal fees related to litigation assumed as part of acquisitions) and acquisition integration expenses (such as costs of personnel required to assist with integration transitions). In addition, we adjust for changes in estimate and final resolution of contingencies that existed at the time of acquisition. Acquisition related expenses also result from events which arise from unforeseen circumstances which often occur outside the ordinary course of business.

Verifone analyzes the performance of its operations without regard to these adjustments. In determining whether any merger or acquisition related adjustment is appropriate, Verifone takes into consideration, among other things, how such adjustments would or would not aid the understanding of the performance of its operations.

Note D: Stock-Based Compensation. Our non-GAAP financial measures eliminate the effect of expense for stock-based compensation because they are non-cash expenses that management believes are not reflective of ongoing operating results. In particular, because of varying available valuation methodologies, subjective assumptions and the variety of award types which affect the calculations of stock-based compensation, we believe that the exclusion of stock-based compensation allows for more accurate comparisons of our operating results to our peer companies. Stock-based compensation is very different from other forms of compensation. A cash salary or bonus has a fixed and unvarying cash cost. In contrast the expense associated with an award of an option or other stock based award is unrelated to the amount of compensation ultimately received by the employee; and the cost to the company is based on valuation methodology and underlying assumptions that may vary over time and does not reflect any cash expenditure by the company. Furthermore, the expense associated with granting an employee an option or other stock based award can be spread over multiple years and may be reversed based on forfeitures which may differ from our original assumptions unlike cash compensation expense which is typically recorded contemporaneously with the time of award or payment.

Note E: Other Charges and Income. Verifone excludes certain revenue, expenses and other income (expense) that we have determined is not reflective of ongoing operating results. It is difficult to estimate the amount or timing of these items in advance. Although these events are reflected in our GAAP financial statements, we exclude them in our non-GAAP financial measures because we believe these items may limit the comparability of our ongoing operations with prior and future periods. These adjustments for other charges and income include:

| |

• | Litigation settlement and loss contingency expense. |

| |

• | Certain costs incurred in connection with senior executive management changes, such as separation payments, non-compete arrangement fees, legal fees, recruiter fees and sign on bonuses. |

| |

• | Certain expenses, such as professional services and certain personnel costs, incurred on initiatives to transform, streamline and centralize our global operations. |

| |

• | Restructure and impairment charges related to certain exit activities initiated as part of our global transformation initiatives. |

| |

• | Gain or loss on financial transactions, such as the accelerated amortization of capitalized debt issuance costs due to the early repayment of debt and costs incurred to refinance our debt. |

We assess our operating performance with these amounts included and excluded, and by providing this information, we believe that users of our financial statements are better able to understand the financial results of what we consider to be our continuing operations.

Income taxes are adjusted for the tax effect of the adjusting items related to our non-GAAP financial measures and to reflect our medium to long term estimate of cash taxes on a non-GAAP basis, in order to provide our management and users of the financial statements with better clarity regarding the on-going comparable performance and future liquidity of our business. Under GAAP our Income tax provision (benefit) as a percentage of Income (loss) before income taxes was 12.6% for the fiscal quarter ended July 31, 2015, 7.6% for the fiscal quarter ended April 30, 2015, (25.5)% for the fiscal quarter ended July 31, 2014, 9.3% for the nine months ended July 31, 2015 and 2.7% for the nine months ended July 31, 2014. For non-GAAP purposes, we used a 14.5% rate for the fiscal quarters ended July 31, 2015, April 30, 2015 and July 31, 2014 and the nine months ended July 31, 2015 and 2014.

Note F: Non-GAAP diluted shares. Diluted non-GAAP weighted average shares include additional shares that are dilutive for non-GAAP computations of earnings per share in periods when we have a non-GAAP net income and a GAAP basis net loss.

Note G: Free Cash Flow. Free cash flow is not defined under GAAP. Therefore, it should not be considered a substitute for income or cash flow data prepared in accordance with GAAP and may not be comparable to similarly titled measures used by other companies. Verifone determines free cash flow as net cash provided by operating activities less capital expenditures. We use this non-GAAP measure to evaluate our operating cash spend including the impact of our investments in long-term operating assets, such as property, equipment and capitalized software.

Contacts

VeriFone Systems, Inc.

Investor Relations:

Douglas D. Reed, 408-232-7979

SVP, Treasury & Investor Relations

ir@verifone.com

or

Media Relations:

Andy Payment, 770-754-3541

andy.payment@verifone.com

Source: VeriFone Systems, Inc.

FINANCIAL RESULTS For the Third Quarter Ended July 31, 2015 Exhibit 99.2

Today’s discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements relate to future events and expectations and involve known and unknown risks and uncertainties. Verifone’s actual results or actions may differ materially from those projected in the forward-looking statements. For a summary of the specific risk factors that could cause results to differ materially from those expressed in the forward-looking statements, please refer to Verifone’s filings with the Securities and Exchange Commission, including its annual report on Form 10-K and quarterly reports on Form 10-Q. Verifone is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise. FORWARD-LOOKING STATEMENTS 2

NON-GAAP FINANCIAL MEASURES 3 With respect to any non-GAAP financial measures presented in the information, reconciliations of non-GAAP to GAAP financial measures may be found in Verifone’s quarterly earnings release as filed with the Securities and Exchange Commission as well as the Appendix to these slides. Management uses non-GAAP financial measures only in addition to and in conjunction with results presented in accordance with GAAP. Management believes that these Non-GAAP financial measures help it to evaluate Verifone’s performance and to compare Verifone’s current results with those for prior periods as well as with the results of peer companies. These non-GAAP financial measures contain limitations and should be considered as a supplement to, and not as a substitute for, or superior to, disclosures made in accordance with GAAP.

INTRODUCTION Paul Galant Chief Executive Officer

Q3 BUSINESS HIGHLIGHTS 5 Record revenue quarter; first $500M+ quarter in company history 18% EPS growth over Q3FY14 North America: 3rd consecutive record quarter of $209M (61% YOY growth) EMEA: 6 European markets with double-digit constant currency growth Latin America: Driving services growth; new global gateway in Mexico Asia: 11% sequential growth; new Asia Pacific, China leaders Year of Product: Progress on next generation terminals and services platforms

TRANSFORMATION PROGRESS – YEAR TO DATE 6 Key Initiatives Product Portfolio Management R&D Re-Engineering Cost Optimization • Driving Global Product Mgmt • Reduced SKUs ~60% • Reduced active platforms from 13 to 8 • Divested non-core businesses • Expanding product portfolio • Verifone Engage • Developing full China product suite • Complete mPOS and mobile product family • Established Global R&D infrastructure • Created 10 Centers of Excellence • Unifying development environment • Consolidated R&D sites from 75 to 60 • Consolidating to next-generation payment gateway • Implemented R&D planning and resource system • Initiated 100 cost-savings projects • Additional restructuring plans announced in Q3 15 • Consolidating distribution, repair & warehouse operations • Refinanced debt with $1.3B agreement • Consolidated 11 data centers • Closed 28 facilities • Liquidated 22 of 134 legal entities • 62% of entities covered by financial shared services

WHAT WILL DRIVE GROWTH IN FY16 AND BEYOND? 7 U.S. EMV migration 3-year upgrade cycle; ~3% North America revenue growth in FY16 U.S. Mid-Tier/SMB ~7M devices still need to be upgraded (~2M of which are greenfield) U.S. Hospitality ~1M additional greenfield opportunity U.S. Petro ~$50M incremental revenue in FY16 (at-pump, site controller, media) Verifone Engage New device platform for interactive commerce; available 1H16 Mobility e355 available Q415; ~$35M incremental revenue in FY16 Next Gen Gateways Successful launch in Mexico; rollout in U.S. next Estate Management VHQ scaling globally Secure Commerce Architecture Over 25 SCA deals in Q3; pipeline of 220k connected devices Visa CyberSource Formal joint marketing begins Q4; client onboarding early 1H16 App Marketplace App ecosystem to launch in early 2016

Q3 FINANCIAL RESULTS AND GUIDANCE Marc Rothman Chief Financial Officer

NON-GAAP KEY METRICS* 9 * Net Income = Net Income attributable to VeriFone Systems, Inc. stockholders * Operating Cash Flow = GAAP net cash provided by operating activities * A reconciliation of our GAAP to Non-GAAP financial measures, including Free Cash Flow, can be found in the appendix section Q315 Q314 Q215 Q315 % SEQ Inc(Dec) % YoY Inc(Dec) Net Revenues 476 490 510 4% 7% Gross Margin 198 210 213 1% 7% % of Revenue 41.6% 42.8% 41.7% (1.1)pts 0.1pts Operating Income 63 69 72 3% 14% % of Revenue 13.2% 14.1% 14.0% (0.1)pts 0.8pts Net Income* 45 51 54 7% 20% EPS 0.40 0.44 0.47 7% 18% Operating Cash Flow* 59 56 71 27% 21% Free Cash Flow* 38 27 42 55% 10% $ in millions, except EPS

$ in millions NON-GAAP NET REVENUES PROFILE* Q315 Q314 Q215 Q315 % SEQ Inc(Dec) % YoY Inc(Dec) YoY Constant Currency Growth North America 130 193 209 8% 61% 61% Latin America 89 68 74 8% (17)% 0% EMEA 190 180 173 (4)% (9)% 5% Asia-Pacific 67 50 55 11% (18)% (8)% TOTAL 476 490 510 4% 7% 18% Q215 Q315 Q314 NA 27% ASIA-PAC 14% LAC 19% EMEA 40% NA 39% ASIA-PAC 10% LAC 14% EMEA 37% NA 41% ASIA-PAC 11% LAC 14% EMEA 34% 10 * A reconciliation of our GAAP to Non-GAAP total net revenues can be found in the appendix section

NON-GAAP NET REVENUES AND GROSS MARGIN* $ in millions Q314 Q215 Q315 System Solutions 299 324 333 Services 177 166 177 Total Net Revenues 476 490 510 Services % of Total Net Revenues 37% 34% 35% $ in millions % of Revenue Q314 Q215 Q315 System Solutions 41.3% 43.1% 41.1% Services 42.1% 42.1% 42.9% Total Gross Margin % 41.6% 42.8% 41.7% 11 * A reconciliation of our GAAP to Non-GAAP Net revenues and gross margin can be found in the appendix section

NON-GAAP OPERATING EXPENSES* 12 * A reconciliation of our GAAP to Non-GAAP operating expenses can be found in the appendix section $ in millions Q314 Q215 Q315 Research and Development 46 46 49 % of Revenue 10% 9% 10% Sales and Marketing 47 51 50 % of Revenue 10% 10% 10% General and Administrative 42 43 42 % of Revenue 9% 9% 8% Total Operating Expenses 135 140 141 % of Revenue 28% 29% 28%

TOTAL CASH, GROSS DEBT AND NET DEBT Total Cash ($ in millions) 268 249 230 264 250 241 234 242 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 Gross Debt ($ in millions) 1036 1001 940 924 883 863 843 814 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 814 As of July 31, 2015: $814M Outstanding Debt: – Short-term of $32M – Long-term of $782M Credit Ratings: – S&P . . . BB – Moody’s . . . Ba3 Net Debt ($ in millions) 768 752 710 660 633 622 609 572 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 13

Q314 Q215 Q315 $ Days $ Days $ Days Accounts Receivables, net 299 57 328 60 322 57 Inventories 113 37 129 43 122 38 Accounts Payable 143 46 171 55 150 45 Cash Conversion Cycle 47 48 49 $ in millions Notes: Accounts Receivable Days is calculated as Accounts Receivable, net divided by Non-GAAP Total Net Revenues * 90 days Inventory Days is calculated as Average Inventory divided by Non-GAAP Total Cost of Net Revenues * 90 days Accounts Payable Days is calculated as Accounts Payable divided by Non-GAAP Total Cost of Net Revenues * 90 days Cash Conversion Cycle is calculated as Accounts Receivable Days plus Inventory Days less Accounts Payable Days A reconciliation of our GAAP to Non-GAAP total net revenues and GAAP to Non-GAAP total cost of net revenues can be found in the appendix section BALANCE SHEET SELECT DATA 14

WORKING CAPITAL TREND Working Capital Performance* 17.7% 15.7% 14.3% 14.1% 13.7% 14.3% 14.6% 14.4% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% 17.0% 18.0% 19.0% Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 Percent of S a le s Y/Y changes • AR increased $23M • Inventory increased $9M • AP increased $7M 15 * Working Capital Performance, as % of Non-GAAP Total Net Revenues = working capital / quarterly non-GAAP Total Net Revenues annualized • Working Capital = AR + Inventory – AP • A reconciliation of our GAAP to Non-GAAP total net revenues can be found in the appendix section

55 32 57 59 52 41 56 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 CASH FLOW 71 38 11 36 38 29 22 27 42 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 Free Cash Flow* 42 ($ in millions) ($ in millions) Operating Cash Flow: $71M Free Cash Flow: $42M CapEx: ~$30M Operating Cash Flow* 16 * Operating Cash Flow = GAAP net cash provided by operating activities. Free Cash Flow is a non-GAAP financial measure * A reconciliation of our GAAP net cash provided by operating activities to Free Cash Flow can be found in the appendix section

17 Guidance Q415 Full Year FY15 Non-GAAP Net Revenues $510M – 513M $1.997B - 2.000B Non-GAAP EPS $0.47 – 0.48 $1.82 - 1.83 Free Cash Flow ~$50M ~$140M Other Items Q415 Full Year FY15 Non-GAAP Operating Expenses ~$144M ~$562M Non-GAAP Effective Tax Rate ~14.5% ~14.5% Capital Expenditures ~$35M ~$114M Non-GAAP Fully Diluted Shares ~116M ~116M * Reconciliations to GAAP of these forward-looking Non-GAAP financial measures, to the extent available without unreasonable effort, can be found in the appendix section. GUIDANCE*

Q&A SESSION

APPENDIX

RECONCILIATION OF GAAP TO NON-GAAP KEY METRICS Q315 20 (1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares. See explanatory notes for A, C-E at the end of the appendix. 20 (In millions, except per share data and percentages) Note Net revenues Gross margin Gross margin percentage Operating income Income tax provision Net income attributable to VeriFone Systems, Inc. stockholders Three Months Ended July 31, 2015 GAAP $ 509.9 $ 206.5 40.5 % $ 20.3 $ 1.4 $ 9.5 Adjustments: Amortization of step-down in deferred services net revenues at acquisition A 0.1 0.1 0.1 — 0.1 Amortization of purchased intangible assets C — 4.5 24.5 — 24.5 Other merger and acquisition related expenses C — 0.5 1.7 — 3.2 Stock based compensation D — 0.4 11.2 — 11.2 Restructuring charges E — 0.2 6.0 — 6.0 Other charges and income E — 0.5 7.7 — 7.7 Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate E — — — 7.9 (7.9 ) Non-GAAP $ 510.0 $ 212.7 41.7 % $ 71.5 $ 9.3 $ 54.3 Weighted average number of shares used in computing net income per share: Net income per share attributable to VeriFone Systems, Inc. stockholders (1) Basic Diluted Basic Diluted GAAP 114.4 116.4 $ 0.08 $ 0.08 Non-GAAP 114.4 116.4 $ 0.47 $ 0.47

RECONCILIATION OF GAAP TO NON-GAAP KEY METRICS Q215 21 (1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares. See explanatory notes for A, C-E at the end of the appendix. (In millions, except per share data and percentages) Note Net revenues Gross margin Gross margin percentage Operating income Income tax provision Net income attributable to VeriFone Systems, Inc. stockholders Three Months Ended April 30, 2015 GAAP $ 490.1 $ 203.9 41.6 % $ 29.7 $ 1.4 $ 17.6 Adjustments: Amortization of step-down in deferred services net revenues at acquisition A 0.2 0.2 0.2 — 0.2 Amortization of purchased intangible assets C — 4.6 25.2 — 25.2 Other merger and acquisition related expenses C — 0.4 0.5 — 1.5 Stock based compensation D — 0.4 8.9 — 8.9 Restructuring charges E — — 0.2 — 0.2 Other charges and income E — 0.2 4.6 — 4.6 Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate E — — — 7.3 (7.3 ) Non-GAAP $ 490.3 $ 209.7 42.8 % $ 69.3 $ 8.7 $ 50.9 Weighted average number of shares used in computing net income per share: Net income per share attributable to VeriFone Systems, Inc. stockholders (1) Basic Diluted Basic Diluted GAAP 113.9 115.9 $ 0.15 $ 0.15 Non-GAAP 113.9 115.9 $ 0.45 $ 0.44

RECONCILIATION OF GAAP TO NON-GAAP KEY METRICS Q314 23 (1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares. See explanatory notes for A, C-F at the end of the appendix. (In millions, except per share data and percentages) Not e Net revenues Gross margin Gross margin percentage Operating income (loss) Income tax provision Net income (loss) attributable to VeriFone Systems, Inc. stockholders Three Months Ended July 31, 2014 GAAP $ 475.9 $ 182.8 38.4 % $ (7.5 ) $ 5.8 $ (29.0 ) Adjustments: Amortization of step-down in deferred services net revenues at acquisition A 0.5 0.5 0.5 — 0.5 Amortization of purchased intangible assets C — 10.1 34.6 — 34.6 Other merger, acquisition and divestiture related expenses C — 0.6 1.2 — 1.9 Stock based compensation D — 0.5 13.2 — 13.2 Restructuring charges E — 1.8 10.9 — 10.9 Cost of debt refinancing E — — 4.1 — 9.3 Other charges and income E — 1.9 5.9 — 5.9 Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate E — — — 2.0 (2.0 ) Non-GAAP $ 476.4 $ 198.2 41.6 % $ 62.9 $ 7.8 $ 45.3 Weighted average number of shares used in computing net income (loss) per share: Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders (1) Basic Diluted Basic Diluted GAAP 112.0 112.0 $ (0.26 ) $ (0.26 ) Adjustment for diluted shares F — 2.3 Non-GAAP 112.0 114.3 $ 0.40 $ 0.40

RECONCILIATION OF GAAP TO NON-GAAP GROSS MARGIN 23 See explanatory notes for A, C-E at the end of the appendix (In millions, except percentages) Note System solutions net revenues Services net revenues Total net revenues Total cost of net revenues System solutions gross margin Services gross margin Total gross margin Three Months Ended July 31, 2015 GAAP $ 333.0 $ 176.9 $ 509.9 $ 303.4 $ 131.8 $ 74.7 $ 206.5 Amortization of step-down in deferred services net revenues at acquisition A — 0.1 0.1 — — 0.1 0.1 Other acquisition and restructure related, net C — — — (5.2 ) 4.4 0.8 5.2 Stock based compensation D — — — (0.4 ) 0.3 0.1 0.4 Other charges and income E — — — (0.5 ) 0.2 0.3 0.5 Non-GAAP $ 333.0 $ 177.0 $ 510.0 $ 297.3 $ 136.7 $ 76.0 $ 212.7 Percentage of Non-GAAP net revenues 65.3 % 34.7 % 58.3 % 41.1 % 42.9 % 41.7 % Three Months Ended April 30, 2015 GAAP $ 324.3 $ 165.8 $ 490.1 $ 286.2 $ 135.3 $ 68.6 $ 203.9 Amortization of step-down in deferred services net revenues at acquisition A — 0.2 0.2 — — 0.2 0.2 Other acquisition and restructure related, net C — — — (5.0 ) 4.2 0.8 5.0 Stock based compensation D — — — (0.4 ) 0.3 0.1 0.4 Other charges and income E — — — (0.2 ) — 0.2 0.2 Non-GAAP $ 324.3 $ 166.0 $ 490.3 $ 280.6 $ 139.8 $ 69.9 $ 209.7 Percentage of Non-GAAP net revenues 66.1 % 33.9 % 57.2 % 43.1 % 42.1 % 42.8 % Three Months Ended July 31, 2014 GAAP $ 299.4 $ 176.5 $ 475.9 $ 293.1 $ 112.6 $ 70.2 $ 182.8 Amortization of step-down in deferred services net revenues at acquisition A — 0.5 0.5 — — 0.5 0.5 Other acquisition and restructure related, net C — — — (12.5 ) 10.2 2.3 12.5 Stock based compensation D — — — (0.5 ) 0.3 0.2 0.5 Other charges and income E — — — (1.9 ) 0.5 1.4 1.9 Non-GAAP $ 299.4 $ 177.0 $ 476.4 $ 278.2 $ 123.6 $ 74.6 $ 198.2 Percentage of Non-GAAP net revenues 62.8 % 37.2 % 58.4 % 41.3 % 42.1 % 41.6 %

RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSES 24 See explanatory notes for C-E at the end of the appendix (In millions, except percentages) Note Research and development Sales and marketing General and administrative Total Three Months Ended July 31, 2015 GAAP $ 54.2 $ 56.6 $ 55.4 $ 166.2 Other acquisition and restructure related, net C, E (3.4 ) (1.1 ) (2.6 ) (7.1 ) Stock based compensation D (1.7 ) (4.7 ) (4.4 ) (10.8 ) Other charges and income E — (0.9 ) (6.3 ) (7.2 ) Non-GAAP $ 49.1 $ 49.9 $ 42.1 $ 141.1 As a percentage of total Non-GAAP net revenues 10 % 10 % 8 % 28 % Three Months Ended April 30, 2015 GAAP $ 47.6 $ 55.3 $ 49.5 $ 152.4 Other acquisition and restructure related, net C, E — (0.1 ) (0.2 ) (0.3 ) Stock based compensation D (1.2 ) (3.5 ) (3.8 ) (8.5 ) Other charges and income E (0.1 ) (0.3 ) (2.9 ) (3.3 ) Non-GAAP $ 46.3 $ 51.4 $ 42.6 $ 140.3 As a percentage of total Non-GAAP net revenues 9 % 10 % 9 % 29 % Three Months Ended July 31, 2014 GAAP $ 53.2 $ 54.1 $ 58.5 $ 165.8 Other acquisition and restructure related, net C, E (4.8 ) (2.0 ) (2.7 ) (9.5 ) Stock based compensation D (2.1 ) (5.6 ) (5.0 ) (12.7 ) Cost of debt refinancing E — — (4.1 ) (4.1 ) Other charges and income E — 0.7 (4.9 ) (4.2 ) Non-GAAP $ 46.3 $ 47.2 $ 41.8 $ 135.3 As a percentage of total Non-GAAP net revenues 10 % 10 % 9 % 28 %

RECONCILIATION OF GAAP TO NON-GAAP NET REVENUES 25 See explanatory notes for A-B at the end of the appendix. $ in millions GAAP net revenues Amortization of step-down in deferred revenue at acquisition Non-GAAP net revenues Constant currency adjustment Non-GAAP net revenues at constant currency Note (A) (A) (B) (B) Three Months Ended July 31, 2015 North America $ 208.6 $ — $ 208.6 $ 1.2 $ 209.8 Latin America 73.7 — 73.7 15.1 88.8 EMEA 172.6 0.1 172.7 27.2 199.9 Asia-Pacific 55.0 — 55.0 6.5 61.5 Total $ 509.9 $ 0.1 $ 510.0 $ 50.0 $ 560.0 Three Months Ended April 30, 2015 North America $ 193.0 $ — $ 193.0 Latin America 68.1 — 68.1 EMEA 179.4 0.2 179.6 Asia-Pacific 49.6 — 49.6 Total $ 490.1 $ 0.2 $ 490.3 Three Months Ended July 31, 2014 North America $ 129.8 $ — $ 129.8 Latin America 89.2 — 89.2 EMEA 190.0 0.2 190.2 Asia-Pacific 66.9 0.3 67.2 Total $ 475.9 $ 0.5 $ 476.4

RECONCILIATION OF OPERATING CASH FLOW TO FREE CASH FLOW 26 See explanatory notes for G at the end of the appendix. Three Months Ended $ in millions Note July 31, 2015 April 30, 2015 January 31, 2015 October 31, 2014 Free Cash Flow GAAP net cash provided by operating activities G $ 71.4 $ 56.3 $ 41.1 $ 51.6 Less: GAAP capital expenditures G (29.6 ) (29.3 ) (19.6 ) (22.2 ) Free cash flow G $ 41.8 $ 27.0 $ 21.5 $ 29.4 Three Months Ended July 31, 2014 April 30, 2014 January 31, 2014 October 31, 2013 Free Cash Flow GAAP net cash provided by operating activities G $ 58.9 $ 56.5 $ 31.9 $ 54.9 Less: GAAP capital expenditures G (20.9 ) (21.0 ) (20.9 ) (17.2 ) Free cash flow G $ 38.0 $ 35.5 $ 11.0 $ 37.7

RECONCILIATION OF NET REVENUES GUIDANCE 27 See explanatory notes for A at the end of the appendix. Three Months Ending October 31, 2015 Year Ending October 31, 2015 Range of Guidance Range of Guidance GAAP net revenues $ 510 $ 513 $ 1,996 $ 1,999 Adjustments to net revenues A — — 1 1 Non-GAAP net revenues $ 510 $ 513 $ 1,997 $ 2,000

EXPLANATORY NOTES TO RECONCILIATIONS OF GAAP TO NON-GAAP ITEMS 28 Note A: Non-GAAP net revenues. Non-GAAP net revenues exclude the fair value decrease (step-down) in deferred revenue at acquisition. Note B: Non-GAAP net revenues at constant currency. Verifone determines non-GAAP net revenues at constant currency by recomputing non-GAAP net revenues denominated in currencies other than U.S. Dollars in the current fiscal period using average exchange rates for that particular currency during the corresponding financial period of the prior year. Verifone uses this non-GAAP measure to evaluate performance on a comparable basis excluding the impact of foreign currency fluctuations. Note C: Merger and Acquisition Related. Verifone adjusts certain revenues and expenses for items that are the result of merger and acquisitions. Acquisition related adjustments include the amortization of intangible assets, fixed asset fair value adjustments, contingent consideration adjustments, incremental costs associated with acquisitions, acquisition integration expenses and changes in estimate on contingencies that existed at the time of acquisition. Note D: Stock-Based Compensation. Our non-GAAP financial measures eliminate the effect of expense for stock-based compensation. Note E: Other Charges and Income. Verifone excludes certain revenue, expenses and other income (expense) that are the result of unique or unplanned events, such as litigation settlement and loss contingency expense, certain costs incurred in connection with senior executive management changes, certain personnel and outside professional service fees incurred on initiatives to transform, streamline and centralize our global operations, and restructure and impairment charges related to certain exit activities initiated as part of our global transformation initiatives and gain or loss on financial transactions, such as the accelerated amortization of capitalized debt issuance costs due to the early repayment of debt. In addition, income taxes are adjusted for the tax effect of the adjusting items related to our non-GAAP financial measures and to reflect our estimate of cash taxes on a non-GAAP basis. Under GAAP our Income tax provision (benefit) as a percentage of Income (loss) before income taxes was 12.6% for the fiscal quarter ended July 31, 2015, 7.6% for the fiscal quarter ended April 30, 2015, (25.5)% for the fiscal quarter ended July 31, 2014, 9.3% for the nine months ended July 31, 2015 and 2.7% for the nine months ended July 31, 2014. For non-GAAP purposes, we used a 14.5% rate for the fiscal quarters ended July 31, 2015, April 30, 2015 and July 31, 2014 and the nine months ended July 31, 2015 and 2014. Note F: Non-GAAP diluted shares. Diluted non-GAAP weighted average shares include additional shares that are dilutive for non-GAAP computations of earnings per share in periods when we have a non-GAAP net income and a GAAP basis net loss. Note G: Free Cash Flow. Verifone determines free cash flow as net cash provided by operating activities less capital expenditures.

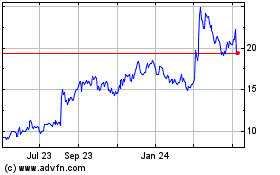

Paymentus (NYSE:PAY)

Historical Stock Chart

From Aug 2024 to Sep 2024

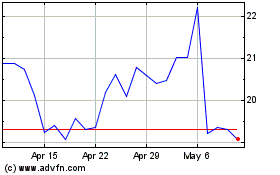

Paymentus (NYSE:PAY)

Historical Stock Chart

From Sep 2023 to Sep 2024